In one of our previous articles, we discussed the business impact of Big Data across various business verticals. This time we will focus on the applications of Artificial Intelligence in the financial industry, discussing how exactly you can leverage data analysis to build an AI-enabled fintech solution that will elevate your organization to an entirely new level.

While AI in fintech can still be considered a growing and evolving market, with the most valuable innovations being on the horizon, you are welcome to tap into it, being supported by the solid experience and latest expertise of our fintech and AI engineering specialists. In this article, we analyzed the possibilities of AI in financial technology from the perspective of our experience and will share our insights.

5 Ways AI Impacts Fintech Businesses and Their Customers

The market size of Artificial Intelligence in fintech was valued at $44.08 billion in 2024 and is projected to grow to $50 billion in 2029, according to Statista. So, while the impact of AI in the Financial industry is already backed up by numbers, let’s take a closer look at what areas this value is felt the most.

Making Financial Services Customer-Centric

Similarly to many other industries, AI in Fintech transforms key aspects of customer service. Based on data analysis, it is possible to offer highly personalized services catering to specific customer behavior.

AI for customer behavior analysis allows for effectively predicting customer needs and preferences. In the Fintech industry, in addition to customer-centric personalized services, AI unlocks the power of tailored financial advice, making it possible to offer help close to the level of human advisors.

As for customer support, AI-powered chatbots and virtual assistants are already changing customer interaction, and the financial industry is at the forefront of their global adoption. Thanks to advancements in Natural Language Processing for business, it is possible to:

- Understand and respond to customer queries in real-time

- Offer 24/7 customer service availability

- Eliminate any significant wait times for fintech products users.

Improving Financial Inclusion

Traditional credit scoring methods often exclude individuals without a significant credit history, limiting the number of potential customers. By using AI, financial and banking institutions can utilize alternative data sources such as utility payments, social media activity, and mobile phone usage to assess creditworthiness, helping include individuals who were previously underserved or excluded by traditional financial systems.

Another important aspect of AI in Fintech is overall cost reduction for financial services providers, due to extensive automation of operational processes. This leads to more affordable financial services and products with lower fees and interest rates, promoting financial inclusion even further, as a result.

Finally, AI-powered solutions can guide users through budgeting, saving, and investing, empowering them to make more informed financial decisions. It can be useful not only for end-clients but also for financial advisors as well. For example, in one of our recent projects, we delivered a web solution tailored to give financial advisors direct access to the precise products their clients demand. We introduced an AI-based matching process for wealth and asset managers, creating a robust web crawling mechanism in 1 week, and later developing a fully-functional website.

Preventing Money Laundering and Terrorism Financing

According to the United Nations Office on Drugs and Crime (UNODC), between 2% and 5% of global GDP is laundered each year, which makes innovations in Anti-Money Laundering (AML) more needed than ever before. AI in Fintech can secure financial data by delivering functionalities to monitor financial transactions in real time, identifying patterns indicative of money laundering or terrorist financing. Machine Learning algorithms, specifically, can analyze transaction data to detect anomalies and suspicious activities far more effectively compared to traditional methods.

Serhii Leleko

ML & AI Engineer at SPD Technology

“An important aspect of AI and Machine Learning is that they enhance Know Your Customer (KYC) and Customer Due Diligence (CDD) processes by automating customer identity verification and providing accurate risk assessment. Based on our projects, I can say that Machine Learning-based automated compliance software proved time and time again to be a significant cost-cutter and time-saver for our clients, by quickly analyzing various data points to ensure compliance with all necessary regulatory requirements.”

Machine Learning is also a key technology for advanced Fraud Detection systems, that can learn and adapt to evolving fraudulent patterns, analyzing customer behavior to analyze suspicious deviations.

Credit card fraud detection is one of the most important areas in which AI in Fintech can effectively help.

Read our article to discover the real-world fraud detection solutions that are already changing the Fintech industry.

