As of 2024, over 90% of European and US consumers have utilized some form of electronic payment in the past year. McKinsey explains that this high percentage is attributed to the popularity and convenience of online shopping and in-app purchases. Yet, these are not all benefits digital payments offer for online commerce. Paying without cash allows buyers to pay faster, track spendings, and shop anywhere in the world. Sellers, in turn, use cashless payments to reduce operations costs, create faster cash flow, and keep precise records for tax reporting and compliance.

With such a spectrum of advantages, we can be certain that retail businesses will want to integrate e-payment systems for eCommerce or develop new ones. In this article, we uncover how to approach these processes smarter as well as provide a deep explanation of the role of e-payment systems in modern commerce.

What Is an E-Payment System?

An electronic payment system is software designed to enable cashless financial transactions. Businesses and individuals can use it to transfer money via internet-based platforms and digital devices with ease and unparalleled speed.

Online payment solutions have the potential to accelerate commercial activities. No more need to deal with calculations, change, and handling cash: customers can shop without checkout friction, and businesses reduce transaction costs and boost the user experience thanks to such features as encrypted connections, user authentication, and automated record-keeping.

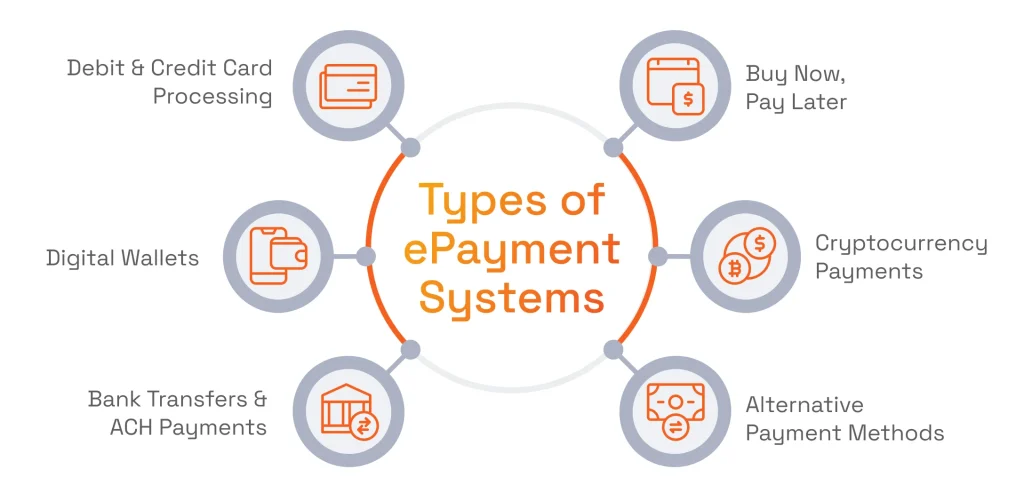

Types of Electronic Payment Methods

One of the advantages of online payment systems is their ability to accommodate a wide variety of transaction options. By offering these multiple methods, businesses can cater to the diverse preferences and financial tools of different customer segments. Below, we list the most popular eCommerce payment methods and explain them by highlighting payment processing trends.

Debit & Credit Card Processing Service (Visa, Mastercard, AMEX)

According to the report by Accenture, 69% of consumers choose credit cards as their preferred payment method, and 21% favor debit cards. Undoubtedly, the debit and credit card processing service remains the most convenient, accessible, and, of course, a popular way for most consumers worldwide to pay. The reasons for such popularity are the ease of use, widespread acceptance, and added benefits like rewards and cashback.

Debit and credit card processing companies, such as Visa, Mastercard, and American Express, provide globally recognized networks that handle transaction authentication, currency conversion, and fraud protection. Moreover, today’s trends for contactless payment technology allow these companies to make online credit card processing even more accessible, solidifying their position as the dominant payment method.

Digital Wallets (Apple Pay, Google Pay, PayPal, Venmo)

Accenture reported that when consumers were asked about their usage of next-generation payment methods, 56% stated they use digital wallets at least five times per month. Apple Pay, Google Pay, PayPal, and Venmo are preferred choices of consumers who prioritize quick, touchless, or mobile-first payments.

Mobile wallets are flexible because they can store payment details and personal information on secure payment platforms without the need to repeatedly enter card or bank account information at checkout. What’s more, these wallets often include additional security features, such as biometric authentication, tokenization, and encryption, that provide users with peace of mind over the security of their funds.

