Given the evolving landscape of digital transactions, integrating a robust payment gateway into your website or app is no longer a convenience but a strategic imperative. Still, when you need to integrate payment gateway, it requires strong technical expertise, deep understanding of data security practices and 360-degree awareness of compliance requirements. Supported by a solid technical input of our fintech software developers, we are going to cover all the important aspects of integrating a payment gateway into your business processes.

Integrated Payment Gateway vs Payment Gateway Software Development

In one of our recent articles, we discussed how to build a payment gateway tailored to your specific needs in a custom way. But what if an existing solution is good enough for your case, and you don’t need to spend an enormous amount of money on entirely custom-made software? Before making the final choice, let’s compare the pros and cons of building a custom gateway vs an integrated payment gateway.

In short, smaller businesses with standard requirements and a need for quick implementation may find existing payment gateways more suitable, while large enterprises with unique needs and the resources for custom development may opt for a tailored solution.

Custom Payment Gateway Development

Pros:

- Tailored to Specific Needs: All of your unique requirements will be covered to the fullest extent. With a custom solution, you will maximize your revenues, since you will have all the payment options you need.

- Complete Control: You won’t have to rely on a third-party payment gateway provider, since you will be in charge of all software development and technical aspects, making changes and adding features to the system when necessary.

- Brand Consistency: You can design your gateway to seamlessly match the brand identity of the business, providing a consistent user experience throughout the entire payment process.

Cons:

- High Development Costs: You can expect a high development cost, starting from $200,000 and increasing depending on the desired functionality. The costs include development time, testing, ongoing maintenance, and improvements. By the way, we discussed the payment gateway development cost and provided a detailed breakdown of each component of the final price.

- Security Challenges: Your development team needs to have deep domain knowledge, including but not limited to implementing KYC standards in Finance, and ensuring compliance. Failure to meet security standards could result in security vulnerabilities and major financial losses.

- Development Duration: Building a custom solution will take significantly more time compared to when you integrate a payment gateway. This can delay time-to-market and potentially impact revenue streams.

Existing or White Label Payment Gateway Integration

Pros:

- Quick Implementation: Integrating an existing payment gateway is generally faster compared to developing a custom solution. Most vendors offer well-documented payment gateway API integration and plugins that make the integration process straightforward.

- Security: Ensuring data security in Fintech is always a priority, and established payment gateways invest heavily in security measures, including encryption and fraud prevention. You can be sure that all transactions will be secure and compliant with the latest industry standards.

- Cost-Effective: The cost for an integrated payment gateway will be significantly lower compared to building a solution from the ground up. The top vendors often provide a range of pricing plans, allowing businesses to choose a package that suits their needs and budget.

- Wide Range of Features: While customization is not a forte of existing solutions, popular providers still offer an impressive variety of features including subscription management, reporting tools, and multiple payment options like PayPal payments, Stripe or Square.

Cons:

- Limited Customization: Existing providers still offer limited customization options that may not cater to unique needs and specific requirements.

- Transaction Fees: While costs, when you integrate payment gateway, will end up lower, compared to a custom solution, most existing payment gateways charge transaction fees, which can add up over time and impact the overall cost for businesses, especially large enterprises with high transaction volumes. Still, transaction costs are easily calculable and accurately predictable depending on the transaction volume, so you will be able to choose a payment gateway provider that meets your business budget.

- Vendor lock-in: When youintegrate payment gateway it may imply some kind of vendor lock-in – a situation when a business becomes dependent on the third-party solution. To avoid it, you have to carefully evaluate their long-term requirements, and choose online payment gateway providers that offer flexibility and scalability.

