Artificial Intelligence (AI) and machine learning (ML) are reshaping every aspect of the financial sector. These technologies improve security by enhancing fraud detection and risk management, elevate operational efficiency with automation, and provide actionable insights for making informed decisions. No wonder, financial companies are adopting AI and ML at an accelerating pace. In fact, a 2024 McKinsey survey found that 72% of financial institutions have integrated AI into their operations.

While the benefits of AI in finance are evident, a closer look shows how these innovations are redefining industry dynamics. In the following sections, we’ll examine how advanced algorithms, predictive analytics, automation, and other AI-driven solutions are enhancing key aspects of financial operations.

How Machine Learning in Finance Changes the Industry

ML and AI in FinTech apply complex algorithms to analyze vast data sets and identify anomalies, recognize subtle patterns, generate real-time insights, and more. Below are some of the key ways ML influences the finance industry.

Financial Security of a New Level

Ensuring data security in FinTech applications has taken center stage in modern finance, and ML is the driving engine behind these improvements. While traditional rule-based systems rely on static filters, which makes them inflexible in case of new fraud tactics, ML models continuously learn from historical and real-time data to detect typical and new anomalies.

In finance, the business impact of Big Data plays a crucial role in preventing fraud. Scammers are constantly refining their tactics, but Big Data gives ML algorithms a broader set of attributes to monitor. Consequently, algorithms can sift through billions of transactions and user interactions in real time to identify subtle anomalies and flag them for further investigation.

Smarter Risk Assessment

Machine learning and Artificial Intelligence in finance unlocks smarter risk assessment through holistic credit scoring. ML models incorporate both traditional credit reports and financial statements and additional data sources (banking transaction histories, online behavior, etc.) to develop a more nuanced evaluation of a customer’s creditworthiness.

When it comes to assessing risks connected to external factors, from currency fluctuations to shifts in consumer sentiment, ML and Big Data form a powerful duo. They allow aggregating and analyzing vast quantities of information to gain a more detailed view of potential threats. This approach ensures that financial companies can better manage risks across diverse market conditions.

Advanced Predictive Analytics in Finance

Predictive analytics is another key driver for process improvements, a development introduced by AI for financial services. Financial institutions can optimize multiple aspects of their processes with financial predictive analytics, namely:

- Cost Optimization & Revenue Growth: Data-rich ML models can analyze consumer purchase behavior, real-time market data, and operational metrics to find opportunities for better resource allocation, price optimization, and product offerings.

- Improved Operational Efficiency: Big Data can provide ML models with an abundance of examples to learn, which contributes to better processes automation and, as a result, reduced costs and boosted efficiency.

- Improved Decision-Making: With ML and AI, financial services companies can automate and speed up the analysis of market feeds, news analytics, social signals and respond instantly to changes in an informed manner.

- Reduced Compliance Risks: Using AI in finance allows for scanning huge volumes of transactions, documents, and communications for potential compliance violations, which promotes their timely prevention.

Serhii Leleko

ML & AI Engineer at SPD Technology

“Predictive analytics in finance changed the rules of the industry. Today, companies identify potential opportunities and pitfalls before they materialize in the market. This involves spotting inefficiencies in operations, shifts in consumer behavior, and early signs of market disruptions. As a result, organizations optimize resource allocation and engage in proactive planning.”

Understanding AI and ML in Financial Services

The use of AI and machine learning in finance have changed how businesses approach and complete diverse tasks. These technologies enabled automation, personalization, scalability, and real-time insights, making it possible for financial institutions to improve operations and offer unparalleled services for their customers.

AI tools for finance unlocked automation that allows for handling repetitive, manual tasks, such as data entry, document verification, and compliance checks. Such a streamlining of operations not only reduces human error but also frees up time for employees to focus on more customer-facing activities.

Beyond automation, financial AI and ML enable scalable solutions. This means that financial institutions can grow, expend their customer base, and offer more services while also being confident that the technology they use is capable enough to handle new operational demands.

Another important factor improved with financial AI is offerings. Equipped with this technology, they can be personalized. Thus, companies can analyze individual customer behaviors and financial histories and hyper-targeted product recommendations.

Real-time market insights are not to be overlooked as well. Finance AI enables advanced data analytics, which can monitor market feeds, news analytics, and social media sentiment to detect emerging opportunities or risks before human analysts can react. As a result of using AI-powered financial platforms, traders, portfolio managers, and risk officers can then make data-driven decisions with greater speed and confidence, whether they’re adjusting portfolios, recalibrating credit limits, or refining risk models.