Bank Transfers & ACH Payments

Bank transfers and Automated Clearing House (ACH) payments directly transfer funds between bank accounts. In regions like the United States, ACH is the backbone of electronic bank-to-bank payments, processing everything from payroll direct deposits to regular bill payments.

The distinct feature of ACH transactions is lower per-transaction costs. While card payments can carry higher fees for merchants, organizations can use ACH payments to perform larger or recurring transactions. The downside of such lower fee settlements is that they can cause slower payment processing.

Buy Now, Pay Later (BNPL) Payment Platforms (Affirm, Klarna, Afterpay)

The ability to split purchases into several low payments without an interest made such solutions as Affirm, Klarna, and Afterpay widespread. According to Accenture, Buy Now, Pay Later (BNPL) platforms are the fourth most popular payment processing service after credit cards, debit cards, and cash, used by 12% of surveyed online consumers.

These payment solutions have gained the attention of online shoppers due to the flexibility they provide in managing their budgets. Yet, consumers are not the only ones who benefit from them. For merchants, eCommerce payment processing with BNPL services can lead to higher average order values and lower cart abandonment rates, as the financial burden on customers is reduced at the time of purchase.

Cryptocurrency Online Payment Systems (Bitcoin, Ethereum)

The blockchain technology that made cryptocurrency transactions possible is often regarded by modern users as one of the safest eCommerce payment options. This is because banks do not interfere with the payment process: when a customer pays for an online purchase with Bitcoin, Ethereum, or other digital currency, the transaction is recorded on decentralized ledgers.

While the volatility of digital currencies poses a challenge for merchants and customers, some businesses accept cryptocurrencies to attract tech-savvy customers and benefit from reduced transaction fees. Yet, as Accenture reported, the number of such customers reaches only 4%.

Alternative Payment Processing Methods

When it comes to meeting distinct payment needs of specific niches, alternative eCommerce website payment methods come into play: electronic checks, loyalty points, gift cards, mobile carrier billing, and some region-specific systems can do what the most popular services often overlook.

These methods typically cover local payment habits like iDEAL in the Netherlands or POLi in Australia. Businesses that integrate these alternative methods of eCommerce payments can see advantages in the form of diversification and bigger customer base, and the possibility of international trade.

Andrii Semitkin

Delivery Director at SPD Technology

“We see the growing demand for wearable payments as more people rely on Garmin, Apple Watch, and FitBit. One of the main reasons for this trend is improved security with tokenization and biometric authentication. Future advancements, like deep learning, will further improve smartwatch authentication.”

The Role of E-Payment Systems in eCommerce Business Growth

To be able to grow and flourish, eCommerce store owners must add multiple online payment solutions to checkout pages and optimize them to handle large customer flows. Hence, an online store must have credit and debit cards, digital wallets, BNPL services, and, in some cases, even cryptocurrency payment methods.

In such a way, eCommerce companies take into account the diverse preferences of their existing and potential customers. The better a store meets the needs of its customers, the lesser cart abandonment rates are, and the greater customer loyalty becomes.

It is also important to consider that relying on a single payment gateway or method increases the risk of service disruptions. This, in turn, could lead to lost sales. Therefore, diversifying payment options means also accommodating retail businesses with uninterrupted operations.

Business Critical Reasons for eCommerce to Implement Online Payment Services

Online payment platforms may seem like just a practical solution for customers and businesses. Every individual needs to pay for product or services, and every business needs to receive money for their work, right? However, the implementation of the right online payment platforms helps businesses grow, improve, and guarantee trustworthiness. Having secure payment solutions in place can mean:

- Revenue Growth & Increased Conversions: Shoppers can abandon their carts due to inconvenient or limited payment options. By offering a variety of payment methods, such as credit and debit cards, digital wallets, BNPL, and cryptocurrency, businesses can cater to different customer preferences and increase the likelihood of completed purchases.

- Ability to Scale Beyond Local Markets: Local bank transfers or cash-on-delivery does not allow businesses to offer their services worldwide. A well-integrated online payment system eliminates these limits by supporting multi-currency payments, international payment methods, and localized checkout experiences.

- Enhanced Security & Fraud Protection: A reliable eCommerce payment gateway offers advanced security features such as encryption and tokenization to protect sensitive customer data, AI-powered fraud detection to identify suspicious activity, and 2FA to add an extra layer of security by verifying customer identities.

