In 2025, mobile phone payment solutions became an integral part of customer experience in many industries. Users now expect the most popular payment methods to be integrated into the apps by default. The absence of such an opportunity brings a risk of losing revenue for businesses that struggle with integrating payments in a smooth, secure, and efficient way. In fact, according to a study by ZenDesk, over half of customers are willing to switch to a competitor after a single negative experience.

So, if you are on the way to mobile payment integration, you need to make the right decisions in vendor choices and implementation partners. This article discusses how to add payment in app and cover everything you need to prepare your business for such an integration.

The Increasing Urgency to Accept Mobile Payments for Business Growth

For businesses that aim to stay competitive in their respective markets, leveraging mobile payment services is vital. The explosive growth of mobile payments is breaking all records, with total transaction value projected to reach USD 20.37 trillion in 2025, according to Statista.

Today’s customers expect the highest level of efficiency and convenience that mobile app payment gateway brings, including quick and easy transactions, as well as intuitive checkout processes.

With the rise of payment solutions like Amazon Pay in the USA or Alipay and WeChat in Asia, customers are expecting the support of these systems in certain industries. Furthermore, mobile payment solutions become a driver of international trade, offering multi-currency support, dynamic currency conversion, and expanding the reach of businesses.

Benefits of an Integrated Payment Gateway into a Mobile App

What is payment gateway integration value for businesses? We believe that its principal advantages include but aren’t limited to:

- Increased Revenue and Faster Conversions: Modern mobile payment gateways offer a seamless experience and reduce friction during checkout, leading to higher conversion rates and higher bottom line.

- Enhanced Customer Experience and Loyalty: Leading payment gateway providers offer exceptional solutions that build customer trust and loyalty by delivering outstanding customer experience.

- Improved Cash Flow and Faster Settlements: Mobile payment service providers offer quicker settlement times compared to traditional banking methods.

When Integrating Ready-Made Mobile Payment Solutions Makes Most Sense

This integration can become a strategic decision that offers various benefits, particularly in scenarios where time, cost, security, customer trust, and feature richness are critical considerations. Let’s discuss each of the circumstances in more detail.

Time Constraints to Implement a Mobile App Payment Gateway

In situations where there’s a pressing deadline for launching the mobile app, opting for a ready-made payment gateway can speed up the development process significantly. Custom systems require significant time for development, testing, and integration, whereas ready-made gateways offer pre-built solutions that can be seamlessly integrated, saving crucial time in the app deployment process.

Enhanced Security and Compliance of a Mobile Payment Service

Established payment gateways prioritize security and compliance, often maintaining robust measures to safeguard user data and transactions. Ready-made gateways commonly adhere to industry standards such as PCI compliance, offering businesses peace of mind regarding data protection and regulatory requirements. By leveraging the security infrastructure of these trusted providers, mobile apps can enhance their credibility and build trust among users.

Customer Trust and Familiarity of Mobile Payments Platforms

Users tend to prefer making payments through well-known and trusted payment gateways due to familiarity and perceived reliability. Integrating a ready-made gateway allows mobile apps to leverage the existing trust associated with popular platforms such as PayPal, Stripe, or Square. By offering familiar payment options, apps can enhance user confidence and streamline the checkout experience, ultimately driving higher conversion rates.

Feature Richness of Mobile Payment Processing Systems

Established payment gateways typically offer a diverse range of features designed to enhance the payment experience for both businesses and customers. These features may include support for multiple payment methods, recurring billing, fraud detection mechanisms, and advanced analytics capabilities. By integrating a ready-made gateway, mobile apps can access these sophisticated functionalities without the need for extensive development efforts, thereby enriching the overall user experience and optimizing payment processes.

Cost Considerations to Integrate In-App Payment Processing

The cost to develop a custom payment gateway entails substantial upfront investment into technical expertise and infrastructure setup. For startups or small businesses operating under tight budgets, ready-made payment gateways present a more financially feasible option. They typically come with predictable pricing structures and lower upfront costs, making them an attractive choice for businesses looking to minimize initial investment.

Mobile Payment Gateway Common Use Cases & Industry Examples

According to Research and Markets, the digital payment gateway market is expected to reach USD 205.9 Billion by 2030, so let’s review industries already benefiting from mobile online payment solutions.

eCommerce and Retail

Retail and eCommerce professional services are using mobile payment platforms to enable frictionless transactions through digital wallets, QR codes, and one-click payments. In particular:

- One-Click Checkout for Faster Purchases: with a one-click approach, the checkout process can be streamlined, significantly reducing cart abandonment and tangibly increasing conversions as a result.

