Payments are the blood of the economy. In this sense, business entities that help accept digital payments and process payments are the economy’s blood veins that enable its functioning on a global scale. The impossibility to conjure up life without an exchange of digital payments and the sheer size of the payment market make payment processing an increasingly budding business niche to tap into. According to a report by Future Market Insights, this market is expected to secure a mind-boggling $237,1 billion from 2022 to 2032.

However, to stay competitive, both well-established and fledgling payment-processing businesses and other Fintechs have to keep pace with the popularity of the existing payment methods. It is also essential for them to identify any emerging trends in payments to harness them in time and meet the changing needs of their target audiences.

While in our recent article we have explained how to start a payment processing company, in this piece we’ll take a brief look at the more pronounced and new payment trends to help you enhance your service offering and beef up your technical capacity accordingly.

Mobile Payments

As a hassle-free payment method, Mobile Payments enable you to pay for products or services by just passing your smartphone by a barcode reader. Prime examples of this will be Apple Pay on iPhone and Google Pay on Android-based devices.

Not a new trend by any means (they’ve been around since 1997), mobile payments are projected to continue growing by a very large margin – from $ 53.5 billion in 2022 to an estimated $607.9 billion in 2030.

This massive growth is likely to create many profitable opportunities for payment processing companies and technology providers. For example, as the lion’s share of mobile payment options constitute payments via digital wallets, it makes all the sense for payment processors to integrate with as many digital wallets as possible, as well as monitor the emergence of any new digital wallets. As the global digital wallet landscape comprises hundreds of digital wallets, there is always room for growth here.

P2P (Peer-to-Peer) Payments

If you need to quickly send a small amount of funds to one of your family or friends, pay in favor of some local business, or even make recurring digital payments for some service, you can conveniently use a P2P app, like, for instance, Venmo. Combining the traits of a payment app with those of a social network, P2P apps allow users to make payments from their credit card or bank account.

Since their advent, P2P payments have become hugely popular and the vast majority of consumers have used them in making digital payments. To illustrate, the P2P payments’ market was valued at $2.21 trillion in 2021 and is expected to reach $11.62 in 2032, which makes P2P payments a definite must-watch.

The future growth of P2P payments is likely to be connected with their integrations with social networks and a growing use of Blockchain that can immensely improve their security and protect customer data. Both these scenarios are bound to further promote P2P payments’ growing popularity.

Andrii Semitkin

Delivery Director at SDP Tech

“Interesting new trends in payment processing crop up and catch on, and we can sometimes see Fintechs in a certain niche could really benefit from something – be it Credit Card Processing or something other than that. Still, it’s essential to bear in mind that regardless of a specific trend, strong overall Fintech expertise is instrumental for implementing an app that makes a match with any new trend.”

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) payments allow consumer payments on an installment plan without any interest to be paid.

They are enabled by BNPL platforms (like, for example, Affirm or Zip) that merchants use to extend the service to their customers, and have become quite popular over recent years. According to Juniper Research, in 2022, the total number of BNLP users constituted 360 million and is expected to hit 900 million people by 2027.

Due to the unique benefits they allow, BNPL payments represent a payment method that is vastly attractive to end users. Correspondingly, they provide a very significant competitive edge that will likely be impossible for the majority of merchants to overlook in the future. The latter makes BNPL a highly promising business niche for payment startups.

Cryptocurrencies

The сryptocurrencies will likely continue to grow – both in volume and number. According to FMI, the volume of the Cryptocurrencies market is projected to increase to $4853.8 million by 2033, from only $1294.1 million in 2023.

The rapidly rising adoption of crypto currencies in particular, ones like Ethereum and Bitcoin, is having an increasingly pronounced impact on the environment – the process of crypto currency mining that is used to validate and process transactions is very energy-consuming. This is especially the case for those cryptocurrencies that use The Proof of work (Pow) consensus algorithm for this purpose.

The need to curb the rising energy consumption has given birth to a sub-trend called eco-friendly eco currencies or green coins. Instead of the POW algorithm, eco-friendly currencies use innovative consensus algorithms that minimize energy consumption, and, consequently, their carbon footprint, reduce e-waste, and encourage the use of renewable energy. For example, in the case of such eco-friendly as NANO, transactions are validated by trusted representatives to whom users delegate their voting power.

