The insurance industry is becoming more data-driven than ever before, leveraging data not only for risk management and fraud detection but also for other essential operational and marketing processes. Insurers fully realize the importance of the technology, as according to a report by Yahoo! Finance, investments into the data analytics insurance market have recorded an astonishing 220% growth in 2024.

In this article, we aim to provide a detailed description of data analytics in insurance, discussing its principal benefits, and sharing our own practical experience of developing and implementing these solutions, while recognizing them as not just a technical upgrade, but rather a strategic necessity.

Why Insurance Analytics Becomes Critical for Risk Management

Traditionally, the insurance industry has a dynamic range of risks, from cyberattacks to climate change. The fraud alone occurs in about 10% of property-casualty insurance losses if Coalition Against Insurance Fraud is to be believed. Data analytics is one of the most effective ways to improve risk management, as it helps organizations across the world to reduce common risks:

- Risks of Fraudulent Claims: Predictive analytics in insurance, powered by machine learning algorithms, helps to identify anomalies in claims data, flagging potentially fraudulent activities before payouts happen.

- Risk of Non-Compliance: With the help of advanced data analytics techniques, insurers benefit from tracking regulatory changes and getting automated reports on any changes in the constantly evolving regulatory landscape.

- Risk of Overpayments Because of Process Inefficiencies: Implementing data-driven automation optimizes workflows for insurers, resulting in accurate claims assessment, while predictive modeling in insurance secures precise risk pricing.

With the most common risk discussed, let’s focus on the advantages that the combination of insurance and data analytics brings.

The Benefits of Using Data Analytics in Insurance Industry

The Insurance Information Institute reports that data analytics in insurance is responsible for saving USD 308.6 billion on average every year by detecting and preventing fraudulent claims. Some of the other major benefits include:

- Enhanced Risk Mitigation Strategies: By integrating predictive models with historical data, insurance companies can anticipate and prepare for different scenarios, from weather events to market fluctuations.

- Better Operational Efficiency: Automating processes across the organization can lead to a significant revenue increase and cost savings. For example, automating claims processing with advanced AI tools improves the speed of settlement and reduces the involvement of employees.

- Improved Customer Retention and Acquisition: Real-time data analytics open a brand-new world of opportunities for personalized offerings based on customer preferences, as well as help to identify at-risk customers and launch targeted retention programs.

Advanced Technologies Driving Data Analytics for Insurance

The latest technological advancements in Big Data, cloud computing, blockchain, Artificial Intelligence, and the Internet of Things drive modern data analytics. Let’s discuss what drives the adoption of these technologies in insurance with some real-world examples.

AI and Machine Learning

Being one of the most popular technologies in insurance, with global Artificial Intelligence in the insurance market size accounting for USD 8.13 billion in 2024, AI/ML covers a wide range of use cases for process automation, detecting hidden patterns in customer behavior, fraud detection, product recommendation, and outcome prediction. Like other customer-centric industries, insurers can truly experience the business benefits of using chatbots and virtual assistants combined with predictive analytics capabilities that can proactively detect customer needs.

As an example of leveraging AI for customer behavior analysis, a market leader, Progressive Insurance, has already implemented an ML-based solution that analyzes the driving data of its customers and offers personalized premium packages based on driving behavior.

Find out more examples of using Artificial Intelligence in insurance by reading our featured article!

Insurance Big Data

With the advancements in Big Data, it became possible for insurance companies to collect, analyze, and benefit from massive volumes of structured and unstructured data, that may include customer demographics, claim histories, and social media activity. By leveraging modern technological solutions and these data sources, companies can obtain a holistic view of their operations, and benefit from insurance claims data analytics, underwriting optimization, as well as other fascinating use cases.

One of which includes AXA, which uses Big Data analytics for geospatial data analysis and defines the possibility of natural disasters. By doing this, the company adjusts risk assessment models and tailors policies by specific regional risks.

Cloud Technologies

Big Вata analytics for insurance companies is impossible without implementing cloud computing, which offers scalable, cost-effective data storage that allows fast processing and sharing of vast amounts of information for real-time analytics. Having cloud infrastructure set up helps to explore Big Data and get the most out of cutting-edge data analytics insurance solutions.

Just like, MetLife doing this by running processing and analysis of customer feedback in real-time in the cloud. It has proven to be an effective way to boost service delivery and strengthen customer loyalty, saving costs by avoiding on-premise solutions.

