The global Artificial Intelligence market size is valued at USD 26.23 billion in 2024, according to Precedence Research, and it’s fair to say that investment banking plays a major role in this growth. While it’s hard to overestimate the business impact of big data combined with powerful AI/ML solutions for investment banks, there are more and more technological breakthroughs and market trends emerging each day.

Financial institutions and leading banks are at the forefront of AI adoption, with major banks in North America making substantial investments to drive innovation. The global banking industry is expected to invest roughly $632 billion in AI technology by 2028, aiming to enhance efficiency and security. Large banks are strategically reallocating their IT budgets to foster innovations and effectively counter competitive threats from tech giants. According to the McKinsey Global Institute, generative AI could add between $200 billion and $340 billion in value to banking through greater productivity.

In this article, we will share our insight on how exactly leveraging AI can help to improve various aspects of this sub-industry, enhancing efficiency and automating repetitive tasks that hold back the progress of financial institutions across the globe.

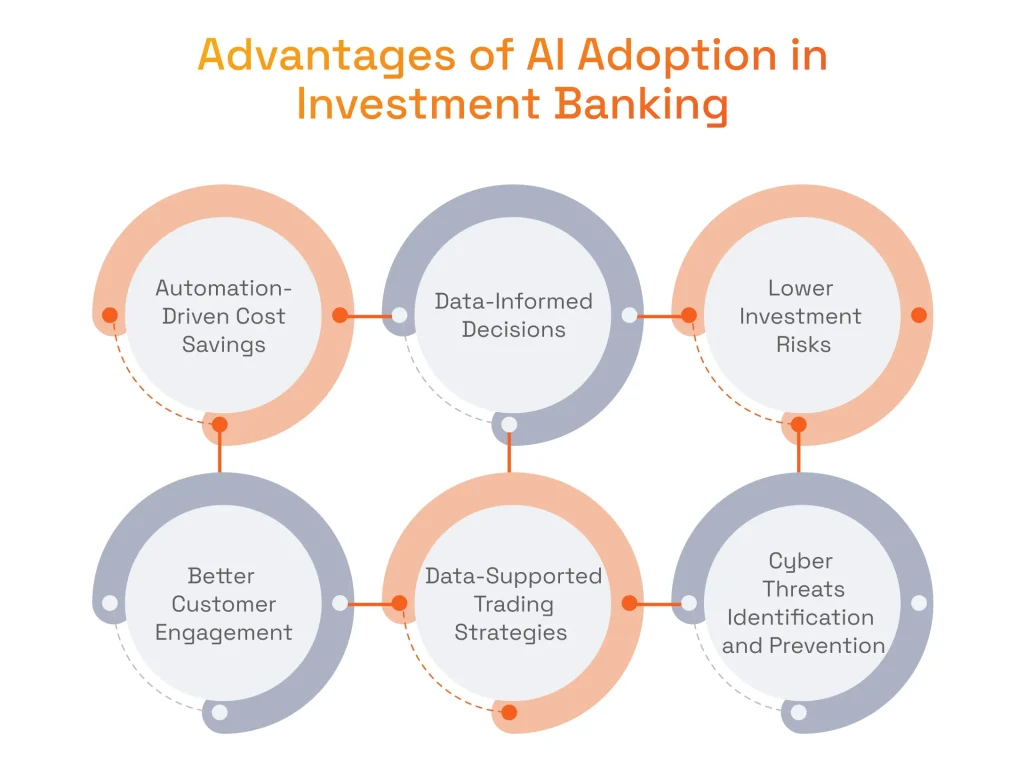

5 Undeniable Advantages of AI Adoption in Investment Banking

The growing importance of competent AI implementation in investment banking is becoming a paradigm shift in the industry, improving efficiency, decision-making, and everything in between. Corporate and investment banks are leveraging AI to gain a competitive edge, using both traditional and generative AI to stay ahead in the industry. If Deloitte is to be believed, generative AI alone can boost front-office productivity for 14 global investment banks, which have the potential to obtain additional revenue of US$3.5 million per front-office employee by 2026. Corporate and investment banks are making the most progress in new product development, customer operations, and marketing and sales through generative AI.

