Banks report that customer onboarding is significantly slowed by know your customer (KYC) due diligence, which, along with account opening, absorbs over 40% of a new customer’s time. This comes up as a substantial bottleneck in the onboarding process that demands a solution. For this reason, this article addresses the importance of KYC in banking, its requirements and processes, and how to identify when KYC verification improvements are needed.

KYC for Banking: Definition & Main Things to Know

If you are asking the question: “What does KYC stand for in banking?” This is the right article for you. KYC stands for know your customer, and it is a crucial part of customer-bank relationships.

Know your customer (KYC) requirements for banks refer to all the checks required to verify a customer’s identity, understand the nature of the customer’s activities, and assess the risk that those activities could involve money-laundering, terrorist financing, fraud, or other financial crime. For Fintech businesses in the era of commoditization, robust KYC is a market differentiator that lifts user trust and retention.

Fulfilling the banking KYC requirements is necessary for ensuring payment processing compliance that makes financial applications secure and trustworthy. Due to the multi-layered and interconnected nature of the global finance industry, there are several organizations, authorities, and legal frameworks that require banks to follow KYC:

- The Financial Action Task Force (FATF) is an independent body that mandates different countries to require financial institutions to undertake customer due diligence for preventing money laundering, terrorist financing, and the financing of proliferation of weapons of mass destruction.

- Local financial regulators (e.g., SEC, FCA, NBU) are national authorities responsible for overseeing the financial system within their respective jurisdictions. While the FATF provides global recommendations, local regulators translate those into rules tailored to their country’s legal and financial environment.

- AML/CFT laws are specific anti-money laundering (AML) and counter-financing of terrorism (CFT) legislation policies in separate countries that directly mandates KYC practices.

Here’s how KYC works in practice:

- The FATF sets the global standard (e.g., “Banks must verify customer identity and assess risk”).

- In the UK, for example, the Financial Conduct Authority (FCA) and HM Treasury transpose these standards into UK law, primarily through legislation like the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 and related regulatory guidance. These laws specify exactly how banks and financial institutions in the UK must implement KYC banking regulations and anti-money laundering measures.

- The FCA then supervises, audits, and penalizes firms that fail to comply with these requirements.

Oleksandr Boyko

Delivery Director at SPD Technology

“While the KYC structure is universal, its details are always local. When we work on an application that operates in multiple countries, we rely on FATF as the common backbone, but map each jurisdiction’s specific laws and regulator expectations.”

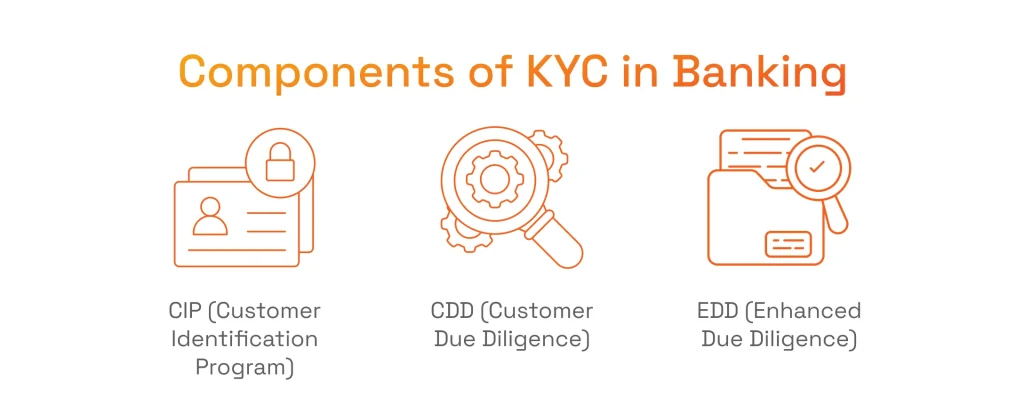

Components of KYC in Banking Solutions

The Know Your Customer requirements for banks form a framework with several steps to make, from the basic verification to more rigorous assessments.

