The rapid adoption of electronic payments and alternative payment methods throughout the world, and, in particular, in the developing countries is giving the global digital payments market a tremendous boost: according to MarketsAndMarkets, the size of the digital payments market is projected to grow from $112,3 billion in 2023 to $193.7 billion in 2028. In this context, payment processors, or companies that help businesses accept and process payments, come to the fore and can see some exciting business opportunities.

In our article, we’ll take a look at the different aspects of starting a payment processing company. Our objective is to help those wishing to tap into this market take their bearings as to what should be done to achieve their goal, so let’s get started right now.

Understanding Payment Processing Business Landscape

Payment processing businesses are evolving at an impressive pace, and this growth is driven by technological advancement and growing customer expectations. Key trends that are shaping this market include:

- Increasing Digital Payments Adoption: contactless payments, QR codes, and peer-to-peer transfers are becoming the norm, and it’s safe to say that the movement towards cashless transactions will only increase as digital payments software evolves.

- The Rise of Mobile Wallets: popular mobile wallets including Apple Pay, Google Pay, and Samsung Pay have already taken the leading positions, and according to Statista, will help digital wallet share reach 61% in eCommerce by 2027.

- Demand for Cross-Border Payments: as international trade expands, with B2B cross-border payments market size is projected to reach USD 50 trillion in 2032, according to the abovementioned research, organizations require more cost-effective cross-border payment solutions.

These trends unlock more market opportunities in specific industries like eCommerce, Fintech, and subscription-based services, for organizations that are looking for more flexible payment solutions. We can already experience the rise of embedded finance, Buy Now, Pay Later (BNPL) options, and cryptocurrencies that shape the future of software for payment processing.

The role of Artificial Intelligence in business payment processing is also significant, starting from advanced fraud detection software and including powerful risk assessment and transaction optimization systems. With the capabilities of AI to analyze transactions in real time, it is possible to prevent fraud, improve overall efficiency, and minimize false declines.

As existing companies implement modern custom payment solutions, customer expectations are expanding, as users get used to cutting-edge solutions that offer unmatched speed, high reliability, and exceptional security features.

Why Now Is the Right Time for Starting a Payment Processing Company

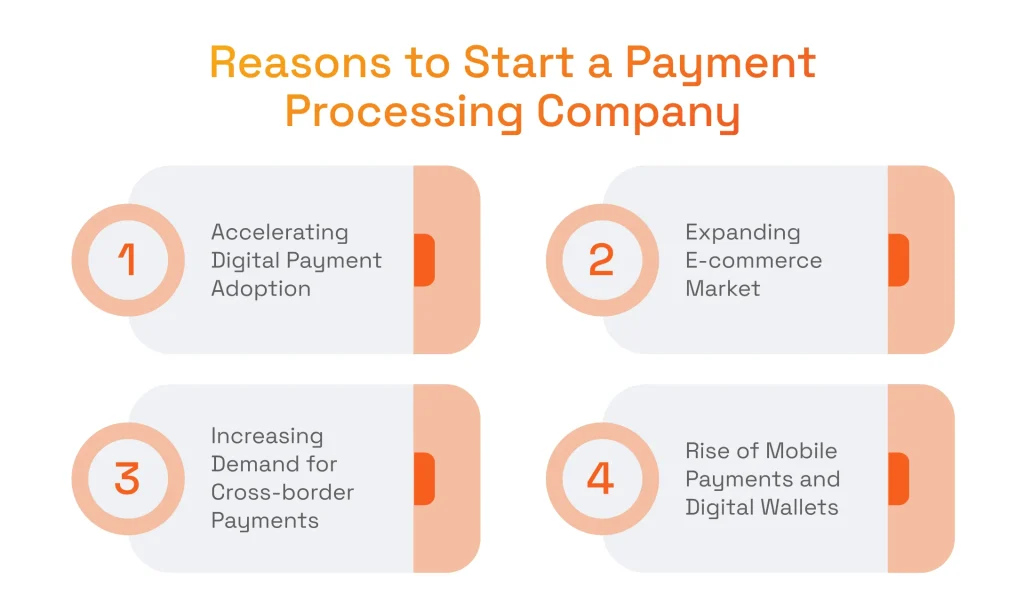

Right now is a perfect moment for starting a payment processing company because the global payment processing solutions market size was valued at USD 66.8 billion in 2024 and is projected to grow at a CAGR of 11.7% between 2025 and 2034 if experts at Global Market Insights are to be believed.