Eco-friendly cryptocurrencies are increasingly referred to as the future of the crypto market. Currently, more than 250 companies and individuals that hail from industries like the Crypto and Finance, NGO, Technology, Energy, and Climate have joined the Crypto Climate Accord of Supporters, aimed to achieve net-zero emissions from the electricity consumption associated with their cryptocurrency-related operations by 2030.

Biometric Payment Cards

Ensuring security in Fintech has always posed a significant challenge, and credit card transactions are no exception. Because of this, the bumped-up security of Biometric Payment Cards, which includes not only chips, but also such a reliable biometric factor as fingerprints, makes them another promising payment industry processing trend to watch.

This higher level of security allows setting much higher transaction limits, which appeals to shoppers who use such cards for payments in brick-and-mortar stores. So much so, that the Biometric Payment Cards market is expected to grow almost two-fold by 2032 – to $15498.82 million from just $73.5 million in 2022.

The advent and growing popularity of biometric payment cards creates new business opportunities for several types of market players at once – banking institutions, merchants, smartcard manufacturers, and, of course, payment software vendors and payment startups.

Real-Time Payments (RTPs)

Real-Time Payments (RTP) seem like a major leap in payment technology as far as account-to-account transfers are concerned. Enabled by special RTP networks, they ensure immediate debiting of funds from the sender’s account and their immediate or near-immediate availability in the recipient’s account.

Moreover, currently, RTP systems allow instant payments, transferring funds 24/7 and 365 days per year. Often operated by central banks or national bankers’ associations (like, for example, the Reserve Bank of Australia or Danish Bankers’ Association), RTP networks are continually growing in number – currently, there are around 40 of them globally in around 30 countries. The success of Brazil’s Central Bank’s RTP system called PIX has shown that RTP systems are capable of expediting and dramatically improving the payment infrastructure on a much larger, nationwide scale.

Although presently the roster of the markets the RTP technology has spread across is quite formidable, it’s plain to see there will be many more opportunities for Fintech software providers in the future in those nations that could benefit from RTP too.

Web3 Payments

Web3 Payments are a relatively new payment industry processing trend. In a way, they represent a crossbreed between Blockchain and RTP. Namely, they are real-time payments that use the Blockchain technology and allow users to transfer funds in favor of one another directly, without employing the services of any trusted 3rd party.

Web3 Payments’ ease of use, security, and reliability account for their growing popularity and the significant growth of the whole of the Web3 ecosystem. Between 2022 and 2028, the global Web3 Blockchain market is expected to be growing with a GAGR of 41.6% to hit a formidable $23.3 billion in 2028 – something for Blockchain technology providers and payment startups to take note of.

Central Bank Digital Currencies (CBDCs)

Originating from Nigeria, the Bahamas, and Jamaica, the Central Bank Digital Currencies are one of the most recent trends in payment processing that has also been actively explored by in excess of 100 other nations.

In essence, CDBCs represent electronic currencies denominated in the fiat currency of the corresponding country. Just like a national currency, a CDBC can appear on the liability sheet of the central bank that has issued it and has this bank’s full faith and credit.

There are two types of CDBCs – retail CDBCs and wholesale ones. While retail CDBCs serve businesses and individuals and are intended to be used in direct transactions between them, wholesale CDBCs are intended for use by financial institutions and other high-scale institutions.

Also, there are cross-border CDBC projects that involve two or more countries and aim to create an international CDBC arrangement with a view to enabling expeditious and seamless money transfers and foreign exchange transactions. A good example would be mBridge – a CDBC initiative that involves China, Hong Kong, and the U.A.E.

The scale on which the adoption of the CDBC currencies is currently being globally explored by means of various pilot projects bodes well for Fintech providers that work with Blockchain.

