Today, the banking and financial services industry is in the midst of unprecedented transformation and increasing complexity. Emerging technologies, intense competition, and rising customer expectations shape the way organizations operate in 2026. McKinsey backs this statement by reporting that banks today face demanding market conditions that require not just incremental improvements, but strategic technological reinvention to remain competitive and relevant.

The demand for the services of competent banking software development companies is higher than ever, as software for banks has transitioned from a support tool to a core infrastructure that underpins every aspect of daily operations, including real-time transactions, mobile engagements, complex regulatory reporting, and advanced security protocols. Legacy technology stacks, often decades old, struggle to meet these demands. In fact, according to a Forbes survey, 55% of banks cite legacy systems as a key obstacle to digital transformation.

That’s why partnering up with the right development company becomes a critical, strategic decision, as it helps to ensure that technology investments support long-term business goals, deliver measurable outcomes, and reduce risk during complex deployments.

In this article, we’ll present a curated list of leading banking software developers, explain what these firms actually do, and offer guidance on how to choose the right vendor to future-proof your institution.

Key Takeaways

- Software development vendors provide full-cycle services across core banking functionality with secure system integration.

- Modern banking applications leverage the latest technologies, including custom architectures, AI-driven analytics, cloud-native infrastructure, and API-based ecosystems.

- Custom software is far more suitable for banking institutions of any size than off-the-shelf solutions. Tailored software can meet all technological needs of a modern organization.

- The ideal vendor should have proven domain expertise, strong security and compliance capabilities, and a track record of long-term partnerships.

List of the Top Banking Software Development Companies

The possible options for custom software development vendors may seem endless; however, there are distinctive leaders among banking software development companies that deliver flawless software for global organizations at the top level of excellence. Each software development company listed here plays a crucial role in empowering financial institutions and enabling banks to modernize, innovate, and enhance operational efficiency in a rapidly digitalizing industry.

In this section, we created a list of the most prominent developers you should pay attention to.

| COMPANY NAME | FOUNDED | CORE EXPERTISE | INDUSTRIES SERVED |

|---|---|---|---|

| SPD TECHNOLOGY | 2006 | Custom Software Development, Data Analytics, Data Engineering, BI, AI/ML, Cloud | Banking, Finance, Healthcare, Retail, Manufacturing, Logistics |

| PRAGMATIC CODERS | 2014 | Custom Software Development, AI Development, Enterprise Application Modernization, AI Consulting, Web Development | Financial Services, Business Services, Medical, eCommerce |

| SCALO | 2007 | Custom Software Development, Application Management & Support, BI & Big Data Consulting & SI, IT Managed Services, IT Staff Augmentation, Mobile App Development | Financial Services, Business Services, Energy & Natural Resources, IT, Manufacturing, Media |

| AILLERON | 2007 | Mobile App Development, AI Development, Custom Software Development, UX/UI Design, Low/No Code Development | Financial Services, Business Services, IT, Education, Hospitality & Leisure |

| DEVINITI | 2004 | Generative AI, AI Consulting, AI Development, Custom Software Development, Mobile App Development | Financial Services, Consumer Products & Services, IT, Retail |

| INTELLIAS | 2002 | Custom Software Development, Generative AI, AI Consulting, AI Development, BI, Big Data Consulting & SI, Cybersecurity | IT, Automotive, Energy & Natural Resources, Financial Services, Hospitality & Leisure |

| EUVIC | 2005 | Custom Software Development, IT Managed Services, IT Strategy Consulting, Mobile App Development | Supply Chain, Logistics & Transport, Media, eCommerce, Government, IT |

| ITRANSITION | 1998 | Custom Software Development, AI Development, BI, Big Data Consulting & SI, CRM Consulting, Cloud Consulting, E-Commerce Development | IT, Business Services, Financial Services, Media, Medical, Retail |

| LEANCODE | 2016 | Mobile App Development, Custom Software Development, IT Strategy Consulting | Financial Services, Energy & Natural Resources, Telecommunications, Manufacturing, Retail, Sports, eCommerce |