- QR Code Payments for Contactless Transactions: this will allow improving in-store experience by providing secure payment functionality without physical contact.

- Buy Now, Pay Later (BNPL) for Flexible Payments: an effective way to boost sales by giving customers the option to split payments over time.

- Digital Loyalty Programs Integrated with Mobile Payments: a great way to encourage repeat purchases by adding a reward automatically during the checkout process.

Mobile Payment Solutions Use Cases

Starbucks is among the top examples in retail, as they successfully merged mobile payments with their current rewards program. By using an app, customers can pay directly through smartphones and earn points that can be redeemed in the future, allowing the company to increase customer engagement and encourage repeat purchases.

Fintech and Banking

To deal with banking and Fintech development challenges, organizations use mobile payment gateways for secure digital banking that allows for real-time transactions and P2P transfers. Particularly, modern payment processor integration introduces advanced authentication methods like biometric verification, tokenization, and AI-driven fraud detection. The most impactful opportunities here include:

- Mobile Wallet Integration: banks and fintech firms improve user experience by integrating popular digital wallets like Apple Pay and Google Pay.

- P2P Money Transfers: mobile payment gateway integration into P2P money transfer apps enable instant, one-tap transactions leading to higher user retention and increased transaction frequency.

- Crypto Payment Gateways: supporting the latest digital currencies help to massively expand financial inclusion.

- Automated Bill Payments: another effective way to boost user experience by allowing to set up recurring payments for utilities, subscriptions, and loans.

Phone Payment Solutions Use Cases

A standout example in this category is Venmo, as they reimagined the approach to P2P transactions with seamless and social payment experience. Their app allows transferring funds instantly, while supporting detailed payment descriptions and activity feeds, displaying an outstanding user-friendly approach.

Healthcare and Telemedicine

Organizations in this industry can benefit from secure and seamless payments for telemedicine consultations, prescription services, and insurance co-payments. Being integrated with Electronic Health Records (EHR) and insurance systems, the payment gateway for mobile apps allows healthcare organizations to automate billing and elevate patient experience. Specific cases include:

- In-App Payments for Telehealth Services: this allows patients to pay for medical services directly from the app, saving time and improving convenience.

- Insurance Co-Payments and Billing Automation: the automation of claims processing leads to a significant reduction in administrative workload.

- Contactless Payments for In-Hospital Transactions: this is especially important in terms of hygiene and prevention of spreading diseases among hospital visitors.

Mobile Payment Gateways Use Cases

Teladoc Health is a good example here, as they integrate mobile payments for telemedicine visits and allow patients to pay securely for doctor consultations within a mobile app.

Travel and Hospitality

Businesses in these industries can leverage payment gateway for Android apps and iOS software for automated online booking, contactless payments, and transactions in real-time. Particularly:

- In-App Airline and Hotel Bookings: this is a very important feature that allows travelers to make instant automatic reservations with stored payment methods, which can be extremely helpful in cases where free bookings are available for a limited amount of time.

- Mobile Check-In and Room Access Payments: allow visitors to easily access booked rooms without a need to contact administrators.

- Ride-Hailing and Contactless Transport Payments: helps to improve customer experience for taxis, shared rides and public transportation.

Mobile Payment Services Integration Use Cases

Uber, a true innovator for travel payments, automatically processes payments through its app, sparing the need for users to pay cash or make card transactions manually. This experience allowed the company to reach the pinnacle of an industry with millions of loyal customers worldwide.

Volodymyr Soska

Senior Software Engineer at SPD Technology

“Integrating mobile payment gateways into applications across industries requires a multi-layered approach that balances security, scalability, and seamless user experience. The key challenge isn’t just embedding a payment API, but rather ensuring optimal latency, compliance, and cross-platform interoperability while maintaining high availability under peak transaction loads.”

Top Mobile Payment Services Providers to Choose From

When evaluating existing options for payment gateway services, several factors come into consideration, including global reach, ease of integration, security features, monthly fees, and additional functionalities. However, it is safe to say that all mentioned vendors are delivering top-notch levels of security, adhering to modern payment processing compliance standards and regulations.

PayPal

PayPal is one of the most widely recognized and trusted online payment platforms globally, with 432 million active accounts registered at the end of 2024. According to Demand Sage, last year alone, this platform generated an astonishing $23.4 billion in revenue.