This market growth presents outstanding opportunities for new entrants, as several factors indicate this fact. First, is the rise of digital payment adoption, as reported by McKinsey and Company, 92% of consumers in the United States and Europe used digital payment methods in the past year.

As for the second reason, global eCommerce sales are projected to surpass USD 8 trillion by 2027, as stated from the surveys by Statista. This expansion also triggers an increase in international trade as well, as organizations will be looking for seamless payment gateway systems and payment processors.

Finally, there is also a massive increase in mobile payments and digital wallets, from 4.3 billion in 2024 to 5.8 billion by 2029, according to Juniper Research, so the question of how to start a merchant services business is more relevant than ever.

How to Start a Credit Card Payment Processing Company: Key Business Considerations

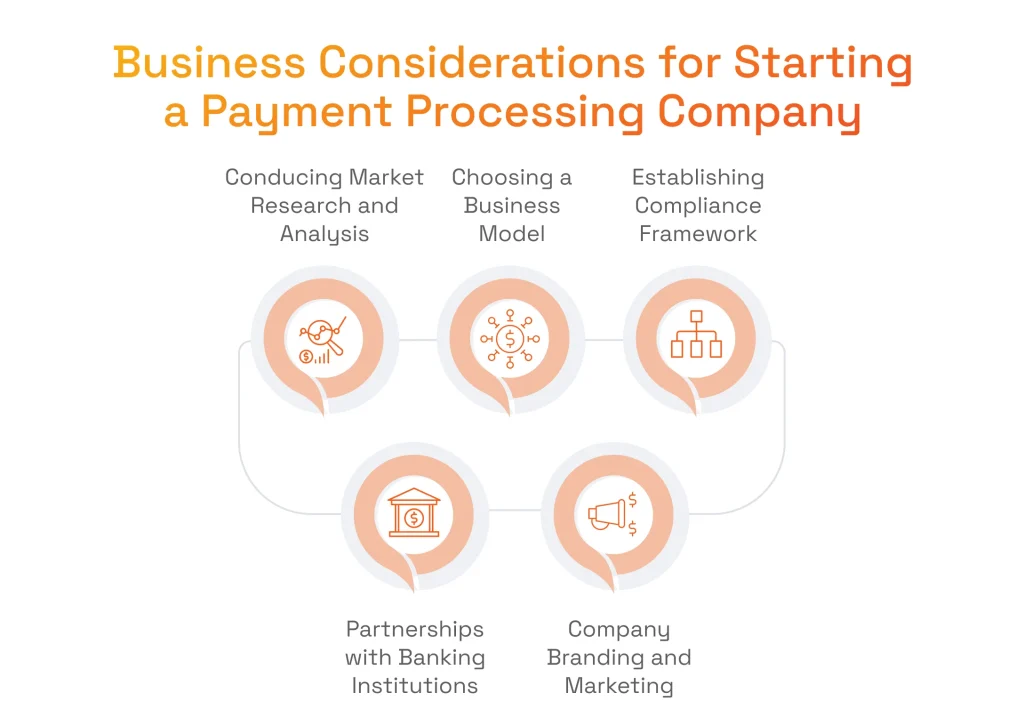

Start a Credit Card Processing Company with Market Research

The success of your payment-processing business will hinge very significantly on how well you’ve researched the demands and specifics of your target market or markets. These factors tend to vary from market to market, even when it deals with your adjacent markets that, at first glance, look quite similar.

What should one pay attention to while doing market research for a payment-processing startup?

Payment Methods

First off, you will need to survey merchants in the various business niches based in your target market or markets. Namely, you will need to find out the payment methods that they currently prefer to utilize or would welcome to adopt.

Overall, your payment methods must include credit cards, debit cards, prepaid cards, e-Wallets, cryptocurrencies, and QR codes. Pay special attention to digital wallets and the other modern alternative payment methods to encompass their full required variety.

Currencies to Work With

The second major point you must necessarily discuss is the currencies your future target audience or audiences need, want, and are legally entitled to accept.

It is essential that you have support for all such currencies implemented prior to when your solution hits the market. For this purpose, one should take into consideration the following factors:

- Target Market – delineate your target market and list the currencies that are commonly used in the geographies it spans.

