Given the evolving landscape of digital transactions, integrating a robust payment gateway into your website or app is no longer a convenience but a strategic imperative. Still, when you need to integrate payment gateway, it requires strong technical expertise, deep understanding of data security practices and 360-degree awareness of compliance requirements. Supported by a solid technical input of our fintech software developers, we are going to cover all the important aspects of integrating a payment gateway into your business processes.

What Is an Integrated Payment Gateway?

Before learning how to add payment to website, it’s essential to understand that integrating a payment gateway is a necessary step. A gateway, in turn, is a payment processing solution that has a seamless connection with a website, mobile app, or Point-of-Sale (POS) system of an organization. As the opposite of external redirection-based payment systems, an integrated gateway operates within the platform, providing a frictionless and secure checkout experience while maintaining branding consistency.

What Is Payment Gateway Integration?

It is the process of connecting an existing payment gateway with a digital platform of an organization. This enables processing customers’ transactions directly, while they can use any payment method supported by the gateway provider – whether it is credit or debit card, electronic wallet or bank transfer.

While integrating a third-party payment gateway is a popular option, businesses with unique requirements or industry-specific needs may consider custom payment gateway development. This alternative provides full control over the payment flow, supports niche functionalities, and allows deeper customization tailored to specific business needs.

Integrated Payment Gateway vs Payment Gateway Software Development

In one of our recent articles, we discussed how to build a payment gateway tailored to your specific needs in a custom way. But what if an existing solution is good enough for your case, and you don’t need to spend an enormous amount of money on entirely custom-made software? Before making the final choice, let’s compare the pros and cons of building a custom gateway vs an integrated payment gateway.

In short, smaller businesses with standard requirements and a need for quick implementation may find existing payment gateways more suitable, while large enterprises with unique needs and the resources for custom development may opt for a tailored solution.

Custom Payment Gateway Development

Pros:

- Tailored to Specific Needs: All of your unique requirements will be covered to the fullest extent. With a custom solution, you will maximize your revenues, since you will have all the payment options you need.

- Complete Control: You won’t have to rely on a third-party payment gateway provider, since you will be in charge of all software development and technical aspects, making changes and adding features to the system when necessary.

- Brand Consistency: You can design your gateway to seamlessly match the brand identity of the business, providing a consistent user experience throughout the entire payment process.

Cons:

- High Development Costs: You can expect a high development cost, starting from $200,000 and increasing depending on the desired functionality. The costs include development time, testing, ongoing maintenance, and improvements. By the way, we discussed the payment gateway development cost and provided a detailed breakdown of each component of the final price.

- Security Challenges: Your development team needs to have deep domain knowledge, including but not limited to implementing KYC standards in Finance, and ensuring compliance. Failure to meet security standards could result in security vulnerabilities and major financial losses.

- Development Duration: Building a custom solution will take significantly more time compared to when you integrate a payment gateway. This can delay time-to-market and potentially impact revenue streams.

Existing or White Label Payment Gateway Integration

Pros:

- Quick Implementation: Integrating an existing payment gateway is generally faster compared to developing a custom solution. Most vendors offer well-documented payment gateway API integration and plugins that make the integration process straightforward.

- Security: Ensuring data security in Fintech is always a priority, and established payment gateways invest heavily in security measures, including encryption and fraud prevention. You can be sure that all transactions will be secure and compliant with the latest industry standards.

- Cost-Effective: The cost for an integrated payment gateway will be significantly lower compared to building a solution from the ground up. The top vendors often provide a range of pricing plans, allowing businesses to choose a package that suits their needs and budget.

- Wide Range of Features: While customization is not a forte of existing solutions, popular providers still offer an impressive variety of features including subscription management, reporting tools, and multiple payment options like PayPal payments, Stripe or Square.

Cons:

- Limited Customization: Existing providers still offer limited customization options that may not cater to unique needs and specific requirements.

- Transaction Fees: While costs, when you integrate payment gateway, will end up lower, compared to a custom solution, most existing payment gateways charge transaction fees, which can add up over time and impact the overall cost for businesses, especially large enterprises with high transaction volumes. Still, transaction costs are easily calculable and accurately predictable depending on the transaction volume, so you will be able to choose a payment gateway provider that meets your business budget.

