Statista believes that by the end of 2025, the global Artificial Intelligence market will reach USD 243.72 billion, and is projected to reach USD 826.73 billion by 2030 with a CAGR of 27.67% disrupting many industries along the way. However, to unlock the massive potential of Insurance and Artificial Intelligence, companies should consider teaming up with professional software development vendors that will ensure seamless integration, ethical governance of data, and long-term scalability. This article aims to help you follow the insurance industry transformation, showing how AI changes the insurance sector and what advantages it offers. For this goal, we have examined the most common applications in the industry as well as potential developments. We have also prepared some how-to recommendations if your insurance company plans to integrate AI into its daily operations.

What Is AI in Insurance?

This is the use of Artificial Intelligence technology in insurance, including its branches — machine learning, Natural Language Processing, Deep Learning, and Computer Vision. AI in insurance companies works the same way as in any other industry. AI, specifically machine learning algorithms, processes vast amounts of data to identify patterns in it.

Once these patterns are detected, they are further analyzed using advanced data analytics solutions. These solutions dive deeper than a surface level, uncovering hidden correlations, predicting trends, and calculating the probability of various events occurring. By leveraging both historical and real-time data, AI enables Insurance businesses to make data-driven decisions with greater accuracy.

How Insurance AI Reshapes the Industry

Precedence Research estimates that the global Artificial Intelligence in Insurance industry market will reach an astonishing USD 141.44 billion by the end of 2034, reflecting a massive shift in the combination of Insurance and AI. The Global Insurance Report by McKinsey states that AI-driven insurance investment is expected to grow by 20–25% in 2025 alone.

Whether it is the use of generative AI Insurance, implementation of advanced fraud detection mechanisms, predictive risk assessment, or personalized customer experience, it is clear that in 2025 AI will turn from optional to an essential component of leading Insurance companies that want to thrive in the competitive market.

The Main Benefits of Using Artificial Intelligence in Insurance

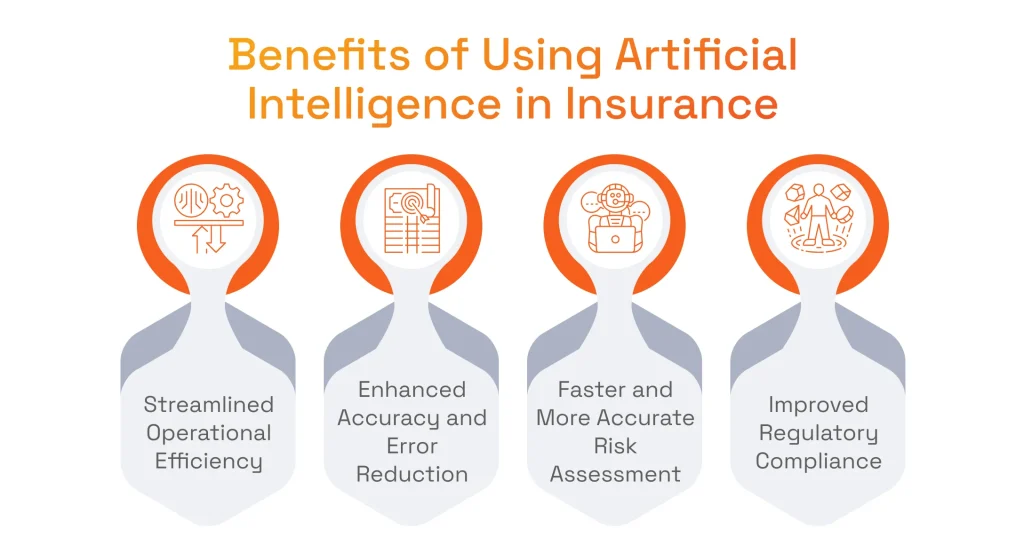

AI is on the way to shaping the future of Insurance industry with:

- Streamlined Operational Efficiency: AI can easily automate mundane and repetitive tasks from claims processing to policy underwriting. With the automation that comes from AI for the insurance industry, companies can significantly reduce manual workload, improve productivity, and optimize resource allocation while maintaining reasonable operational costs.

- Enhanced Accuracy and Error Reduction: With the help of machine learning models, it is possible to analyze vast amounts of data with peak precision, minimizing human error in multiple areas including fraud detection, risk assessment, and claim evaluation, reducing potential financial losses.

- Faster and More Accurate Risk Assessment: By leveraging AI-driven analytics, it is possible to dramatically increase the speed and accuracy of risk assessment compared to traditional methods. This leads to more accurate price policies and reduced losses.

- Improved Compliance and Regulatory Adherence: Last but not least, AI allows insurers to stay compliant with evolving regulations. It is achieved thanks to automated data reporting, transaction monitoring, and alignment with legal requirements.