Improving In-Branch Security

Modern AI-driven biometric systems, like facial recognition and fingerprint scanning, are offering an additional layer of security to traditional passwords and PINs. Surveillance systems for monitoring in-branch activities can also benefit from innovation, with technologies like Computer Vision that can identify suspicious behavior and potential security threats thanks to video analytics.

AI can also be a great help with incident response strategies, by analyzing security breaches and providing insights into how they occurred, preventing potential similar incidents in the future.

Empowering Regulatory Compliance and Governance

Due to its ability to analyze vast amounts of data, AI can eliminate any chances of human errors by monitoring and detecting the slightest regulatory changes to ensure that your organization’s policies and procedures remain compliant. It is also possible to automate the generation of regulatory reports, which reduces the burden on compliance teams and helps financial institutions meet regulatory deadlines.

As a part of risk management functionality, AI systems can analyze various risk factors and provide insights into potential regulatory risks, enabling proactive mitigation strategies.

The possible risk factors may include:

- Non-compliance

- Regulatory changes

- Data privacy and security

- Reporting and disclosure.

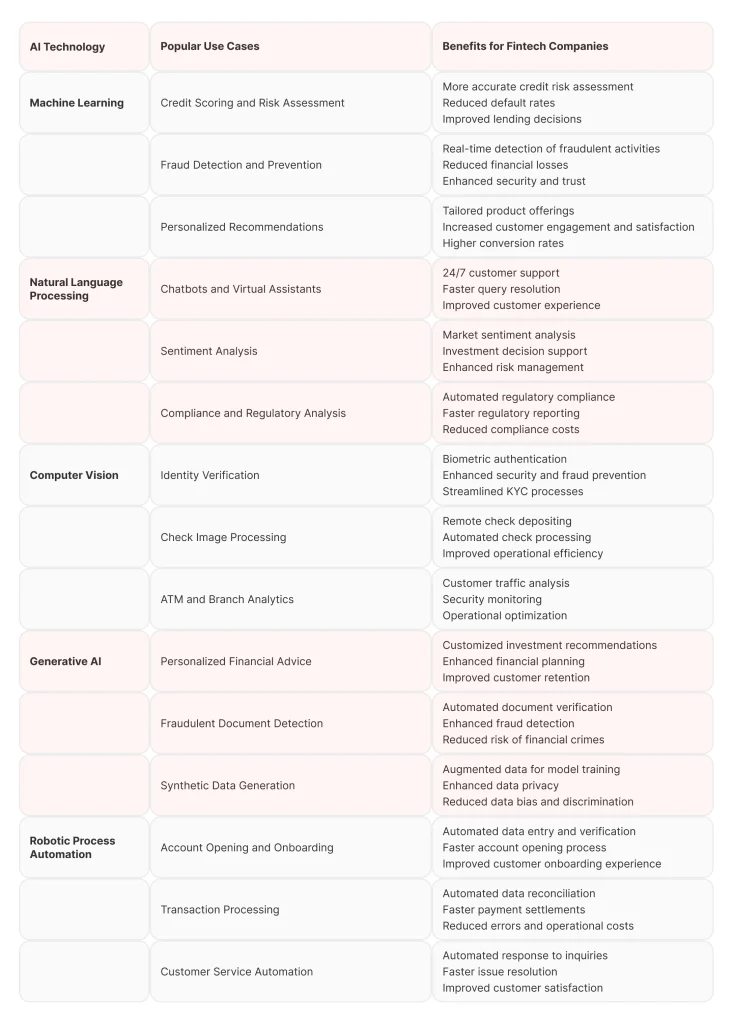

Advanced AI Technologies Being Continuously Adopted in the Fintech Sector

The Fintech industry always stays on top of innovation, so no wonder it employs the latest advancements of AI technology for diverse and fascinating use cases. Let’s explore them in more detail.

Machine Learning

Machine learning algorithms are at the core of any AI-driven solution used in the fintech industry. To get a deeper understanding of this technology, consider our introduction to Machine Learning, and we, in the meanwhile, will focus on its practical implementation in financial services.