IoT

The IoT insurance market has enormous potential and is projected to grow from USD 49.40 billion in 2024 to USD 76.73 billion by 2029, according to the Mass Technology Leadership Council. With IoT devices including telematics in vehicles, wearable health trackers, and smart home sensors, insurance agents can improve their risk assessments, offer value-adding services, and even run predictive analytics in some cases.

One of many examples is displayed by John Hancock Insurance, which integrated the data from wearable fitness devices into its Vitality program, offering customers a versatile reward system for maintaining healthy lifestyles.

Smart Contracts

The most advanced way to automate policy management and improve insurance claims processing is to leverage smart contracts that have blockchain technology at their core. Smart contracts allow the automatic execution of specific actions when certain conditions are met, boosting transparency, reducing fraud, and lowering human intervention.

A great example of this is a blockchain-powered platform by Etherisc that offers parametric insurance solutions. In their case, smart contracts trigger payouts for flight delays or cancellations, speeding up the processing time and requiring the involvement of employees only in complex scenarios.

Real-Life Use Cases of Insurance Data Analytics

Let’s move on to discussing some more applications of data analytics in the insurance industry that help companies improve key processes, mitigate possible risk, and boost customer experience to never-before-seen heights.

Claim Fraud Detection with AI-powered Algorithms

The Business Research Company reports that the insurance fraud detection software market will reach USD 7.66 billion this year. A big part of this market is represented by custom AI solutions development, since AI-based solutions have proven to be very effective in dealing with any kind of online fraud, including the realm of claim processing. AI/ML technology presents multiple tools for battling claims fraud, it offers automated fraudulent pattern detection, constant learning on data, and alerting human experts to take necessary actions.

Learn more about machine learning models for fraud detection to discover the most common applications and protect your business!

Personalized Health Insurance Using Wearable Data

According to IDC, the number of worldwide wearable device shipments will reach 537.9 million units in 2024. This unlocks even more opportunities for insurers, as they can obtain real-time data on policyholders’ health and lifestyle habits through fitness trackers. By properly analyzing the data from wearable devices, insurers can offer more personalized plans. For example, with the achievement of specific fitness milestones, insurers may offer discounts or rewards for customers, strengthening customer loyalty.

Claims Prediction and Management with Predictive Modeling in Insurance

Predictive analytics for insurance allows companies to make predictions on the likelihood of claims, and be prepared for allocation of resources most efficiently. Working similarly to demand forecasting with machine learning, companies leverage insurance predictive analytics and analyze a variety of factors including historical claim data, customer behavior, or even weather patterns, and forecast a high-risk period to improve response time.

Usage-Based Auto Insurance with Telematics

Telematics is another rapidly growing market, and it allows gathering driving information from vehicles, that include mileage, average speed, or braking habits. For companies, using telematics auto insurance allows more precise adjustment of usage-based auto insurance policies, for example rewarding safe drivers with lowered prices on premium insurance packages. This not only promotes safety but also improves pricing policies, elevating customer satisfaction as well.

Underwriting and Customer Onboarding Automation with RPA

Using Robotic Process Automation (RPA) is a great way to improve underwriting analytics, specifically simplifying and accelerating onboarding processes. Compared to manual efforts, RPA bots can accurately extract data from multiple sources, check this information, and process applications in a fraction of the time. This is one of the ways artificial intelligence transforms customer service, and with underwriting processes automated, you should expect fewer errors, lower expenses, and significantly better customer experience.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“While modern data analytics solutions are leading the way for the giants of the insurance industry, small-to-midsize insurers can also benefit from these groundbreaking products. Smaller companies can start from targeted use cases, like fraud detection or usage-based policies, and eventually expand their analytics capabilities as their companies grow.”

Best Practices for Implementing Analytics in Insurance

When done right, implementing data analytics in the insurance industry secures long-term strategic value for an organization. In this section, we would like to share some of our best practices that have proven to be the way to unlock the fullest potential of the technology.

Focus on Data Quality and Governance

High-quality and well-governed data is the basis of any analytics initiative. When data quality is poor, one should not expect reliable insights for accurate decision-making. Before implementing any analytics insurance project, we employ robust data governance policies and, after that, run advanced data cleansing and integration solutions.

Invest in Scalable and Secure Technology Infrastructure

Another important aspect of any data analytics for insurance solutions is scalable and secure infrastructure, able to handle the demands of Big Data. Insurance companies of any size typically deal with vast amounts of sensitive customer data. That’s why our Insurtech development services include designing cloud infrastructures with advanced encryption and access control, tailored to the needs of insurance companies.