Insurance Industry Transformation: AI Technologies Involved

The future of insurance brokers seems to be brighter than ever, with the following technologies disrupting traditional processes and breeding innovative solutions to common problems.

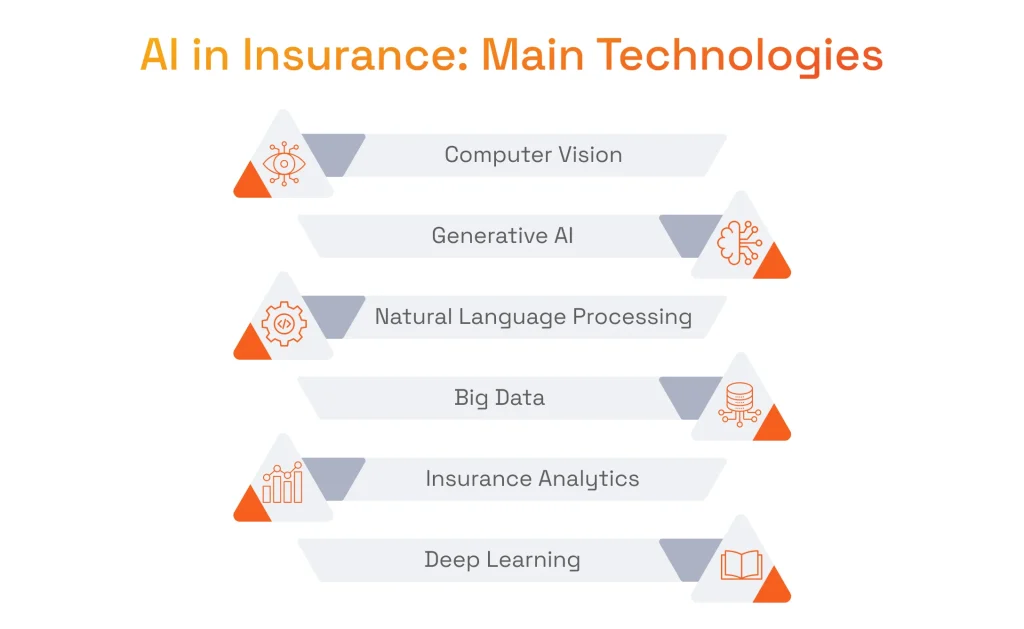

Computer Vision for Insurance Claims AI Processing

With the help of computer vision, it is possible to not only automate claims processing but also improve it by analyzing images and videos to assess damages. For example, a modern image recognition system can easily evaluate the extent of damage to vehicles or property without the need for manual inspections positioning claims automation as the future of insurance.

Generative AI in Insurance

Leveraging Gen AI in Insurance allows for automating content generation, improves risk modeling, and boosts fraud detection. After analyzing large datasets of real-world information, generative AI for insurance creates synthetic data that can be used for risk assessment, simulating claim scenarios, and communicating with customers via chatbots. Let’s take a closer look at generative AI use cases in insurance that already make a difference for leading companies.

Generative AI Use Cases in Insurance

- Automated Policy Drafting: AXA uses Gen AI to automate policy generation and gets more accurate policy creation catered to specific customers.

- Synthetic Data for Risk Modeling: Allstate already uses synthetic data for risk assessment models, dramatically improving predictions for claims processing and underwriting.

- Fraud Pattern Generation: A leading AI-driven insurer Lemonade, conducts training of fraud detection models by using Generative AI that helps to simulate possible fraudulent scenarios.

- Personalized Customer Communication: A great example of the usage of chatbots and virtual assistants is set by Progressive Insurance, as the company leverages Gen AI for highly personalized customer support.

- Claims Documentation Assistance: GEICO integrates generative AI to help policyholders submit structured claims and allows them to automatically generate required documentation, significantly reducing processing time.

NLP for Enhanced Customer Service

Natural Language Processing technology is at the heart of AI-driven virtual assistants and chatbots that allow for highly effective claims processing. With NLP, insurance can automatically analyze customer requests, and extract key information and even sentiments to provide accurate responses. While deeply understanding customer needs, it is possible to boost customer engagement and satisfaction.

Big Data and Artificial Intelligence in Insurance Underwriting

The business impact of Big Data is felt in AI underwriting Insurance, as the combination of the two technologies transforms traditional approaches. ML models can evaluate policyholder behavior, financial history, and external factors like economic trends to refine premium pricing and risk predictions, showcasing the true power of Insurance Artificial Intelligence.

Insurance Analytics and AI

Combining Insurance analytics and AI opens new possibilities in data-driven decision-making identifying patterns, detecting anomalies, and forecasting trends. We already have existing AI use cases in insurance, where real-time data insights allow insurance to personalize policies, prevent fraud, and improve risk assessment for more efficient operations.