The strategic deployment of generative AI represents a comprehensive reimagining of operations, product development, and risk management in banking. While there are some potential risks and concerns, like ensuring data security in Fintech apps that should be addressed, the benefits of AI in investment banking outweigh any possible challenges.

Automation-Driven Cost Savings

A lot of mundane and time-consuming complex tasks will no longer be a problem since AI introduces a massive potential for automation. Not discarding the capabilities of the human brain, AI can be much more effective for tasks like transaction processing or compliance checks, saving time for organizations on each operation. This efficiency translates into overall productivity gains and positively affects the bottom line.

Data-Informed Decisions That Lower Investment Risks

Even the best experts in the industry can miss some of the patterns hidden in the market data. Predictive analytics in investment banking uses historical data to estimate future market and credit risks, providing valuable decision support for investment bankers. AI algorithms, on the other hand, can derive game-changing insights based on automated data analysis. Organizations can benefit from this and make informed decisions on asset allocation, risks, and portfolio optimization.

Better Customer Engagement Through Personalization and Support

It is possible to implement AI into your Customer Relationship Management (CRM) system and deliver the functionality of tailored financial advice to your customers. Leveraging the advancements of Natural Language Processing for business, AI can convert human speech into text and vice versa, enabling clear and quick communication. Based on these interactions and analyzing the answers and the sentiment, investment banking institutions can anticipate customer needs and offer relevant products proactively.

There are also chatbots and virtual assistants, that with the help of AI can:

- Offer 24/7 customer support

- Rapidly answer questions

- Deliver account status updates

- Guide through key banking processes.

More Profitable and Data-Supported Trading Strategies

There is always room for improvement in trading strategies. AI in investment banking can bring in massive revenue streams by identifying opportunities in capital markets. AI models can analyze trading patterns and stock prices to optimize trading strategies and forecast market outcomes. AI-powered algorithms execute trades based on real-time market signals, enabling algorithmic trading. Keep in mind that AI models are constantly learning, and they’re not only good with their initial strategies but also improve on them based on new data, becoming more efficient over time when used in capital markets.

Proactive Cyber Threats Identification and Prevention

AI systems can monitor network traffic, analyze patterns, and detect anomalies that may indicate potential security breaches, which is critical for the industry. On our blog, we discussed closely AI-driven credit card Fraud Detection and investment banking can benefit from mitigating potential risks just as much. The clients of banks that fully leverage the capabilities of AI for a proactive approach to cybersecurity are maintaining client trust and always ensuring adherence to regulatory compliance to the highest extent.

The Applications of AI in Investment Banking

It looks like the Investment Banking industry will never be the same with AI implementations already covering the essential parts of this domain, helping banks to deliver highly personalized, secure, and sophisticated services. New technology, such as generative AI, is transforming the day-to-day operations of wholesale bankers by automating and optimizing routine activities. Below are some of the most prominent applications of AI in investment banking.

Risk Management

With the help of advanced AI models, it is possible to unleash the capabilities of predictive analytics and based on historical data analysis forecast risks that might occur. For investment banks, it means having the ability to anticipate:

- Market fluctuations

- Credit defaults

- Operational risks.

To top that off, modern AI ecosystems offer proactive risk management, achieved by continuous monitoring of transactions and changing market conditions. Generative AI can also create synthetic data for trading and risk modeling, allowing banks to test and enhance risk assessments even when real-world data is limited.

Customer Service Automation

Machine Learning helps to personalize client interactions for investment banking and significantly boosts customer experience across various touchpoints. Robotic Process Automation truly shines here, as chatbots work great for increasing worker productivity due to managing basic inquiries, and guiding customers by sharing information. With advanced virtual assistants, it is possible to provide more sophisticated services, like highly personalized financial advice based on individual data.

Serhii Leleko

ML & AI Engineer at SPD Technology

“Our use cases have proven that combining AI chatbots and virtual assistants with human experts is the most efficient way to leverage the technology. While chatbots are highly effective with the automation of mundane tasks, working in the assisting role is bringing the best of both worlds of innovation and human intelligence to result in superb customer experience.”