The Best Payment Gateway App For:

- Global Reach: with operations in over 200 countries and support of 25 currencies, PayPal effectively facilitates digital transactions for businesses targeting international markets, securing its position among the top mobile payments services.

- Seamless Checkout Experience: with features like PayPal One Touch, customers can enjoy a hassle-free checkout process, leading to faster payments and improved conversion rates.

- Buyer and Seller Protection: PayPal offers robust protection mechanisms for both buyers and sellers, enhancing trust and payment gateway application security, which is particularly important for e-commerce businesses.

Stripe

Stripe is a technology company operating in 47 countries that provides payment infrastructure for online businesses. It offers a suite of APIs and tools that enable businesses to accept payments, manage subscriptions, conduct mobile payment gateway integrations, and handle financial transactions.

Suitable Mobile Payments Solution For:

- Small Businesses: Stripe is renowned for its user-friendly APIs and straightforward payment gateway mobile integration process, making it an ideal choice for startups and small businesses with limited technical expertise and budgets.

- Subscription-Based Businesses: businesses relying on subscription models or recurring payments benefit from Stripe’s comprehensive subscription management tools, allowing for flexible billing and improved customer retention.

- Enabling Fraud Prevention Across Multiple Payment Methods: Stripe provides built-in fraud prevention tools that support a wide range of payment methods, including credit/debit cards, as well as popular digital wallets like Apple Pay and Google Pay.

Square

Square is a financial services and mobile payment company known for its Point-of-Sale (POS) solutions and hardware products designed for small businesses. The company is on the rise, as its peak quarterly revenue was $6.1 billion in the fourth quarter of 2024.

Stands Out Among In-App Payment Solutions:

- Point-of-Sale Solutions: Square caters to businesses needing POS solutions, offering a suite of hardware options such as card readers and POS terminals for accepting mobile payments in various environments, including in-store and on the go.

- Integrated Features: beyond in-app payment processing, Square offers additional features like inventory management and Customer Relationship Management (CRM) capabilities, enabling businesses to streamline operations and improve customer service.

- Advanced Analytics: Square provides robust analytics and reporting features, empowering businesses to track sales and gain insights into customer behavior and trends.

Braintree

Braintree, a subsidiary of PayPal, is a payment gateway system provider with 20+ years of experience that offers secure and scalable solutions for online payment processing. Particularly, this platform delivers clients PayPal, Venmo, credit and debit cards, and popular digital wallets like Apple Pay and Google Pay in a single, seamless integration.

Advantages of Briantree’s Gateway Integration:

- Security and Compliance: Braintree is well-suited for businesses operating in industries with strict security and mobile payment processing systems compliance, such as healthcare, finance, and gaming. It offers robust security measures and ensures adherence to industry standards.

- International Transactions: for mobile payment solutions targeting international markets, Braintree’s support for multi-currency and multi-language capabilities proves invaluable, facilitating seamless transactions across borders.

- Easy Integration Across Platforms: Braintree offers seamless integration with popular platforms and frameworks, including iOS and Android apps, as well as JavaScript, simplifying the implementation process across different platforms and devices.

Feel like popular mobile gateway providers do not meet the unique needs of your business?

Find out how to build a custom payment gateway in our detailed guide!