Deep Learning in Insurance

Neural networks can process vast amounts of data and find hidden patterns in claims, customer behavior, and policy risks. Deep learning in insurance improves claims automation, detects fraudulent activities with high precision, and optimizes customer segmentation for personalized insurance products. As for one of the AI in insurance use cases, deep learning algorithms play an integral role in achieving higher accuracy, efficiency, and competitive advantage in creating a significant advantage in the competitive market.

The Most Effective AI Use Cases in Insurance

The complexity of today’s insurance tasks is too much for traditional technology. This is why innovative solutions are needed to create customized plans, automate tasks like payroll, invoicing, and fraud prevention. However, AI-driven Insurtech development services can change the way insurance companies operate. Below we describe how the companies from the insurance industry can leverage the power of AI for streamlining their business processes.

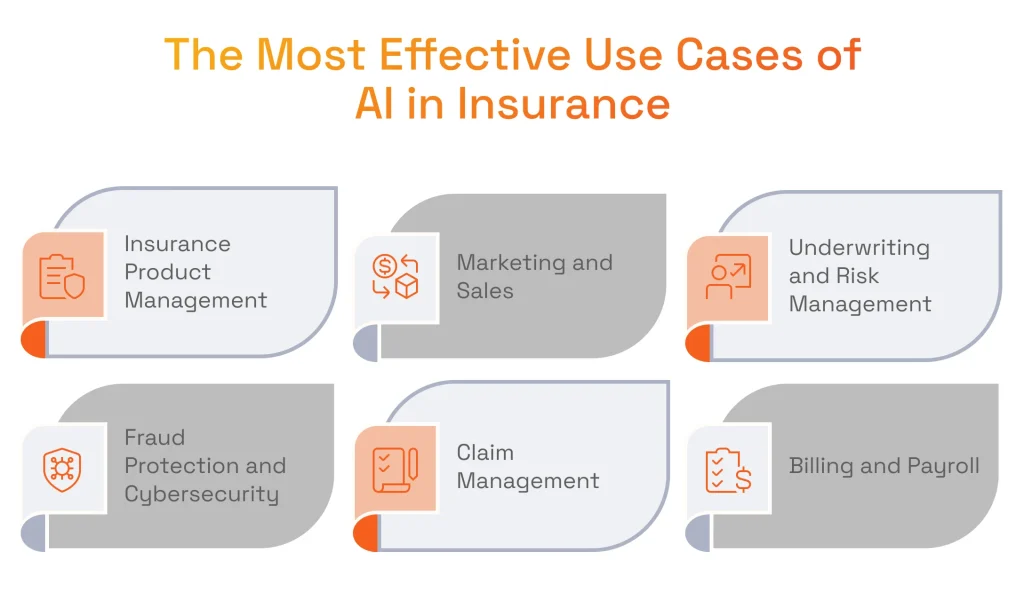

AI for Insurance Companies Product Management

Insurance policies can become much more personalized when machine learning handles customer demand, sentiment, and potential insurance scenario analysis. ML can assess the following data to satisfy the individual demands of different consumer groups:

- Real-time data, such as location or weather patterns;

- Consumer data, such as demographics, preferences, and behavior;

- Historical data, such as claims or insurance cancellation reasons.

Natural language processing (NLP) also plays its role in crafting better insurance policies. This technology can extract data from chats, emails, surveys, and reviews so that later analyze it and understand the demand or sentiment concerning specific insurance products.

Serhii Leleko

AI & ML Engineer at SPD Technology

“Fair and accurate pricing for insurance products is also a decision-making point when presenting those products to customers. And we can actually achieve a great level of price fairness with deep learning models. They have the ability to adapt, when new data is fed to them. This enables dynamic pricing, where market conditions and customer behavior that change rapidly can be taken into account.”

Marketing and Sales

Machine learning techniques allow analyzing vast volumes of customer data, including location, demographics, online behavior, and purchase history to craft targeted marketing campaigns. Plus, there are scoring AI models that make it possible to analyze lead data from any campaign and see what actually triggered a lead to engage with a specific insurance company. This can help correctly allocate sales efforts.

Another tool that is incredibly helpful for insurance marketing campaigns is generative AI. With its assistance, companies can create unique emails, social media posts, and ad copies. Additionally, companies can personalize these marketing materials for different customer segments. Hence, generative AI is capable of increasing engagement and click-through rates.

Using chatbots and virtual assistants in insurance also contributes to superior customer engagement. AI technology serves as a foundation for chatbots that can understand contextual information, outline customer needs, and provide responses in a natural language. Thus, insurance companies can utilize such conversations, for example, to suggest recommendations as part of sales efforts. In our project for HaulHub, we leveraged OpenAI’s GPT for the tasks involving NLP and created the chatbot that understands contextual data, processes customer inquiries, and facilitates conversations.