Online Payment System vs E-Payment Gateway vs Payment Processor

Multiple terms related to payment processing systems are often used interchangeably, which creates confusion. When researching how to build a payment processing app, it is crucial to understand the nuanced meanings of each term.

What is an Online Payment Processor?

Payment processors are systems responsible for handling the technical aspects of transferring funds between a buyer’s bank account and a seller’s account. In other words, an eCommerce payment processor communicates with the customer’s bank and the merchant’s bank to make the transactions possible: it evaluates the validity of a transaction, withdraws the necessary amount from one account, and sends this sum to another account.

What is an Online Payment Gateway?

A payment gateway is a secure interface that collects and transmits payment data from the customer to the payment processor. It typically appears as a checkout page or embedded form on an eCommerce store. All payment gateways ensure that sensitive payment information (e.g., credit card details and digital wallet credentials) is encrypted and protected as it travels to the processor.

Need to develop a payment gateway but do not know where to start?

Find it out in our article on how to build a payment gateway.

Combining Both: A Full-Fledged Payment Solution

When a debit and credit card gateway and payment processing system are integrated into a single software product, eCommerce businesses get a complete end-to-end payment solution. This solution provides a unified system for managing payment authentication, settlement, security, and reporting.

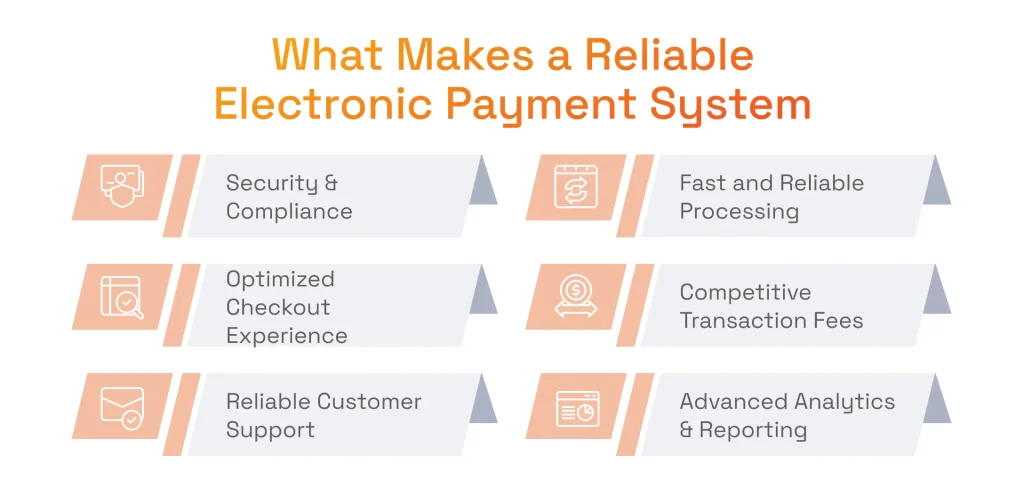

What Makes a Reliable Electronic Payment System

If entrepreneurs are willing to launch a new payment system or are looking for insights into how to start a payment processing company with a competitive product, they will certainly want to make their electronic payment system trustworthy. To achieve this, they must follow key best practices.

Security & Compliance of a Payment Processing System

Ensuring data security in FinTech is undoubtedly one of the non-negotiable requirements for online payment providers to consider. There is nothing more important than to protect customer identity and card data from fraud and ensure this information is stored and processed in accordance with legislation.

To ensure the security of transactions are up to the highest standards, it is crucial to:

- Use encryption during transmission to make sure fraudsters cannot reach sensitive information.

- Implement KYC standards to ensure that customers are who they claim to be and reduce the chance of fraud.

- Follow compliance requirements, including but not limited to the PCI DSS compliance checklist, to verify that user data is processed following industry guidelines.

- Utilize multi-factor or biometric verification to verify user identities.

Fast and Reliable eCommerce Payment Processing

If a store experiences a surge in abandoned carts and a drop in conversion rates, it might be because of poor-performing handling of transactions. When customers experience payment delays or failures, they usually go shopping elsewhere.

That’s why effective and reliable eCommerce payment systems stand out with:

- High uptime and stability at minimized downtime to ensure uninterrupted transaction flows.