Portfolio Management

Numerous success stories have proven that AI-driven Portfolio Management delivers higher precision and deeper customization, compared to traditional approaches, eliminating the chances of human error. Hedge funds are leveraging AI to improve operational efficiency, risk management, and trading strategies by analyzing large data sets and streamlining compliance and reporting processes. The most important aspects we should mention are:

- Robo-Advisors: AI systems that create and automatically manage investment portfolios customized to individual client goals and risk tolerances.

- Optimization Algorithms: With the help of AI, it is possible to optimize asset allocation and rebalance strategies to ensure the highest ROI.

- Personalized Strategies: Machine Learning algorithms are capable of offering personalized investment strategies based on rigorous analysis of huge amounts of data.

In one of our projects, we developed an MVP for the Diligence Fund Distribution Platform, providing our Artificial Intelligence and Machine Learning expertise to introduce a highly efficient matching process for users of the product, as well as smart search functionality. This portfolio management solution allowed our client to pitch to investors and raise funds for the next iterations of this startup and evolve the project further.

Market Research and Analysis

With AI, the changes in investment banking market trends are easy to detect and follow, with deeper insights for a more data-driven decision-making process. AI-driven financial modeling improves the accuracy and efficiency of financial analysis and forecasting in investment banking research. It takes powerful sentiment analysis tools to analyze news and social media to gauge market sentiment and determine potential risks and movements. With modern neural networks and deep learning models, it is possible to significantly enhance data mining processes, having major advantages in the:

- Feature Extraction

- Pattern Recognition

- Anomaly Detection

- Classification and Clustering

- Handling Unstructured Data.

Learn about the groundbreaking potential of Machine Learning in Finance in our detailed article based on hands-on experience.

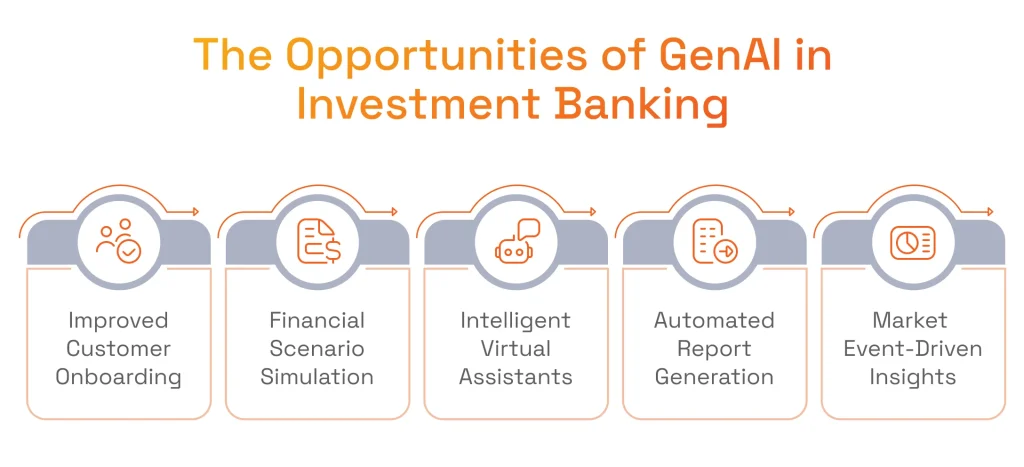

Generative AI for Investment Banking – Promising Opportunities

Generative Artificial Intelligence is set to become a transformative force in the world of investment banking, as the total potential added value of Generative AI could range between 200 and 340 billion U.S. dollars in the next few years, according to Statista. Major Wall Street banks are early adopters of generative AI, leveraging it to transform financial services and operations. Let’s break down what solutions will stimulate this growth the most.

Improved Customer Onboarding

Generative AI can make the customer onboarding process significantly faster and more personalized. For example, it is possible to create tailored legal documents needed for onboarding, including contracts and compliance paperwork. AI can automate the Know Your Customer (KYC) process as well, by generating and verifying the necessary documents, cross-referencing data with multiple databases, and ensuring regulatory compliance.