SPD Technology

- Location: London, England

- Pricing: $50 – $99 / hr

- Founded: 2006

- Clutch Rating: 4.8

SPD Technology is among the top financial software companies, delivering cutting-edge solutions for financial institutions, fintech companies, and digital-first banks. With over 20 years of experience and four R&D centers in Eastern Europe, they design, build, and support custom banking software solutions that power core banking systems, digital banking platforms, and complex financial operations, including AI in investment banking initiatives and enterprise-scale transformation programs.

The company’s expertise spans core banking modernization, mobile and web development, payment processing systems, and data-driven banking platforms, helping banks integrate legacy systems, implement scalable cloud architectures, and adopt modern API-based ecosystems that support innovation without compromising stability. These capabilities enable their clients to meet strict KYC in banking requirements while maintaining flexibility and innovation.

SPD Technology’s portfolio includes complex projects for Fortune 500 companies and leading financial organizations, with clients across the U.S., U.K., Mexico, Israel, Switzerland, and other international markets.

Core Expertise Areas:

- Custom Software Development Services

- Mobile App Development

- Web Development

- E-Commerce Development

- IT Managed Services

- AI/ML Development

Pragmatic Coders

- Location: Kraków, Poland

- Pricing: $50 – $99 / hr

- Founded: 2014

- Clutch Rating: 4.8

Pragmatic Coders helps companies in FinTech, HealthTech, and other industries modernize legacy systems and implement scalable lending solutions powered by automation and AI. Since 2014, they have delivered 150+ products with a skilled team of 100+ tech professionals. Going beyond coding, they combine product management, UX design, and agentic AI development to build intelligent, future-ready applications trusted by unicorn startups and global enterprises.

Core Expertise Areas:

- Custom Software Development

- AI Development

- Enterprise Application Modernization

- AI Consulting

- Web Development

Scalo

- Location: Kraków, Poland

- Pricing: $50 – $99 / hr

- Founded: 2007

- Clutch Rating: 4.7

Scalo builds future-ready digital solutions providing transformative results, backed by 17 years of market presence and over 750 successful projects. Their solutions grow and adapt to the constantly changing tech environment. This forward-thinking approach has helped them successfully serve clients across the banking, renewable energy, manufacturing, and eCommerce sectors.

Core Expertise Areas:

- Custom Software Development

- Application Management & Support

- BI & Big Data Consulting & SI

- IT Managed Services

- IT Staff Augmentation

- Mobile App Development

Ailleron

- Location: Kraków, Poland

- Pricing: $50 – $99 / hr

- Founded: 2007

- Clutch Rating: 4.9

Ailleron specializes in financial technology services, leveraging its financial industry know-how and deeply understanding clients’ challenges. Their agile approach enables the implementation of intelligent automation across customer-facing and internal banking systems, improving efficiency while maintaining compliance with strict financial regulations. The list of their clients includes Citibank, ING, Santander, BNP Paribas, Standard Chartered, and Crédit Agricole.

Core Expertise Areas:

- Mobile App Development

- AI Development

- Custom Software Development

- UX/UI Design

- Low/No Code Development

Deviniti

- Location: Wrocław, Poland

- Pricing: $50 – $99 / hr

- Founded: 2004

- Clutch Rating: 5.0

Deviniti focuses on providing Generative AI development services, among other technological offerings. Their main focus is building secure, self-hosted AI applications that give clients full control over their data. One of their most prominent success stories is an AI Agent for Credit Agricole Bank.