- Vendor lock-in: When you integrate payment gateway it may imply some kind of vendor lock-in – a situation when a business becomes dependent on the third-party solution. To avoid it, you have to carefully evaluate their long-term requirements, and choose online payment gateway providers that offer flexibility and scalability.

The Critical Importance of Seamless Payment Gateway Integration

Integrating a payment gateway seamlessly is critical for the organizations with the business models heavily dependent on online transactions. For them, is critical any friction in payment processing may result in lost sales and disappointed customers. eCommerce payment gateway integration may seem like the first obvious option, however, any business using online transactions can benefit from effective payment processing. Having a reliable payment gateway will enhance business growth, ensure scalability, and provide the highest level of security.

The Value-Adding Benefits of Online Payment Integration

Payment gateways can become an additional driver for business growth, unlocking new opportunities in:

- Improved Customer Experience: a fine-tuned payment process will reduce any significant checkout friction thanks to features like one-click payments, saved payment details, and multiple payment method options.

- Reduced Operational Costs: direct integration into business platforms allows companies to automate transaction processing, reduce manual effort, and minimize costly errors.

- Compliance with Legal Standards: a properly integrated gateway ensures compliance with current regulatory requirements, which not only protects an organization from legal risks and prevents data breaches, but also builds additional customer trust.

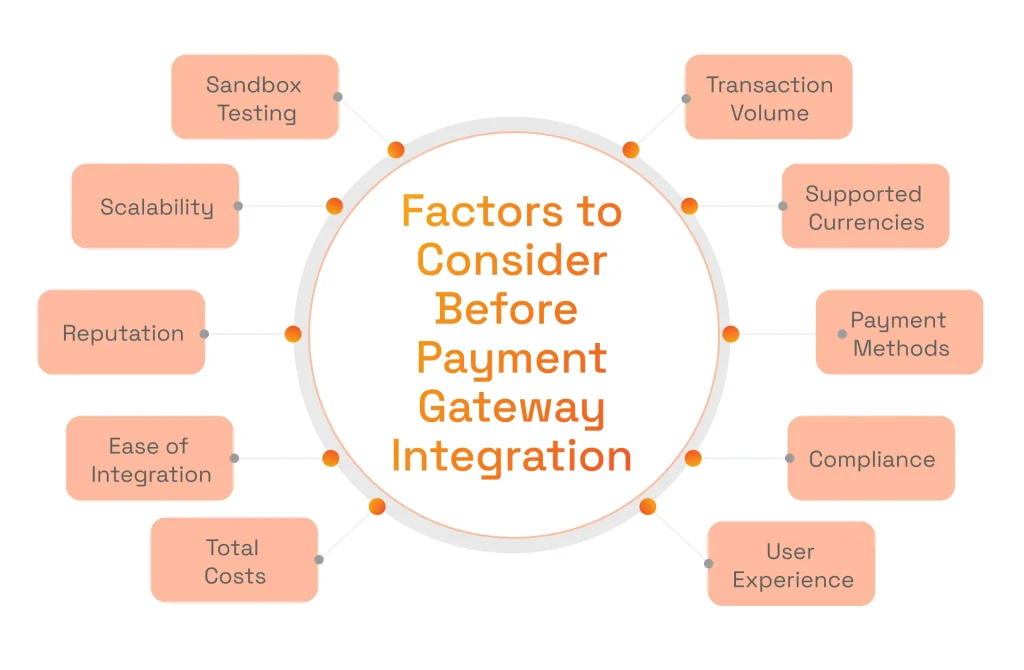

Factors to Consider Before Integrate Payment Gateway

The payment gateways market is booming, and, according to Future Market Insights, is projected to grow from $117.5 billion in 2023 to $293.9 billion in 2033. So, it is safe to assume that there will be more gateway options available, and the existing ones will improve dramatically, as the market grows.

As of January 2025, Forbes considers the following to be the top 10 payment gateways:

- Authorize.net

- Stax

- Payline Data

- Shopify

- Helcim

- Elavon

- Square

- Stripe

- Clover

- PayPal

If you are considering online payment gateway integration, the above-mentioned providers are good options to start with, and before making the final choice, you should consider the following factors.