Customer Identification Program (CIP)

Customer Identification Program involves collecting and verifying essential identity information from customers by presenting passports, national ID cards, driver’s licenses, and proof of address like utility bills.

Customer Due Diligence (CDD)

Customer Due Diligence involves assessing the risk level associated with a customer by checking such factors as the customer’s location, occupation, the purpose of the business relationship, and the expected volume and nature of transactions.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence involves an in-depth level of the KYC process and is applied in case a customer or a transaction is identified as presenting a higher potential risk of financial crime, such as money laundering or terrorist financing.

KYC for Financial Institutions: Why Being Compliant Matters

Ensuring data security in Fintech applications is a top priority for businesses, yet complying with KYC banking regulations offers more. On top of proactively securing the financial companies and its customers, implementing KYC standards also elevates business operations. Here is how:

- KYC Non-Compliance Means Severe Financial and Legal Risk: Regulators worldwide levy multi-million-dollar fines, revoke licences, and can bring criminal charges against executives for AML breaches. Non-compliance also triggers correspondent-bank cut-offs and reputational damage.

- FATF Pressure and Cross-Border Regulations Are Getting Stricter: The FATF now updates its grey and blacklists more frequently, while US, UK, EU, and other regulators impose extraterritorial standards. Banks must comply with regulations or they can lose cross-border market access, passporting rights, and correspondent relationships.

- Fragmented or Manual KYC Creates Operational Bottlenecks: Paper forms, spreadsheets, and disconnected legacy systems slow onboarding, create duplicate data and errors. Analysts chase missing documents instead of monitoring risk, thus delaying revenue gains and frustrating customers.

- A Strong KYC Process Builds Customer Trust and Retention: Well-governed KYC reassures clients their identities and funds are safe from fraud. This creates a positive onboarding experience that lifts NPS, cuts churn, and opens doors to cross-sell opportunities.

- KYC Is No Longer One-Time — It’s Continuous: Regulators expect perpetual KYC: real-time sanctions screening, dynamic risk scoring, and instant refresh when customers change ownership, location, or behaviour. Continuous monitoring catches red flags early, prevents audit backlogs, and lets institutions respond faster than criminal actions evolve.