The Cutting-Edge Benefits of AI in Finance

As mentioned, AI solutions for finance introduce automation, personalization, scalability, and real-time data analytics. These benefits of AI in finance lead to more effective processes that offer considerable benefits to both financial companies and their customers.

- Automated Document Processing: AI incorporates automatic extracting and processing data that streamlines paperwork, reduces errors, and speeds up workflows.

- Automated Compliance Monitoring: AI/ML-driven tools continuously scan transactions and communications to ensure adherence to regulations and identify potential compliance issues.

- Tailored Financial Products: AI finance tools analyze individual customer data to offer personalized products and services that meet specific financial needs.

- Dynamic Portfolio Adjustments: ML models within AI-based financial systems automatically recalibrate investment portfolios based on real-time market conditions to optimize returns and mitigate risks.

- Real-time Anomaly Detection: Financial platforms equipped with ML algorithms effectively identify irregular transactions or behavior patterns to flag potential fraud.

- Adaptive Defense Systems: ML algorithms continuously evolve by learning from new threats, thus, enhancing security measures to protect financial assets.

- Rapid Market Insights: AI platforms process vast data streams in real time to provide up-to-date information for fact-based decision-making.

- Reduced Human Bias: ML and AI in financial systems leverage data-driven algorithms that minimize subjective judgment to ensure more objective and consistent outcomes.

- 24/7 Customer Support: AI-powered chatbots and virtual assistants offer round-the-clock service to guarantee quick technical issues resolution and risk management.

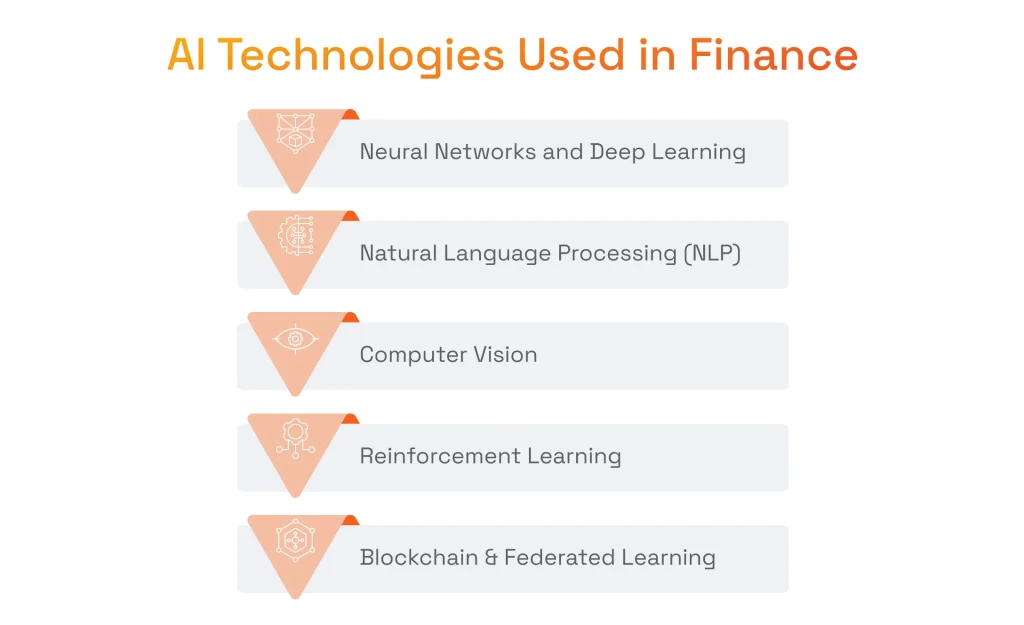

Technological Aspects of AI in Finance

Artificial intelligence in financial services is supported by many underlying technologies that work together to boost the efficiency, accuracy, and security of operations. Each of the following components contributes to a robust and versatile AI ecosystem used in the financial sector.

Neural Networks and Deep Learning in Finance

Neural networks and deep learning in finance enable AI systems to understand and interpret complex patterns in massive datasets. In this way, subtle correlations in pricing trends, transaction anomalies, and market behavior patterns can be uncovered for:

- Forecasting price movements thanks to deep learning algorithms analysis of historical and real-time market data;

- Detecting fraud with advanced pattern recognition applied to transaction or account activities data;

- Portfolio optimization thanks to enablement of sophisticated risk–return models with neural networks;.