Core Expertise Areas:

- Generative AI

- AI Consulting

- AI Development

- Custom Software Development

- Mobile App Development

Intellias

- Location: Kraków, Poland

- Pricing: $50 – $99 / hr

- Founded: 2002

- Clutch Rating: 4.9

Intellias is a global technology partner to top-tier organizations and digital natives, helping them accelerate their pace of sustainable digitalization. For more than two decades, Intellias has delivered mission-critical projects and measurable outcomes that meet clients’ business needs. With delivery capabilities across multiple regions, the company supports banks with financial analytics services that enable data-driven decision-making, regulatory reporting, and operational transparency.

Core Expertise Areas:

- Custom Software Development

- Generative AI

- AI Consulting

- AI Development

- BI, Big Data Consulting, and SI

- Cybersecurity

Euvic

- Location: Gliwice, Poland

- Pricing: $50 – $99 / hr

- Founded: 2005

- Clutch Rating: 4.8

Euvic positions itself as a global technology leader at the forefront of transformation and innovation. Their 6000+ team had delivered 3000+ projects in the Finance, Logistics, Media, and Energy industries. The company focuses on embracing advancements in technology, adapting to industry shifts, and creating true business value, with an emphasis on data analytics expertise to help organizations extract insights from complex datasets.

Core Expertise Areas:

- Custom Software Development

- IT Managed Services

- IT Strategy Consulting

- Mobile App Development

Itransition

- Location: London, England

- Pricing: $25 – $49 / hr

- Founded: 1998

- Clutch Rating: 4.9

Itransition is among the top financial software companies with almost three decades of professional experience. They offer a full spectrum of software consulting and development services for 30+ countries. Their professional team, business knowledge, and mature methodologies allow them to effectively handle software projects of any scale and complexity.

Core Expertise Areas:

- Custom Software Development

- AI Development

- BI, Big Data Consulting, and SI

- CRM Consulting

- Cloud Consulting

- Cloud Modernization Services

- E-Commerce Development

LeanCode

- Location: Warszawa, Poland

- Pricing: $50 – $99 / hr

- Year of founding: 2016

- Clutch rating: 5.0

LeanCode is one of the top financial software developers, recognized by Google as an official Flutter consultant. Trusted by global brands, they cover the entire software development lifecycle, from product strategy and design to development, launch, and maintenance, including complex projects where companies need to build a payment processing app focused on performance, scalability, and usability.

Core expertise areas:

- Mobile App Development

- Custom Software Development

- IT Strategy Consulting

What Banking Software Development Companies Actually Do

Simply put, financial software developers enable banking organizations to build, modernize, and operate the technology needed to improve their core business functions. Skilled software engineering practices are essential in the comprehensive development process for banking and fintech solutions, ensuring the creation of secure, scalable, and reliable financial applications. The duties of software development vendors extend beyond development tasks and include strategic planning, system architecture, integration, and long-term operational support, as well as ensuring data security in fintech apps across complex, regulated environments.

To end up with an effective software that fits an organization like a glove, the development process should include a thorough business needs analysis. Another essential step is to ensure that the chosen development methodologies and technology stack are fully compatible with existing systems. Understanding the vendor’s project management practices also helps ensure the timely delivery of high-quality software.