Financial Scenario Simulation

The creation of different hypothetical market scenarios is possible with generative AI development. Banks need to be able to generate those scenarios to make a reasonable evaluation of the potential risks and their impact on investment portfolios. With the capability to simulate market conditions and the consequences of implementing specific investment strategies, AI can suggest optimal portfolio adjustments, or at least provide ideas for optimization by human employees.

Intelligent Virtual Assistants

The market for Intelligent Virtual Assistants is already booming across all industries, being valued at USD 14.77 billion in 2024, according to Mordor Intelligence. As for investment banking, these software solutions will allow advisors to focus on more important tasks, taking over routine and organizational activities like scheduling meetings with clients and sending reminders on key operations.

In one of our projects, we built a high-load support AI chatbot using Large Language Models (LLMs) and Natural Language Processing (NLP) that handles 99% of queries under 10 seconds. The developed chatbot completely transformed customer service for our client, as it performs flawlessly even during peak hours, showing the true value of AI for businesses.

Automated Report Generation

When there is access to quality data, Generative AI can handle creating comprehensive financial reports, including balance sheets, income statements, and cash flow analyses. Generative AI can also automate the creation and analysis of audit reports, diligence reports, due diligence reports, and technical documents, streamlining compliance and internal assessments.

Even more, detailed performance reports and research reports for investment portfolios can be easily generated, with AI highlighting key attention points and displaying the results in a visually appealing format. AI tools can review legal documents and financial statements during due diligence to efficiently flag risks or inconsistencies.

Market Event-Driven Insights

Generative AI can provide real-time insights into market events and their potential impact on investments, effectively helping banks and clients stay ahead of the curve. With finely tuned ML models, it is possible to evaluate the potential impact of geopolitical developments, economic indicators, or corporate announcements, providing timely insights for clients and advisors.

As a real-world example of this, we can mention an ML-enabled News Trend Detection Service that we built for one of our major, strategic accounts, a US-headquartered global SaaS provider of data, research, and technology. This micro-service-enabled solution allows the efficient processing of around 50,000 articles per day or around 18 million per year to detect both promising investment trends and investment-worthy business entities within them.

Implementing the solution has reduced the workload related to manual data processing by 50%, which has improved the precision and speed of news analysis by human experts. Combined with another ML-based service that helps researchers contextualize news items faster, our News Trend Detection Service has dramatically increased the overall efficiency of new analysis.

Machine Learning in Banking has become a true game changer for the industry, offering never-before-seen levels of automation and outstanding client service.

Discover more benefits in our article!