Build a Data-Driven Culture Within the Organization

Not limited to the actual technological adoption, introducing data analytics insurance solutions requires a cultural shift in the organizations as well. Companies should start by focusing on employee education, showcasing the undeniable benefits of modern tools, AI/ML, and Natural Language Processing (NLP) for business, as well as advancement in cloud computing. By advocating for a data-driven culture, employees will know that analytics and innovative technologies are not just tools, but rather a core part of business strategy, making any implementation of data analytics solutions easier.

Monitor and Update Models Regularly to Adapt to New Risks

The risks for insurance companies are constantly evolving due to changing market conditions, more strict regulations, and evolving cybercrime. Data analytics solutions can’t remain the same and need to be updated to stay effective. We, at SPD Technology, are fully aware of data analytics trends, as we provide ongoing model evaluation and optimization, ensuring our systems stay relevant and reliable over time.

Collaborate with Technology Partners for Expertise

For the development or integration of an advanced analytics solution, the expertise of your existing in-house team may not be enough. Having a team that knows how to develop insurance software at your disposal is critical for the success of your data initiative. Partnering up with a vendor proficient in data science, IT infrastructure setup, and industry-specific challenges will accelerate implementation, reduce risks, and ensure access to cutting-edge innovations.

Getting Ready for Implementing Big Data Analytics for Risk and Insurance

Joining forces with an experienced software development vendor, or at least leveraging the advantages of strategic technology consulting, is a good idea when implementing big data analytics in insurance. This is a strategic initiative that requires rigorous planning and skillful execution. Here are several critical steps of the process, that should be mentioned in the first place.

1. Defining the Main Risks to Address

Businesses in this industry face a multitude of challenges, that range from optimizing insurance claims to battling fraud or improving customer segmentation. As the first step of implementing data analytics in insurance solutions, it makes sense to pinpoint areas that will benefit from the software of this type the most, and focus the first iteration of the project on them.

2. Involving Key Stakeholders

It is vital to involve all key stakeholders from the very beginning of the project because data analytics insurance solutions are not limited to just technical execution. Having an understanding of the nuances and customer interactions, as well as cross-departmental collaboration are just as important. Depending on the scenario, additional input may be required from underwriting teams, compliance officers, or customer service teams.

3. Assessing Data Availability and Quality

Before making significant investments and embarking on a full-scale implementation of an analytics in insurance project, your tech experts must assess data availability and quality across the organization. The most perfect solution will fail without accurate data, so make sure to identify where the data resides, evaluate its current condition, and be aware of any additional actions that should be taken with it.

4. Evaluating Data Infrastructure and Tools

Finally, you need to be sure that the current tools and data infrastructure of your organization can support the demands of a modern insurance Big Data analytics solution. The chances are, before implementing a cutting-edge solution, your organization may need to leverage cloud computing infrastructure benefits and fully transition to the new, future-proofed, cloud environment. This transition may turn into another technological project of its own, with additional investments required.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“I am a strong believer that the transition to the cloud or at least hybrid architecture is a mandatory requirement to truly unlock the transformative power of Big Data analytics solutions. Due to our experience in delivering innovative cloud environments and making them work in cohesion with sometimes irreplaceable legacy systems, cloud adoption is what makes Big Data shine.”