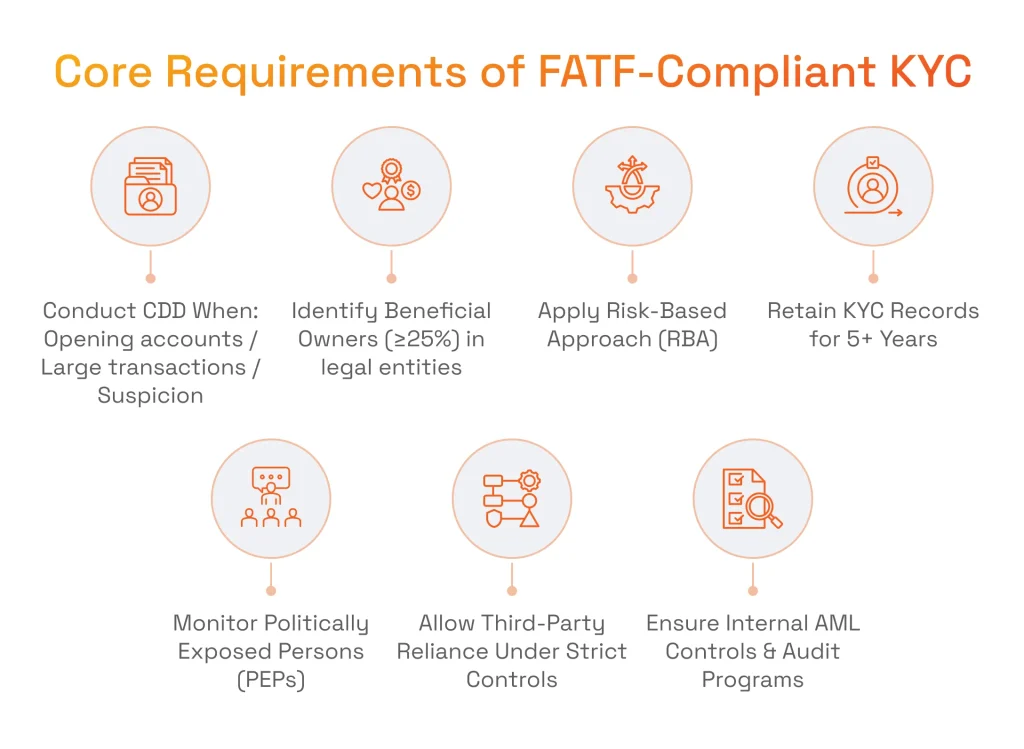

Know Your Customer (KYC) Requirements for Banks

There are several factors that are crucial for KYC processes in financial institutions. We review the factors indicated in the FATF recommendations that are the source of the global KYC framework.

1. Customer Due Diligence (CDD) Requirements

CDD starts the entire KYC process in banking. It defines when identity checks begin, which proofs are acceptable, and how to understand a customer’s intended activity before funds move. The CDD is triggered when establishing a business relationship, making occasional transactions above USD/EUR 15,000, as well as in case of suspicion of money laundering and terrorist financing, and there are doubts about previously obtained information.

During CDD, the following steps are crucial for the KYC process:

- Collect official documents (e.g., passport, driver’s license) to perform identity verification.

- Understand why the customer wants the account and how they will use it.

- Assign a risk rating based on customer profile, geography, and business type.

2. Beneficial Ownership Identification

Finding out who truly owns a company is essential for transparency. This can be done by mapping the individuals who truly own or control a legal entity in question. Thus, banks can translate the structure of this legal entity into a specific people behind it.

Below are the criteria for revealing the real stakeholders of their client companies:

- Identify natural persons with ≥25% ownership or control.

- If no one meets that threshold, pinpoint the senior managing official.

- Verify settlors, trustees, protectors, beneficiaries, and those exerting control.

- Gather shareholder registers, trust deeds, or equivalent records.

3. Risk-Based Approach (RBA)

Not every customer poses equal danger, so control must be adjusted according to possible exposure to risks. Risk-based measures within the frame of the KYC process in banks enable enhanced scrutiny to high-risk relationships and allow lesser attention where threats are minimal.

Below are the actions required for either simplified checks or careful investigation:

- Define factors like geography, industry, and transaction patterns.

- Apply extra checks (e.g., source-of-fund verification) for high-risk profiles.

- Use streamlined processes for very low-risk customers.

- Set parameters (e.g., large transactions, new products) that automatically elevate due diligence.

4. Record-Keeping Requirements of KYC for Financial Institutions

Accurate records are vital evidence for audits and investigations. Institutions must securely store all KYC documentation and transaction histories for a specified period. Financial institutions must ensure that investigations can reconstruct every step when needed.

The Know Your Customer guidelines recommend doing the following:

- Maintain CDD records and transaction data for at least 5 years.

- Must allow full reconstruction of transactions for investigation/prosecution.

- Applies to both domestic and international activities.

5. Politically Exposed Persons (PEPs)

PEPs and their close associates carry elevated bribery and corruption risk. The KYC banking regulation demands to identify any public-office holders and apply stricter controls throughout the relationship. Enhanced scrutiny and governance safeguards help detect unusually large or unexplained fund flows that could signal illicit enrichment.

Below are the main requirements for the PEPs aspect:

- Use databases to flag domestic and foreign PEPs, as well as their family and close aides.

- Obtain sign-off before onboarding any PEP.

- Rigorously document how a PEP acquired their assets.

6. Reliance on Third Parties

The KYC for banking can be delegated to qualified intermediaries, but this has to be done only under strict conditions that secure immediate data access and equivalent regulatory oversight. Also, those who delegate the KYC still remain ultimately liable for compliance gaps.