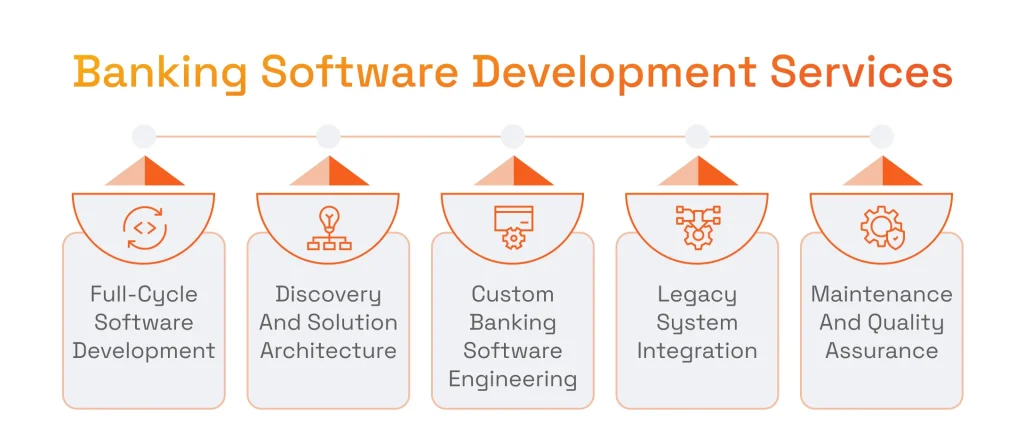

Banking Software Development Services

It is reasonable to expect the following service offerings from a full-cycle development provider:

- Discovery and solution design, translating business and regulatory requirements into scalable technical architectures

- Software architecture and engineering, built to support high availability, security, and performance

- Custom banking software development, tailored to specific operational models, customer segments, and compliance needs

- Integration with legacy banking systems, ensuring modern platforms work seamlessly alongside existing core systems

- Ongoing maintenance, quality assurance, and testing, safeguarding system reliability, regulatory alignment, and long-term stability.

When implemented correctly, these services enable the adoption of the latest technological advancements without disrupting essential business processes and still maintaining airtight security. They allow banks to adopt modern platforms while leveraging data analytics for asset management and reporting.

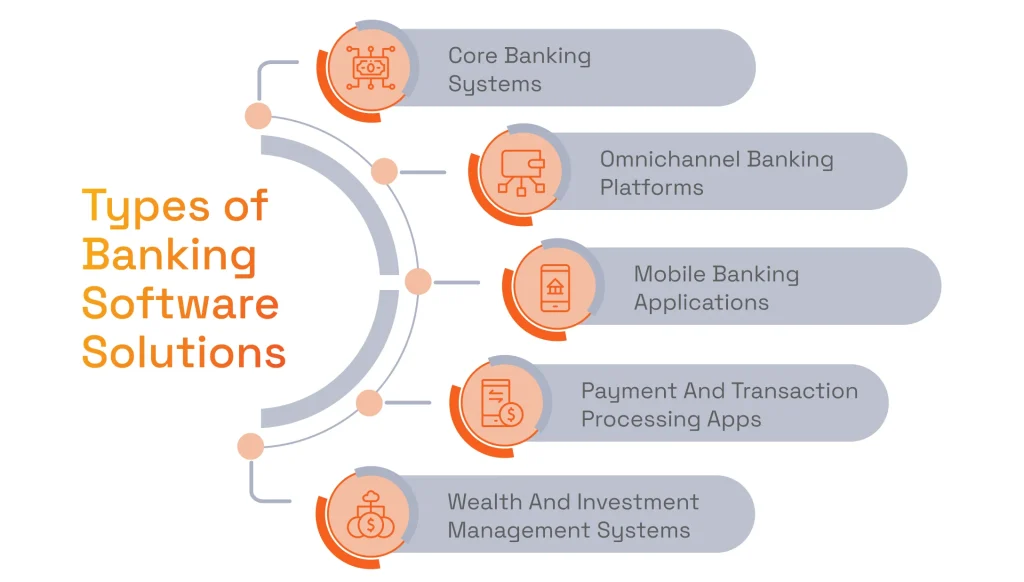

Types of Banking Software Solutions

The common types of banking custom software solutions that leading vendors deliver include comprehensive, scalable platforms known as a banking solution, designed to support digital banking and meet the specific operational needs of modern financial institutions:

- Core banking software and system modernization, replacing or enhancing outdated platforms to improve scalability and flexibility

- Digital banking and omnichannel platforms, unifying customer experiences across web, mobile, and branch channels

- Mobile banking applications, delivering secure, intuitive access to banking services anytime and anywhere

- Payment processing and transaction systems, optimized for speed, accuracy, and high transaction volumes

- Wealth management and investment solutions, supporting portfolio management, reporting, and advisory services.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“It is important to note that we consistently see that banks achieve the greatest results when core, digital, and customer-facing solutions are reinforced by specialized systems for risk management, back-office operations, and enterprise-grade customer data management.”