- Rapid authorization to confirm payments quickly and reduce the wait for both buyers and sellers.

- Scalability to support fluctuating traffic and transaction volumes without sacrificing performance.

Optimized Checkout Experience

According to a study by the Baymard Institute, 70% of online shopping carts are abandoned. Among the reasons cited, 22% of US online shoppers reported having abandoned an order solely due to a too long/complicated checkout process. In order to make payment processing accommodate the needs of consumers, it is important to ensure:

- Mobile-responsive design to provide consumers with a seamless experience across various devices.

- Frictionless flow with a reduced number of steps required to finalize a transaction.

- Multiple payment options to accommodate the preferences of different customer groups.

- Guest checkout for allowing customers to make purchases without the need to create an account.

Competitive Transaction Fees

There are a lot of market players in the payment processing niche, which means that the competition is in full swing. When it comes to overcoming this competition, setting reasonable and affordable fees can be a key to saving customers and translating the amount of customers into higher transaction volumes and revenues.

To make fees balanced, payment processing companies must consider establishing:

- Transparent pricing structures to simplify budgeting and prevent hidden charges.

- Volume discounts with rewards to merchants who process higher transaction volumes.

- Flexible plans that offer tiered or pay-as-you-go options to accommodate different business sizes.

Reliable Customer Support

According to Zendesk, more than half of consumers will switch to a competitor after only one bad experience with customer service, and 73% will switch after multiple negative experiences. For the financial sector, it is especially true, since it is a high-stakes environment where consumers can stress about any technical issues, fraud concerns, and transaction-related questions. Even minor glitches at checkout can lead to significant revenue losses or damage to a merchant’s reputation if not resolved quickly. When online payment providers want to offer the best customer support possible, they need to ensure:

- 24/7 availability that addresses urgent matters with top technical expertise.

- Multichannel support that offers help via phone, email, live chat, and social channels.

- Proactive alerts that notify merchants of potential issues before they become critical.

Payment Provider Analytics & Reporting

Real-time dashboards, in-depth transaction data, and customizable reports allow payment businesses to gain visibility into patterns such as which payment methods are most popular, peak transaction times, and possible fraud indicators. These insights are part of eCommerce business intelligence that paves the way for the optimization of checkout flows, adoption of new payment methods, or strengthening security protocols. Businesses can ensure such BI capabilities in payment systems with:

- Real-time dashboards that shed light on sales volumes, refunds, and disputes.

- Customizable reports that allow merchants to generate specific metrics (e.g., transaction frequency, average order value).

- Fraud analysis that identifies suspicious patterns and facilitates early fraud detection.

- Integration with other systems like CRMs, ERPs, or accounting software for streamlined operations and a single source of truth.

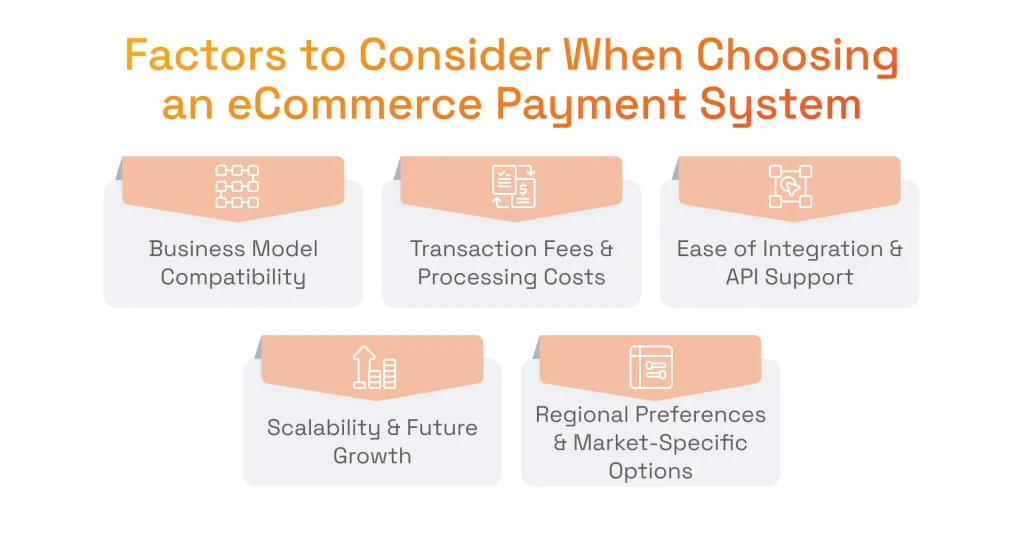

Factors to Consider When Choosing an eCommerce Payment System

The abundance of online payment processing systems on the market makes businesses puzzled over how to narrow down their choices. The factors we mention below will help merchants with that.