Artificial Intelligence Underwriting and Risk Management

AI tools with deep learning and predictive analytics algorithms can automatically collect and analyze vast amounts of both customer data and potential future events with specific risk pools. When an insurance business is able to anticipate possible hazards and provide precise risk assessments for customer-relevant insurance coverage, this helps with predictive underwriting.

On top of that, underwriting processes can also be supported by the use of AI for customer behavior analysis. For instance, insurance agents can rely on evaluation of driving behavior, when elaborating car insurance plans, or health metrics, when crafting life insurance coverages.

Fraud Protection and Cybersecurity

In insurance, anomaly detection with machine learning helps to ensure fraud prevention. For that, ML algorithms examine vast data sources, so they could identify patterns that seem like unusual user behavior and can signal suspicious activity.

Detecting anomalies, for a fraud detection software development company, involves more than just looking for unusual activities. Before a claim is even filed, early warning indicators of fraud can be recognized by utilizing AI approaches like predictive risk modeling. At the same time, behavioral biometrics examines user actions in parallel to look for warning signs of account takeover. Anomaly detection also carefully examines personal data for irregularities, which aids in the detection of attempts to create false identities.

AI technology also offers enhancements for cybersecurity. While deep learning helps with identity verification through facial recognition and document authentication, machine learning and NLP monitor systems to discover emerging cyber dangers.

Explore the nuances of fraud detection using machine learning models in our recent article!

AI in Insurance Claims Management

The Accenture report reveals the result of how an AI-driven system integrated in the processes of a Polish insurance company. That result is a 10% reduction in claims errors, which is a great improvement considering how many claims insurance companies need to process daily.

Similar or even better outcomes for claim processing can be guaranteed, when insurers add the following capabilities to their systems:

- ML-powered demand forecasting that aids in predicting the volumes of claims and commit resources to fulfill them;

- Computer vision along with object detection to analyze images in case damage assessment is required;

- Fraud detection that can spot irregularities in claims, detect discrepancies in repair costs, or check a history of false claims;

- NLP to fine-tune chatbots to answer inquiries concerning claims status and gather customer information.

Moreover, with automation brought to claim processing with AI, insurance companies have the ability to simplify the process of data collection and analysis. In this manner, we completed a project for a B2B Intelligence Services company. Our team integrated NLP and the YOLO model to ensure the extraction of data from PDFs with precision. Camelot or AWS Textract streamlines the extraction, and GPT verified data accuracy for smooth downstream analysis. This resulted in 5x cost reduction.

Billing and Payroll

Predictive analytics, anomaly detection, and automation algorithms in AI applications offer the capabilities for preparing and sending invoices and bills for customers.

With the use of predictive analytics, artificial intelligence technologies may anticipate revenue based on billing data and trends, as well as examine payment data to enhance billing tactics. Also, insurance agents can monitor spending data and spot odd patterns with the help of anomaly detection. This makes it possible to identify possible inefficiencies that could result in fraud or overspending and implement cost-cutting solutions.

Automation, in its turn, can further simplify claim management. We have proved this when completing the project for our client, where machine learning models for NLP, text classification and embeddings to predict the master service code for invoices based textual description. Consequently, the client’s system was set up to have automated invoice processing, which helped to accelerate the process of the aggregation of the information on operational costs from weeks to hours.

AI Insurance Trends Set to Revolutionize the Industry

With the fast-paced advancement of artificial intelligence, it will soon be possible to change the insurance industry beyond recognition. But what exactly will be different? Let’s see what awaits insurance with this new technology in the near future.