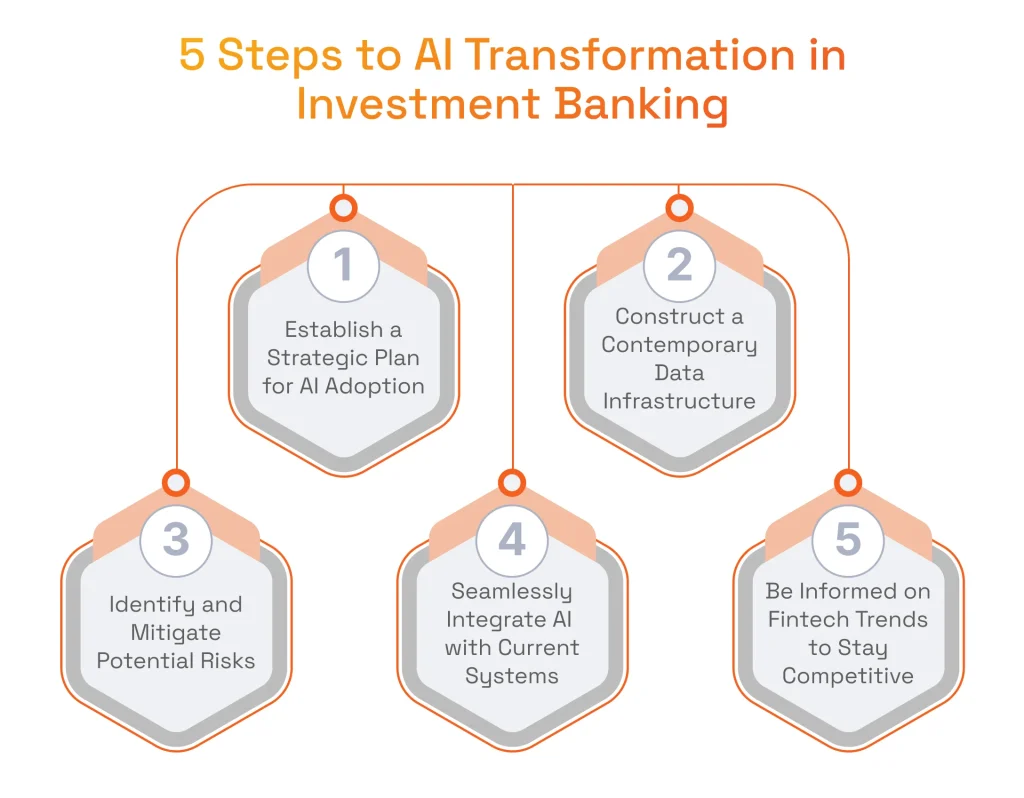

How Investment Banks Can Prepare for an AI-Driven Future

You may not have in-house AI talent on your payroll yet, however, there are ways to get ready for a gradual adoption of Artificial Intelligence and set your organization on the path of technological improvement. Developing a clear strategy is essential as a foundational element for successful AI implementation, ensuring that your AI initiatives align with business transformation, revenue opportunities, and cost management. Here is a step-by-step action plan on how your investment banking institution can get ready for AI transformation.

Establish a Strategic Plan for AI Adoption

It makes sense to start with a comprehensive plan for implementing technology in your organization. Focus on having clear, tangible, and achievable objectives for the AI in your organization. In case you don’t have the necessary perspective, feel free to contact an experienced AI solutions development vendor to enable informed decision-making for the integration process.

Your strategic plan should include:

- A detailed roadmap of the integration steps

- Detailed budget and timelines

- Key performance indicators.

Construct a Contemporary Data Infrastructure

You should invest in scalable and flexible data storage solutions and smart data warehouse design that can handle vast amounts of data from multiple sources, to have a strong basis for an AI-powered solution. This includes building a centralized data repository where data can be collected, stored, and processed efficiently. High-quality training data is essential for ensuring AI prediction accuracy and minimizing bias in investment banking applications. Make sure to leverage the capabilities of cloud computing technologies and establish clear data pipelines to facilitate seamless data flow.

Identify and Mitigate Potential Risks

Of course, there are risks, and the most dangerous are related to data privacy since investment banking is working with sensitive financial information. That’s why it is critical to:

- Ensure compliance with all relevant data protection regulations.

- Implement robust cybersecurity measures to prevent any breaches during or after data entry.

- Conduct regular audits of AI systems for bias.

Seamlessly Integrate AI with Current Systems

While the transformative power of AI in investment banking is undeniable, the proper integration process is key to securing the cost efficiency of the innovation. Close cooperation between IT, operations, and business departments is mandatory to implement new AI tools and not disrupt any critical processes. We, at SPD Technology, know it first-hand, and ensure smooth integration with the help of:

- Gradual upgrade of legacy systems

- Adoption of middleware solutions

- Leveraging APIs.

Be Informed on Fintech Trends to Stay Competitive

Nothing ever stays the same, and this is especially true for AI in investment banking. The next big thing in Fintech can turn everything upside down in moments, so it is super important to keep your finger on the pulse of the latest innovation. Participating in industry conferences, engaging with Fintech startups, and collaborating with academic institutions can help you in this area and secure the market positions of your organization.