Business Model Compatibility with Online Payment Provider Specifics

Every eCommerce business processes different kinds of order volumes at different frequencies for different customer groups. Payment methods must be able to accommodate these requirements. For example, a large retail store might find it reasonable to choose a payment processing option with almost limitless scalability. Or, if an online store sells expensive devices, payment processing companies must provide the BNPL feature.

Apart from basic payment functionality, merchants also need to look for industry or niche-specific functionalities. Those can be split payments for marketplaces to connect multiple sellers and buyers for distributing funds, in-platform loyalty points to simplify rewards, or specialized fraud detection algorithms to minimize losses from chargebacks or unauthorized transactions.

Transaction Fees & Card Processing Companies Costs

Transaction fees can significantly affect profit margins, particularly for smaller businesses or those dealing with high volumes of low-value orders. This is why when choosing an online payment processing system, merchants should compare rate structures, pay attention to flat fees, percentage-based fees, or tiered pricing models.

When it comes to card networks (e.g., Visa, Mastercard, American Express), it is also important to consider variations in fee percentages and settlement times. With such a deliberate approach to credit card processing, eCommerce businesses can avoid fluctuating costs and low speed of access to capital.

Ease of Credit Card Gateway Integration & API Support

The payment gateway integration must be painful in order to ensure businesses can easily connect payments with specific shopping carts, inventory management systems, or CRM solutions. This is why it’s vital that the chosen online payment gateway comes with robust APIs that allows it to easily connect with a shopping platform. The best payment gateway also offers clear documentation to enable faster setup.

Equally important is the level of support payment gateway providers offer an eCommerce store’s technical team. Such support must cover straightforward guides, sample code, and responsive assistance for integration nuances or customizations.

Learn how to integrate a payment gateway into an eCommerce website without hassle.

Scalability & Future Growth of Online Payment Solutions

To support higher transaction volumes over time, eCommerce stores must choose partnership with a payment provider with robust system infrastructures and redundancy so that if one component fails, others can maintain operations without downtime. Also, this system must employ load balancing to spread transaction requests across multiple servers and be capable of both horizontal and vertical scaling.

As the store grows and gains more customers with different payment preferences, a payment platform also needs to include recurring billing, mobile-specific checkouts, and integrating digital wallets or cryptocurrency payments.

Regional Online Payment Providers Preferences

Consumer payment habits vary significantly across different countries. North American consumers, for example, prefer Apple Pay, Google Pay, and PayPal, bank transfers are popular in Europe, and Latin America chooses to use local FinTechs like Mercado Pago, Boleto Bancário, and OXXO. It is important to have in mind, when expanding internationally.

Likewise, certain payment providers know local regulations better. They may save eCommerce businesses time and effort required for ensuring adherence to data privacy and anti-money laundering laws typical in one or another region.

Top 5 eCommerce Payment Systems to Choose From

Integrating the most popular payment systems allows for aligning the online store business requirements with the payment habits of the largest segments of potential customers, eliminating the need for payment gateway development. Below, we review widely used providers of online payment services that can help merchants build trust, reduce checkout friction, and boost conversion rates.

PayPal

PayPal maintains a leading position among payment processing services with a 45% market share on web domains in the world as of January 2025. Both merchants and customers prefer this service for convenience and rich functionality. The former benefit flows from its straightforward integration, robust buyer protection mechanisms, and support for multiple currencies. The latter, meanwhile, enjoy a simple checkout process that requires only an email address and password.

Stripe

Stripe follows PayPal with a market share of around 17%. The most compelling feature of this payment processing provider is its developer-friendly approach. Stripe offers a rich API library that is extremely helpful for technical teams that want to customize checkout to match their brands better. This is why tech-savvy eCommerce startups usually prefer this service over others. What’s more, Stripe goes beyond credit card processing and supports digital wallets, ACH transfers, and recurring billing for subscription-based models.