Below are the actions that let institutions seal the partnership for the KYC:

- Confirm the third party is subject to AML/CFT rules and supervision comparable to your own.

- Require immediate receipt of all underlying identification and verification data.

- Maintain the right to inspect original documentation and audit the third party.

7. Internal Controls & Group-Wide Compliance

Effective KYC rests on clear lines of responsibility, staff training, independent testing, and seamless information-sharing that turn policy into practice. Institutions must embed AML/CFT controls across the organization so everyone follows the same high standards, risks are spotted early, and regulators see a unified, accountable framework.

Below are the internal control measures within the KYC for financial institutions:

- Approve AML/CFT programme with clear roles, responsibilities, and escalation paths.

- Appoint a dedicated compliance officer empowered to enforce policies and report directly to the board.

- Prepare KYC/AML manuals detailing processes for CDD, EDD, transaction monitoring, and sanctions screening.

Oleksandr Boyko

Delivery Director at SPD Technology

“Failure to follow these FATF-aligned KYC requirements can lead to regulatory fines, loss of banking licenses or correspondent relationships, costly remediation programs, criminal liability for executives, and severe reputational damage.”

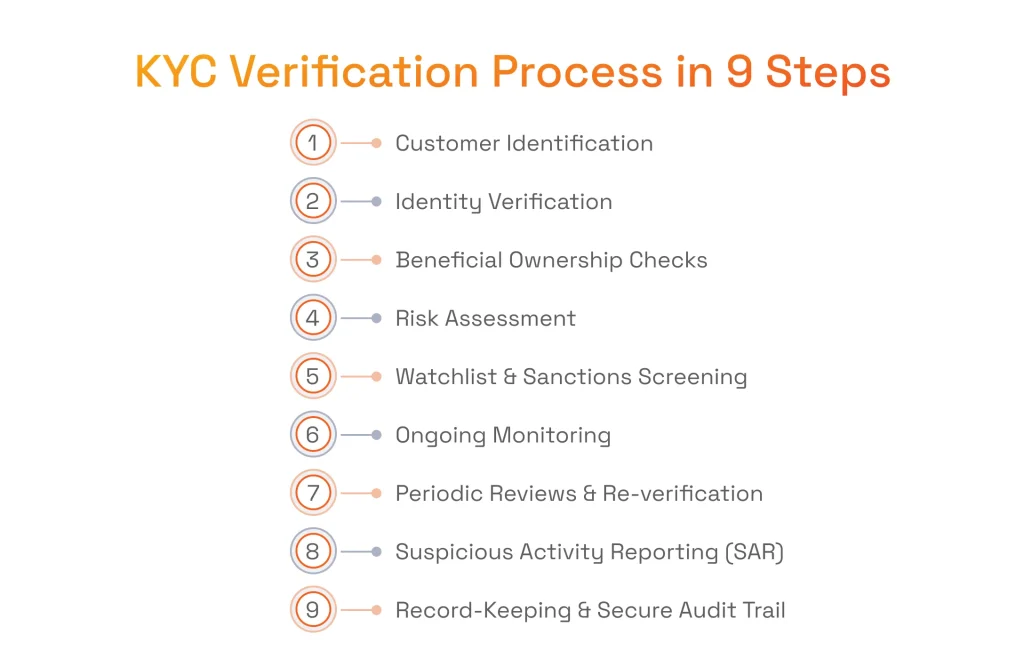

What Does Know Your Customer (KYC) Process Look Like?

To implement KYC requirements for banks, it is necessary to carefully complete several steps. Below is the KYC verification process that banks, payment facilitators, investment firms, and other financial institutions must follow.

Step 1: Customer Identification

The onboarding journey starts with collecting reliable identity evidence. This step is done through the verification of passports, national ID cards, driver’s licences, or corporate formation papers for legal entities. The objective is simple: prove the customer actually exists and that the data supplied are complete before any account is opened. For collecting that information, banks can use tools with OCR to read document data and liveness-detection selfies to confirm that the person presenting the ID is physically present.