Credit Scoring and Risk Assessment

Unlike traditional methods, ML models can process and analyze diverse data sets to create more comprehensive and accurate credit scores. Additionally, they can analyze data in real-time, to assess the risk associated with lending to a particular individual or business. By examining historical loan performance data, ML models can predict the likelihood of a borrower defaulting on a loan, enabling data-driven decisions for financial institutions.

Fraud Detection and Prevention

Machine Learning models excel at Anomaly Detection by continuously learning while monitoring transactions and recognizing what determines normal behavior for each customer. It is also possible to analyze behavioral biometrics, such as typing speed, mouse movements, and touchscreen interactions, to create unique user profiles and detect anomalies instantly in real time.

Personalized Financial Recommendations

Improving financial product personalization is another use case of Machine Learning in financial services. By collecting and analyzing customers’ financial data and online behavior, ML-enabled algorithms can group customers with similar behavior patterns and create targeted campaigns for each group.

Artificial intelligence also allows for leveraging Predictive Analytics when providing product recommendations. Being guided by the customer data collected, an ML model can predict when the customer might need a loan, be interested in a saving or investing opportunity, or require a new insurance policy. Depending on the customer’s financial goals and spending habits, an ML-driven algorithm can define which product is most suitable for an individual user or customer segment.

In one of our articles, we focused on applications of Machine Learning in finance specifically.

Find detailed examples of how Machine Learning algorithms are disrupting traditional business methods for financial institutions.

Natural Language Processing

Statista believes that the Natural Language Processing market will reach USD 36.42 billion in 2024. Fintech is a major part of this growth, and below are some of the use cases of this technology for the fintech industry.

Chatbots and Virtual Assistants

NLP-powered chatbots can handle a wide range of customer queries, providing instant responses and support around the clock, freeing up hands for the customer service teams and assisting customers with:

- Checking account balances

- Making payments

- Transferring funds

- Answering frequently asked questions.

Advanced chatbots can offer personalized experiences by analyzing customer data and understanding each client’s individual preferences. For example, a chatbot might recommend financial products or services based on a customer’s transaction history and financial goals.

Sentiment Analysis

In Fintech, sentiment analysis provides insights into public opinion about financial markets, specific companies, or economic events. Companies can make informed investment decisions and predict market trends by analyzing sentiment. Sentiment analysis plays a significant role in the application of artificial intelligence in retail.

What’s more, merging fintech and retail data provides a more holistic view into customer behavior, unlocking better product personalization and fraud detection opportunities. By recognizing unusual spending patterns, financial technology companies can promptly identify suspicious activities. This integrated data approach can enhance customer segmentation as well, leading to more targeted fintech product recommendations as a result.

Computer Vision

Computer Vision development is becoming a top-rated service among businesses in entirely different verticals, and Fintech is definitely among them.

Identity Verification

Computer vision can detect various security features embedded in identity documents, such as watermarks, holograms, and microtext. It can also compare the facial features on the ID with a live selfie or video of the customer to ensure that the document belongs to the person presenting it. This significantly reduces the risk of identity theft and fraud.

By automating identity verification, computer vision speeds up the onboarding process, allowing customers to open accounts or access financial services quickly and conveniently.

Check Image Processing

Computer vision is also widely used in mobile banking apps for the remote deposit of checks. Customers can simply take a photo of the check using their smartphone, and computer vision algorithms process the image to extract relevant information such as the check amount, date, payee, and payer details. Additionally, computer vision can enhance the quality of check images by correcting distortions.

ATM and Branch Analytics

Computer vision systems installed in ATMs and bank branches can analyze customer behavior to improve service delivery. They enhance security as well, by monitoring and alerting suspicious activities. Some ATMs are now equipped with facial recognition technology to authenticate users, in addition to entering a PIN, which is another significant boost to security aspects.

Generative AI

With the rise in popularity of ChatGPT and DALL-E, generative AI became one of the most exciting tech trends globally. Generative AI development is just as relevant in Fintech, elevating personal finance and banking apps to a new level.