Adyen

One of the most prominent payment processing solutions for enterprise app development in the eCommerce sector is Adyen. It is known for its international coverage and acceptance of local and mainstream payments, which is extremely beneficial for global retailers like eBay and McDonalds and large businesses of other types like Uber and Spotify. Plus, Adyen is equipped with ML algorithms for smart insights into the performance of promotional campaigns and loyalty programs, as well as possible fraud and security vulnerabilities. Having all these functionalities in one place means increased productivity and higher operational accuracy for enterprise businesses.

Amazon Pay

Everyone knows and trusts Amazon, therefore, using Amazon Pay means peace of mind for many customers. However, a familiar brand image is not the only benefit of this service. Amazon Pay’s consumers can use their existing Amazon account credentials for transactions on other eCommerce websites. This approach makes it much easier to complete purchases and thus reduce checkout friction for retailers. At the same time, merchants can benefit from the usage of Amazon Pay by having access to the massive Amazon customer base.

WorldPay

WorldPay serves a wide range of businesses, from small online stores to multinational enterprises. Recognized for its powerful global processing capabilities, WorldPay facilitates multiple currencies and region-specific payment methods, which helps merchants enter new markets. Its suite of services comprises risk management, analytics, and a variety of integration options.

Additional Payment Methods to Consider by Geography

Even the best credit card processing providers may not add expected value to eCommerce development services if geography considerations are neglected. Fortunately, the market offers an abundance of alternative options that cater to specific regional requirements.

Europe: Visa, Mastercard, AMEX, Klarna

Europe is home to a mature financial ecosystem where Visa and Mastercard have traditionally led thanks to their widespread acceptance, trusted security protocols, and full-fledged issuer networks. Although falling behind Visa and Mastercard in popularity, American Express remains popular among certain high-spending segments due to its exclusive perks and loyalty programs. However, when it comes to paying in installments, Klarna is a dominant choice in Europe due to its user-friendliness.

Asia-Pacific: Alipay and WeChat Pay

China has paved the way for the most popular payment systems in the entire Asia-Pacific region, with Alipay and WeChat Pay emerging as dominant solutions. Both systems are actually much more than online payment gateway providers: they are considered to be “super apps” that allow users to bypass traditional plastic cards and still perform peer-to-peer transfers, online purchases, pay utility bills, and even call taxis.

North America: Apple Pay & Google Pay

The proliferation of smartphones supporting near-field communication (NFC) in the US and Canada is reflected by the adoption of contactless mobile wallets, Apple Pay, and Google Pay. The former benefits from a loyal user base embedded in the wider Apple ecosystem, while the latter taps into Android’s market dominance. The increasing popularity of these mobile wallets is primarily connected to a frictionless checkout experience online, in-app, and increasingly at physical points of sale, as well as strong security measures like tokenization and biometric authentication.

Take control of transaction safety.

Unlock expert tips on payment gateway security in our featured article.

E-Payment Systems Integrations Challenges and Our Solutions

Although payment solutions have advanced significantly, eCommerce businesses frequently encounter FinTech development challenges that may prevent them from delivering flawless online merchant services. However, we know how to approach different complexities during the integration of payment solutions and guarantee that these challenges won’t prevent businesses from becoming solid market players.

Choosing the Best Payment Gateway for Business Needs

Different payment gateway services offer varying fee structures, geographical coverage, currency support, and other features that may not align with the business requirements. The wrong choice can lead to excessive processing fees, limited functionality, and integration difficulties that hinder customer satisfaction.

When we were tasked with choosing the most suitable credit card gateway for an online store, we usually:

- Compare multiple gateways in terms of transaction fees, features, user support, and compatibility with the existing technology stack.

- Ensure the gateway can handle the current transaction volume and easily scale with future growth.

- Analyze end-to-end checkout processes to ensure minimal friction.

- Choose providers offering 24/7 assistance and strong technical expertise to minimize downtime.

Curious about the cost of creating a custom payment gateway tailored to your business needs?

Check out our article on payment gateway development cost.

Handling Online Credit Card Processing Fraud Risks

Payment fraud targets vulnerabilities in payment processes, including weak authentication measures or outdated security protocols, unsecured APIs, and lack of multi-factor authentication. These can result in immediate losses through fraudulent transactions or even trigger a series of expenses and repercussions for the business.