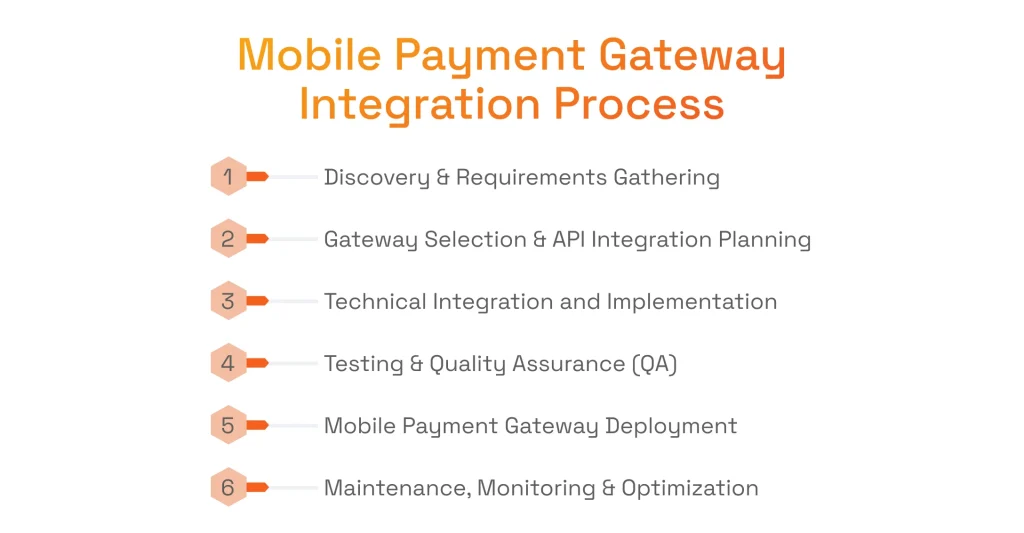

Mobile Payment Gateway Integration Process

The proper integration of mobile payment gateways requires a structured approach, and it makes sense to hire a dedicated development team for the job. In any case, let’s discuss what the typical process looks like.

Discovery & Requirements for Payment Gateway Integration

It all begins with a discovery phase and is followed by requirements for payment gateway integration analysis for the identification of business needs, customer expectations, and compliance factors. At this stage, the supported payment systems should be determined, which may include credit debit cards, digital wallets, and regional payment methods.

Payment Gateway Application Selection & API Integration Planning

Making the right decision on mobile payment gateway involves the evaluation of top providers based on fees, security features, and compatibility. After the choice is made, API documentation and SDK support are reviewed in order to plan a seamless integration strategy.

Integrated Payment Gateway Implementation

Having a clear plan, the implementation finally begins. Software engineers conduct payment gateway app integration, introducing the functionality that allows the business to accept mobile payments. This ensures secure, PCI DSS-compliant back-end logic, strong authentication mechanisms, and a smooth checkout experience.

Testing & Quality Assurance (QA)

After the implementation, the testing phase kicks in to verify the reliability of the functionalities that accept payments. With functional testing, it is possible to confirm smooth payment flows, security testing helps to identify cybersecurity loopholes, and load testing makes sure that the system can handle high transaction volumes.

Deployment of a Payment Gateway for Mobile App

Now, it’s time to roll out an integrated iOS or Android payment gateway into a production environment. At this phase, compliance with app store policies is checked, real-time monitoring is set up, and user acceptance testing (UAT) ensures the system meets customer expectations.

Maintenance, Monitoring & Optimization

As the payment gateway for mobile app is up and running, the focus should shift to ongoing maintenance, monitoring, and optimization. At this stage, businesses frequently consider adding existing modern fraud detection tools, or custom AI solutions development for the peak level of security of the integration.

Mobile Payment Integration Best Practices

Here are some of the most important tips for maximizing payment gateway integration process success while minimizing potential risks.

Aligning Payment Services Integration with Business Goals

First and foremost, integrated payment gateways should be a natural extension of the business model and customer journey of a particular organization. Integrations should complement the overall business vision and offer suitable features tailored to key revenue streams, user expectations, and long-term growth strategy.

To achieve this alignment, organizations should consider:

- Analyzing customer behavior, preferred payment methods, and regional payment trends to offer localized payment options.

- Integrating scalable payment solutions to accommodate increasing transaction volumes and new market entries, in cases when the business strategy aims at such expansion

- Choosing gateways for integration that match the business model. For example, eCommerce marketplaces will likely require split payments and escrow features and multicurrency support, while subscription-based businesses need automated billing and recurring payments.

Enabling Multi-Currency and Localization Support

Speaking of growth, when an organization plans to expand to new markets, it makes sense to implement multi-currency support, provide local payment methods, and comply with local regulations. To achieve this features like currency conversion and language localization should be implemented during gateway integrations.

Integrating Payments System with Fraud Detection Tools

The security demands for modern mobile payments solutions are extremely high, as features like real-time transaction monitoring, advanced fraud detection, and even behavioral analytics are becoming an industry standard. So, to achieve the highest level of payment processing compliance, it will be a good idea to consider integrating top security tools like:

- Riskified

- Forter

- BioCatch

- 3D Secure

- NuData Security.

Optimizing for Scalability and Future Growth

Finally, there is a need to tailor a payment system with an expectation of future growth. It makes sense to partner up with online payment integration vendors capable of delivering solutions that support high transaction volumes, and additional payment methods while keeping their finger on the pulse of the evolving technologies.