Personalized Financial Advice

By synthesizing individual financial data, generative AI models can create customized advice that aligns with a customer’s risk tolerance and financial objectives. Unlike traditional financial advice that often relies on periodic reviews, generative AI provides dynamic and continuous financial planning.

Fraudulent Document Detection

By training on vast datasets of legitimate and fraudulent documents, AI models learn to identify subtle patterns and anomalies that might indicate fraud. Generative AI adds to this by simulating various fraud scenarios. When a new type of fraudulent document is detected, the AI model can generate additional examples of this new fraud type, helping to retrain and update detection systems.

Synthetic Data Generation

Generative AI can create synthetic datasets that mimic the statistical properties of real financial data without compromising individual privacy, which can be used for research, development, and testing purposes. Generative AI is able to generate synthetic data that replicates real-world scenarios, enabling the development of robust models even when actual data is scarce or sensitive.

Robotic Process Automation

For Fintech, Robotic Process Automation development is another area that can be very beneficial and deliver additional value. Below are some examples of RPA technology’s use cases in finance.

Account Opening and Onboarding

RPA bots can automate the process of entering customer information into multiple systems during account opening. By extracting data from digital forms or scanned documents, RPA ensures that information is accurately entered into relevant databases. Even more, RPA can automate the verification of documents required for account opening, including:

- Identification proofs

- Address proofs

- Income statements.

By offering this automation, RPA significantly reduces the time required to open a new account, leading to a better overall experience.

Transaction Processing

RPA solutions can handle the end-to-end execution of financial transactions, such as payments, fund transfers, and trade executions, reducing the risk of errors and delays, and improving the reliability and efficiency of financial operations. The reconciliation process can also be automated by matching transaction records from various sources, identifying discrepancies, and correcting errors.

Customer Service Automation

By integrating with chatbots and virtual assistants, RPA bots can provide instant responses to customer queries, reducing wait times. RPA solutions add to more personalized customer interactions by accessing customer data, analyzing past interactions, and tailoring responses to meet individual customer needs.

How Major FinTech Market Players Take Advantage of AI

If Grand View Research is to be believed, the adoption of AI in the Finance industry will increase from 45% in 2022 to 85% expected by 2025. While the biggest companies are already securing their business growth with innovative solutions, let’s review the most prominent implementations of AI in fintech.

Banks and Digital Banks

Capital One held the largest AI adoption rate among any other banks last year. But what makes AI so effective for banking institutions? The answer lies in the diverse range of its applications.

Customer service, support and offerings personalization

AI systems can automatically tailor product recommendations to meet individual customer needs based on customer data like:

- Transaction history

- Spending patterns

- Life events.

For example, if the client of your bank frequently buys plane tickets, your system can suggest using a credit card with a special plan full of travel rewards. This level of personalization will undoubtedly improve customer experience and boost your brand image as a result.

Both traditional and digital banks can benefit from using smart chatbots that could handle a wide range of customer queries, from basic balance inquiries to personalized financial advice.

Improved credit scoring, loan risk assessment and approval processes

Machine Learning unlocks data analytics capabilities far beyond traditional approaches to checking credit histories. According to the transitional approach, analyzing transaction records of each customer was enough for delivering a comprehensive and accurate assessment of a borrower’s creditworthiness. AI takes this process to the next level by enabling real-time credit scoring and employing a larger data array to make a final decision. Such a data-informed and automated risk assessment speeds up the loan approval process, enabling banks to make faster and more reliable lending decisions.

More accurate churn prediction and effective retention strategies

The analysis of behavioral patterns allows identifying early signs of customer dissatisfaction, enabling banks to act proactively. Machine Learning models can process various data points at the same time, including changes in transaction frequency, customer complaints, and interactions with customer service, to identify at-risk customers. As a part of our experience, we developed a data analysis solution that analyzes a company’s brand image based on the feedback on social media.

Having such a customer-shared insight, banks can implement targeted retention strategies, for example, offering exclusive product offers or discounts to customers who are most likely to leave.