- Client personalization through tailored loans or investment plans done by deep-learning-driven recommendation engines.

Natural Language Processing (NLP)

Finance AI tools enhanced with NLP allows interpreting and processing human language in both written and spoken form. This helps financial institutions handle documents, news, and customer interactions. By extracting relevant insights from text data, NLP makes possible:

- Document analysis through categorization of legal contracts, regulatory statements, or financial reports;

- News sentiment analysis thanks to monitoring real-time news or social media sentiment to gauge public reaction;

- Effective implementation of KYC standards in financial services through automating the extraction of relevant information from massive document repositories;

- Robust virtual assistants through interpreting user queries and delivering 24/7 service.

Computer Vision in Financial AI

Computer vision development done for AI finance software provides the possibility to extract actionable insights from images and videos. Computer vision reduces manual work, prevents fraud, and enhances user experiences by enabling:

- Image-based document verification thanks to automated checks of ID photos and other documents help confirm identities;

- Fraud prevention through detecting inconsistencies in images or forged documents;

- Enhanced security thanks to facial recognition and other biometric measures incorporated in ATMs and payment gateways.

Reinforcement Learning (RL) in Finance AI

Reinforcement learning involves training AI to make optimal decisions in a dynamic environment through trial and error. In financial services, AI and RL algorithms assist with algorithmic trading, dynamic credit scoring, and portfolio management, thanks to the following work:

- In algorithmic trading, RL adapts trading strategies to minimize risks based on changing market conditions;

- In dynamic credit scoring, RL-driven models continuously take new data to refine credit risk assessments;

- In adaptive portfolio management, RL optimizes asset allocations as market experienced shifts;

- In risk management, RL learns to navigate risk-reward trade-offs by simulating different financial scenarios.

Blockchain & Federated Learning in AI Finance

Blockchain provides a decentralized ledger that can store and verify transactions or data transparently. At the same time, federated learning trains AI models across distributed data sources without centralizing sensitive information. When combined, these technologies allow financial companies to unlock:

- Secure data sharing through immutability and transparency;

- Collaborative model training done by allowing multiple institutions to build powerful AI models without exposing proprietary or sensitive client data.

- Improved compliance thanks to blockchain-based decentralized records, which streamline auditing processes, and federated learning that adheres to data governance requirements.

Serhii Leleko

ML & AI Engineer at SPD Technology

“AI often goes hand in hand with other technologies, such as NLP, deep learning, or computer vision because these specialized areas provide the necessary tools to handle specific types of data and tasks within the broader field of AI.”