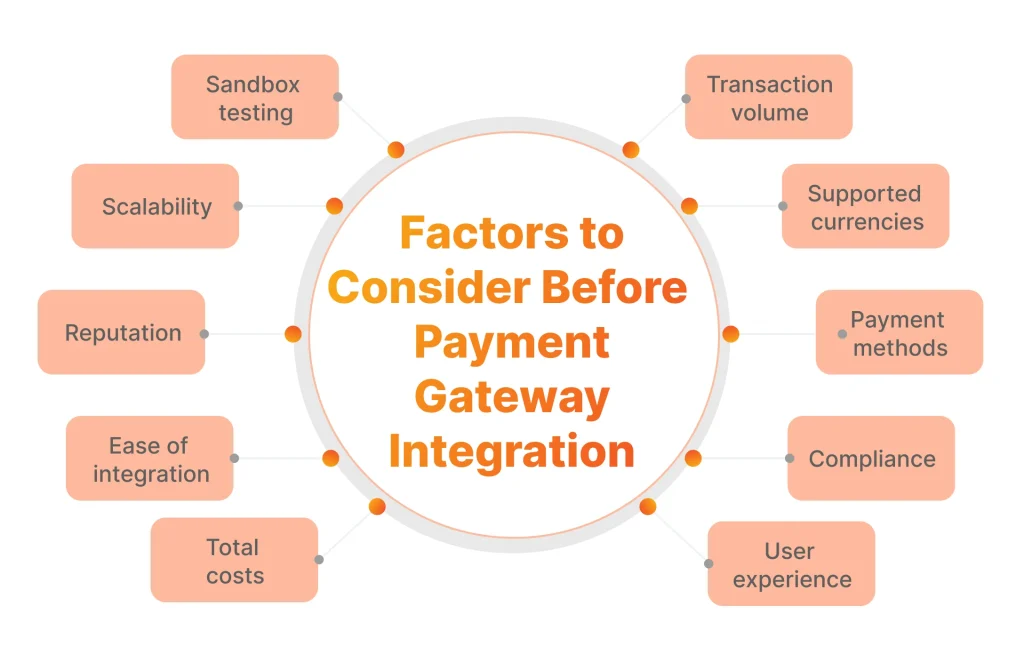

Factors to Consider In Advance Before Integrate Payment Gateway

The payment gateways market is booming, and, according to Future Market Insights, is projected to grow from $117.5 billion in 2023 to $293.9 billion in 2033. So, it is safe to assume that there will be more gateway options available, and the existing ones will improve dramatically, as the market grows.

As of January 2024, Forbes considers the following to be the top 10 payment gateways:

- Authorize.net

- Stax

- Payline Data

- Shopify

- Helcim

- Elavon

- Square

- Stripe

- Clover

- PayPal

If you are considering online payment gateway integration, the above-mentioned providers are good options to start with, and before making the final choice, you should consider the following factors.

Transaction Volume

Before you integrate payment gateway, you need to have estimations on the expected transaction volume to ensure that a payment gateway can handle the scale of your business. Many gateways have pricing based on transaction volume, which may end up in enormous expenses for big organizations with high amounts of operations.

Supported Currencies

If you have an international customer base, or you are looking to expand your business in the future, it makes sense to verify that payment gateways of your choice support the currencies you plan to transact in.

Available Payment Methods

Before deciding on a vendor, you need to do some research on the preferences of your customers and determine what payment methods are the most suitable. The most popular options include credit and debit cards, digital wallets, and bank transfers.

Ensuring Compliance

Payment gateways are subject to various compliance standards to ensure the security, integrity, and confidentiality of payment transactions. The payment gateways of your choice must adhere to compliance standards and update their systems and processes accordingly. Non-compliance can result in financial penalties, reputational damage, and legal consequences for your organization.

Here are some of the key compliance standards that payment gateways typically adhere to:

- PCI DSS (Payment Card Industry Data Security Standard)

- SSL/TLS Encryption

- EMV (Europay, Mastercard, and Visa)

- PSD2 (Payment Services Directive 2)

- GDPR (General Data Protection Regulation)

- ISO 27001

- SSAE 18 / SOC 2 (Service Organization Control)

- NACHA (National Automated Clearing House Association)

- AML (Anti-Money Laundering) and KYC (Know Your Customer)

Also, make sure that you are aware of all geographical regulations, adhering to any specific regulatory requirements in the regions where you operate. Ensure the vendor of your choice complies with these regulations, and you won’t face any potential penalties.

Ease of Integration

Thoroughly review the gateway’s API documentation to assess the ease of integration. Well-documented APIs can significantly speed up the integration process and save you some money. Additionally, it will be a good idea to check the availability of development support from the integrated payment gateway provider if issues or questions arise during integration.

Total Costs

We already mentioned transaction fees, however, there are other components of pricing, including setup fees and fees for specific features or services. You should also carefully look for possible hidden costs, including chargeback fees, currency conversion fees, or payments for premium support. Compare the most suitable options to make a fully informed decision.

Scalability

Determine whether the gateway can handle increased transaction volumes and if it offers features suitable for growing businesses. The payment gateways should support horizontal scaling, allowing businesses to add more resources or instances to distribute the load and enhance performance as transaction volumes increase.

Sandbox Testing

Another important aspect to think about when you integrate payment gateway is whether the provider offers a sandbox or testing environment. This is required for payment gateway integration service providers to test transactions in a simulated environment before going live, reducing the risk of errors and data breaches.

Reputation and Reliability

Consider the reputation of the gateway provider in terms of reliability, security, and customer support. Look for reviews and testimonials from other businesses to know who you are dealing with.