- Target Industries – with businesses in certain industries, you cannot limit your list of currencies to those that are typically used in your selected market. For instance, if your clients are going to cater to eCommerce customers, you should probably implement support for all major currencies. Also, it might be useful to look at the geographies that are your market’s traditional trading partners.

- Market Expansion – if in the near future you are planning to expand internationally, you should include the currencies that are used in the geographies to which you are going to scale.

Work With Regulated Industries

In many instances it makes sense to look at the portions of regulated businesses in your target geographies and make up your mind on whether you’d want to work with such businesses.

If you find out that regulated businesses constitute an attractive target audience in your target markets, you should additionally prepare for bringing them into the fold and meeting their demands. For example, if you decide to start working with Healthcare businesses, you will need to first become familiar with the HIPAA regulations and then make your payment processing solution HIPAA-compliant. In other words, one will need to:

- Encrypt and tokenize all customer data. At that, the encryption level used is to be no lower than vP2PE.

- Set up a server with additional full-disk encryption (in addition to applying vP2PE or higher level of strong encryption).

- Use payment terminals with EVP chips, and more.

Similar to this, some additional requirements are bound to arise if you start working with some other regulated businesses, like, for instance, law firms.

Financial Competitiveness

It’s important to know how to start an online payment processing company with good financial prospects.

In this sense, it’s helpful to list all the types of merchants you are going to cater for, consider the average transaction volumes for these types of merchants, and develop the cost and fee structures based on these volumes.

One should also pay attention to the payment methods that your merchants’ customers prefer, as the fees that payment processors charge usually depend on these payment methods.

These approaches can help you come up with a financially competitive service offering.

Choosing a Payment Processing Business Model

The accurate choice of payment processing business model can make or break the entire initiative, as it defines the interaction with merchants, financial institutions, and payment networks. Let’s review the most common types of these models.

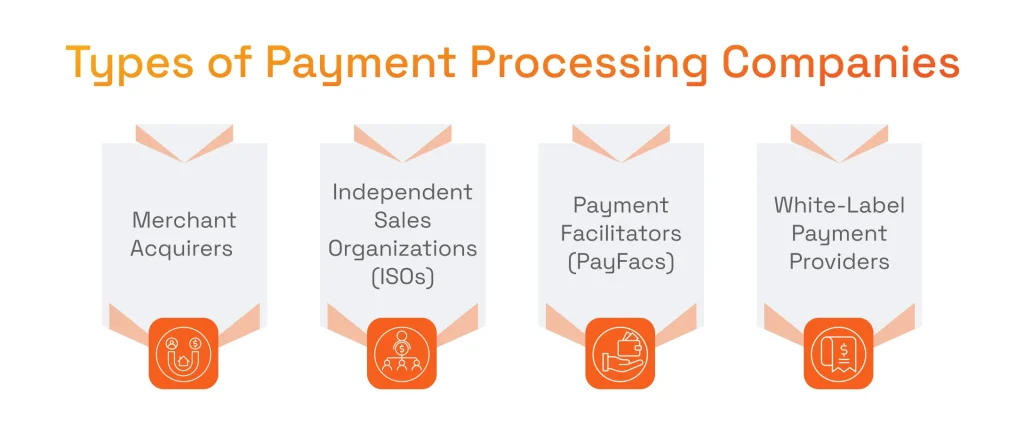

Types of Business Payment Processing

To successfully start payment processing company, you first need to determine which of the following payment processing models your business will focus on:

- Merchant Acquirers: In this model, an organization becomes an intermediate between card networks and businesses. It provides credit card processing business infrastructure for accepting card payments while handling authorization, settlement, and chargebacks. This model secures long-term revenues from transaction fees but requires regulatory compliance and massive financial backing.

- Independent Sales Organizations (ISOs): ISOs join merchant acquirers to resell services for payment processing. Basically, ISOs become sales agents that sell online payment processing for businesses, sparing the need to manage the technical infrastructure. This is a great choice of a model since it allows scalability without the need for large investments.

- Payment Facilitators (PayFacs): this model is aimed at increasing the speed of the onboarding process for small-to-mid-sized companies, allowing them to sign up under a master merchant account. Merchants don’t need to have an ID and will benefit from reduced setup times. With this model, it is possible to earn revenue through transaction fees and monthly subscriptions.