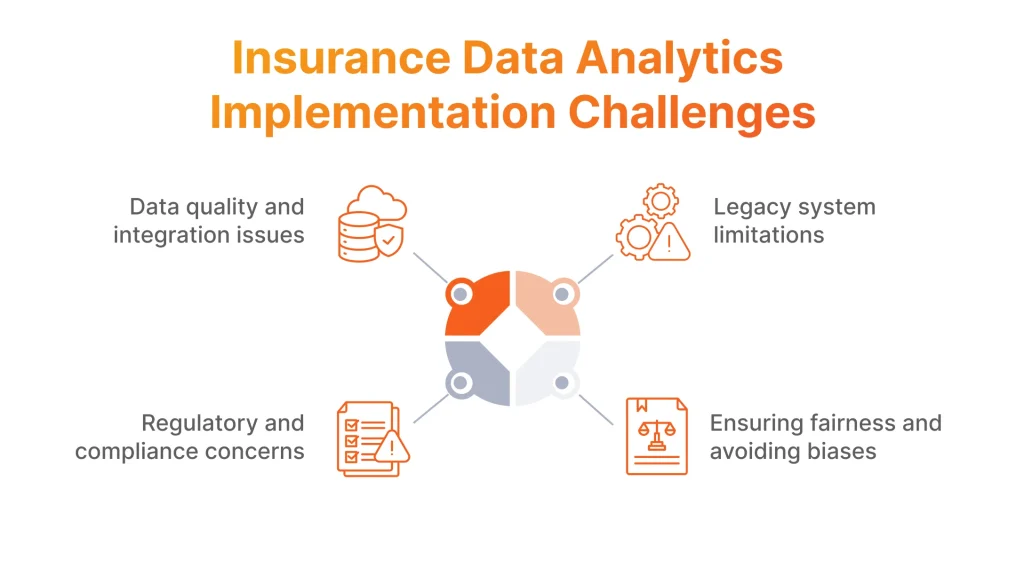

Challenges in Implementing Big Data Analytics in Insurance

The business impact of Big Data is undeniable, however, it brings several major challenges that require the involvement of true professionals. In this section, we will highlight the most common pitfalls and show the ways we, at SPD Technology, deal with each of these challenges in practice.

Data Quality and Integration Issues

For insurance companies of any size, it is a common practice to work with vast datasets of diverse financial information. The sheer volume of information comes from different sources including customer and external databases, claims systems, and more, which results in significant difficulties in data integration. We, at SPD Technology, have proven experience in employing highly efficient ETL processes that help to standardize, cleanse, and consolidate information, ensuring accurate analytics for insurance.

Regulatory and Compliance Concerns

This is one of the industries that have strict regulations of data privacy and require compliance with several policies for companies to even operate, not to mention implementing Big Data analytics solutions. Our team deeply understands the importance of data security and implements robust data governance frameworks in all of our projects, as well as uses encryption, access controls, and automated compliance monitoring tools.

Legacy System Limitations

Having a high amount of legacy systems at their disposal is one of the biggest problems for insurers. It is no surprise that legacy systems are simply not designed to handle solutions like Big Data analytics for risk and insurance. We have a large portfolio of projects, where we modernized legacy systems with middleware solutions, APIs, and cloud architectures to integrate analytics systems without a hitch.

Ensuring Fairness and Avoiding Biases in Analytics Models

Insurance data processing should avoid biases, since any errors may lead to legal and financial consequences, ethical issues, and reputational damage. Our experts fully understand the responsibility in this area and conduct rigorous model validation techniques, train models on diverse datasets, and use fairness checks to eliminate any biases. Additionally, we monitor our models on production as long as needed, to fine-tune our insurance data analytics solutions.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“It is important to remember that dealing with the challenges of Big Data in the insurance industry is not only about impeccable technical proficiency but also requires a deep understanding of the industry itself. In our insurance use cases, some of which we will describe in the sections below, we worked closely with representatives of our clients to get a holistic view of the business side, getting a hold of the unique nuance and complexities that their organizations have.”

Maximize the Potential of Insurance Data Analysis with Professional Tech Support

In the current environment, having business analytics in insurance solutions is simply a mandatory condition for the sustainable growth of an organization in this industry. So, if you want to stay ahead of insurance analytics trends, you need an experienced development partner, who will help you navigate the technical complexities and have just the right experience and tools to benefit from your data-related initiatives.

Partner with a Reliable Retail Business Analytics Development Vendor

Experienced professionals will tailor cutting-edge technologies, like AI and Robotic Process Automation (RPA) to your unique needs. With a reliable tech vendor, you can be assured that costs are optimized and data quality and accuracy are at their peak. What’s more, the actual implementation of the insurance industry data analytics solution will be conducted with minimal disruption to critical processes when you have an experienced partner.

The continuous support that a pro vendor brings, will ensure that the solutions comply with the latest regulations and are scalable enough to improve as your business grows. Ultimately, by outsourcing the responsibility for the software development of insurance data analytics solutions, you will not only maximize the chances of success but also free up your hands to focus on more strategic goals.

While considering creating a tailored data analytics system, take a deeper look at custom insurance CRM development that could become a core data source for your future analytics initiatives!

Why Hiring SPD Technology for Insurance Data Analytics Implementation?

We, at SPD Technology, have all the necessary capabilities to help turn your vast datasets into an asset, unlocking the fullest potential of custom data analytics insurance solutions. With our data analytics services, you can be sure that your data sources will be seamlessly integrated into a state-of-art system, capable of providing a comprehensive view of both critical operations and customer needs.

In all of our projects, we also prioritize the security of client’s sensitive data, holding regulatory compliance at the utmost importance. We have proven experience and the gratitude of our global clients to prove it, since our solutions deliver tangible results, from improving risk assessment to building sophisticated insurance predictive modeling systems.

SPD Technology’s Experience in Implementing Data Analytics for Insurance Companies

Let’s take a look at two of our most recent projects, showcasing the path for our clients from data analytics consulting to flawlessly performing data analytics systems.