User Experience

A smooth and intuitive checkout process is crucial for user satisfaction, so you should choose a payment gateway that provides a seamless and user-friendly checkout experience.

Mobile integration is also very important, as the mobile payment market size is expected to grow at a CAGR of 36.2% between 2023 and 2030, according to Grand View Research. So, make sure that the payment gateway of your choice is fully optimized for mobile devices.

Payment Gateway Redundancy

It will be a good idea to consider implementing multiple gateways for redundancy. If one gateway experiences technical issues, having a backup can prevent disruptions in online payment processing and save costs caused by downtime.

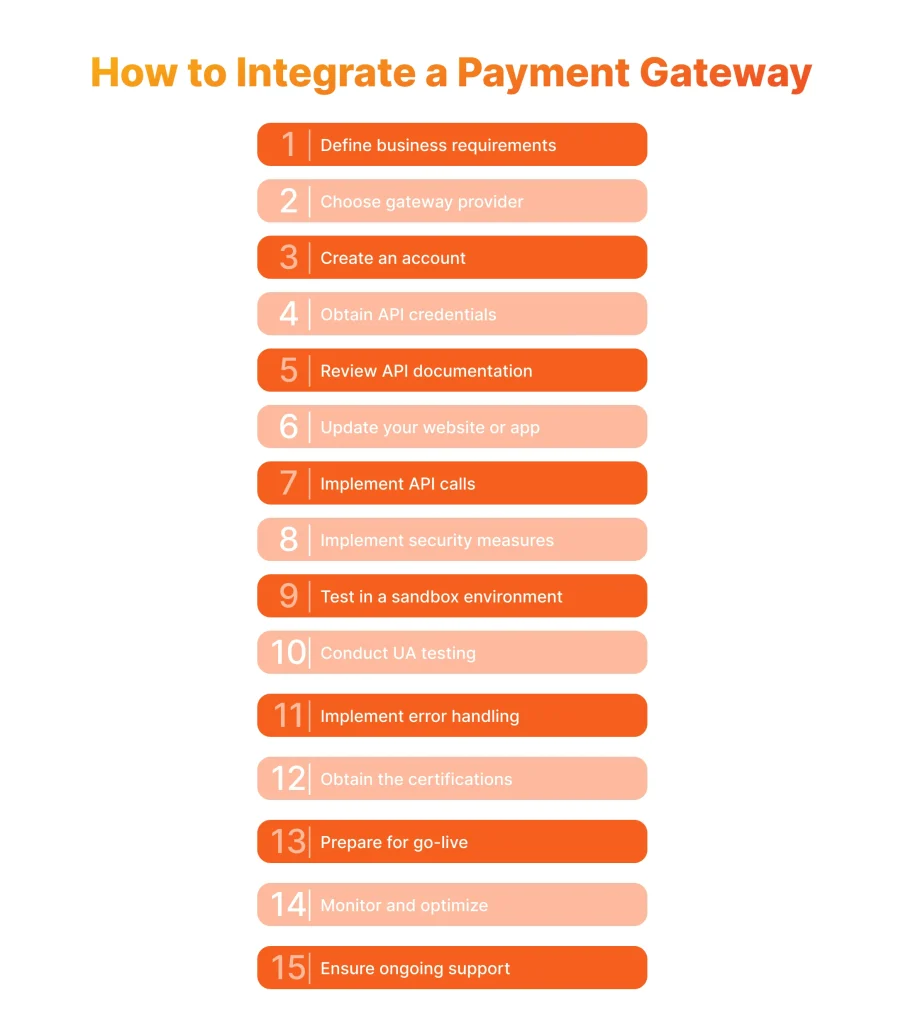

How to Integrate a Payment Gateway Into a Website

When you need to integrate a payment gateway with the website, it is quite a time- and effort-consuming process, but when done correctly, there is nothing particularly hard about it. Here are the key steps to accomplish this goal.

1. Define Business Requirements

Conduct customer research and internal meetings to define your business requirements clearly. Before starting any integration, you should determine:

- Transaction volume.

- Currencies your business needs to support.

- Preferred payment methods of your customers.

2. Research and Choose a Provider

Evaluate the most suitable integrated payment gateways based on your business requirements, and pay close attention to pricing and fees, available payment methods, a list of supported features, as well an industry reputation.

3. Create an Account with the Payment Gateway Provider

When you make your decision, it will be time to create an account with a chosen gateway provider. You need to read and agree to the terms and conditions. If you don’t have any doubts, then you can provide your business details, bank information, and merchant account credentials.