- White-Label Payment Providers: white-label payment processing services allow businesses to leverage payment processing under their brand but using third-party infrastructure. It is a perfect choice for Fintech startups and SaaS providers that require payment integration but don’t want to develop payment gateway software or other technology from scratch.

Establishing Legal and Compliance Framework

It is impossible to start a credit card processing company without diving deep into the intricacies of complex regulatory and legal nuance. In this niche, payment processing compliance is paramount, as it is vital to build trust and even be able to start operating.

Your company should get the necessary licenses and certifications:

- In the U.S. you need to register as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) and adhere to state-specific regulations.

- In Europe, all organizations that want to become credit card processors must comply with the Payment Services Directive (PSD2) and register with local financial authorities. There are also country-specific regulatory bodies, like the UK’s Financial Conduct Authority (FCA).

In all countries, compliance with PCI DSS (Payment Card Industry Data Security Standard) is essential for securing payment transactions and protecting cardholder data while ensuring data security in Fintech.

Organizations are also required to implement strong Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Implementing KYC standards helps to prevent financial crimes and avoid the most common types of fraud.

All of your contracts with merchants should clearly outline transaction fees, and chargeback policies, as well as offer transparent dispute resolution mechanisms.

Going through the abovementioned actions will help you build a strong legal and compliance framework when you start a credit card company. You can also hire additional legal counsel if you struggle to keep up with evolving regulations but want to maintain your business operations.

Partnerships with Banking Institutions

Strong partnerships with banks are vital on your way to starting a credit card processing company. The banks will provide you with key financial infrastructure including merchant accounts, transaction settlements, and even fraud prevention mechanisms.

The first step here is to establish strong relationships with an acquiring bank, as it facilitates card payments from merchants. This bank processes payments and manages chargeback while ensuring regulatory compliance. Making the right choice of the acquiring bank with competitive rates is critical for your success in the long run.

There are also sponsoring banks that are helping to start credit card processing company by granting access to card networks like Visa, Mastercard, and American Express. With this partnership, you can fully leverage global payment ecosystems.

While negotiating terms with banks, you will need to:

- Secure competitive interchange fees

- Determine settlements timelines

- Ensure risk management support

- Discuss the integration of fraud detection systems

Building relationships with banks is not only a defining step in starting credit card processing company and securing reliable payment operations, but it also helps to achieve credibility in the eyes of the merchants and regulatory bodies.

To successfully start payment processing company, you first need to determine which of the following payment processing models your business will focus on:How to create a payment processing app? Discover the step-by-step guide prepared by our tech experts!

Credit Card Processing Business Branding and Marketing

Answering the question of how to start a payment processing business without mentioning the importance of branding and marketing activities would be incomplete.

Regardless of the technical excellence you’ve achieved for your payment processing solution with the help of your DMS software developers, you also need to ensure the consistency of your branding throughout the payment cycle it supports. Users must see your logo and other branding elements at all the touchpoints. Your value proposition should also emphasize such aspects as security and speed of payment execution, as these are the two main characteristics of your service both merchants and their customers appreciate the most.

Expansion and Scaling

As a fledgling payment-processing company, you need to be well-aware of the ways to scale and expand your payment processing business early enough to use them quickly and correctly when you have growth opportunities.

Expanding your market to other geographies would be one of the ways to up your game. One can achieve business expansion here by adding more currencies and focusing on the payment methods preferred in your new target markets. Another way to expand both locally and overseas would be to implement convenient and well-suited support for the recurrent payments business model. This can both help develop brand loyalty and attract new clients who are looking for a more convenient service.

Payment Processing Company Business Plan Template

To help you seamlessly build a payment processing business from the ground up, we prepared a business plan template that you can use and adjust according to your goals.