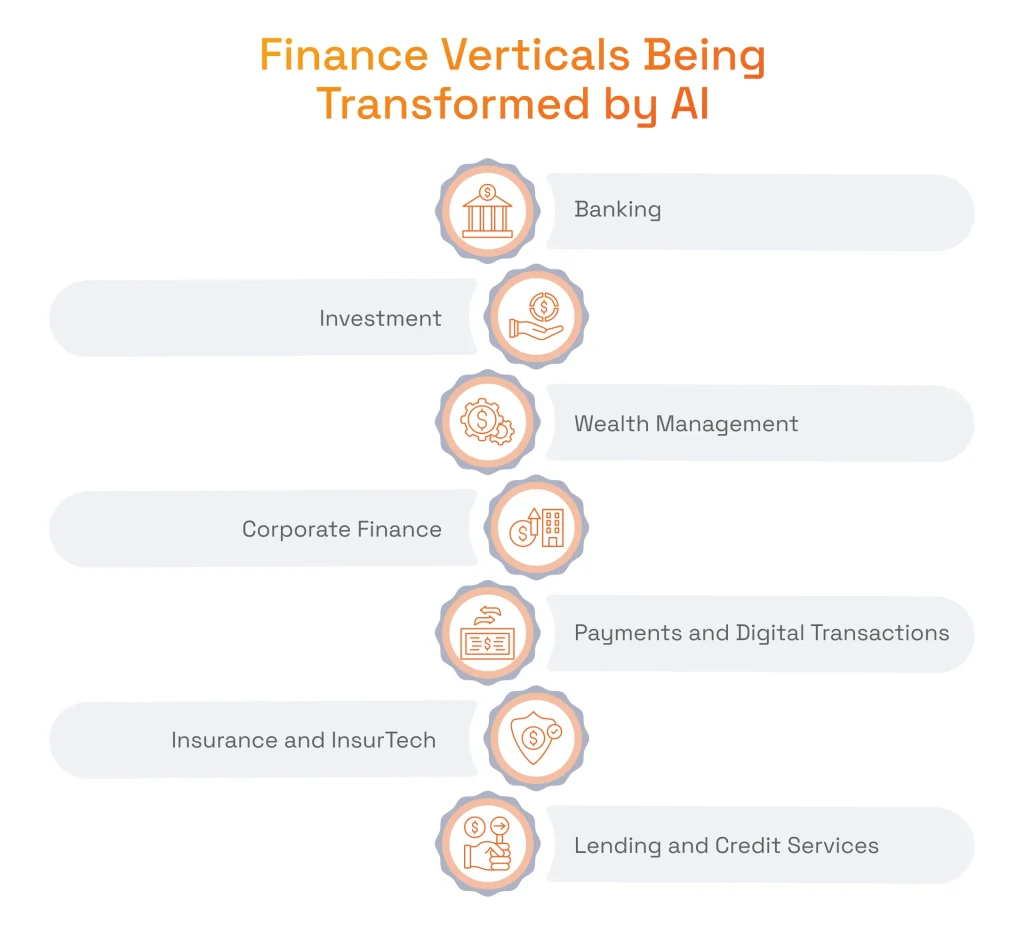

AI Applications in Finance Verticals

To answer the question: “How is AI used in finance?”, it is essential to review several niches because the industry is highly diversified and multifaceted. In this manner, it becomes possible to fully cover the whole spectrum of AI applications in finance.

Banking Machine Learning

Using machine learning in banking is a must nowadays as this technology shapes everything from customer service to risk management. In fact, AI technologies, ML in finance included, could add up to $1 trillion annually to global banking by enhancing marketing, risk management, and operational efficiency. Such a transformative power of AI and machine learning in banking paves the way for more innovative applications.

AI Use Cases in Banking

When it comes to AI in banking, use cases directly influence both efficiency and customer satisfaction.

- AI-driven automation speeds up the completion of such tasks as document verification and data entry.

- Predictive analytics tools improve credit scoring and underwriting processes, thereby increasing approval rates and reducing default risks;

- AI-powered anti-money laundering systems continuously scan transactions for suspicious activity, ensuring banks meet strict regulatory requirements;

- Credit card fraud detection using machine learning identifies anomalies and unusual behavior in real time to prevent fraudulent transactions;

- Chatbots provide 24/7 customer support, handling large volumes of inquiries while freeing human representatives to address more complex issues.

Investment Management and Banking

Investment firms employ AI in financial services to enable deeper insights into market trends and make data-driven decisions in near real time. They can analyze historical data, economic indicators, and even social media sentiment with AI-powered models and, thus, forecast market fluctuations with accuracy. Consequently, AI in investment banking allows firms to optimize asset allocations, recognize emerging opportunities, and minimize exposure to unnecessary risks.

Another essential AI use for investment management is attributed to generative AI. Deloitte predicts that this technology will help the global investment banks to enhance front-office productivity by 27% to 35%, mainly through automation. This can potentially result in an additional $3.5 million in revenue per front-office employee by 2026.

Wealth Management

Wealth management is increasingly driven by AI, which allows advisors and clients to benefit from hyper-personalized financial planning. Through advanced analytics, AI systems learn client profiles, taking into account financial goals, risk tolerances, and spending behaviors, to suggest optimal investment strategies.

Moreover, AI-enabled tools can significantly boost advisor capacity by automating routine tasks such as data collection, portfolio rebalancing, and risk assessment. This will allow wealth management advisors to save time on client meeting preparation, financial planning, and administrative duties, enabling them to focus on higher-value activities. According to McKinsey, if 30 to 40% of advisors adopt these AI tools, it could lead to a 6 to 12 percent increase in overall advisor capacity by 2034.

Want to know how data enables financial advice personalization and automation?

Read our article on data analytics in asset management!

AI in Corporate Finance

Corporate finance departments leverage AI and ML in financial software development to tackle budgeting and forecasting with greater precision. This can be done thanks to advanced ML models that can parse large datasets that contain sales figures, operational costs, and market indicators. With such use of AI, finance companies unlock data-driven approaches that allow for identifying cost-reduction opportunities and optimizing capital allocation with a level of precision that traditional methods often cannot match.

By incorporating AI in corporate finance, companies gain the ability to harness predictive analytics and real-time data to anticipate market trends and respond rapidly to changes. This integration enables dynamic adjustments to budgets, forecasts, and investment strategies. The result of this innovation is improved cash flow management and minimized financial risks.