4. Obtain API Credentials

Once registered, the vendor will provide you with API credentials including API key, secret key, and merchant ID. These credentials are essential for making API calls, which are crucial for real-time communication and seamless integration between the merchant’s system and the gateway. They allow for the secure exchange of information, enabling merchants to offer smooth and efficient online payments to their customers.

5. Understand API Documentation

Thoroughly review the gateway’s API documentation with your development team to understand the available functionalities, request and response formats, as well as any specific technical requirements and limitations that hosted payment gateways might have.

6. Develop or Update Your Website/Application

Finally, at this stage, some coding is required. To complete the integration, the existing code of your website may need to be updated, or the development of entirely new features may be required to accommodate payment processing. It will be a good idea to hire seasoned experts with industry experience for this task, as any errors on this task may cost you valuable time.

7. Implement Payment Gateway API Calls

With all software development aspects covered, you can use the obtained API credentials to make API calls for transactions and get access to features such as payment initiation, payment processing, order confirmation, and handling of payment responses.

8. Implement Security Measures

Ensure that your integration follows best practices for security, as we mentioned in one of the previous sections of the article. Implementing SSL encryption, and adhering to PCI DSS standards are mandatory to ensure the safety of the payment information in the modern Fintech industry.

9. Test in a Sandbox Environment

Most providers offer a sandbox or testing environment. Your development team can leverage this environment to perform thorough testing without processing real transactions. This process will help to verify that API calls, responses, and error handling work as expected.

10. Conduct User Acceptance Testing (UAT)

Conduct user acceptance testing with a select group of users to ensure that the payment processing is user-friendly and error-free. This will help to detect and report any issues that might occur.

11. Implement Error Handling

It is important to have robust error-handling mechanisms to manage situations such as payment failures, timeouts, or connectivity issues. Users should get clear error messages and know exactly what to do in case of any failures when a particular payment method doesn’t work as expected.

12. Obtain Necessary Certifications and Approvals

It is probably the most time-consuming part of the entire process, as you will need to get approval from the provider to use their services on your platform and finally start to accept payments.

Volodymyr Soska

Software Development Engineer at SPD Technology

“The actual technical integration may be completed within a month, however, getting the permission to use a certain gateway may take significantly longer, depending on the provider and its requirements.”

13. Prepare for Go-Live

Now it is time to inform relevant stakeholders and your team members, plan the launch process carefully, and watch the system closely during the initial rollout.

14. Monitor and Optimize

As you will get your first transaction data, and user feedback and see how the system performs, you will be able to fine-tune the integration based on real-world usage and address any issues promptly as they occur.

15. Provide Ongoing Support

Your provider can make changes or updates at any time, which may disrupt the integration and put your transactions on hold. To prevent that unfortunate scenario, you need to stay informed about new features or security measures on the vendor’s side and react rapidly to keep your integration at maximum efficiency level.

Conclusion

Hopefully, this article provides you with some essential information on the topic and offers you a perspective on the integration of an existing payment solution. Keep in mind that properly integrating payment gateways and payment processors are only a few of the Fintech development challenges that organizations face in 2024.

We, at SPD Technology, have over a decade of experience in Fintech projects, and will gladly help you integrate a payment gateway into your business processes with the highest efficiency and technical proficiency. Get in touch with us now for an initial consultation and an accurate estimate!

FAQ

- What is payment gateway integration?

It is the process of connecting a gateway with an e-commerce website or an application to facilitate the seamless and secure processing of online transactions, protecting the payment details of the customers.

- How to integrate payment gateway?

To benefit from an integrated payment gateway, you should:

- Select a Payment Gateway

- Create an Account

- Obtain API Credentials

- Understand API Documentation

- Integrate Payment Gateway into Website/Application

- Implement Security Measures

- Conduct Testing

- Go Live.

- What are the methods to integrate payment gateway?

The methods may vary for different payment gateway providers. However, common methods include:

- Direct API Integration or Hosted Payment Gateway: Directly integrating with the gateway’s API using programming languages like PHP, Java, or Python.

- Non-Hosted Payment Gateways: Redirecting users from websites to a secure payment page of payment gateway providers. After payment, users are redirected back to the merchant’s website.

- What is the payment gateway integration cost?

It is impossible to give a one-size-fits-all answer, as the cost of integration can vary based on several factors:

- Setup Fees

- Transaction Fees

- Monthly Fees

- Custom Development Costs

- Transaction Volume Discounts.

Keep in mind that you are always welcome to get in touch with us for an accurate integrated payment gateway cost estimation based on your project requirements and in-depth consultations on the payment process.