Insurance Companies

Insurance businesses can benefit from AI technology as well. For example, as a part of one of our projects, we leveraged ML and OpenAI for automated data collection and processing of the financial reports of leading insurance companies, helping our customer to achieve 5x cost efficiency. Automated data processing isn’t the only use case of AI in insurance, so below we provided more examples of using this technology within the insurance niche.

Improved claims processing efficiency

Advanced solutions with Machine Learning algorithms can quickly analyze claims data, verify the information, and detect inconsistencies, dramatically reducing the time required to process claims. This not only speeds up the settlement process overall but also improves accuracy, reducing the likelihood of human error, which is quite common in this area. AI-powered systems can also handle customer interactions during the claims process, providing updates and answering queries in real-time.

Creating personalized policy offerings and improving pricing accuracy

AI helps insurance companies to offer personalized policy options by analyzing individual customer data, including:

- Health records

- Lifestyle choices

- Driving behavior.

In fact, it is possible to improve pricing policy accuracy by using probability prediction techniques. This approach has proven to be very successful for predictive analytics in retail, and getting more popular in Fintech as well.

Improving fraud detection in claims with computer vision

AI, particularly through the use of сomputer vision, enhances fraud detection in insurance claims by analyzing images and documents to detect anomalies. The automation of this process leads to faster and more accurate investigations compared to manual cases. This not only helps insurers reduce losses from fraudulent claims but also speeds up the processing of legitimate claims by reducing the need for lengthy investigations.

Payment Processing Companies

Payment processing companies can benefit from leveraging AI in numerous ways, with transaction security, fraud protection, and ensuring regulatory compliance as the main use cases.

Strengthening transaction security

Machine learning models have already proven to be effective in identifying anomalies that indicate potential fraud, such as unusual transaction locations or spending spikes. By quickly flagging fraudulent transactions, AI helps prevent a fraudulent issue before it occurs, protecting both payment processing companies and their customers.

AI also improves the security of online transactions by using behavioral biometrics to verify user identities. For example, AI can analyze typing patterns, mouse movements, and other behavioral indicators to ensure that the person making a transaction is a legitimate bank account holder.

More effective dispute resolution and chargeback management

When a dispute arises, AI solutions can quickly gather and analyze relevant information, such as transaction records, communication logs, and previous dispute histories, to determine the validity of the claim. This significantly accelerates the resolution process, reducing the time and resources required to manage disputes and chargebacks. AI systems can also identify patterns in those disputes, helping companies address underlying issues and reduce the overall number of chargebacks.

Improving compliance with KYC and AML

AI solutions dramatically speed up compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations by automating the verification of customer identities and the monitoring of transactions. Machine learning algorithms can analyze vast amounts of data to identify suspicious behavior and flag potential money laundering activities. It is also possible to streamline the KYC process by automating document verification and risk management.

Venture Capital Firms

VC firms operate in a highly competitive and dynamic environment, where identifying promising startups and making informed investment decisions are crucial to success. Here is how AI can help with this.

Due Diligence with NLP

Natural Language Processing algorithms are used to analyze vast amounts of textual data, including:

- Financial reports

- News articles

- Social media posts.

This information enables extracting valuable insights about potential investment opportunities. Venture capitalists are already able to make more informed decisions, identifying risks and opportunities that are often overlooked in manual reviews.

More effective portfolio management with predictive analytics

The portfolio management area benefits from predictive analytics in forecasting the performance of investments. This allows venture capital firms to optimize their portfolios, reallocating resources to maximize returns and minimize risks. Demand Forecasting with Machine Learning in retail works according to quite a similar concept that we already discussed in one of our articles, so we suggest you read it to get familiar with this topic.

Improved deal sourcing, market sentiment analysis, and exit strategy planning

With the opportunities that AI presents, it is possible and already getting popular to enhance deal sourcing by analyzing large datasets to identify promising startups and investment opportunities. Market sentiment analysis powered by AI, on the other hand, provides insights into public perceptions and market trends by analyzing social media, news, and other sources. This helps venture capital firms understand market dynamics and make more informed investment decisions.