Transaction Volume

Before you integrate payment gateway, you need to have estimations on the expected transaction volume to ensure that a payment gateway can handle the scale of your business. Many gateways have pricing based on transaction volume, which may end up in enormous expenses for big organizations with high amounts of operations.

Supported Currencies

If you have an international customer base, or you are looking to expand your business in the future, it makes sense to verify that payment gateways of your choice support the currencies you plan to transact in.

Available Payment Methods

Before deciding on a vendor, you need to do some research on the preferences of your customers and determine what payment methods are the most suitable. The most popular options include credit and debit cards, digital wallets, and bank transfers.

Ensuring Compliance

Payment gateways are subject to various compliance standards to ensure the security, integrity, and confidentiality of payment transactions. The payment gateways of your choice must adhere to compliance standards and update their systems and processes accordingly. Non-compliance can result in financial penalties, reputational damage, and legal consequences for your organization.

Here are some of the key compliance standards that payment gateways typically adhere to:

- PCI DSS (Payment Card Industry Data Security Standard)

- SSL/TLS Encryption

- EMV (Europay, Mastercard, and Visa)

- PSD2 (Payment Services Directive 2)

- GDPR (General Data Protection Regulation)

- ISO 27001

- SSAE 18 / SOC 2 (Service Organization Control)

- NACHA (National Automated Clearing House Association)

- AML (Anti-Money Laundering) and KYC (Know Your Customer)

Also, make sure that you are aware of all geographical regulations, adhering to any specific regulatory requirements in the regions where you operate. Ensure the vendor of your choice complies with these regulations, and you won’t face any potential penalties.

Ease of Payment Integration in Website

Thoroughly review the gateway’s API documentation to assess the ease of integration. Well-documented APIs can significantly speed up the integration process and save you some money. Additionally, it will be a good idea to check the availability of development support from the integrated payment gateway provider if issues or questions arise during integration.

Total Costs of Payment Gateway Integrations

We already mentioned transaction fees, however, there are other components of pricing, including setup fees and fees for specific features or services. You should also carefully look for possible hidden costs, including chargeback fees, currency conversion fees, or payments for premium support. Compare the most suitable options to make a fully informed decision.

eCommerce Payment Integration Scalability

Determine whether the gateway can handle increased transaction volumes and if it offers features suitable for growing businesses. The payment gateways should support horizontal scaling, allowing businesses to add more resources or instances to distribute the load and enhance performance as transaction volumes increase.

Sandbox Testing

Another important aspect to think about when you integrate payment gateway is whether the provider offers a sandbox or testing environment. This is required for payment gateway integration service providers to test transactions in a simulated environment before going live, reducing the risk of errors and data breaches.

Reputation and Reliability

Consider the reputation of the gateway provider in terms of reliability, security, and customer support. Look for reviews and testimonials from other businesses to know who you are dealing with.

User Experience

A smooth and intuitive checkout process is crucial for user satisfaction, so you should choose a payment gateway that provides a seamless and user-friendly checkout experience.

Mobile integration is also very important, as the mobile payment market size is expected to grow at a CAGR of 36.2% between 2023 and 2030, according to Grand View Research. So, make sure that the payment gateway of your choice is fully optimized for mobile devices.

Website Payment Integration Redundancy

It will be a good idea to consider implementing multiple gateways for redundancy. If one gateway experiences technical issues, having a backup can prevent disruptions in online payment processing and save costs caused by downtime.

How to Integrate a Payment Gateway Into a Website

When you need to integrate a payment gateway with the website, it is quite a time- and effort-consuming process, but when done correctly, there is nothing particularly hard about it. Here are the key steps to accomplish this goal.

1. Define Business Requirements for Payment Gateway Integration

Conduct customer research and internal meetings to define your business requirements clearly. Before starting any integration, you should determine:

- Transaction volume.

- Currencies your business needs to support.

- Preferred payment methods of your customers.

2. Research and Choose a Payment Services Integration Tool

Evaluate the most suitable integrated payment gateways based on your business requirements, and pay close attention to pricing and fees, available payment methods, a list of supported features, as well an industry reputation.