Executive Summary

Objective: Launch and operate a cutting-edge payment processing company focused on providing secure and efficient transaction solutions for businesses of all sizes.

| Mission Statement | To revolutionize payment processing by delivering innovative, secure, and user-friendly solutions. |

| Vision Statement | To be a leading provider of seamless and reliable payment processing services globally. |

| Primary Objectives | 1. Establish a robust and secure payment processing platform. 2. Gain a significant market share within the first two years. 3. Achieve profitability by the end of the third year. |

Products and Services

| Service | Description |

| Online Payments | Secure and efficient processing of online transactions. |

| In-store payments | Point-of-sale solutions for brick-and-mortar businesses. |

| Mobile Payments | Seamless mobile payment options for on-the-go transactions. |

Payment Processing Packages

| Basic | Core payment processing features | Competitive rates |

| Advanced | Additional security layers, analytics, and customization | Customized based on usage volume |

| Enterprise | Scalable solutions for large businesses | Negotiable based on requirements |

Market Analysis

| Target Market Segment | Description |

| Small business | Affordable and user-friendly solutions tailored for small enterprises. |

| eCommerce | Integration-ready APIs for online stores and e-commerce platforms. |

| Retail chains | Scalable point-of-sale systems for large retail chains. |

Competitor Analysis

| Competitor | Strength | Weaknesses | Market positioning |

| Competitor 1 | Established brand reputation | Limited flexibility in pricing plans | Leader in online payment solutions |

| Competitor 2 | Advanced security features | Higher processing fees | Preferred choice for large retailers |

| Competitor 3 | Seamless integration with apps | Limited customer support | Niche market focus on mobile payments |

Marketing Plan

| Channel | Strategy |

| Digital marketing | Social media campaigns, content marketing, and SEO. |

| Partnerships | Collaborate with e-commerce platforms and business associations. |

| Referral programs | Incentivize existing clients to refer to other businesses. |

Sales Strategy

| Sales channel | Approach |

| Direct sales | Establish a dedicated sales team for B2B relationships. |

| Online sales | Implement an easy-to-navigate online signup and onboarding process. |

| Partnerships | Form strategic partnerships with industry-related businesses. |

Financial Projections

| Year | Revenue | Expenses | Net Profit |

| Year 1 | $X,XXX,XXX | $X,XXX,XXX | $X,XXX,XXX |

| Year 2 | $X,XXX,XXX | $X,XXX,XXX | $X,XXX,XXX |

| Year 3 | $X,XXX,XXX | $X,XXX,XXX | $X,XXX,XXX |

Milestones and Timelines

| Milestone | Timeline | Responsible party |

| Product launch | Q2 Year 1 | CEO, CTO |

| Market expansion | Q1 Year 2 | Head of Sales |

| Technology upgrade | Q1 Year 3 | CTO, Development Team |

Risk Analysis

| Risk | Likelihood | Impact party | Mitigation strategy |

| Cybersecurity Threats | Medium | High | Regular security audits, encryption protocols. |

| Market Saturation | Low | Moderate | Continuous market research, diversification of services. |

| Regulatory Changes | High | High | Legal counsel, staying informed on industry regulations. |