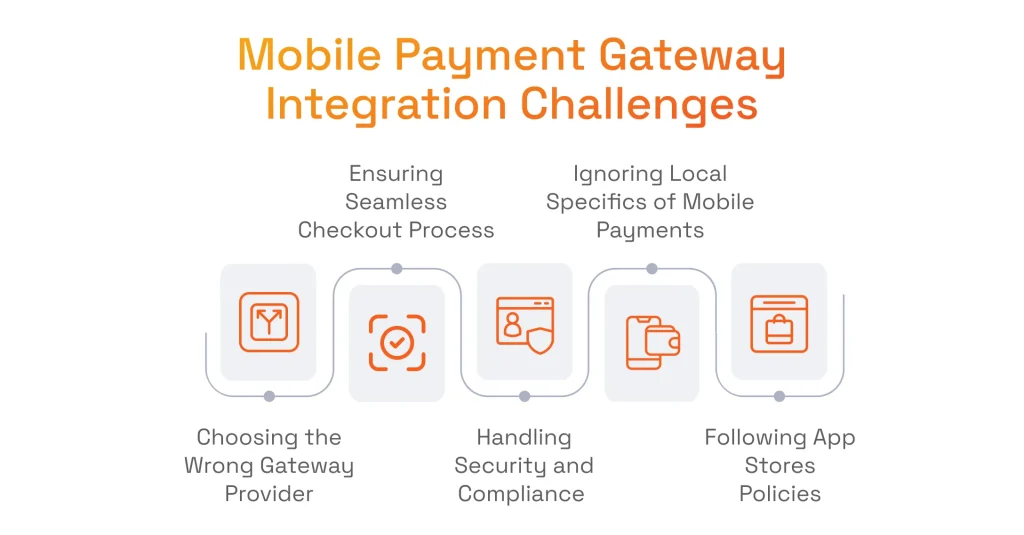

Online Payment Integration Challenges and SPD Technology’s Solutions

In this section, we will discuss the ways SPD Technology deals with the most common obstacles in the way of seamless payment gateway integration.

Choosing the Wrong Mobile Payment Service Provider

While choosing a provider among dozens of top options available, it is easy to make a wrong choice, and lose money on fees, struggle with bad performance, as well as limited reach.

To prevent such issues, we always conduct a rigorous evaluation of the business needs of our clients, including required transaction volume, coverage, and unique requirements to select and integrate the best providers for mobile payments.

Ensuring Quick and Seamless Checkout Process

Stripe believes that complex checkout experience is among the top 8 reasons for cart abandonment among its users. In fact, it is the responsibility of the integration vendor to make the checkout process as smooth and intuitive as possible.

That’s why at SPD Technology, we focus on frictionless payment experiences in our projects. Particularly, we create a fast checkout process by leveraging features like auto-filled credentials, tokenization, and one-click payments.

Handling Security and Compliance Requirements

Like with any transaction-related initiative, ensuring the highest level of payment gateway security is paramount. Financial transaction data and sensitive credit card information of the clients should be carefully protected according to legal requirements specific to the country and industry the business operates in.

We are fully committed to security as a mobile payment integrator, and we achieve this by ensuring PCI DSS compliance and implementing KYC standards. Our team always incorporates end-to-end encryption of sensitive information, and provides fraud detection software development expertise with AI and ML in its core.

Ignoring Local Specifics of Accepting Mobile Payments

Geographical regions can play a deciding role in payment preferences, as in some locations credit and debit cards dominate the transactions, while others rely more on bank transfers or digital wallets.

We always conduct research on local markets to ensure the highest acceptance rates possible, focusing on the most popular payment methods in the targeted regions for our solutions.

Following Application Stores Policies

Apple’s App Store and Google Play have strict regulations for mobile apps in their stores, and the slightest non-compliance with their key policies can result in the removal of an app entirely. Having extensive experience with payment gateway development and integration for leading companies, we know how to align with the regulations of each store and achieve approvals for payment integrations in the mobile apps without any delays.

Why Partnering with a Tech-Savvy Vendor Is Crucial to Integrate a Mobile Payment Solution

Mobile app payment gateway integration goes far beyond adding a checkout option and requires proficiency to ensure that all functionality, security, and reliability aspects will be handled.

Expert Guidance in Choosing Among Mobile Payment Providers

As the global Mobile Payment Technologies market is expected to reach USD 168.13 billion in 2025, according to The Business Research Company, there are countless providers with several major players. An experienced mobile payment integration vendor will help you select the best option for your business, evaluating factors like coverage, fees, multi-currency support, and security features.

Reliable Payment Processor Integration at Faster Time-to-Market

With an experienced partner, you will get smooth integration of mobile payments solutions as fast as possible, without costly and time-consuming development errors. As a result, you will get shorter time-to-market and the ability to scale your business while maintaining a seamless user experience.