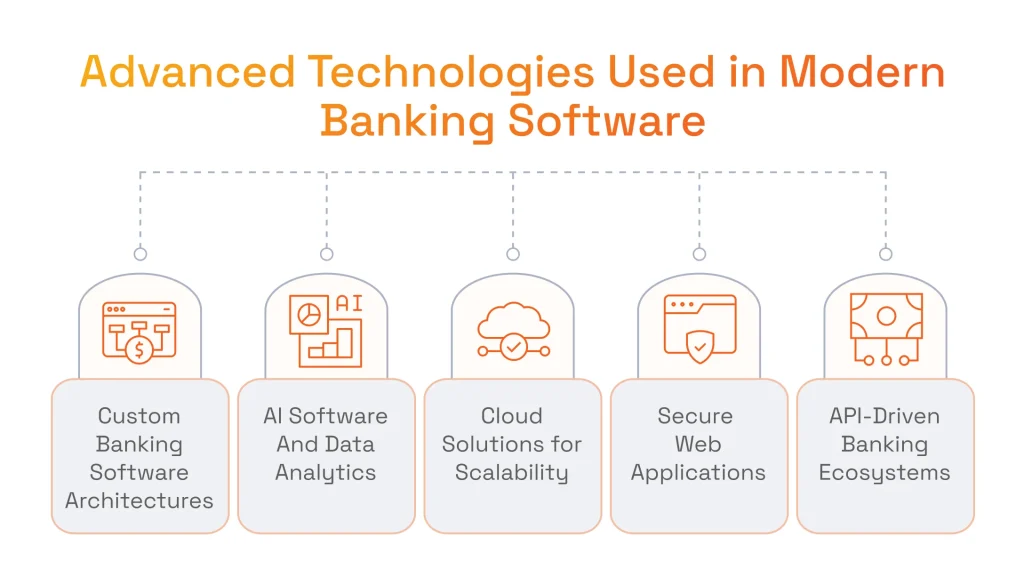

Advanced Technologies Used in Modern Banking Software

To meet growing performance, security, and innovation demands, modern banking software leverages advanced technologies, including but not limited to:

- Custom software architectures designed for high-load, regulated banking environments

- AI software development and advanced data analytics, such as leveraging AI for fraud detection, predictive analytics, and operational automation, help banks reduce risk, improve customer trust, and enable better decision-making and personalized services.

- Cloud solutions, providing scalability, resilience, and cost efficiency

- Secure web development and API ecosystems, enabling integrations, open banking initiatives, and faster product delivery.

Leading software development vendors combine these capabilities into secure, production-ready banking platforms, helping financial institutions modernize confidently.

Why Custom Banking Software Matters More Than Ever

Custom software can unlock the full potential of using machine learning in banking, as well as many other trending technologies. For example, Buy Now Pay Later technology, which requires deep integration with lending, risk assessment, and payment systems.

Let’s examine why custom software is superior to ready-made solutions for bankers.

Why Off-the-Shelf Banking Software Often Falls Short

Existing banking platforms are built to serve all users, not the specific operational, regulatory, and strategic realities of individual financial institutions. So, banks that use ready-made solutions struggle with limited customization and integration complexities. As time goes by, these limitations pile up and slow innovation, increase dependence on third-party vendors, and drive up the total cost of ownership through licensing fees, workarounds, and forced upgrades that don’t always align with business priorities.

Benefits of Custom Banking Solutions

On the contrary, custom software is designed with specific business processes in mind, perfectly aligning with growth objectives and data flows. With this technological and business synchronicity, banks benefit from improved system performance, reduced manual effort, and greater operational efficiency.