3. Create an Account with the Payment Gateway Provider

When you make your decision, it will be time to create an account with a chosen gateway provider. You need to read and agree to the terms and conditions. If you don’t have any doubts, then you can provide your business details, bank information, and merchant account credentials.

4. Obtain API Credentials to Integrate Payment Gateway

Once registered, the vendor will provide you with API credentials including API key, secret key, and merchant ID. These credentials are essential for making API calls, which are crucial for real-time communication and seamless integration between the merchant’s system and the gateway. They allow for the secure exchange of information, enabling merchants to offer smooth and efficient online payments to their customers.

5. Understand API Documentation

Thoroughly review the gateway’s API documentation with your development team to understand the available functionalities, request and response formats, as well as any specific technical requirements and limitations that hosted payment gateways might have.

6. Develop or Update Your Website/Application

Finally, at this stage, some coding is required. To complete the integration, the existing code of your website may need to be updated, or the development of entirely new features may be required to accommodate payment processing. It will be a good idea to hire seasoned experts with industry experience for this task, as any errors on this task may cost you valuable time.

7. Implement Payment Gateway API Calls

With all software development aspects covered, you can use the obtained API credentials to make API calls for transactions and get access to features such as payment initiation, payment processing, order confirmation, and handling of payment responses.

8. Implement Gateway Integration Security Measures

Ensure that your integration follows best practices for security, as we mentioned in one of the previous sections of the article. Implementing SSL encryption, and adhering to PCI DSS standards are mandatory to ensure the safety of the payment information in the modern Fintech industry.

9. Test a Payment Platform Integration in a Sandbox Environment

Most providers offer a sandbox or testing environment. Your development team can leverage this environment to perform thorough testing without processing real transactions. This process will help to verify that API calls, responses, and error handling work as expected.

10. Conduct User Acceptance Testing (UAT)

Conduct user acceptance testing with a select group of users to ensure that the payment processing is user-friendly and error-free. This will help to detect and report any issues that might occur.

11. Implement Error Handling

It is important to have robust error-handling mechanisms to manage situations such as payment failures, timeouts, or connectivity issues. Users should get clear error messages and know exactly what to do in case of any failures when a particular payment method doesn’t work as expected.

12. Obtain Necessary Certifications and Approvals

It is probably the most time-consuming part of the entire process, as you will need to get approval from the provider to use their services on your platform and finally start to accept payments.

Volodymyr Soska

Software Development Engineer at SPD Technology

“The actual technical integration may be completed within a month, however, getting the permission to use a certain gateway may take significantly longer, depending on the provider and its requirements.”

13. Prepare eCommerce Payment Gateway Integration for Go-Live

Now it is time to inform relevant stakeholders and your team members, plan the launch process carefully, and watch the system closely during the initial rollout.

14. Monitor and Optimize

As you will get your first transaction data, and user feedback and see how the system performs, you will be able to fine-tune the integration based on real-world usage and address any issues promptly as they occur.

15. Provide Ongoing Support

Your provider can make changes or updates at any time, which may disrupt the integration and put your transactions on hold. To prevent that unfortunate scenario, you need to stay informed about new features or security measures on the vendor’s side and react rapidly to keep your integration at maximum efficiency level.

Payment Integration Best Practices

To successfully add payment to websites or mobile apps, extensive knowledge of this process is required. In this section, we will share our practical insights on how to integrate payment gateways most efficiently, and you will be aware of the essential elements to pay attention to.

Setting Up a Fraud Prevention Mechanism

First and foremost, having a well-structured fraud prevention system that incorporates security features like 3D Secure authentication, tokenization, and Address Verification Systems (AVS) is mandatory. Additionally, the wise move will be to add fraud monitoring tools that analyze transaction patterns and flag potential threats in real-time. With a proactive approach to fraud prevention, the business and its customers will be safeguarded from unauthorized transactions, data breaches, reputational damage, and financial losses.

Enabling Tokenization for Repeated Payments

Tokenization helps to replace sensitive credit card details with a token, a unique identifier that allows the business to store this information securely. So the need to store raw data is being eliminated, while fast and seamless checkouts are provided. This secure storage of payment details boosts the trust of customers and reduces checkout friction with complete adherence to security regulations.