Step 2: Identity Verification

Once documents are captured, their authenticity and the applicant’s biography are checked against trusted sources. Parallel database queries hit credit bureaus, population registries, and government blacklists to ensure the identity is neither stolen nor deceased. This is typically done via specialised APIs connecting to security features, while facial-recognition algorithms compare the selfie to the ID photo. If discrepancies emerge during this step of the KYC in banking, the application is sent for manual review.

Step 3: Beneficial Ownership Identification (For Businesses)

For corporate or trust applicants, compliance teams must peel back every ownership layer until the individuals who ultimately own or control the business. Those individuals typically have 25% or more equity or voting rights. Once they are found, the process proceeds with the verification of settlors, trustees, protectors, and beneficiaries. All this is done thanks to an automated KYC software that checks share registers and offshore structures to get the big picture of ownership tree.

Step 4: Customer Risk Assessment

With identity confirmed, the institution assigns a risk score that dictates how deep due diligence must go. This enables risk-based compliance, as required by FATF and is done by an internal engine that weighs factors such as politically exposed person status, residence in sanctioned or high-corruption jurisdictions, business sector, product usage, and source-of-funds narrative. Also, ML models engines, mirroring advances in AI in investment banking, flag patterns historically linked to suspicious behaviour.

Step 5: Watchlist & Sanctions Screening

The next step of onboarding with the KYC for banking is checking every new and existing customer against global threat databases. This means going through UN and OFAC sanctions lists, domestic asset-freeze orders, politically exposed person catalogues, and adverse-media feeds that surface allegations of fraud or organised crime. Fuzzy-matching algorithms provide a huge help here as they handle misspellings, transliteration quirks, and alias networks, reducing false positives while still catching subtle matches. Once a positive hits, it automatically escalates to compliance officers for confirmation and, if warranted, blocking of the account.

Step 6: Ongoing Monitoring

KYC does not end once the bank account is live, the activity also must align with the customer’s stated purpose. This is why the financial institution can use real-time transaction-monitoring systems to profile deposits, withdrawals, beneficiaries, geographies, and timing to detect anomalies such as rapid funds turnover or sudden high-risk counterparties. At the same time, behaviour-analytics engines update risk scores dynamically, generating alerts for anything outside expected patterns. Compliance teams investigate these alerts, deciding whether to clear, escalate, or file a suspicious activity report.

Step 7: Periodic KYC Reviews & Data Updates

Banking KYC regulations require periodic updates, typically every one to three years depending on risk tier. These updates and reviews ensure records stay current and are conducted thanks to automated workflows that trigger reminder emails or app notifications requesting updated IDs, proof of address, or corporate documents. The customer’s risk profile is re-scored in light of new information, business changes, or macro factors such as revised sanctions regimes. However, in case of failure to obtain fresh data, an account can be subject to restrictions until remediation occurs.

Step 8: Suspicious Activity (or Transaction) Reporting (SAR/STR)

When monitoring or reviews uncover activity that appears inconsistent with the customer’s profile or indicative of criminal intent, the institution must compile a SAR/STR. Pre-filled templates pull transaction data, narrative explanations, and investigative notes into the form required by the national Financial Intelligence Unit. Submission deadlines are often within 24 hours of determining suspicion, so workflow automation routes cases swiftly through approvals.

Step 9: Record-Keeping and Audit Trail

Every document collected, decision taken, and alert generated must be stored securely for at least five years after the relationship ends. Banks use modern archiving platforms to encrypt data at rest, apply role-based access controls, and maintain immutable time-stamped logs of every user action. At the same time, indexed metadata and full-text search let investigators reconstruct funds flows or compliance decisions quickly during audits or legal proceedings. In this manner, financial institutions adhere to retention and integrity standards that satisfy FATF expectations, national regulators, and privacy laws.

The KYC procedures are done automatically thanks to specialized software.

Discover the market-leading KYC software vendors to choose the one that fits your business.