As for exit strategy planning, AI can help with identifying optimal timing and methods for exiting investments by analyzing:

- Market conditions

- Competitor actions

- Financial performance.

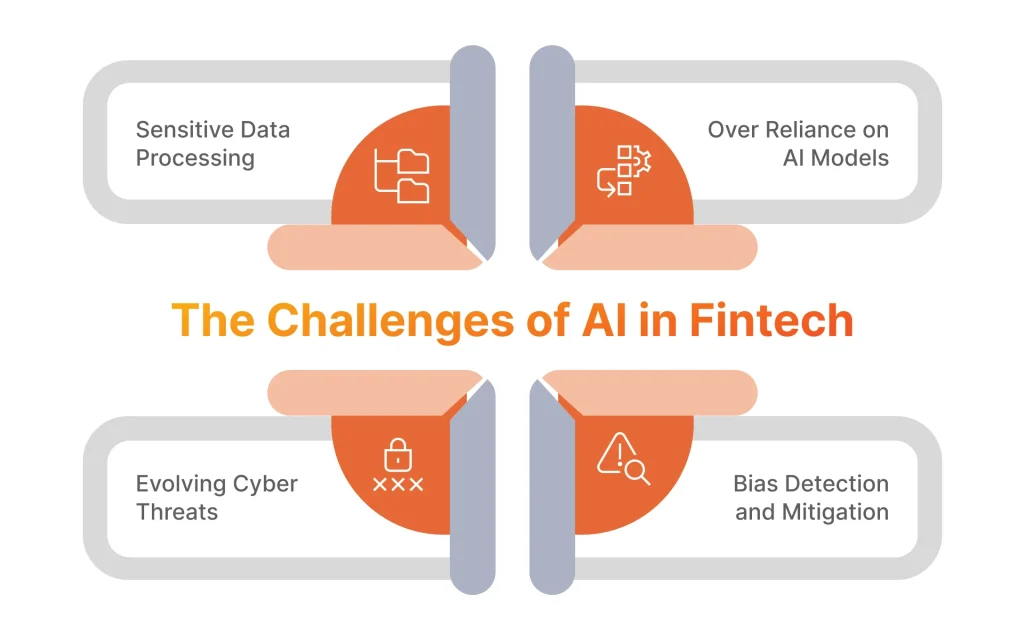

The Challenges of AI in Fintech

Despite all the promising applications and value-adding advantages, the deployment of Artificial Intelligence in the Financial sector has some obstacles that should be carefully considered. Let’s discuss them closely and talk about the ways to effectively overcome those challenges during AI systems development and adoption.

Sensitive Data Processing

Financial institutions are working with vast amounts of personal and financial data, making data security a top priority. AI systems should be designed to safeguard this sensitive information against breaches and any kind of unauthorized access. Additionally, Fintech companies must adhere to stringent data protection laws like the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States. Ensuring compliance while managing large-scale, sensitive data processing is a significant challenge that companies should overcome to truly leverage Fintech Artificial Intelligence.

Serhii Leleko

ML & AI Engineer at SPD Technology

“At SPD Technology, we prioritize data security throughout the entire lifecycle of our projects. We implement strong encryption protocols to protect both stored data and data in transit across networks. Our secure environments include robust access controls, ensuring that sensitive data is accessible only to authorized personnel. We utilize secure servers and cloud storage solutions with rigorous security measures, conduct regular security audits, and employ robust key management practices to further safeguard our data.”

Over-Reliance on AI Models

While AI algorithms can significantly enhance decision-making processes, an over-dependence on them can be problematic. Relying heavily on Artificial Intelligence can create scenarios where critical decisions are made without adequate human intervention, which may result in errors or unethical outcomes.

Many AI models, particularly those based on Deep Learning, can be difficult to interpret and understand how they arrive at specific decisions. This lack of explainability can undermine the trust and accountability of a company, putting into question the implementation of AI models in the first place.