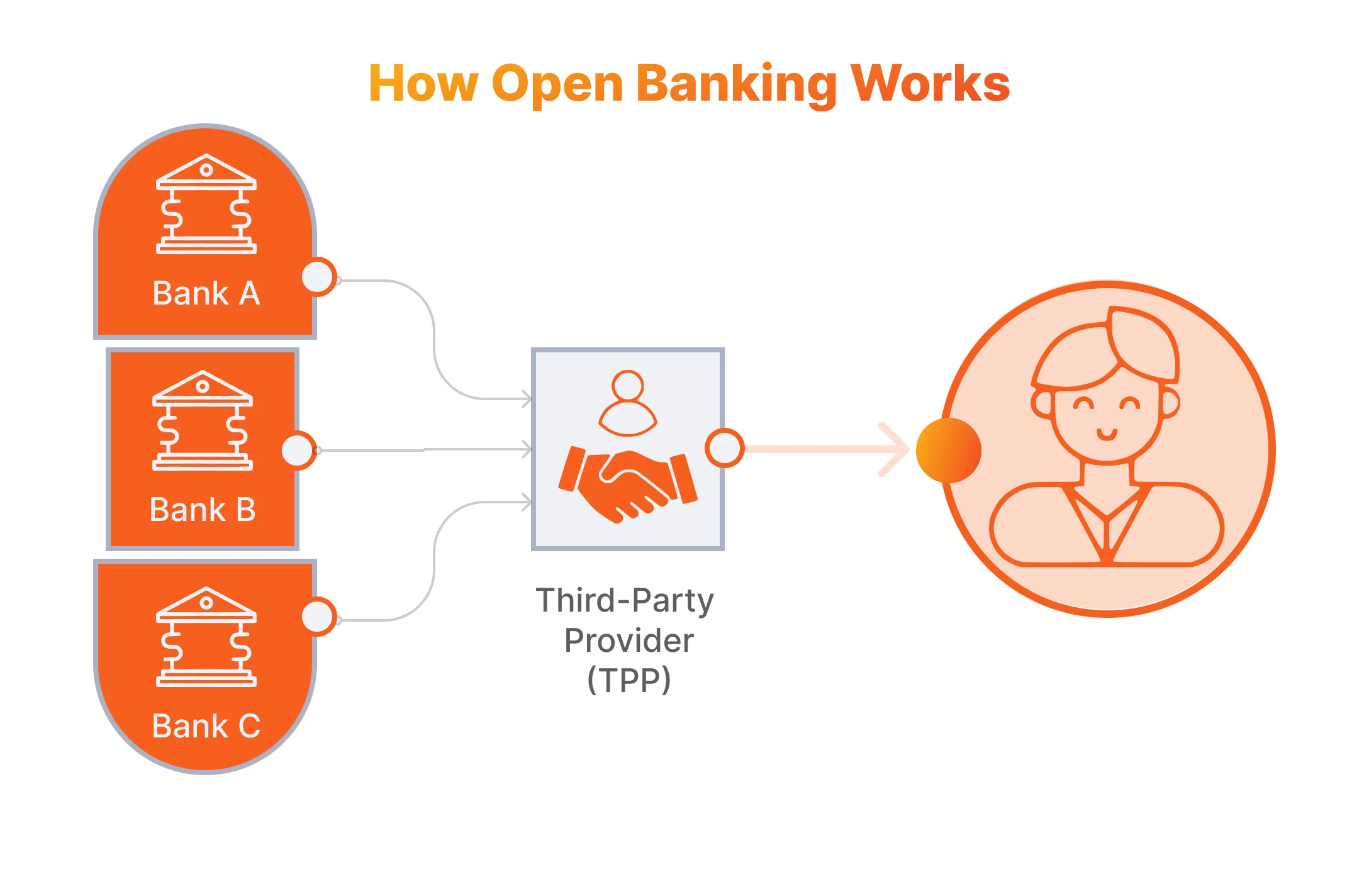

Open Banking

Open Banking is a banking approach whereby, to perform a transaction, a bank directly shares financial customer data with another bank or a 3d-party service provider with the help of an API. The 3d-party service providers can include various Fintech companies, financial institutions, and payment providers.

Open Banking allows bankers and financial institutions to significantly simplify and reduce the cost of money transfers, facilitate money exchange operations, as well as offer customers innovative and personalized variations of lending and other services.