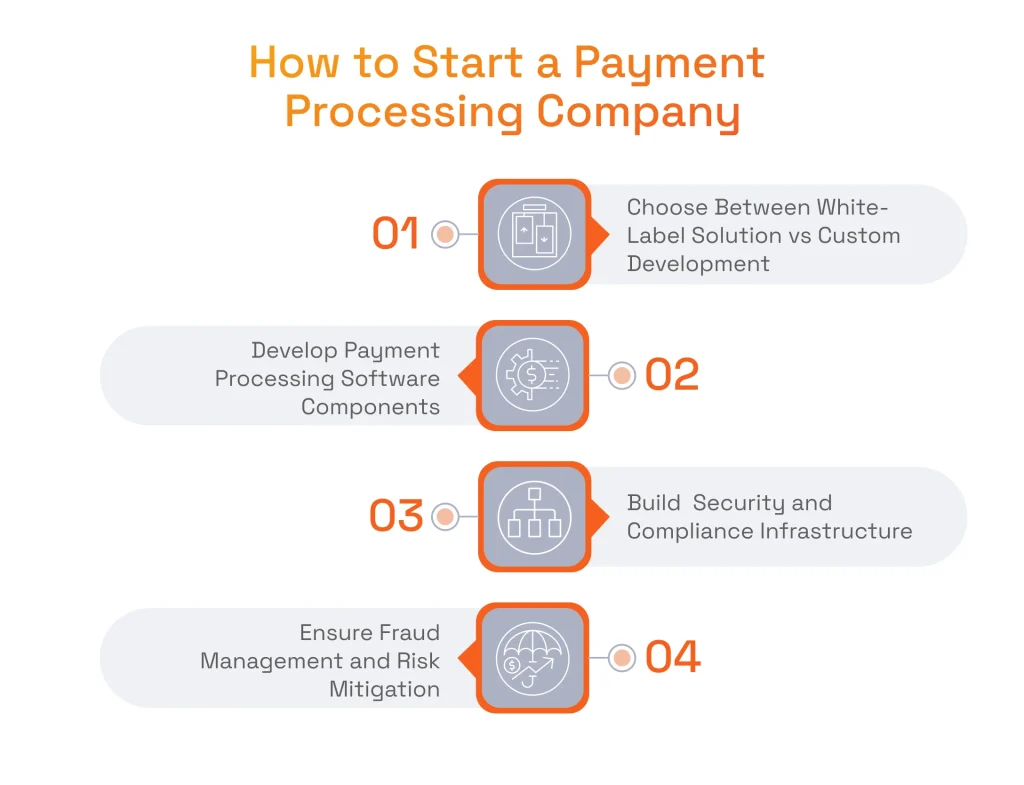

How to Become a Payment Processor: Technical Perspective

The complete answer to the question of how to start a credit card processing business consists of two parts. We have already shed some light on the business-centric considerations, so now let’s dwell on the technical issues. Indeed, there are a lot of technical nuances to keep in mind, and most likely at this point you will need profound technical expertise to help you with payment gateway integration, implementing a fraud detection system and ensuring security of your payment processing app.

Custom vs White Label Payment Processing Software Development

When it comes to building a payment processing software, you would basically be facing two options – develop a bespoke payment processor from scratch, or use a while-label solution that will need to be adjusted to your business context. Let’s compare these options to choose the one that suits your needs best.

| Criteria | White-Label Payment Processing Software | Custom Payment Processing Software |

| Customization | Limited customization options. Businesses can add their logo and branding but have little control over features or functionality. | Highly customizable. Businesses have control over every aspect, from features to user interface. |

| Time-to-market | Faster time-to-market as the core solution is already developed. Businesses can quickly launch their payment processing services. | Longer time-to-market as the software is developed from scratch. Development time depends on complexity. |

| Cost | Generally lower initial costs as development expenses are shared among multiple businesses using the same solution. | Higher initial costs due to the development of a unique solution tailored to specific business needs. |

| Scalability | Limited scalability as the features and capabilities are predefined by the third-party provider. | High scalability as the software can be designed to accommodate the specific growth needs of the business. |

| Control over features | Limited control over features and updates. Businesses rely on the white-label provider for upgrades and new features. | Full control over features, updates, and roadmap. The business can adapt the software as needed. |

| Branding | Limited branding options. The software may have the branding of the white-label provider, and businesses can add their branding to a certain extent. | Full control over branding. The business can create a unique brand identity for its payment processing solution. |

| Maintenance and support | Maintenance and support are typically handled by the white-label provider. Businesses may have limited influence over updates. | The business has control over maintenance and support. It can choose its support model and implement updates according to its schedule. |

| Integration with existing systems | Integration may be limited and may depend on the capabilities provided by the white-label solution. | High flexibility in integrating with existing systems and infrastructure, tailored to the business’s specific requirements. |

| Compliance | Compliance may be pre-built into the white-label solution, but businesses need to ensure it aligns with their specific regulatory requirements. | Full control over ensuring regulatory compliance tailored to the specific industry and location. |

| Use cases | Suitable for businesses that want to enter the market quickly with a basic payment processing solution. | Ideal for businesses with unique needs, specific industry requirements, or those aiming for a distinct competitive advantage. |

In the event that you choose to develop a custom payment-processing solution, you will also need to take care of the technical matters related to the ecosystem your payment processor will reside in.

Leverage our extensive expertise in financial technology coupled with the best practices of custom software development!