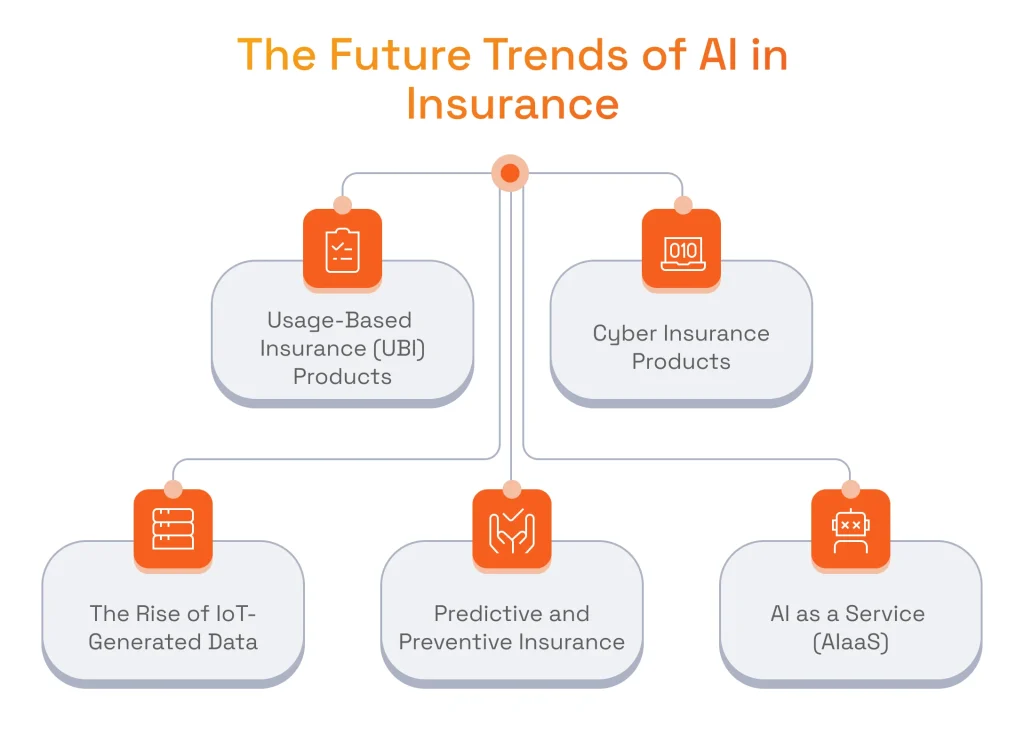

Usage-Based AI for Insurance (UBI) Products

With data analytics that become enabled thanks to AI businesses can get the most out of data and improve their usage-based insurance (UBI). In particular, they can use AI models to process data about drivers’ behavior and vehicle usage trends in real-time. AI gathers and evaluates pertinent data on mileage, journey duration, speed, acceleration, use of seatbelts, engine performance, and other topics with the use of telematics devices. Furthermore, risk assessment makes use of this data.

Equipped with all that data, businesses can tailor personalized insurance plans. For example, UBI programs might offer discounts for drivers who stay below a certain mileage threshold per month, indicating less overall usage of the vehicle.

Cyber Insurance Products

According to Forbes, 2,000 cyberattacks were reported in 2023. And while not all the issues are reported, the real number is always higher. People and businesses are now reliant on technologies in almost every aspect of their actions. So, cyber insurance becomes another necessity.

With cyber insurance, policyholders can prevent financial losses because of data breaches, network outages, and cyber extortion. AI technology enables insurers to predict the chances of cybercrime and notify their clients about it. Thus, preventive measures against possible issues can be undertaken.

The Rise of IoT-Generated Data and Unified Data Ecosystems

Since data is the primary input for any AI-driven systems, any enterprise or industry must have open access to it in order to maximize its value. This might entail businesses releasing their data in accordance with open-source guidelines, promoting a cooperative environment where all parties gain from a shared data set. To protect data security and privacy, nevertheless, a strong legislative and cybersecurity framework must be established.

Therefore, any insurance company will have access to the data from those devices to analyze it and develop coverage plans. The most efficiency of this opportunity will be seen in healthcare, automotive, and property insurance. AI will be able to collect and analyze data from wearables, smart cars, and smart home devices to later transform collected insights into insurance terms.

Switch to Predictive and Preventive Technology in Insurance

We know insurance as the one that returns the losses of the accidents that have already happened. But what if insurance companies will be able to forecast potential risks with AI and prevent them? Predictive analytics and data-driven insights will become the cornerstone of preventive insurance.

Serhii Leleko

AI & ML Engineer at SPD Technology

“Supervised learning models (classification & regression) predict incidents and claim costs respectively. Unsupervised learning (clustering) groups policyholders by risk profiles. In such a way, insurers get the opportunity to personalize insurance coverage plans and reduce overall claims. The customer will be happy because of such AI capabilities in insurance.”

Artificial Intelligence Insurance: AI as a Service (AIaaS)

Artificial intelligence integration in insurance companies’ systems has its limits. It is difficult and resource-efficient to develop and maintain ML models for each and every aspect of operational processes. That is why, AIaaS can help insurers to buy pre-built AI models that can address specific functionality as well as purchase tools without the need to invest in building their own complex AI infrastructures.

Those pre-built AI models will offer such capabilities as:

- Image Recognition

- Generative AI

- Predictive Analytics

- Personalized Recommendations

- Chatbots

- Smart Home Integrations

- Fraud Detection

- Sentiment Analysis

InsurTech earnings are eventually increased and customer needs are met when insurance organizations utilize AIaaS to simplify processes, cut costs, and provide a more efficient and personalized client experience.

AI and Insurance: How Insurance Companies Can Start Adopting AI

The transformative power of artificial intelligence is evident, however, many companies still puzzle over its implementation in existing systems or embarking on software development insurance applications with AI. Yet, we are sure that there is nothing impossible. We believe that if you prioritize starting points, craft suitable and appropriate strategies, and invest in training your staff, your organization will handle AI adoption challenges. See the details on our tips below.