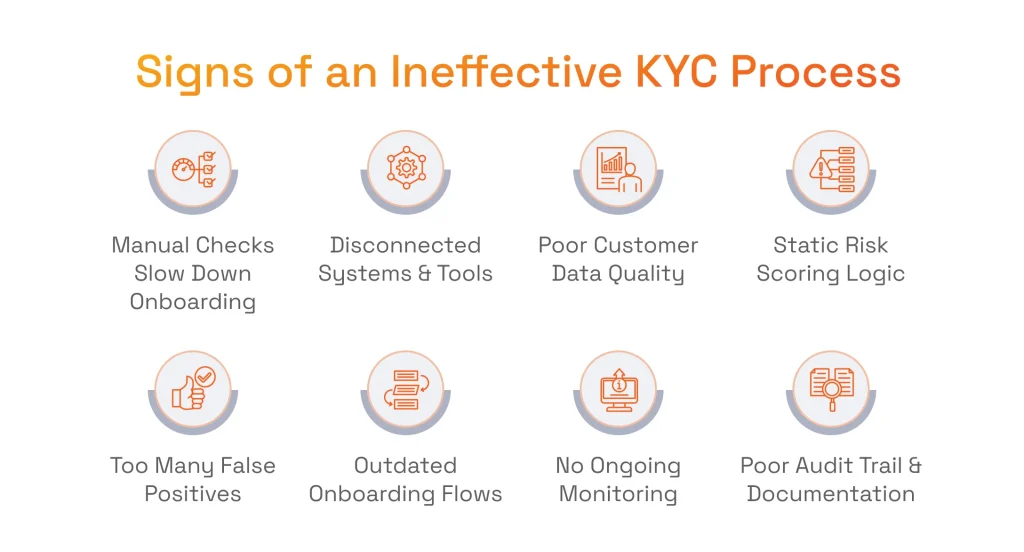

Common Signs Your KYC Process Isn’t As Effective As It Could Be

While the KYC requirements for banks sound pretty clear and straightforward, following them in practice is difficult. Below we list the most common bottlenecks in the KYC process reported by our clients during real-life projects.

Over-Reliance on Manual Verification

Our clients noted that their employees get bogged down in KYC-related paperwork: analysts retype passport numbers, scan utility bills, and shuffle PDF attachments between inboxes. With a manual approach, bank employees can create errors, while customers endure days-long onboarding and may abandon the process entirely.

McKinsey stresses how important the automation of the KYC is. According to their findings, banks that boosted their end-to-end KYC process automation by 20% unlocked a triple benefit. We support this message, having seen firsthand how onboarding that once took seven days can be reduced to just 24 hours through automated compliance checks. In turn, onboarding time reduction entails onboarding cost minimization and enhanced customer engagement.

Disjointed Systems and Lack of Integration

The KYC in financial services is covered with multiple tools that create silos as our clients noted. From our experience, document-capture software, CRM screens, core-banking ledgers, and AML monitoring maintain their own records and often lack a unified source of truth like data lakes or data warehouses. As a result, analysts paste information between windows, thus creating typos or omissions across tools.

Across several projects, we linked formerly siloed KYC, CRM, and core-banking platforms so they now share data in real time. The integration eliminates the delays, duplicate effort, and uncertainty that once hampered decision-making.

Inconsistent or Poor-Quality Customer Data

Our clients acknowledge that passports photographed at odd angles, corporate certificates uploaded in low resolution, and handwritten charts force analysts into detective work. At the same time, critical fields like beneficial owners, birth dates, tax numbers may be blank, illegible, or conflicting across documents.

McKinsey estimates that such incomplete records drive up to 26% of AML operational costs. Inaccurate data creates additional problems in risk scoring, sanctions screening, and transaction monitoring. All these issues often require creating a governance framework, single customer view, automated document ingestion, and even AI-driven deduplication & cleansing.

Static Risk Scoring and Rules

We observed that many of our clients used the same rigid risk matrix they set up years ago. For this reason, a customer tagged high-risk during onboarding may stay that way even after their risk falls, while a low-risk client who starts dealing in sanctioned countries goes unnoticed.