Purpose-built solutions also enhance customer engagement by enabling more personalized, seamless interactions, leading to a better overall customer experience. Additionally, custom solutions lower long-term operational costs by eliminating unnecessary features, minimizing vendor lock-in, and enabling controlled, incremental evolution, rather than disruptive, sometimes chaotic platform replacements.

Supporting Digital Transformation in the Banking Sector

True digital transformation requires a flexible, adaptable technology foundation. Custom software allows banks to modernize core systems gradually, integrate digital channels seamlessly, and adopt new technologies without compromising stability or compliance. This approach enables financial institutions to respond faster to market changes while maintaining control over security, data governance, and regulatory requirements.

Enabling Innovation

Custom platforms make it easier to launch new digital banking services, optimize payment systems, and create personalized customer experiences through thoughtful UI/UX design. Banks can integrate emerging technologies, APIs, and third-party services on their own terms, accelerating time-to-market and enabling continuous innovation.

Custom Software as a Competitive Differentiator

Another benefit is that custom software helps organizations operate more efficiently, innovate faster, and deliver unique value to customers, which off-the-shelf solutions simply cannot match. By joining forces with a dedicated developer, you will not only receive these advantages but also see how they will transform into sustainable competitive strength in the long run.

Choosing the Right Banking Software Development Vendor

The selection of the most suitable development partner is a strategic decision that makes the digital transformation initiative truly successful. For organizations in the financial sector, it is crucial to choose banking software development companies with proven expertise in delivering solutions tailored to the unique regulatory, security, and operational requirements of this industry. Your perfect candidate should most definitely combine technical expertise, deep domain knowledge, and a long-term partnership mindset.

In this section, we will delve deeper into the critical factors to consider during the vendor selection process.

Specific Expertise in the Banking Industry

A vendor must have a clear understanding of banking operations, financial products, and regulatory requirements. Deep knowledge of the banking and finance industry ensures solutions are aligned with real-world workflows, compliance obligations, and the complex demands of core banking, digital payments, and risk management.

Experience with Core Banking and Complex Banking Systems

Banks rely on platforms capable of handling high-volume transactions, sensitive financial data, and integrations with legacy systems. The ideal partner should demonstrate a proven track record in delivering large-scale, mission-critical banking software that is reliable, scalable, and resilient.

Ability to Work with Financial Data Securely

Everything related to security is paramount in financial services. A competent vendor prioritizes data security and implements essential measures, including but not limited to data protection protocols, encryption, and access controls, ensuring that sensitive customer and transactional data remain safe from breaches or misuse.

Strong Quality Assurance and Testing Maturity

To minimize defects, ensure compliance, and reduce downtime, it is critical to have comprehensive Quality Assurance (QA) processes in place. A proven approach to testing helps to safeguard both customer trust and operational efficiency.

Understanding of Regulatory Compliance and Risk

Financial institutions are forced to operate in an extremely regulated environment. A top-tier vendor maintains expertise in relevant compliance standards, risk assessment, and auditing practices to reduce exposure and maintain operational integrity.

Scalability, Support, and Long-Term Partnership Mindset

Custom banking software is a long-term investment, so the right partner delivers scalable solutions, ongoing support, and a collaborative approach to evolving requirements, enabling your organization to respond to market changes efficiently.

Global Presence and Communication Capabilities

For banks operating across regions, effective communication and international presence are critical. Vendors with global reach can manage distributed teams, coordinate across time zones, and ensure consistent project delivery.

Why Consider SPD Technology

At SPD Technology, we combine cross-industrial experience, proven financial domain expertise, and a partnership-oriented approach to be your perfect custom software development vendor. With over two decades of delivering state-of-the-art financial software solutions for our global clients, some of which grew from startups to household names, SPD Technology has a strong reputation for overcoming even the most complex mobile and web application development challenges. Our proficiency covers core banking software solutions, digital banking platforms, and fully custom software development, helping our clients to modernize legacy systems, streamline operations, and create seamless digital experiences for their customers.