Designing for Multi-Device Compatibility

In 2025, eCommerce payment integration, as well as one for any other industry, entails consistent and responsive experience across desktops, mobile devices, and tablets. The optimization for various screen sizes, input methods, and network conditions adds to an uninterrupted checkout experience. There is a trend for a growing number of mobile transactions, that the companies should be ready for by providing a responsive payment experience across all platforms.

Using Webhooks for Real-Time Updates

With the help of webhooks, it is possible to provide instant notifications on transaction statuses automatically. This functionality helps both organizations and their customers to stay informed without the need for manual checks. Real-time updates help to improve transparency and boost customer satisfaction, allowing to increase the speed of payment-related issues.

Providing Backup Payment Methods

This is a great idea for mobile apps and websites with payment gateways, as it ensures continuous payment processing despite possible technical failures, maintenance periods, or changes in regulatory requirements. Relying on a single payment gateway, in turn, is risky because possible service interruptions will harm business continuity and the bottom line.

Gathering User Feedback for Continuous Improvement

Getting feedback from the customers helps to get ideas for payment experience improvement. In particular, organizations can uncover complex checkout flows, unclear instructions, or desired but unsupported payment methods. Knowing exactly what the customers want, it becomes possible to optimize conversion rates and offer a more intuitive checkout experience.

Implementing Retry Logic for Failed Payments

There are different reasons for payment failures, including insufficient funds, connectivity disruptions, or alerts from fraud detection systems. By having smart retry logic in the payment system, it is possible to provide automated additional attempts that will reduce unnecessary declines. This will eliminate the frustration of customers whose payments fail due to temporary issues.

Enhancing Accessibility of the Payment Process

Last but not least, the organization must ensure that payment forms are navigable via screen readers, keyboard inputs, and assistive technologies. This can be achieved by adhering to the accessibility standards, such as WCAG (Web Content Accessibility Guidelines). It is a critical move to remove the possible blockers for users with disabilities and broaden the customer base.