Spurred by the need to diversify their service offering and make it more convenient and appealing to their customers, banks help Fintechs and propel the adoption of Open Banking too. The prospects of such cooperation seem to be quite good: according to Future Market Insights, from 2022 to 2032, the open banking market will be growing at a CAGR of 23.2% to reach $158.6 billion in 2032, which makes it an all the more appealing business niche for fintech software development.

Since their integration with payment solutions, social media platforms have become major avenues of sales for vendors and merchants from a diverse range of business niches.

SMM platforms make it possible for businesses to market their products directly to their followers. Furthermore, those of them that include payment gateways also provide their audiences with seamless shopping experiences that encourage impulsive buying: such gateways eliminate the need for users to go to a 3d-party payment solution to make a purchase.

Given the already enormous size of the social commerce market that constituted $ 727.63 billion in 2022 and the fact that this market is forecasted to grow at a CAGR of 36.1 between 2023 and 2030, one can safely presume that payment vendors and startups should keep an eye on the related developments and opportunities of this payments landscape.

Integration of Payment Systems with Instant Messaging Apps

Similar to their integration with social media platforms, payment systems’ integration with instant messaging apps is another interesting trend to note.

This kind of integration is performed with the help of messaging apps’ APIs and enables users of these apps to conveniently make both P2P payments and those in favor of various businesses. Also, users of payment integration-enhanced messaging apps can easily communicate while shopping, as well as instantly share the products that appeal to them with other users.

An array of messaging apps (like, for instance, iMessage and WeChat) have already taken advantage of the payment integration approach, while more are likely to follow suit in the near future.