Aligning AI with Business Goals

To ensure successful adoption of Artificial Intelligence in insurance, companies must align their technological initiatives with strategic business goals. Whether the goal is to improve risk assessment processes, introduce AI insurance claims processing, or boost customer personalization, there should be clear KPIs and measurable value that drive ROI.

Ensuring Data Readiness

Another crucial aspect of successful Artificial Intelligence insurance projects is the access to well-structured, consistent data. To achieve this, there may be a need to consolidate disparate data sources, cleanse data for better accuracy, and ensure compliance with industry regulations like GDPR and HIPAA.

Starting with Small Pilots of Insurance and AI Projects

With a chosen goal for your future insurance software and prepared data infrastructure, it’s time to run a high-impact, proof-of-concept project. This will allow you to test the feasibility and effectiveness of AI in a controlled environment before making larger investments into a custom AI solutions development.

Building an Adaptable Insurance Artificial Intelligence Strategy

While starting small, you still need to elaborate a vision for how AI will be used to transform your insurance operations in the long run. To do that, you must identify the domains in which artificial intelligence will have the most effects, as well as any obstacles you may encounter and a plan for implementing AI gradually.

Moreover, take care of the adaptability of your strategy, since it can undergo numerous adjustments, while you will be adopting AI. So, in the process you need to have a better understanding of how AI can accommodate your growing requirements.

For example, we helped to deliver custom insurance software for Pie Insurance. To successfully realize this project, we focused on the most important features during the planning stage. We outlined that we needed to embark on billing software development and deliver an operational data maintenance platform with a self-service application for end customers.

Also, the platform needed to be integrated with a policy management application. With such detailed planning, our team managed to deliver a solution that directly addressed Pie Insurance’s business needs. Upon a successful delivery of the project, the company achieved a 40% reduction in operational time and a 30% increase in profits, proving that we truly know how to make billing software that makes a difference.

Prioritizing Customer-Centric Solutions of AI in Insurance Companies

Customers are the center of your business, therefore all the services, features, and functionalities of your insurance applications should also ensure that they receive the maximum benefits from it. To do so, prioritize features like chatbots for customer support efforts, develop personalized risk assessments to be able to design on-point premiums, and ensure active loss prevention measures.

On top of that, you can leverage generative AI development services for the creation of tailored marketing campaigns depending on the unique characteristics and inclinations of each client. This can entail giving helpful safety advice, promoting pertinent insurance products, or delivering targeted savings. Customers will find this strategy more relevant, and engagement rates will rise as a result.

But just as crucial is that your app’s UI/UX be created in accordance with the most recent developments in the sector. Adding AI-driven functionality to your app is a great step, but in order to keep users, you also need to make the program easy to use and intuitive.

Start Automating Rule-Based Processes

Insurance processes are built on repetitive data entry, document verification, claim review, payment processing, and others. These tasks are ideal for robotic process automation (RPA).

If your insurance business decides to opt for RPA development services, you can speed up all the aforementioned operations. Also, insurers can spend less time on policy renewals processing policy charges. The less time insurance agents spend on such tasks, the more they can focus on creative tasks. Moreover, automation eliminates human error, consequently, improving customer experience due to faster and impeccable service.

Performance Monitoring and Optimization

Implementing AI for Insurance is an ongoing process that requires continuous monitoring and gradual refinement of the solution. It is vital to establish an effective performance-tracking mechanism to constantly evaluate the accuracy of AI and its compliance with the latest regulations. AI for insurance companies, like in any other industry, requires regular model retraining, improvements in bias detection, and constant real-world testing of the algorithms for the system to stay effective and up-to-date with modern requirements.