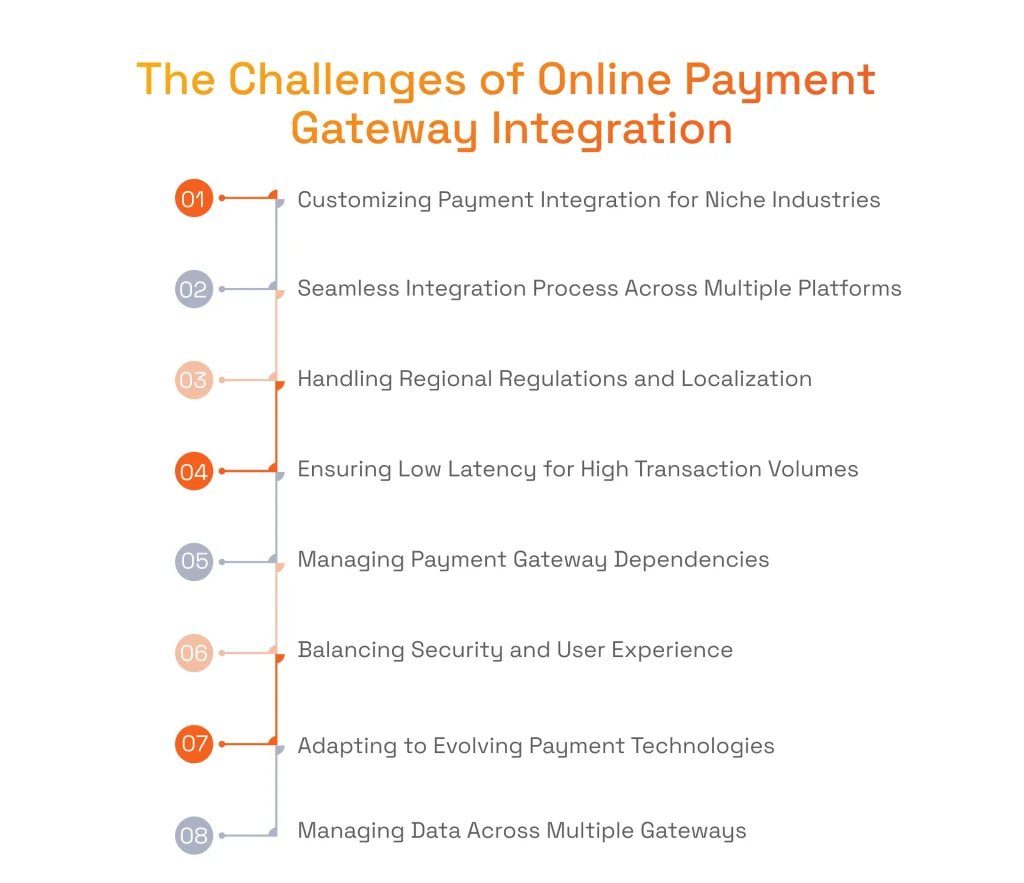

The Challenges of Online Payment Gateway Integration

Payment integration in website or mobile app requires dealing with business and technical challenges. Let’s review the most common of them and discuss our approaches to resolve potential issues.

Customizing Payment Gateways Integration for Niche Industries

Organizations in different industries may require entirely different customization of payment flows or features beyond the capabilities of standard gateways. When you still decide to integrate payment gateways with basic functionality, your business may face transaction inefficiencies, compliance issues, and overall problems with customer service.

Having deep knowledge of requirements for payment gateway integration and experience with delivering tailored functionality, we always develop effective integrations using APIs and diverse modular architectures. Our teams conduct research and build unique features aligned with the needs of a specific business in a particular industry.

Achieving Seamless Payment Gateway Integration Across Multiple Platforms

It is hard enough to integrate payment gateway in website, mobile app, and POS system, however, it is even harder to maintain consistent functionality across them. Any inconsistencies in payment experiences may lead to gaps in user experience and revenue loss.

Thanks to our vast multiplatform development experience, we develop responsive payment flows across multiple platforms. Our experts achieve this by designing smooth integration frameworks for reliable transactions.

Handling Regional Regulations and Localization

Local regulatory requirements remain a major blocker for global-scale payment gateway integrations. Organizations are always at risk of missing some local regulations or skipping preferred payment methods in particular regions.

Our experts have proven experience in ensuring compliance with key regulatory frameworks and region-specific regulations. We leverage localized payment options to allow our clients to expand.

Ensuring Low Latency for High Transaction Volumes

Peak sales periods become a true testament to payment processor integration and the platform’s ability to take on high loads of traffic. Any issues with the latency may result in abandoned carts and lowered revenue.

To deal with this issue, in our projects, we deploy scalable cloud infrastructures, caching mechanisms, and optimized payment workflows. With our performance-optimized architectures, clients get minimal-to-none latency even during traffic spikes.

Managing Payment Gateway Dependencies

Another potential issue we should talk about is the downtimes of third-party APIs connected to payment processing. In some cases, even the slightest disruptions may result in massive reputational and financial losses.

We solve this by integrating multiple redundant gateways and implementing robust error-handling mechanisms to maintain uptime in any circumstances. Our systems automatically switch to backup payment providers when required to ensure uninterrupted service.

Balancing Security and User Experience

Unfortunately, implementing strong security measures like 3D Secure authentication can add friction to the checkout process. With every security step, the possibility of cart abandonment grows.

Our experts are always working on implementing streamlined authentication flows that create a reasonable balance between convenience and security. We achieve this by properly implementing tokenization, biometric authentication, and risk-based authentication.

Adapting to Evolving Payment Technologies

While you integrate payment solutions, there are probably new payment methods that become popular, like new cryptocurrencies or digital wallets. Your customers are probably expecting to use them as soon as possible.

We always keep our finger on the pulse of the latest payment trends and technology and constantly integrate innovations into the payment systems of our clients. Our company has proven flexible integration frameworks that allow us to access innovation at speed.

Managing Data Across Multiple Gateways

Consolidating data from multiple sources is always time-consuming and error-prone. Not enough attention to data management can bring major consequences, from operational inefficiencies to compliance risks.

Having profound experience in data analytics and management, we develop centralized data aggregation and reporting systems that unify payment data across all gateways. By doing this, we deliver real-time visibility into transactions, simplifying reconciliation, tracking, and financial reporting.