Our team often deals with specific fraud prevention requirements that require customization. For that, we opt for:

- Custom fraud detection software development to ensure real-time alerts, address verification systems (AVS), and card verification value (CVV) checks.

- Automated analytics to detect suspicious activity patterns and adapt to new fraud tactics.

- Defining limits for high-risk transactions and setting instant notifications to relevant teams for review.

- Secure network maintenance to regularly patch software, update firewalls, and encrypt all sensitive data in transit and at rest.

Ensuring Online Payment Processing Compliance

Ensuring payment processing compliance, considering PCI DSS, GDPR, and local data protection laws, is necessary to make the business credible, avoid fines, and maintain security of operations. If eCommerce businesses cannot comply with regulations, they will likely experience legal issues.

We help our clients to make sure that their payment systems are set up to comply with all the required security standards by:

- Frequently reviewing the latest payment compliance guidelines to ensure adherence.

- Scheduling periodic internal and external audits of payment processes and systems.

- Replacing sensitive payment data with secure tokens to reduce the risk of theft or exposure.

- Keeping clear records of compliance activities, security policies, and incident response plans.

Handling Payment Failures

When customers stumple upon issues connected to payment processing timeouts, card verification errors, or system glitches, they may leave the store and never come back. Thus, the business suffers immediate revenue loss. Over time, these negative experiences erode customer trust and can prompt buyers to switch to competitors perceived as more reliable.

To help our client avoid such issues and ensure the smooth flow of transactions, we:

- Track system performance in real-time and address bottlenecks or downtime swiftly.

- Set up a variety of payment options to reduce the likelihood of transaction failures.

- Allow automated retries for failed payments to recover transactions that might fail due to temporary issues (e.g., network or bank delays).

- Provide immediate notifications of failures and simple instructions on the next steps to reduce confusion.

Why Partnering with a Tech-Savvy Vendor for eCommerce Payments Integration

eCommerce businesses are often focused on their industry-specific products, marketing strategies, and customer engagement, which can leave little resources to address the technicalities of payment integration, security, and regulatory compliance. A seasoned vendor, in turn, brings specialized expertise to the table and ensures:

- Preventing Revenue Loss Due to Improper Gateway Setup: A specialized vendor guarantees a smooth integration from the outset, which minimizes transaction errors.

- Avoiding Risks of Data Breaches and Regulatory Fines: With robust security expertise and compliance knowledge, a seasoned tech company helps safeguard sensitive data and keep businesses away from costly penalties.

- Optimizing Transactions Fees in Advance: Vendors analyze transaction patterns early on to negotiate the most favorable rates and prevent unexpected processing costs.

- Opportunity for Post Integration Monitoring and Setup: Development companies provide continuous support and real-time performance tracking to maintain the optimal and secure functioning of the payment systems.

Consider SPD Technology for an Online Payment Solution Integration Support

We helped dozens of companies integrate payment systems into their online stores, insurance platforms, or healthcare solutions. Our team also supports these systems and improves or customizes them when business grows and requires adjustments. Businesses can hire a dedicated development team and get the following benefits of partnering with us.

Business-Focused eCommerce Payment Gateway Integration Strategy

Our team adopts a holistic approach that aligns payment solutions with each merchant’s unique business goals. We customize integrations to match the company’s target market, product offerings, and growth objectives. In this manner, we ensure seamless customer experiences, streamlined internal processes, and maximized conversion rates.

Expertise in Multi-Gateway & Multi-Currency Payment Processors

We have rich expertise in integrating numerous gateways as well as making a payment system support various currencies and consider regional preferences. Organizations can benefit from our experience and effortlessly expand and cater to international customers without sacrificing on performance or reliability.

Secure & Fully Compliant Payment Gateway Integration

Our professional team emphasizes the importance of compliance and data protection from the very start. For that, we opt for employing robust encryption, tokenization, and ongoing risk assessments to secure sensitive financial information.

Intelligent Payment Routing & Failover Protection

We deliver solutions that include advanced routing logic. It can quickly switch between gateways if one experiences downtime or performance bottlenecks. This helps us reduce the likelihood of transaction failures.

AI-Driven Fraud Prevention Expertise

Our team has deep AI/ML development expertise and leverages ML models to monitor transactions in real time, detect suspicious patterns, and adapt to new threats. In this way, we minimize fraudulent activity, save on chargebacks, and protect both merchants and customers from cyber risks.