The solutions we deliver are designed to align with our clients’ growth strategy and operational needs, empowering them to leverage modern, scalable platforms that support complex banking operations end-to-end. From automating internal processes and integrating legacy systems to implementing cloud architectures and advanced analytics, our expert team covers all aspects of software development.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“In addition to technical excellence, our company is always working towards long-term business value. We conduct rigorous research and evaluations to understand each client’s unique objectives and guide the companies we partner with through technology-driven transformation.”

If you are looking for a strategic technology and business partner, SPD Technology may be the best option. By combining deep banking proficiency, including mobile payment app development, with bleeding-edge technology expertise and a client-focused mindset, SPD Technology enables financial institutions to innovate safely and scale confidently.

Conclusion

We can already say that banking software is mission-critical infrastructure that determines how organizations innovate, compete, and deliver value to their customers. While branch networks and interest rates remain critical for banks, they are now also evaluated on the personalization, quality, and speed of their digital services. Digital transformation remains a top priority for banks worldwide, with investments focused on improving customer satisfaction and operational efficiency. Gartner believes that financial institutions must prioritize emerging technologies, integration strategies, and digital capabilities to stay relevant and responsive.

The right choice of banking software developers directly influences three vital business outcomes:

- Customer satisfaction is enabled by modern software, which delivers seamless omni‑channel experiences, real‑time responsiveness, and data‑driven personalization.

- Operational efficiency is achieved by automating manual workflows, integrating disparate systems, and enabling real‑time visibility across platforms, thereby reducing costs, accelerating innovation cycles, and optimizing resource allocation.

- Long‑term competitiveness improves as scalable and adaptable platforms help organizations anticipate market changes, adopt new services quickly, and support strategic growth without being held back by legacy constraints.

That’s why building banking software requires specialized knowledge of financial regulations, security frameworks, and customer expectations that go beyond generic IT development.

Here, at SPD Technology, we help banks to modernize, scale, and innovate safely. We have the necessary blend of industry insight and technical excellence to deal with all operational challenges and create a strong competitive advantage. Our company sees advanced banking software as the principal driver of growth, and not just a technological upgrade. Feel free to contact us anytime if you need scalable and secure solutions that make a difference.

FAQ

What is the best banking software?

The truth is, there is no universal solution for organizations of all types and sizes. To find the solution that works the best, you need to consider a variety of factors, including but not limited to the bank’s digital maturity, regulatory environment, size, and business model. The biggest banks use enterprise-grade core banking software solutions, complemented by custom layers for integrations, analytics, and digital channels. Challenger banks, on the other hand, may choose cloud-native, modular systems for easier scaling and faster product launches. Practical implementations demonstrate that the most effective approach is a highly customized ecosystem that has robust core, secure integration, and functionality tailored to specific compliance requirements and business goals.

What are the big 3 core banking platforms?

It is safe to say that the global core banking market is dominated by three leading vendors:

- Temenos (T24 / Transact) is widely used by both traditional banks and digital-first institutions due to its modular architecture and global regulatory coverage.

- Oracle FLEXCUBE is a comprehensive enterprise platform popular among large banks, especially those operating across multiple regions.

- FIS (including platforms such as Finacle, Horizon, and Profile) is known for its stability, scalability, and strong presence in retail and corporate banking.

These platforms provide foundational banking capabilities, including account management, payments, lending, and compliance. However, most banks extend them with custom software to support modern digital experiences, advanced analytics, and integrations with third-party services.

Which software is used in banking?

Banks of all sizes typically use sophisticated software solutions, rather than single systems. These solutions include:

- Core banking platforms

- Web and mobile online banking applications

- Payment processing systems

- Fraud detection and AML tools

- CRM solutions

- Data warehouses

- Reporting platforms

It also becomes common to use AI-driven banking custom software for risk management, customer support, and credit scoring. It makes sense to invest in custom modern digital banking software development for proper integration of desired functionality, as well as peak performance and scalability.