Why Professional Payment Gateway Implementation Is the Best Option

Mobile app or website payment integration has a unique set of risks, that we closely discussed in the previous section. To eliminate all of them and get exceptional results, you will require the help of a professional vendor.

By partnering up with specialized companies, you will get access to payment gateway implementation proficiency enabling optimized performance, strong security, and outstanding reliability. You will also be assured of adherence to PCI DSS, GDPR, and other regulatory requirements.

Skilled vendors can easily avoid potential pitfalls, minimizing the number of transaction failures and properly addressing any security vulnerabilities along with system incompatibilities that can disrupt business operations.

Finally, with a team of experts proficient in web and mobile payment gateway integration, the deployment process will be accelerated with lowered technical overhead, allowing you to focus on business growth.

SPD Technology as Your Reliable Payment Gateway Integration Services Provider

Teaming up with a company that knows how to implement payment gateways is a wise strategic decision that significantly increases the chances of project success. SPD Technology is a great choice because of 19+ years of cross-industrial experience and a powerful, 600+ team of skilled professionals. We stand out as a trusted partner for payment gateway integrations due to:

- Proven Expertise in Payment Gateway Integration Process: our portfolio includes payment platform integration projects of any complexity, as we continue to optimize transaction processing for businesses of all sizes.

- Expertise in Multi-Platform Integration: partnering with us will ensure that you’ll have smooth payment experiences across, web, mobile, and cloud platforms with frictionless transactions for your customers.

- Scalable Solutions for Growing Businesses: all our solutions are scalable and flexible by design, as we expect them to grow along with the success of our clients.

- Efficient and Reliable Implementation: we know how to add payment gateway to websites and mobile apps seamlessly and securely with minimal to no downtime.

- In-Depth Knowledge of Regional and Global Gateways: our portfolio includes integrations with top payment processors like PayPal and Stripe, as well as regional gateways with their local regulations.

- Post-Integration Support and Maintenance: for all of our projects, we provide ongoing monitoring and support, when required by the client, to maintain peak levels of security and performance.

- Expertise in Complex Features: our experts can handle features far beyond basic payment processing, including split payments, recurring billing, and real-time reporting, making the most out of integrated payment gateways.

Proven Ways to Add Payment to Website: SPD Technology’s Successful Projects

During our nearly two decades of hands-on experience, we have dealt with projects of different sizes and complexities. Here are a few examples of how our involvement brings value to the clients.

Developing Custom Payment Processing Services for Poynt Open-Commerce Platform

Business Challenge

Our client is Poynt, a leading B2B company with two decades of experience operating in the eCommerce and FinTech industry. The product is a holistic set of services covering mission-critical functionality and is responsible for a full cycle of payment processing, settlement, and integration with 3rd party payment partners.

SPD Technology Approach

Our team of 10 experts, proficient in payment gateway integration services, conducted a major transformation of the settlement service to support PayFac transactions. This involved redesigning transaction processing and settlement to meet PayFac model requirements. The team also reimagined the subscription system plans, introducing flexible billing models like subscription-based, usage-based, and tiered pricing.

React-based payment gateway UI, which our Front-End developer built, can now be embedded into any web page for seamless card data collection.

Other milestones for our team included enhancing payment processor integration for improved compatibility, developing a regression testing framework for automated testing, and implementing bidirectional data synchronization across internal systems to ensure real-time accuracy.

Value Delivered

- Delivering Business-Critical Functionality: we enabled the client to become a payment facilitator, offering payment process consolidation and providing customers with a highly performing, unified platform.

- Improved Customer Experience: our involvement helped the client significantly expand a set of features and dramatically improve service offerings.

The results of developing custom payment processing services for the Poynt open-commerce platform have been truly amazing. The global company eventually acquired our client, and we joined the new owners and continued to expand our expertise in online payment gateway integration.

How We Helped LegalTech Company with Improving Payment Systems Integration

Business Challenge

Our client is a well-established online LegalTech company helping individuals and small-to-midsize businesses. The challenge was to establish and maintain a robust payment system and two additional payment methods within the client’s online platform.

SPD Technology Approach

Based on LegalTech and online payment integration expertise, we provided the client with our top two Back-End engineers. These experts were integrated into the client’s payment team and focused on Stripe payment services integration as well as the addition of ACH and IBAN payment methods.