Revamping the Billing Solution and Upgrading Data Management for Pie Insurance

Business Challenge

Our client is Pie Insurance, an American worker’s compensation insurance leader, operating in a wide range of nationwide industries. The challenge was to develop a custom billing system instead of a legacy third-party system for an already existing insurance platform.

SPD Technology Approach

Our team collaborated closely with stakeholders, to accurately define requirements and create a billing system architecture that was closely aligned with the needs of a client. By leveraging a diverse tech stack, we delivered a system that can:

- Create, update, and customize billing plans

- Track premiums

- Calculate equity

- Automate non-payment cancellations

Our system adheres to state-specific regulations and supports commission payments by accurately differentiating premiums from taxes, surcharges, and fees.

Acknowledging the importance of data integration, the next goal was to develop an Operational Data Management (ODM) platform to integrate, cleanse, and automate data updates from various sources, streamlining data operations. We not only developed this platform but also integrated it with the client’s Insurance Policy Management application, accommodating regional policy rules.

We also created a self-service online user account, enabling customers to manage policies and payments seamlessly, with full integration with the billing system and payment provider, enhancing efficiency and customer experience.

Value Delivered

- Improved Operational Efficiency: our custom billing system saved 40% of operational time for the customer success team in investigating the reasons for payment failures.

- Boosted Revenue: we added more payment options, attracting new customers and increasing average checks by 30%, boosting Insurtech profits for our client.

Overall, we delivered an outstanding product, accommodating the growing business needs of Pie Insurance. The brand-new systems with revamped online account functionality and improved UX attracted more customers and made the onboarding process significantly more convenient.

Creating an API Service and BI Dashboards for an Embedded Insurance API Provider

Business Challenge

Our client is a B2B company from Israel that provides an embedded insurance solution. The challenge was to create an API service, as well as build custom Business Intelligence dashboards.

SPD Technology Approach

We delivered the logic and the front-end of an API service that allows users to run APIs right from the browser. Our solution can generate an interactive documentation interface, with detailed information on API endpoints, parameters, request/response examples, as well as other details specified in the OpenAPI Specification.

Value Delivered

- Improved User Experience: we made the API integration process smooth and easy, simplifying the way to get interactive documentation.

- Introducing Additional Functionality: our team also introduced an A/B testing module, allowing users to get valuable insights into the performance of different insurance products.

In this project, we displayed the importance of data visualization for businesses and allowed users to check metrics on sales and revenue on a daily basis, and make informed decisions.

Conclusion

Fortune Business Insights believes that data analytics in the insurance market will continue to grow from USD 14.50 billion in 2024 to USD 44.77 billion by 2032, with a CAGR of 15.1%

This remarkable improvement is reasonable because more and more companies realize the potential opportunities that Insurtech data analytics presents, as well as its tangible value in real-world scenarios. Insurance data analysis enables companies to gain a competitive edge in the rapidly evolving market by improving risk management, optimizing critical processes, and transforming customer experience with data-driven decisions.

We, at SPD Technology, position ourselves as vetted professionals in data analytics, delivering projects of any complexity, from advanced fraud detection software development to cutting-edge, cross-industrial solutions in robotic process automation. As for insurers, we are turning their data into a vital business asset, driving innovation and growth in organizations. Contact us, and we will help your business maximize the potential of custom insurance analytics solutions.

FAQ

How Is Data Analytics Used in the Insurance Industry?

Today, data analytics in the insurance sector is a key reason for business leaders to achieve data-based decision-making, streamlined operational efficiency, and outstanding customer experiences. The most prominent applications of insurance business analytics include:

- Risk assessment and pricing optimization with predictive analytics approaches.

- Fraud detection and prevention with advanced machine learning models.

- Customer personalization from the preferences and behavior of customers.

- Automated claims management with powerful data-driven models.

- Underwriting optimization by leveraging insights from different data sources.

- Market trend analysis with reliance on Big Data adoption.

What Is the Role of Data in Insurance?

Data plays a deciding role in the modern insurance industry, being involved in almost any critical function, including decision-making, operational processes, risk mitigation, and regulatory compliance.

What Is Insurance Analysis?

It refers to the process of systematic analysis of data for providing decision-making support and planning opportunities for companies in the insurance industry. The insurance analysis process includes:

- Collection and integration of data

- Employing AI/ML-based predictive analytics techniques

- Forecasting potential claims, pricing policies, or any other required outcomes

- Measuring the efficiency of existing processes and the overall effectiveness of an organization.

- Simulating scenarios to determine the impact of the potential risks.