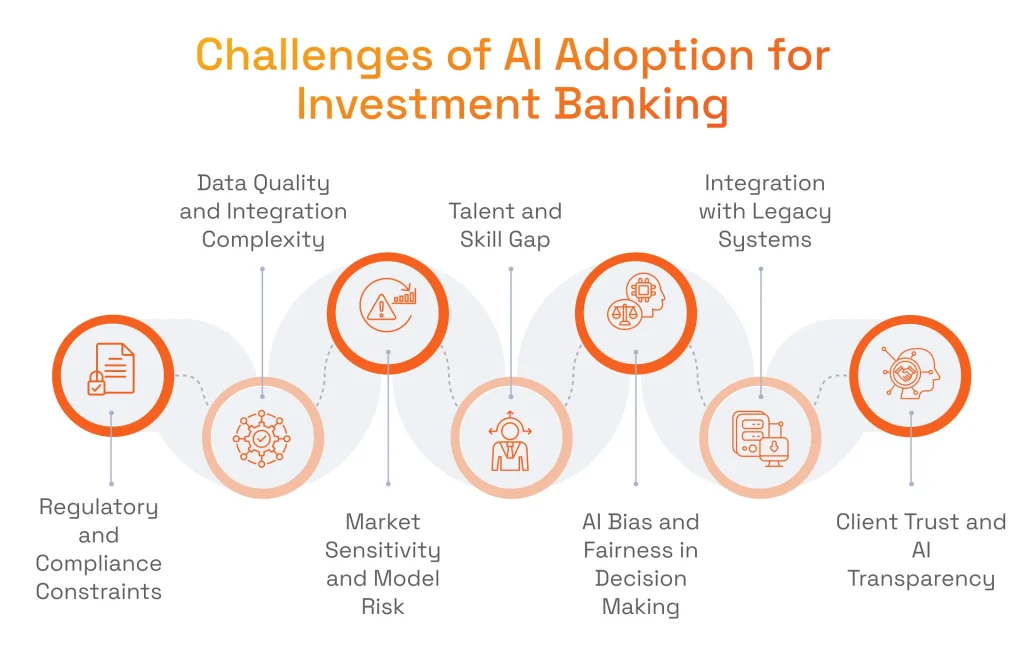

Challenges of AI Adoption for Investment Banking and How We Overcome Them

Effective adoption of AI requires a tailored approach and the ability to deal with sophisticated challenges, unique to industry-specific use cases. Regulatory bodies play a crucial role in overseeing AI deployment and ensuring transparency, while cultural resistance within organizations can hinder the adoption of AI. Additionally, the use of third-party vendors for AI can create security vulnerabilities and dependencies. We, at SPD Technology, have extensive experience in dealing with those complexities, including but not limited to devising a competent enterprise data strategy, ensuring data quality and integrating AI with legacy solutions.

Regulatory and Compliance Constraints

Navigating always-changing regulations, market rules and data privacy standards is a big challenge for any AI initiative. Investment banking requires adherence to the General Data Protection Regulation (GDPR) in Europe, which governs data usage and privacy, and the Dodd-Frank Act in the United States, which imposes transparency and risk management requirements on financial activities. Non-compliance can end up with significant penalties and massive reputational damage.

We deal with these complexities by collaborating closely with highly competent legal teams and building advanced compliance checks into our AI platforms. Our experts build solutions capable of dynamic adaptation, following changing regulatory landscapes and providing a robust compliance framework.

Data Quality and Integration Complexity

Another prominent challenge lies in the inconsistency and fragmentation of data obtained from multiple sources, which harm the accuracy of AI models and the quality of real-time processing. Most commonly, the problems occur with data format mismatch, incomplete client records, and discrepancies in financial transaction data from different reporting standards across regions.

We, at SPD Technology, have hands-on experience with various projects, where seamless data integration was required to deliver exceptional AI models. Our experts know how to deliver efficient real-time data processing regardless of the complexity of a particular use case. In one of our projects, we have developed data pipelines from scratch to consolidate information from CRM systems, trading platforms, and external market feeds into unified, actionable datasets, addressing inconsistencies such as missing timestamps, duplicate entries, and conflicting currency formats.