Protection Against Payment Failures and Downtime

Even with the most popular mobile payment providers, there is a risk of failures and downtime, that could end up in revenue losses and disappointed users. Experienced payment services integration vendors ensure uninterrupted transactions even during periods of peak traffic by implementing redundancy mechanisms and reactive strategies.

Consider Payment Gateway Integration in Mobile Application by SPD Technology

Here, at SPD Technology, we specialize in end-to-end mobile payment gateway integration. We deliver both iOS and Android payment gateway integrations with leading vendors like Stripe, PayPal, Braintree, and Adyen thanks to our proven expertise in enterprise mobile app development. Our integrations ensure a smooth user experience with the support of features like one-click payments and digital wallets.

Our company prioritizes security and always delivers PCI DSS-compliant solutions, implementing encryption and tokenization. Furthermore, our AI/ML development expertise allows us to leverage advanced predictive fraud protection mechanisms, including real-time monitoring, anomaly detection, and behavioral analysis.

Volodymyr Soska

Senior Software Engineer at SPD Technology

“After the successful implementation of our solutions, we provide ongoing monitoring and analytics activities to ensure optimal performance and maximal business value. This is an essential move, since regulations and compliance requirements change, as well as technologies, so it is important to always keep a support team to make timely adjustments.”

Our Experience in Successful Mobile Payment Gateway Integrations

How We Helped LegalTech Company with Improving Payment Systems Integration

Business Challenge

Our client is an innovative online legal technology company catering to individuals and small-to-medium-sized businesses by providing access to legal documents, legal information, and attorney services. The challenge was to improve the quality of financial transactions by establishing and maintaining a robust payment system with two additional payment methods that protect sensitive cardholder data.

SPD Technology’s Approach

Having proven experience in ensuring data security in Fintech and Legaltech, we were a perfect fit for this project. Our company assigned two leading Back-end engineers who were added to the client’s internal team to focus on payment processing. The project followed the SCRUM methodology in Jira, with design and communication handled via Figma.

We successfully integrated Stripe and implemented ACH/IBAN payments. Our developers also delivered a custom dashboard and alerting system with Prometheus and Grafana for real-time monitoring and valuable security insights. We also provided traffic filtering mechanisms to mitigate bot attacks, integrating a parameter analytics system with a 0-100 rating scale to assess incoming traffic based on user behavior, IP data, and other parameters.

Value Delivered

- Improved Customer Experience: our experts successfully facilitated secure and versatile additional payment options for customers through integration with Stripe and the introduction of ACH and IBAN payment methods.

- Increased Transparency: we dramatically improved the visibility into transactions for users with our dashboards and highly customizable alert system.

Overall, in helping a Legaltech company with improving payment systems integration, we managed to address the critical needs of our client, with the effective introduction of additional major payment methods and robust security.

Conclusion

Hopefully, this article helped to shed some light on how to implement payment gateways. Whether your mobile app works in cohesion with an eCommerce platform, SaaS, Fintech solution, or subscription-based business, a professional payment gateway implementation can elevate customer experience, and open up additional revenue streams. Choosing a partner that knows the ins and outs of how to integrate a payment gateway will ensure that all transactions will remain efficient and secure, adhering to the latest security standards.

We, at SPD Technology, deliver end-to-end payment gateway integration in mobile applications, helping our clients maximize the potential of modern, high-performance solutions in a scalable payment infrastructure. Let’s elevate the payment experience of your customers! Contact us, we will discuss your unique integration needs and help you build or choose payment gateway.

FAQ

What is a Payment Gateway Integration?

This is connecting an online payment system to a website, mobile app, or eCommerce platform for secure payment processing. This creates a bridge between customers, merchants, and financial institutions.

Which Payment Gateway is Best to Integrate?

The most suitable option for a particular case depends on a variety of factors, including business goals, geographic location, target customers and technical requirements. Top providers of payment solutions include:

- Stripe

- PayPal

- Adyen

- Square

- Authorize.Net

- Braintree

What Are the Four Types of Payment Gateways?

The essential types of gateways include:

- Hosted Payment Gateway (PayPal, Stripe)

- Self-Hosted Payment Gateway (Razorpay, PayU)

- API-Based/Non-Hosted Gateway (Stripe, Braintree)

- Local Bank Integration.

What is an Integrated Gateway?

An integrated gateway is a payment solution embedded directly into a merchant’s app or website and allows customers to complete transactions without redirection to an external payment page. Top payment gateway providers supporting this include Stripe, Braintree, and Authorize.Net.