Payment Platform Integration: Successful Projects by SPD Technology

Our efforts in integrating and maintaining payment platforms help our clients to see tangible results.

Enhancing an Online LegalTech Platform’s Payment Experience and Security

An online legal technology company sought to implement and support a payment system as well as two additional payment methods within their LegalTech platform.

Business Challenge

Our clients asked us to integrate their platform with a high-performing payment ecosystem to handle credit card, ACH, and IBAN transactions.

SPD Technology’s Approach

We chose to integrate Stripe as it had a developer-friendly API that allowed us to easily connect this secure payment gateway with the existing platform, implementing ACH and IBAN payment methods. Our client also was a subject of bot attacks. To prevent those, we introduced advanced traffic filtering logic. In this manner, we could accurately distinguish legitimate requests from bots, using a dynamic rating system that factored in user behavior, IP addresses, and other parameters.

Additionally, the clients asked us to set up effective visualization, monitoring, and alerting to be sure that the payment method remained on top of system performance and security. This is why we created real-time dashboards and alerts using Prometheus and Grafana.

Value Delivered

Our experts integrated secure and reliable Stripe that enhanced the platform’s appeal across different markets. The system’s newly implemented business logic significantly reduced bot-related fraud risks, while customizable notifications and alert functionalities gave the client visibility into transaction flows and system performance.

Building a White-Label eCommerce Platform

NimbleCommerce, a Silicon Valley eCommerce startup, aimed to help merchants and brands manage pre-paid offers, gift card programs, and digital revenue streams.

Business Challenge

The client tasked us with the development of a full-fledged B2C and B2B platform supporting eCommerce operations (promotions, targeted customer segmentation, and AI-driven reporting), integrations with multiple payment systems, and seamless scalability to reach global audiences.

SPD Technology’s Approach

We designed a powerful Administration module to create sophisticated promotional offers and integrated the platform with 27 payment systems via a specialized workflow. Our ML engineering team also performed custom AI solutions development to set up analytics and forecasting. Throughout the project, our team ensured a white-label solution is flexible enough to cater to diverse brand needs while maintaining high performance, security, and user experience standards.

Value Delivered

We successfully delivered a solid platform that attracted millions of B2C users and thousands of B2B partners. The solution’s flexibility, extensive features, and scalability made it possible for NimbleCommerce to be acquired by BlackHawk Network Inc.

Conclusion

Electronic payment systems help businesses and consumers pay for goods and services online via digital wallets, credit and debit cards, bank transfers, BNPL or other forms of online payments. They are a necessity nowadays, allowing businesses to reach greater audiences, improve scalability and boost security of transactions.

The best payment methods are characterized by solid security and adherence to compliance, fast and reliable payments, competitive transaction fees, and access to reliable customer support. To set up such popular eCommerce payment platforms as PayPal, Stripe, Adyan, Amazon Pay or WorldPay, companies must consider card processing costs, scalability, regional preferences to make sure that their business model is compatible with payment processing companies offerings.

Yet, it might be difficult to connect existing platforms with payment methods. eCommerce business requirements might be overlooked, the system may have issues with cyber attacks or compliance, or the company may experience payment failures. To overcome these challenges, partnering with an experienced tech vendor comes up as a viable option. We can say that from our experience, as we helped eCommerce, insurance, and LegalTech businesses to seamlessly integrate payment solutions into their existing systems. If you also need a hand with that, you can contact us. We will be happy to share our payment integration expertise.

FAQ

What Are the Payment Systems for eCommerce?

Payment systems for eCommerce vary, including credit card processors, digital wallets (e.g., PayPal, Apple Pay), cryptocurrency gateways, bank transfers, and buy now, pay later solutions designed to ensure convenient transactions.

Which Payment Gateway Is Best for eCommerce?

Choosing the optimal payment gateway depends on factors like transaction volume, security features, supported regions, and integration ease. Popular options include PayPal, Stripe, and Adyen, each excelling in different scenarios.

What Is eCommerce Payment Processing?

eCommerce payment processing covers all financial steps enabling online transactions, from securely capturing payment details to verifying funds, authorizing purchases, and ultimately transferring money between customers, merchants, and financial institutions.

What Is the Best Online Payment System?

There’s no universal “best” online payment system, as unique business needs vary. Platforms like PayPal, Stripe, and Square excel differently in pricing models, international reach, developer tools, and user experience.