Payments and Digital Transactions

When used in financial services, AI can modernize payments and digital transactions by improving speed and user experience. It can be done by making advanced algorithms to swiftly process and verify transaction data. Thus, it becomes possible to minimize wait times and reduce the potential for errors.

At the same time, custom AI solution development can be used to incorporate biometric authentication or adaptive security checks into financial applications. This helps create a frictionless yet secure environment for users. As a result, customers benefit from faster, more reliable payment processes, while financial institutions gain valuable insights into transaction patterns, which can inform personalized service offerings and additional security measures.

Insurance and InsurTech

Global financing for insurance technology firms rose by 40% to $1.27 billion in the second quarter of 2024, with approximately 33% of this funding directed towards AI-focused InsurTechs. Such a staggering number is not a surprise, since financial AI tools help underwrite policies, detect fraud, and settle claims.

With machine learning, financial applications analyze vast amounts of data in near real time. As models spot subtle patterns in this data, AI-driven systems become capable of streamlining underwriting and expediting claims processing while also pinpointing anomalies indicative of fraudulent activity.

Another important technology that works in conjunction with AI is data analytics in insurance, which informs risk assessment, pricing, and customer segmentation. In this way, insurers get the opportunity to deliver customer-centric products.

Looking to discover how insurance and finance firms improve decision-making with data and AI?

Read our article on data analytics in finance!

Lending and Credit AI Financial Services

FinTech AI companies leverage AI to streamline lending and credit services by delivering more accurate risk assessments, competitive loan terms, and faster approvals. For that, ML algorithms consider a variety of data points, including payment histories to social media cues, to generate holistic credit scores.

TurnKey Lender is a notable example of using AI for lending process automation and risk assessment quality. The platform employs cutting-edge algorithms and data analysis to empower lenders in making well-informed lending decisions. This ensures loans are approved for borrowers with a high potential for successful repayment.

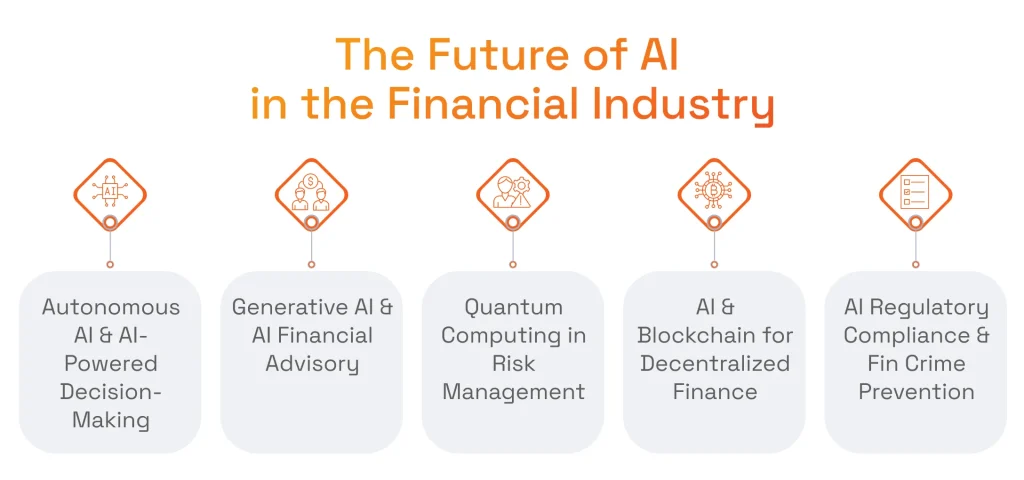

The Future of AI in the Financial Industry

A Deloitte survey indicates that 86% of financial services AI adopters consider AI to be very or critically important to their business success. This high adoption rate reflects the technology’s ability to streamline operations, enhance customer experience, and optimize risk management. This is why the future of AI in finance is not only assured but also poised for continued expansion with the following technological advancements.

Autonomous AI for Finance & AI-Powered Decision-Making

While today’s AI outputs still require human oversight, the AI-driven systems of the future will free financial advisors from this task. This means that the evaluation of vast volumes of market data, economic indicators, and geopolitical events will be done with more precision, and AI/ML in finance can autonomously adjust portfolios, lending parameters, or even operational processes based on evaluation results. With this level of automation by AI and machine learning for finance, companies can reduce human effort while also increasing portfolio resilience.