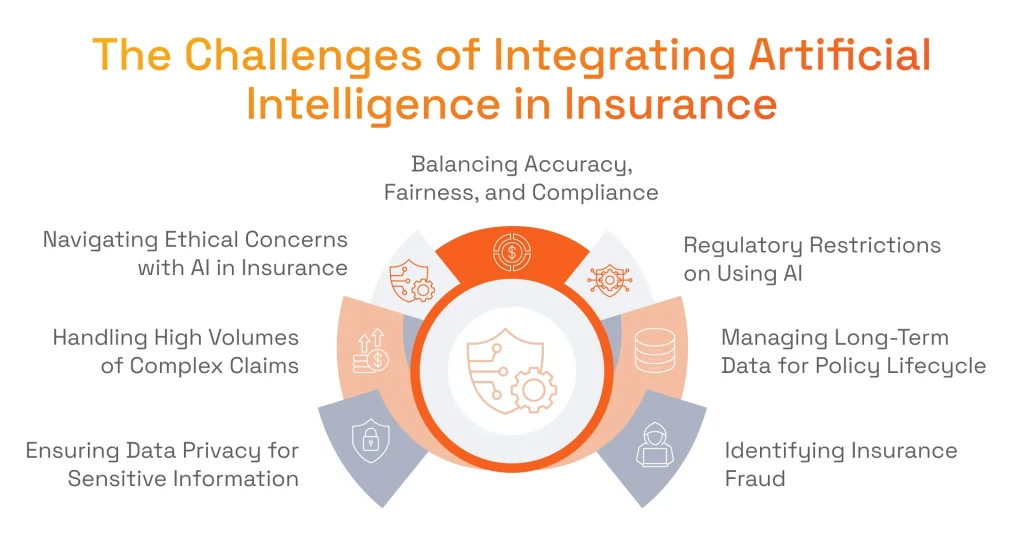

Integrating Artificial Intelligence in Insurance Sector: Challenges and Solutions

The implementation of Artificial Intelligence in insurance sector comes with its own unique set of challenges. In this section, we will address these complexities and show how we overcome them here, at SPD Technology.

Balancing Accuracy, Fairness, and Compliance in AI Underwiring Insurance

Artificial Intelligence underwriting models should strike a perfect balance between precision and fairness, avoiding any bias while ensuring compliance. Mistakes in this area can lead to incorrect risk assessments, unfair pricing, and rejections.

SPD Technology develops Artificial Intelligence insurance underwriting models with explainable AI techniques, achieving the highest levels of security and compliance. We know how to incorporate bias detection and mitigation algorithms and continuously refine our models with the latest, diverse datasets.

Regulatory Restrictions on Using Decision-Making AI for Insurance Industry

There are strict rules and regulations regarding AI in insurance market, which may limit automation features in underwriting, policy approvals, or claims processing.

We build solutions that include Human-In-The-Loop (HITL) frameworks, that allow users to effectively combine automation with expert involvement. Since we implement AI governance tools that ensure compliance and are following any changes in the regulations, we know where automation is suitable and where human experts should handle specific tasks.

Managing Long-Term Data for Policy Lifecycle

Policies related to the insurance processes can span for decades, creating a need for scalable long-term data management with accessibility for claims, renewals, and audits.

We know how to leverage cloud-based data lakes and AI-driven data governance solutions to ensure strict structure, versioning capabilities, and compliance with all required data retention policies. Our experts can build effective data archiving and retrieval mechanisms, when needed, to access historical records most efficiently.

Identifying Insurance Fraud While Avoiding False Positives

Even the most advanced AI-driven fraud detection systems, in some cases, struggle with identifying suspicious activities without flagging legitimate customers and creating problems with user experience.

We see AI-based fraud detection systems as the future of insurance and create solutions that combine behavioral analytics and anomaly detection. While minor setbacks can still occur, we train our models to continuously learn from real-world fraud use cases and minimize false positives with outstanding detection accuracy.

Ensuring Data Privacy and Customer Consent for Sensitive Information

Like with any other data-related initiatives, insurance companies using AI require access to personal and sensitive financial data, creating reasonable concerns about privacy and security.

Here, at SPD Technology, we are always committed to the highest standards of security and compliance, delivering effective solutions to protect the data of our clients. Among those solutions is the integration of robust consent management frameworks, providing clients with control over data usage while ensuring compliance with regulations like GDPR and CCPA.

Handling High Volumes of Complex Artificial Intelligence Insurance Claims

Artificial Intelligence insurance claims processing solutions are tasked to handle enormous amounts of data, sometimes even Big Data, while making accurate assessments of damages, liabilities, and settlements.

We deliver scalable AI solutions for insurance claims, closely integrated with cloud computing systems for high-performance processing. We achieve accurate and quick claim resolutions by using NLP for document analysis and computer vision for damage assessment.

The usage of AI in life insurance brings up some valid ethical concerns regarding discrimination, transparency, fair pricing, and claim approvals.

We deal with this issue by prioritizing ethical practices with compliance-driven AI governance frameworks, additional explainability tools, and fairness audits. We ensure that AI and insurance claims maintain trust and regulatory compliance, with understandable, reasonable decisions by algorithms.

Why Implementing AI in Insurance Industry Requires a Strategic Tech Partnership

The adoption of AI in the insurance industry goes far beyond just the deployment of the latest technologies, so strategic tech partnership with a software product development company is essential for several major reasons.

An experienced partner will help to tailor Insurance AI specifically to the needs of a particular business, delivering measurable value and tangible results. Additionally, with industry expertise and proven frameworks, top vendors can fast-track the implementation while ensuring peak performance and reliability.

With a trusted tech partner, you can be sure that all compliance requirements are met, including adherence to GDPR, HIPAA, and PCI DSS. Your AI Insurance solution will not only have robust security mechanisms, but it will also align with ethical AI principles.