Market Sensitivity and Model Risk

Depending on market conditions, AI models can be not as effective as they should, or even provide false results. This will undeniably harm the decision-making process for an organization.

We are fully aware of the consequences and stress-test our models under the most common market scenarios, making sure they are highly adaptable and resilient. In particular, our stress-testing framework includes market crash simulations, possible geopolitical events, and changes in interest rates.

Talent and Skill Gap

Building and implementing AI systems requires rare professionals, skilled in AI and machine learning development services, as well as proficient in finance, which could be difficult to find in local markets. Very often, companies struggle to find specialists with such a skillset because they are currently in high demand.

Our cross-functional teams with multi-industrial experience combine latest A expertiseI and the experience in delivering projects for global finance leaders. Additionally, we gladly offer training and knowledge-sharing sessions for the internal teams of our clients, to ensure the maximal effectiveness of AI initiatives. We have access to professional networks and a powerful recruiting department, allowing us to assemble teams of top talent per our client’s demands.

AI Bias and Fairness in Decision-Making

AI models can produce biased outcomes that negatively impact client trust by resulting in financial and ethical risks. Being fully aware of this problem, we implement robust bias detection and mitigation strategies in our models. Specifically, the solutions we deliver include bias audits, in which algorithms are evaluated for potential disparities in outputs across different demographic groups.

Integration with Legacy Systems

Chances are that our clients will have some kind of outdated system that can hardly be compatible with advanced AI solutions, significantly delaying the full implementation.

We deal with this problem by making the most out of API-first strategies, middleware, and powerful cloud-based solutions, ensuring seamless integrations without any significant downtime. Our experts prioritize operational continuity and masterfully modernize dated infrastructures without a hitch.

Client Trust and AI Transparency

It is reasonable for clients to question the transparency of AI systems, as well as the reasons for their decision-making process, as errors and miscalculations can lead to costly mistakes and harm the reputation of an organization.

Experts at SPD Technology, are fully aware of this issue and develop explainable models that provide understandable insights behind each decision, fostering client trust and ensuring compliance. Our solutions leverage model interpretability techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) to break down model predictions into comprehensible components. We also use intuitive visualization tools, such as dashboards that map AI decisions to key financial metrics, and Natural Language Processing systems to explain all model outputs.

Why You Should Consider Strategic Tech Partnership for AI Implementation

Having a proficient tech vendor on your side can help you overcome even the most sophisticated challenges when developing and implementing AI solutions. Firstly, the vendor will offer you specialized knowledge of AI technologies and a deep understanding of the investment banking industry in general, covering areas like risk assessment, algorithmic trading, and fraud detection. An experienced development partner knows how to create models capable of handling all the complexities of unstructured data, developing a data strategy, unifying entirely different data sources, and coming up with actionable insights.

What’s more, investment banking is one of the most complex industries in terms of regulatory compliance. A vendor with in-depth knowledge can help you navigate those complexities, incorporating from the very start the features that help adhere to frameworks like GDPR, the Dodd-Frank Act, and other global standards.

Finally, with a clear understanding that investment banking is rapidly growing, a tech partner can offer the necessary scalability and flexibility for your organization, enabling solutions to scale effortlessly to support the growth of your business and maintain stable performance without any disruptions.

Achieve a Competitive Advantage in Investment Banking with SPD Technology

At SPD Technology, we have been building top-tier software solutions for two decades already. The fintech software development services we deliver to our global customers strategically merge the deep understanding of the banking business domain with the next competencies in emerging technologies such as:

- Artificial Intelligence and Machine Learning

- Data Engineering and Management

- Cloud Development and DevOps

- Cybersecurity and Resilience

- Payment Software Engineering.

Our company excels in delivering future-proof cutting-edge solutions that secure leading market positions for clients, earning our rightful place among top Fintech development companies. We are versatile, holding extensive experience in multiple domains, with a heavy emphasis on the Financial, Legal, Insurance, and eCommerce industries.