Generative AI & AI Financial Advisory

McKinsey estimates that Gen AI could contribute between $2.6 trillion and $4.4 trillion annually across various industries. Specifically, the AI use cases in banking take approximately $200 billion to $340 billion per year, primarily through automation that brings increased productivity. This and also Gen AI’s ability to analyze data for insight generation create high demand for FinTech software development services. The technology allows synthesizing massive amounts of customer information, market data, and regulatory constraints to generate tailored advice for clients. Such a human-like yet data-driven advisory approach brings investment outcomes on a whole new level.

AI & Quantum Computing in Risk Management

The financial industry’s investment in quantum computing is expected to surge from approximately $80 million in 2022 to an estimated $19 billion by 2032. This is because this technology has the potential to speed up data processing and problem-solving in risk management. Combined with artificial intelligence and machine learning in financial services, it can evaluate countless risk scenarios almost instantaneously. This ensures improved stress-testing measures and, hence, elevates risk mitigation in banking, insurance, and trading.

AI & Blockchain for Decentralized Finance (DeFi)

The DeFi market is projected to reach a revenue of $376.9 million by 2025 according to Statista. This indicates a growing interest in blockchain-based financial services. Such significant attention is dictated by the ability of AI-driven smart contracts, used in DeFi, to dynamically adjust terms, rates, or credit limits based on real-time data.

This means DeFi platforms are more adaptive and secure. Meanwhile, blockchain’s immutable ledger ensures the transparency and trust required for AI-based transactions and data sharing. Coupled together, these technologies create a more resilient financial ecosystem.

Finance AI Tools for Regulatory Compliance & Financial Crime Prevention

As financial markets grow more complex and digitized, regulators and financial institutions are figuring out how to use AI in finance for security purposes. Fraud detection software development is a primary focus here as financial artificial intelligence can detect fraud, money laundering, and other illicit activities. AI/ML algorithms can sift through enormous volumes of transactions to identify fraudulent patterns. Another focus is AI-driven compliance: algorithms are becoming increasingly proactive, adapting to emerging threats and newly introduced regulations without significant manual intervention.

Serhii Leleko

ML & AI Engineer at SPD Technology

“While quantum computing and autonomous AI are still on the horizon, Gen AI, blockchain, and AI-driven compliance checks are already integrated into today’s finance. Their use demonstrates a clear divide between emerging innovations and the practical solutions used for everyday financial operations.”

The Dangers and Challenges of Adopting AI for the Financial Industry

With artificial intelligence, finance becomes more powerful. Yet, new FinTech applications development challenges arise during AI implementation. The good thing is they are all solvable. Below, we list the most common challenges we encountered when delivering AI-driven financial systems and their corresponding solutions.

Machine Learning Finance Model Reliability & Market Volatility Risks

Machine learning in financial services is subject to rapid market fluctuations, which can invalidate even the most accurate predictive algorithms. Sudden economic shifts, geopolitical events, or unforeseen market conditions introduce levels of volatility that strain model reliability. As a result, financial institutions risk making ill-informed decisions if their models cannot adapt quickly or accurately to changing environments.

Luckily, it is possible to make ML models adapt. When working on financial project, our machine learning engineers make models more flexible thanks to:

- Continuous stress tests to ensure model performance remains sound under various scenarios;

- Development of adaptive algorithms capable of updating parameters as they encounter new data;

- Pairing AI insights with traditional risk frameworks to ensure that human oversight remains part of the decision-making process.

Integration of AI Tools for Finance with Legacy Systems

The importance of data integration is especially evident when financial institutions have to introduce AI for finance systems with decades-old technology infrastructures. Outdated systems can limit data accessibility, reduce scalability, and complicate compliance processes.

We know how to successfully blend AI tools with legacy platforms. It usually requires us to leverage:

- API-based middleware to use modular software architectures that interface with legacy systems without requiring a complete overhaul;

- Cloud computing infrastructure benefits for gradual migration of main functionalities without disrupting core operations;

- Data governance strategies to standardize data formats and establish protocols that facilitate the flow of information between old and new systems.

Explainability & Trust Issues with Financial Services AI

AI in the financial industry requires transparency, since AI models, particularly deep learning systems, often operate as “black boxes”. This makes it difficult for regulators, decision-makers, and clients to understand how outcomes are generated.

When working on implementing AI in finance, we apply our machine learning expertise to overcome the lack of explainability by:

- Using explainable AI frameworks that provide insights into model decisions;

- Ensuring human auditing by asking data scientists and domain experts to evaluate model outputs and foster transparency.