Because the rules never update for job changes, faster transactions, or new crime patterns, our clients indicate that they drown in false alerts. This does not allow them to spot the real cases of fraud and makes credit card fraud prevention as well as elimination of identity theft and phishing difficult. In such cases, we recommend using data-driven models that learn from new information and eliminate outdated rules.

False Positives Overload

According to our clients, another issue connected to the KYC in finance is sanctions and adverse-media screening engines that match on common names, transliteration variants, and historic aliases. Without smart filtering, even weak matches trigger alerts that analysts must check by hand.

The main concern here is that this slows down work on real threats. Too many false alarms lead to alert fatigue, higher staffing costs, and longer case resolution times. To fix this, we recommend our clients to use fuzzy-matching, smarter risk scoring, and tools that understand context.

Outdated or Inflexible Onboarding Flows

Bank customers expect seamless registration, yet many of our clients noted that onboarding is possible only as a multipage form due to Know Your Customer regulations. Other onboarding bottlenecks include legacy portals that lack retry logic, mobile camera optimisation, or jurisdiction-specific ID options.

When onboarding overwhelms customers, they tend to abandon applications. At the same time, when compliance can not properly check the documentation sent during the onboarding process, officers ask the bank for every possible document, which also creates operational bottlenecks. When such registration complexities occur on our project, we introduce modern orchestration platforms that adapt flows to risk, user type, and local regulations.

Lack of Ongoing Customer Monitoring

The importance of KYC in banking matters not only during onboarding. Once the account opens, risk scores remain frozen, the customer’s circumstances continue to evolve and remain the subject of the KYC procedure. Without monitoring of customer data, changes that go unnoticed can create issues with regulators.

When financial businesses need ongoing customer monitoring, we highlight the need for a robust framework with real-time transaction analytics, perpetual sanctions screening, and automated refresh triggers. In this manner, it is possible to ensure that risk profiles stay current and suspicious patterns surface before reputational damage spreads.

Poor Audit Readiness

When regulators ask for proof, bank employees search through scattered emails and spreadsheets. Without a single, unchangeable audit trail, our clients find it hard to show who did what, which documents were checked, or why a decision was made. Missing time-stamps and approval records weaken trust and raise the risk of fines.

In such cases, we recommend our clients to set up a dedicated audit-log system that records every action and is protected by role-based access. This helps turn surprise inspections into routine tasks and shows that the bank truly follows its policies.

Why Considering Custom KYC Solution for Your Bank

Implementing KYC for banking software can be one of the Fintech application development challenges.