Last, but not least, whether it is a generative AI in insurance or AI in insurance claims, this type of innovation works best from a long-term perspective. It makes sense to find the best technological provider for continuous optimization, adaptation to evolving market demands, and the ability to scale when necessary.

Start Building the Future of Insurance with SPD Technology

We stand out among competitors as a well-established provider of AI in Insurance, as we transform critical processes of our clients. From delivering advanced fraud detection systems and underwriting automation to the implementation of real-time data processing and predictive analytics, our experts ensure the strategic alignment of AI and insurance companies with end-to-end adoption support.

In addition to AI/ML development services, our company also helps to scale existing insurance platforms with robust cloud infrastructures that are designed for outstanding performance. We always regard security and compliance as the foundation of our solutions, so we adhere to the latest industry standards and incorporate encryption, access control, as well as privacy-enhancing technologies to protect sensitive customer data.

Let’s shape the future of insurance together, with innovative products and ground-breaking solutions!

AI in the Insurance Industry: SPD Technology’s Successful Project

Revamping the Billing Solution and Upgrading Data Management for Pie Insurance

Business Challenge

Our client, Pie Insurance, is a leading U.S. workers’ compensation insurance company, providing services through a custom-built software platform. The challenge was rebuilding an existing billing system and eliminating any significant payment delays.

SPD Technology’s Approach

We started with close collaboration with the client’s stakeholders to define requirements for their billing system. After that, our engineers moved on to designing the system architecture and the development process.

By leveraging our profound experience of AI in Insurance industry, we developed a powerful billing system that enables the creation, updating, and customization of billing plans, tracks payments, supports ACH payments, and automates policy cancellations based on equity calculations and state-specific regulations. It also accurately tracks premium payments and differentiates them from taxes, surcharges, and fees. Key capabilities include processing installments, managing policy ledgers, generating reports, and integrating with PMS for cancellations.

We also developed an Operational Data Management (ODM) application to integrate, cleanse, and automate data updates, streamlining insurance operations. Our experts integrated our services with the client’s Insurance Policy Management system, accommodating regional policy rules.

Finally, we built a self-service application with an online user account for Pie Insurance customers, integrating it with the billing system and payment provider, elevating user experience and payment processing efficiency.

Value Delivered

- Massive Operational Time Savings: our solution allowed us to speed up the work of the customer success team by 40% by eliminating the need to investigate the reasons for payment failures.

- Eliminating Payment Delays: the implementation of a new billing system led to a 3x increase in the usage of ACH payments among customers and lowered the amount of payment terminations.

- Expanding Payment Options: the platform added new payment options to the customers, which led to a 30% increase in the average check.

While revamping the billing solution and upgrading data management for Pie Insurance was successfully completed, our team continues to collaborate with this client on enhancing the solution’s ODM platform.

Conclusion

By changing insurance coverage plans, risk and claim administration, billing and payroll, fraud protection, and marketing, artificial intelligence improves the insurance sector. It helps businesses to create customized products, automate procedures, and guarantee correctness throughout the whole process.

However, this is just the beginning: AI’s capabilities advance, and its impact is growing. In the near future, insurers will be able to improve their services thanks to AI-enabled usage-based and cyber insurance, AI-as-a-service, and preventive approach for risk prevention. For the case you are also planning a switch to AI-driven insurance, get started with feasible initiatives. To successfully adopt AI, start by running a small pilot project, develop adaptable AI implementation strategies, prioritize customer-centric solutions and consider technology partnerships with a trusted AI/ML development company!

FAQ

What Is AI in Insurance?

AI in insurance shifts business operations via data analysis. Data analytics in insurance makes it possible for more easy and accurate risk assessment, individually-tailored insurance policies, simplified administrative processes, and even risk prediction to avert claims. For insurance businesses, this means more efficiency, better customer service, and more equitable pricing.

How to Use AI in the Insurance Industry?

AI is potent to completely change the insurance business by improving fraud detection, enhancing the claims process, and providing individualized customer service. Big data is analyzed by ML algorithms to further forecast dangers and customize policies. Chatbots answer questions around-the-clock, which enhances customer service. AI also makes pricing models more accurate and streamlines underwriting procedures, increasing insurers’ productivity and profitability.

What Are the Ethical Issues of AI in Insurance?

When biased data is utilized to build algorithms, it might result in incorrect risk evaluations and even discriminatory pricing. This raises ethical questions regarding AI in insurance. Additionally, questions regarding accountability and fairness are raised by the opaque decision-making process used by AI algorithms.

How to Leverage AI in the Insurance Industry?

When implementing AI for an insurance company, begin with automating rule-based procedures before progressing to more difficult jobs like fraud detection or claims processing. Prioritize customer-facing projects and train your staff to collaborate with AI. Join forces with AI specialists to have access to pre-made solutions and knowledge. This speeds up the deployment of AI while generating internal knowledge for upcoming innovations.