Accessing AI and FinTech Development Talent

The race to innovate the finance sector created a talent shortage: there is a lack of ML engineers and data scientists with deep knowledge of financial industry specifics. It can slow product development, inflate recruitment costs, and limit an organization’s ability to maintain cutting-edge solutions.

To keep pace, our company balances talent recruiting and upskilling thanks to:

- Distributed software development that provides access to global talent pool with skilled professionals outside the financial company’s primary geographic location;

- Opting for upskilling programs with ongoing training for current employees to get proficient in emerging tools and best practices.

Adopting Artificial Intelligence in Finance: Why Partnering with a Trusted Vendor Matters

Blending finance and AI requires both domain expertise and technical proficiency. Yet, it is a rare combination typically found only in technical vendors. So, partnering with a tech company allows financial institutions to bridge the skills gap and ensure technical excellence. Below are some more reasons why partnering with a development company that combines both AI and fintech expertise is important.

Regulatory-Compliant Implementation of AI for Financial Services

Partnering with AI FinTech companies ensures that software adheres to evolving legal requirements, such as GDPR, KYC, and anti-money laundering (AML) regulations. Thus, the collaboration provides guidance on compliance best practices and reduces liability risks.

Building Scalable AI Solutions for Finance

An experienced vendor designs architectures that can handle surges in data volume and transaction loads without sacrificing performance. This allows systems to adapt quickly to market changes and growth opportunities. In this manner AI and financial services complement each other to create benefits for financial companies and their customers.

Ensuring Machine Learning Finance Model Transparency

The best FinTech development companies implement explainable AI frameworks. This ensures clear insights into decision-making processes and boosts stakeholder trust. Transparent models help satisfy regulatory demands and maintain accountability in the face of complex data-driven operations.

Cost-Effective AI Development & Faster Deployment

When equipped with tech vendor expertise and pre-built modules, the project dedicated to artificial intelligence and finance can be done in shorter development cycles. This means accelerated time-to-market and faster ROI.

Consider SPD Technology as Your AI Finance Software Development Company

We make machine learning and finance a powerful duo thanks to our experience with emerging technologies, deep understanding of the financial sector, and the application of best practices. Our team is known for:

- Tailored AI Consulting: We offer guidance before initiating the project to align AI solutions with each client’s specific financial goals.

- Deep FinTech Expertise: Our background in artificial intelligence for finance enables us to design solutions that address complex industry challenges.

- End-to-End AI/ML Development Services: We offer a full package of services, from initial strategy and data architecture to full-scale deployment.

- Proven Track Record with Industry Leaders: Our team has successfully partnered with top-tier financial organizations ensuring the reliability and scalability of our solutions in real-world environments.

- Commitment to Regulatory Compliance and Ethical AI: Our adherence to legal standards, combined with responsible AI practices, protects client reputations.

Using AI in Financial Services: SPD Technology’s Success Stories

We helped many clients to enhance their processes with AI and ML in finance. Thanks to our efforts in leveraging AI, financial companies can experience accelerated operations, improved customer experiences, and cost savings.

Boosting Financial Data Management with AI Solutions for Morningstar

Morningstar, Inc., an asset management company operating in 32 countries and managing over $200 billion in assets, tasked us with several projects operating in the same financial ecosystem.

Business Challenge

The client needed advanced technology to automate data collection, enhance data analysis, and modernize legacy systems.

SPD Technology’s Approach

We partnered with Morningstar across three core subprojects:

- AI/ML-powered Web Crawler application development;

- Data Collection application development;

- Kessler App overhaul.

Leveraging AI/ML models (Doc2Vec, Word2Vec, AWS Comprehend) and a modular monolith architecture, our team automated data crawling, integrated advanced data annotation and validation features, and built a high-load, cloud-native platform. By optimizing data storage, refining software architecture, and implementing cutting-edge AI techniques, we thrived to ensure seamless integrations, robust performance, and significant cost savings.

Value Delivered

Thanks to applying AI and ML in finance, our team helped the client to achieve their business goals, namely:

- Automated data Collection from 500+ websites and eliminated manual web-scraping;

- Achieve 10x performance optimization of data analysis tasks;

- Achieve 10x data storage cost reduction thanks to deployed optimal solutions;

- Unlock new revenue stream through IPO data;

- Handle 1 million daily users through a cloud-based Kessler app.

Automated Underwriting and Real-Time Fraud Detection for a Global FinTech Leader

A leading global FinTech company with over 10,000 employees sought to enhance its payment platform’s risk management capabilities.