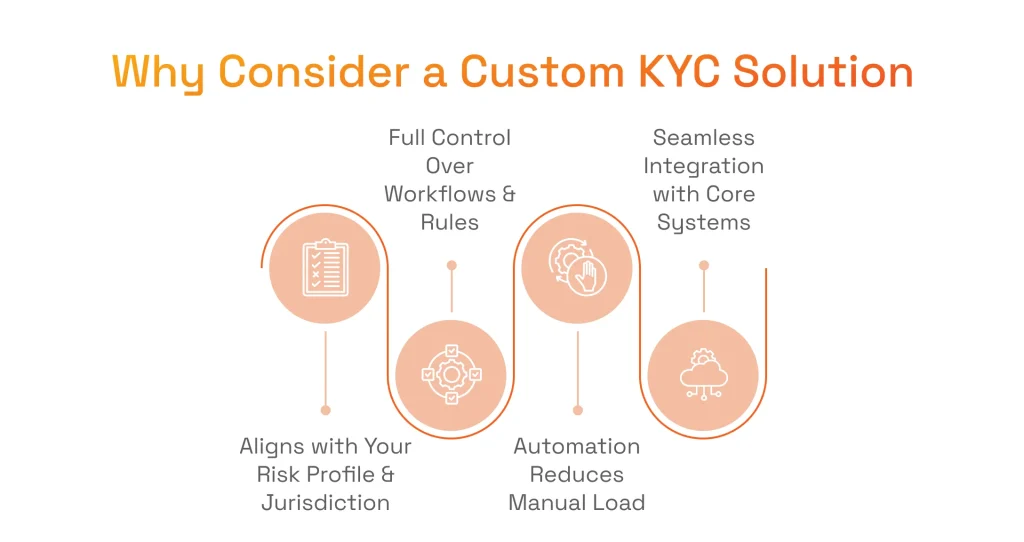

Navigating these challenges is far easier when a bank partners with a vendor specialized in Fintech software development services to build a tailored KYC platform that allows:

- Meeting Your Unique Regulatory and Risk Profile: A tailored platform lets banks set the exact KYC rules for banking that apply to specific licences, customer segments, and jurisdictions.

- Gaining Full Control Over Risk Logic and Onboarding Flows: With ownership of the codebase, banks decide how customers move through verification: what data they ask for, when to trigger enhanced due diligence, and how to handle exceptions.

- Reducing Operational Load Through Intelligent Automation: Custom KYC solutions can embed OCR, biometric checks, sanctions screening, and ML-driven risk scoring in a single workflow that help clear low-risk cases in minutes and reserve time for anomalies.

- Integrating with Core Banking, CRM and AML Tools Seamlessly: Because banks control the interfaces with a custom KYC platform, they can push and pull data via APIs to the core banking system, CRM, transaction-monitoring engine, and data lake.

- Using Artificial Intelligence and ML to Adapt KYC: Emerging tech helps accommodate your bank’s specific risk profile, products, and customer base rather than relying on generic rules.

A custom software for KYC that covers all the onboarding checks for banks can be delivered by a professional tech vendor.

To find the one that suits your projects, check our article dedicated to the best Fintech development companies.

Conclusion

The KYC requirements refer to a collection of checks required to be completed by customers of financial institutions. To better answer the question “What is Know Your Customer in banking?” it is important to note that it covers three components: CIP. CDD, and EDD, that allow banks to make both basic verification to in-depth checks.

The requirements of the KYC for financial institutions include customer due diligence, beneficial ownership identification, risk-based approach, record keeping, politically exposed persons, reliance on third parties, and internal control. We helped a lot of clients to develop custom KYC solutions to streamline the verification process, so you can contact us if you need an expert hand.

FAQ

How Often Do Banks Update KYC Information?

Banks refresh KYC compliance information under a customer identification program (CIP) and broader risk management framework to support regulatory compliance, AML compliance, and the prevention of financial crimes while providing financial services across digital banking channels. Update frequency follows a risk-based diligence process: low-risk customer relationships (including a business entity) are typically reviewed every three to five years, medium-risk customers are often reviewed annually based on customer transactions and evolving risk factors, and high-risk accounts are monitored continuously, especially when risk signals emerge (e.g., changes in behavior, geography, or product use).

Is KYC the Same in All Banks or Countries?

KYC requirements are not the same across all banks or countries. While global standards from FATF shape key components of AML regulations worldwide, banks implement those standards through local laws.

Banks apply a risk-based approach and tailor due diligence across the customer lifecycle. That’s why requirements like acceptable KYC documents, review frequency, and screening steps can vary not only by jurisdiction but also between banks within the same country.

Banks also differ in how they use external data sources (e.g., sanctions/PEP lists, adverse media, corporate registries) and monitoring controls to identify suspicious activity and flag suspicious transactions, especially where there is greater risk of illicit funds, terrorist funding, terrorism financing, or financing terrorism linked to a customer’s profile or customer’s financial activities.

KYC is a core part of AML and often the first line of defense against money laundering: through a customer identification program, banks verify a customer’s identity, understand account purpose, and assign a risk rating. Strong onboarding and profile data then supports ongoing monitoring across customer relationships as they power transaction monitoring, sanctions screening, and suspicious-activity reporting to meet regulatory requirements and help prevent money laundering.