Serhii Leleko

ML & AI Engineer at SPD Technology

“While building and implementing our Artificial Intelligence and Machine Learning solutions, we always integrate human judgment at key points in the decision-making process, preventing errors and ensuring that all ethical considerations are taken into account. We prioritize enhancing the transparency and explainability of our solutions, developing models that can provide clear and interpretable explanations for their predictions, and helping stakeholders to understand how decisions are made.”

Evolving Cyber Threats

According to Check Point, the average number of cyberattacks per organization per week reached 1,308 in the first quarter of 2024, which is a 28% increase from the last quarter of 2023. Fintech companies are aware of this and may hold on deploying Artificial Intelligence. This consideration is reasonable since AI systems themselves can become targets of sophisticated cyberattacks, with attackers using advanced methods to breach these systems.

Data poisoning is an AI-specific threat where attackers manipulate training data to corrupt AI models, leading to incorrect or harmful decisions. So, in order to protect Fintech companies, an additional effort needs to be made to secure the models, as well as the underlying infrastructure of organizations.

Fintech is one of the industries that uses AI algorithms for fraud detection purposes. However, to make sure that fraud detection using Machine Learning models performs at its best, it is vital to monitor the advancements in malicious software and regularly update AI systems to prevent any fraudulent attempts.

Bias Detection and Mitigation

Finally, some AI models are trained on historical data, which can contain inherent biases. These biases can be learned by the AI systems, leading to unfair outcomes in critical processes such as credit scoring and loan approvals.

Some of the most common data biases include:

- Sampling bias

- Label bias

- Feature selection bias.

To deal with algorithmic bias, Fintech companies need to develop effective tools. This is a complex task requiring continuous monitoring and adjustment of models to ensure fairness. Ethical considerations play a crucial role here, as defining and measuring fairness can vary significantly across different contexts. However, with an experienced custom AI solutions development partner, this issue can be effectively eliminated.

Conclusion

The integration of AI in Fintech already proved to be a major driver for enhanced efficiency, deeper personalization, and overall innovation in financial operations for prominent industry leaders across the globe. This technological revolution has its fair share of challenges, however, it is possible to overcome them with robust data governance, enhanced security measures, bias mitigation strategies, and having an experienced development company as your partner.

We, at SPD Technology, are here to help your organization to embrace innovation, and benefit from cutting-edge Artificial Intelligence solutions, delivering transparent and explainable business software driven by AI algorithms without any disruptions to your processes. Let us help you navigate this transformative journey and maximize the potential of your company!

FAQ

- How is AI Used in Fintech?

Artificial Intelligence has plenty of game-changing implementations for the organizations in the financial sector, some of the most interesting include:

- Fraud Detection and Prevention: among the two most popular Fraud Detection methods powered by AI algorithms are pattern recognition and real-time monitoring with the usage of Machine Learning models.

- Customer Service and Support: personalized recommendations for financial advice have already made a significant impact on customer experience, as well as AI-driven chatbots and virtual assistants that have become a Fintech industry standard.

- Credit Scoring and Lending: Artificial Intelligence offers entirely new opportunities in analyzing customer data by assessing non-traditional data including social media and mobile data to evaluate creditworthiness.

- Investment Management: AI-powered platforms provide automated, algorithm-driven financial planning services never seen before, while Predictive Analytics functionality allows predicting market trends and proposing investment strategies.

- Regulatory Compliance: Artificial Intelligence helps financial institutions comply with regulations by automating data reporting and monitoring compliance in real-time.

- What is Generative AI in Fintech?

Just like with many other industries in 2024, Generative AI has enormous potential for the Financial industry as well. The most interesting use cases include:

- Creating realistic financial scenarios to stress-test financial models and strategies.

- Generating synthetic datasets that mimic real data, allowing for analysis without compromising privacy.

- Providing financial reports and summaries based on data inputs.

- How is AI Used in Digital Banking?

This industry specifically, just like AI in Fintech in general, can benefit greatly from round-the-clock support, personalized products, critical process automation, anomaly detection, predictive analytics, and real-time credit scoring.