SPD Technology’s Partnership with MorningStar – Globally-Leading Investment Research Company

Business Challenge

Our client is Morningstar, Inc., one of the top asset management companies in the USA with over 12,000 employees, operations in 32 countries, an investment portfolio above $200 billion, and revenue exceeding $1 billion in 2018 alone. We became a long-term software development partner for this client, developing and improving several business-critical subprojects.

SPD Technology Approach

We started by assembling a team for an AI/ML-powered web crawler application that would eventually include an Engineering Manager, Full-Stack Developers, AI/ML specialists, and QA professionals, fitting perfectly for the task. The team overcame all critical challenges of the project by using advanced AI/ML models like Doc2Vec and Word2Vec to filter irrelevant data, significantly reducing employee processing workloads. The app prioritized retrieved results, scored relevance with AWS Comprehend, and optimized performance through techniques like proxy servers and modular monolith architecture. Our involvement also included cost-saving optimizations in data storage and backend implementation.

The success of a Web Crawler led to the next subproject, a data collection application where we were tasked to revamp an existing solution. To achieve set goals, our experts audited and redesigned the architecture of an app to prevent data losses and enhance performance, introduced robust data annotation and validation features, and aligned the GUI with client requirements.

Another prominent subproject under the Morningstar’s umbrella is the Kessler application, in which we transformed a legacy solution into a high-performing cloud application leveraging AWS and unlocking the cloud computing infrastructure benefits for our customer. We introduced advanced investment analytics, an expanded Screener for criteria-based stock searches, as well as seamless integration with Morningstar, Inc’s aggregated accounts system.

Value Delivered

- Improved Operational Efficiency: our involvement in these subprojects resulted in a 10x boost in three areas, including performance optimization of data analysis tasks, data storage cost reduction, and improvement of processing power and stability.

- Core Business Lines Automation: we managed to automate data collection from 500+ websites for the client.

- Introducing New Business Line: allowed our client to provide IPO data, unlocking an entirely new business direction.

Conclusion

The wider adoption of Artificial Intelligence in investment banking is already displaying greater efficiencies, surpassing the traditional ways of doing business. The research by Deloitte on productivity gains due to implementation of generative AI, states that by 2026 AI can boost productivity for front-office employees by as much as 27%–35%. And this is only one of the areas that can be enhanced, as AI-driven solutions are expected to boost seemingly every aspect of the Banking Industry.

For investment bankers, fully embracing AI/ML is no longer an option, but rather an essential measure to remain competitive in a quickly changing environment, bringing in another level of business intelligence. We, at SPD Technology, are ready to help you go beyond what was previously possible in investment banking, shattering the boundaries of traditional approaches with state-of-art technology and proven experience in delivering intelligent automation to leading organizations across the globe.

Get in touch with us now to discover how our data-related and AI/ML expertise can transform your investment business!

FAQ

How to Use AI in Investment Banking?

Artificial Intelligence is already can be considered a major force in this industry, with the most notable areas that can be transformed including:

- Algorithmic Trading: Models can handle some essential, critical tasks like optimizing strategies and predicting market trends.

- Risk Management: based on historical financial data, AI-powered Fraud Detection systems can detect patterns and alert on suspicious activities.

- Customer Service: AI-powered chatbots and personalized financial advisors are already changing the industry, by offering massive cost reduction for organizations.

- Portfolio Management: robo-advisors based on AI technology not only manage and create investment portfolios for customers but also optimize portfolio allocation.

- Due Diligence and Compliance: with the capabilities of modern solutions, it is possible to conduct quick due diligence by scanning large volumes of data.

Is AI Transforming Human Intelligence?

Yes, AI is changing multiple aspects of human intelligence for the better. In particular, it improves decision-making, problem-solving, and data analysis, sometimes delivering outputs far superior compared to human experts.

What Does the Future Hold for AI in Investment Banking?

The AI enabled future looks to be very bright, as we can expect:

- Further breakthroughs in Advanced Analytics and Predictive Models.

- Even better customer experience thanks to more precise AI-based investment strategies.

- Advancements in ethical AI will ensure even more transparency.

- More effective real-time analytics, leading to more accurate and timely decision-making.