By leveraging Jira and SCRUM methodology, we completed the project with exceptional proficiency. All design and communication activities were handled in Figma. We developed a monitoring and alerting system with Prometheus and Grafana, ensuring real-time performance and security insights.

Additionally, our developers built a bot traffic filtering system, analyzing user behavior and IP data through a rating mechanism. This allowed the system to assess the request’s legitimacy and take action accordingly.

Value Delivered

- Successful Payment Integration: we successfully facilitated secure and versatile payment options for customers by integrating with Stripe and introducing ACH and IBAN payment methods.

- Enhanced Traffic Security: our experts introduced a complex business logic that helped with filtering from bots and ensured the highest level of security on the platform.

By helping LegalTech Company with improving payment systems integration, we once again solidified our position as an exceptional payment integrator and helped our client to achieve goals and reach new heights in the quality of service offerings.

Developing a Global White-Label eCommerce Platform for NimbleCommerce

Business Challenge

Our client was NimbleCommerce, a promising startup from Silicon Valley, founded in 2010, and had a goal to help merchants and brands manage their own pre-paid offer and gift card programs or resell through a network of retailer and publisher-branded sites. The challenge was to develop from the ground up a high-scale and extremely feature-rich B2C and B2B solution.

SPD Technology Approach

We began with a small team of two developers, rapidly expanding as project needs became clear, peaking at 30+ experts. Lead developers and Project Managers from our side also acted as software architects, collaborating closely with the client’s team to shape NimbleCommerce’s products.

SPD Technology’s dedicated teams operated as self-managed units, working directly with the client’s leadership, product managers, and account managers. Some team members even remained onsite to handle complex requirements and support major B2B client onboarding, including a major U.S. restaurant network.

We successfully delivered the core functionality, which included AI/ML fraud detection features, and launched the product without any major blockers or delays. As the solution became popular among users, we conducted 27 payment gateways integrations.

Value Delivered

- Innovative Solution from Scratch: our team created an innovative B2C and B2B software platform far beyond the client’s expectations, showcasing our proficiency in payment gateway integration.

- Massive Market Success: the platform attracted millions of B2C customers and thousands of B2B clients.

Our involvement helped the product to reach its peak and be acquired by BlackHawk Network Inc. (BHN) in 2016. We continued to work on this platform under new ownership, expanding it with entirely new features, including data analytics functionality.

Conclusion

Hopefully, this article provides you with some essential information on the topic and offers you a perspective on the integration of an existing payment solution. Keep in mind that properly integrating payment gateways and payment processors are only a few of the Fintech development challenges that organizations face in 2025.

We, at SPD Technology, have over a decade of experience in Fintech projects, and will gladly help you integrate a payment gateway into your business processes with the highest efficiency and technical proficiency. Get in touch with us now for an initial consultation and an accurate estimate!

FAQ

What is payment gateway integration?

It is the process of connecting a gateway with an e-commerce website or an application to facilitate the seamless and secure processing of online transactions, protecting the payment details of the customers.

How to integrate payment gateway?

To benefit from an integrated payment gateway, you should:

- Select a Payment Gateway

- Create an Account

- Obtain API Credentials

- Understand API Documentation

- Integrate Payment Gateway into Website/Application

- Implement Security Measures

- Conduct Testing

- Go Live

What are the methods to integrate payment gateway?

The methods may vary for different payment gateway providers. However, common methods of how to connect to payment gateway include:

- Direct API Integration or Hosted Payment Gateway: Directly integrating with the gateway’s API using programming languages like PHP, Java, or Python.

- Non-Hosted Payment Gateways: Redirecting users from websites to a secure payment page of payment gateway providers. After payment, users are redirected back to the merchant’s website.

What is the payment gateway integration cost?

It is impossible to give a one-size-fits-all answer, as the cost of integration can vary based on several factors:

- Setup Fees

- Transaction Fees

- Monthly Fees

- Custom Development Costs

- Transaction Volume Discounts.

Keep in mind that you are always welcome to get in touch with us for an accurate integrated payment gateway cost estimation based on your project requirements and in-depth consultations on the payment process.