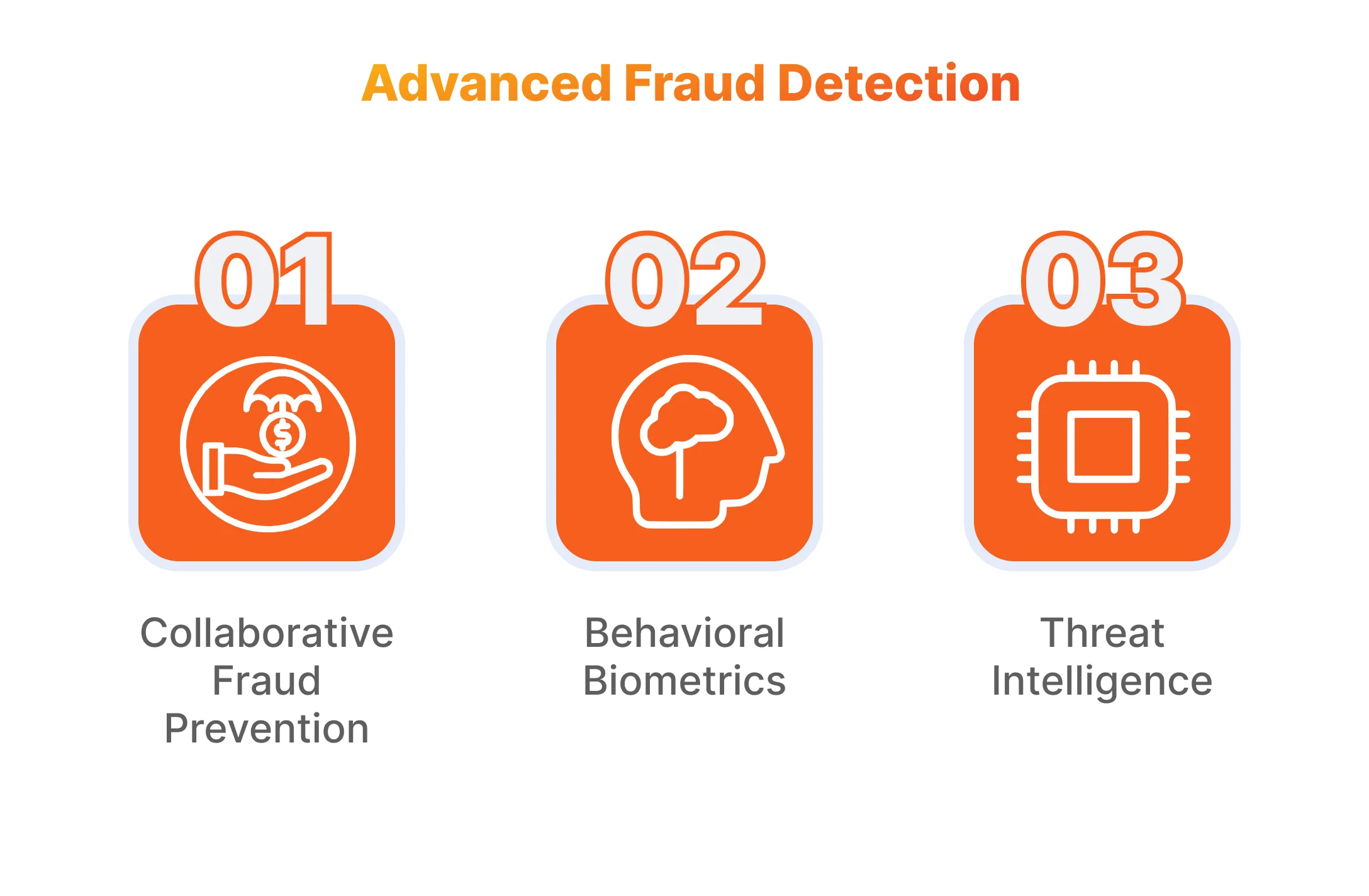

More Advanced Fraud Detection and Prevention

Fraud is rampant in business niches like, for example, e-Commerce. According to Juniper Research, losses from payment fraud are expected to exceed $362 billion over the next five years. Considering this, payment processors and other market players are seeking for new ways of combating payment fraud.

There are several advanced applications of AI and Machine Learning in finance that are increasingly gaining traction and tend to be used in parallel. They are:

- Collaborative Fraud Prevention – banks, insurance companies, and other market players can form fraud prevention networks to share consumer payments insights and fraud patterns in real time, with a view to flagging high-risk customers and preventing suspicious transactions. To maximize the efficiency of such interactions, they can also adopt common fraud prevention policies and coordinate technical efforts.

- Behavioral Biometrics – to prevent payment fraud, banks, insurers, and other market players are increasingly trying to verify customer identity on a continuous basis. To do this, they use an array of techniques that allow them to analyze a number of nuances associated with customers’ behavior and digital trails. These nuances include digital bread crumbs, the way the customer enters their login (fraudsters tend to use the copy/paste approach), the customer’s touchscreen interactions, and others.

- Threat Intelligence – this approach helps financial market players stay continually informed about the various cyberthreats that emerge and learn about the ways one can counter them. The latter includes detecting attacks, understanding their nature and the way they can affect a business, and suggesting an effective means of averting an attack of a specific type. Threat intelligence consists of Strategic Intelligence (high-level analysis of the context in which a threat exists), Operational Intelligence (information associated with a specific attack that is gleaned from the attacking party), Technical Intelligence (technical evidence or artifacts associated with a specific attack).

To make Threat Intelligence more efficient and comprehensive, businesses can equip their efforts with specialized Vulnerability Management platforms.

In Conclusion

As you can see from the overview we’ve made, there are many interesting payment trends to watch and embark on if you are going to profitably expand a payment-processing business or launch a payment or Fintech startup.

As a Fintech software development services provider, we have significant experience in building payment solutions designed to meet diverse business goals, navigate the payments landscape and changing users’ preferences. Our payment software developers and Business Analysts would be glad to answer both tech and business-related questions you may have and help you tap into the dynamic Fintech industry.

FAQ

- What are the main payment processing trends in 2024?

The major payment industry trends include Digital Wallets, Social Media Messaging App Integrations, BNLP payments, Open Banking, Biometric Payment Cards, Web3 Consumer Payments, Peer-to-Peer (P2P) Payments, and Real-Time (RTP) Payments. The ones that we think are worth paying close attention to in the immediate future are Mobile Payment Apps, Biometric Payment Cards, Cryptocurrencies, and Web3 Payments.

- How to stay up to date with the trends in the payments landscape?

To be aware of the payment industry trends, you should certainly monitor tech media and visit payment industry events. Also, it might be useful to talk to software providers that specialize in the Fintech niche. We, at SPD-Tech, would be glad to answer your questions about the future of payment processing and share our technical expertise to make your fintech solution more competitive – you are welcome to get in touch.