Business Challenge

The client’s goals included automating the underwriting process for merchant onboarding, providing real-time transaction monitoring, detecting and preventing fraud, and delivering a user-friendly tool for manual decision-making. Additionally, they asked our team to ensure the system could seamlessly scale to handle high transaction volumes and maintain compliance across multiple geographies.

SPD Technology’s Approach

We used Java and Spring Boot for microservices, Camunda for business process automation, and Node.js/React for user interfaces. Hence, our team created a robust architecture integrating third-party KYC/KYB tools. In-house engines for counters and risk score rules were developed to handle dynamic risk scoring logic, while Kafka events and REST APIs enabled real-time data exchange and transaction monitoring.

Value Delivered

The new solution consolidated underwriting, fraud detection, alert management, and merchant account administration into a unified, scalable system. The software now supports high-load automated risk management and has boosted security (rejects high-risk merchants). Also, our efforts allowed the client to expand underwriting services and launch them in Canada (previously present only in the United States).

AI-Driven PDF Data Extraction for a Leading Financial Intelligence Firm

A top B2B provider of data and intelligence services for financial institutions needed a more efficient way to collect and process tabular data from diverse PDF reports.

Business Challenge

Without a standard format for financial documents, manual data extraction was time-consuming and prone to errors. The client sought to automate this workflow, reduce human intervention, and ensure the solution could easily scale to handle increasing volumes of financial reports.

SPD Technology’s Approach

Our ML engineers were set to develop a robust Python pipeline integrating cutting-edge AI components. We leveraged NLP for identifying relevant text within PDF files and a YOLO model to pinpoint table locations for subsequent extraction using Camelot or AWS Textract. After extraction, we used GPT-driven post-processing to ensure data accuracy and completeness before consolidating tables into an Excel file.

Value Delivered

Thanks to our efforts dedicated to machine learning, financial services with the delivered product have become faster and more accurate. The product changed the rules of how the process of data extraction from PDF documents works. Our efforts resulted in:

- 3x faster document processing due to automation of PDF data extraction;

- 5x cost reduction thanks to improved efficiency and reduced manual labor.

Conclusion

With artificial intelligence and machine learning, finance becomes much more powerful and value-driven. It automates document processing, reduces human bias, helps crafting tailored financial reports and make dynamic portfolio adjustments, as well as enhances security with better fraud detection and risk management. All these improvements are possible because AI and ML often come hand-in-hand with such technologies as NLP, computer vision, neural networks, reinforcement learning, and blockchain.

AI use cases in financial services include automating routine tasks, detecting fraud, delivering personalized product recommendations, expediting customer support with AI-driven chatbots, and more. These AI and machine learning use cases in finance cover investment banking, wealth management, corporate finance, insurance, and lending.

In the future, AI will likely be enhanced with quantum computing and autonomous decision-making, while blockchain and generative functionalities are already in use and are going to evolve. However, to leverage the benefits of AI/ML and implement these technologies into financial services, it is important to overcome a number of challenges, including poor model reliability, explainability, integrations with legacy systems and talent shortage.

These challenges are possible to overcome with the help of a reliable technology vendor. Such a partner can bring AI and financial software development expertise to the table. We know that for a fact as our team helps implement AI into financial applications. If you need a hand as well, do not hesitate to contact us. We are ready to provide you with guidance and skills for your AI project.

FAQ

How Are AI and ML Used in Finance?

ML and AI in the finance industry drive predictive analytics, automate processes, and enhance risk management. They detect fraud by spotting anomalies, streamline tasks like customer onboarding, and personalize services through data-driven insights.

What Is the Future of AI in Finance?

AI’s future in finance will likely bring more autonomous decision-making and deeper personalization. Innovations like quantum computing and advanced generative models can reshape risk management and compliance, while blockchain will bring more secure financial infrastructures.

What Are 5 Applications of AI in Banking?

Key AI and machine learning use cases in finance and banking include advanced fraud detection, automated loan underwriting, predictive analytics for risk management, personalized financial recommendations, and chatbots for 24/7 customer service. While these are the most common machine learning applications in finance, there is much more this technology can offer to the industry.

What Is the Best AI for Finance?

The choice of AI solutions depends on specific needs, such as fraud prevention, portfolio optimization, or compliance. Many institutions leverage a blend of cutting-edge ML platforms, cloud-based services, and proprietary models tailored to unique operational and regulatory requirements.