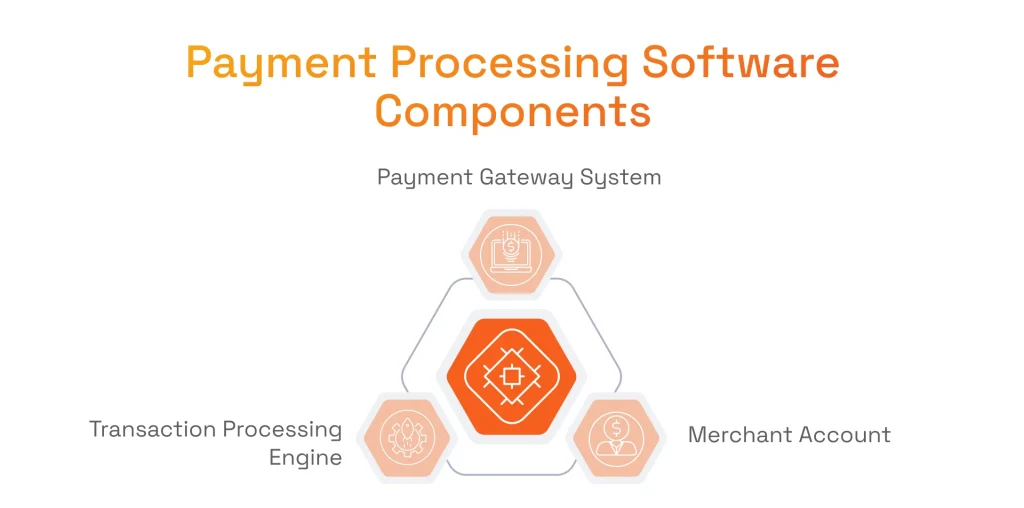

Building the Components of Software for Payment Processing

Developing a robust payment processing system requires several key components that work together to ensure seamless, secure, and efficient transactions. Below are the essential building blocks of a payment processing system.

Payment Gateway System

A payment gateway connects merchants, customers, and financial institutions by transferring financial information for authorization. Payment gateway security is an integral part of the system, as gateways encrypt sensitive card data, verify transactions, and ensure compliance with security standards.

In addition to security, another important aspect of payment gateway development is speed. A well-crafted gateway will have minimal transaction failures while supporting several financial institutions and providing real-time fraud detection functionality.

Want to learn how to create a payment gateway in 2025?

Read our featured article for all the details!

At the same time, building a payment gateway entirely from scratch may be cost-intensive, so we recommend discovering how to integrate a payment gateway and evaluating off-the-shelf solutions to make the right choice for your payment processing company.

Merchant Account

This refers to a specialized bank account that enables businesses to accept and process card payments. A merchant account holds funds from transactions for a certain amount of time and transfers them to the primary bank account of the business.

Ensuring fast and smooth merchant onboarding is critical. The merchant account should support quick approvals while maintaining compliance with regulatory requirements. To get access to the best merchant account, you need to choose a reliable acquiring bank wisely, as it offers this account and is responsible for its performance.

Transaction Processing Engine

This is a core component that takes over the entire payment workflow, starting from authorization and moving on to the settlement. Transaction Processing Engine is responsible for verifying the card details, ensuring fund availability, communicating with card networks, and finalizing transactions.

The most important qualities of an engine are efficiency and reliability, as it must handle massive transaction volumes with minimal latency. Having advanced AI-driven fraud detection systems and chargeback management will be a big plus.

Building a Security and Compliance Infrastructure

This is your foundation when you start credit card company and want to have a reliable payment processing system. We already mentioned that one of the key security requirements is the adherence to PCI DSS compliance that includes encryption and secure transmission of data.

It is impossible to learn how to set up an online payment system without diving into the intricacies of PCI DSS Compliance.

Luckily we have a detailed article that will shed some light on this topic!

To protect the data of the payment processor for website or mobile app, end-to-end encryption (E2EE) and tokenization are used. Additionally, to ensure compliance with KYC and AML regulations, identity verification, Multi-Factor Authentication (MFA) and transaction monitoring should be implemented.

Fraud Management and Risk Mitigation

Unfortunately, having strong security is not enough, since the approaches of cybercriminals are constantly evolving, so well-designed fraud detection and prevention systems are also required.

Nowadays, AI plays a major role in effective fraud detection systems and helps to instantly identify suspicious activities thanks to machine learning models that can analyze transaction patterns in real time.

Dynamic risk scoring is another interesting feature that assesses transactions based on device fingerprinting, geolocation, and spending behavior. There is also a possibility to automate chargeback management and introduce a strong dispute resolution system that helps to find fraudulent claims and save lost revenue.

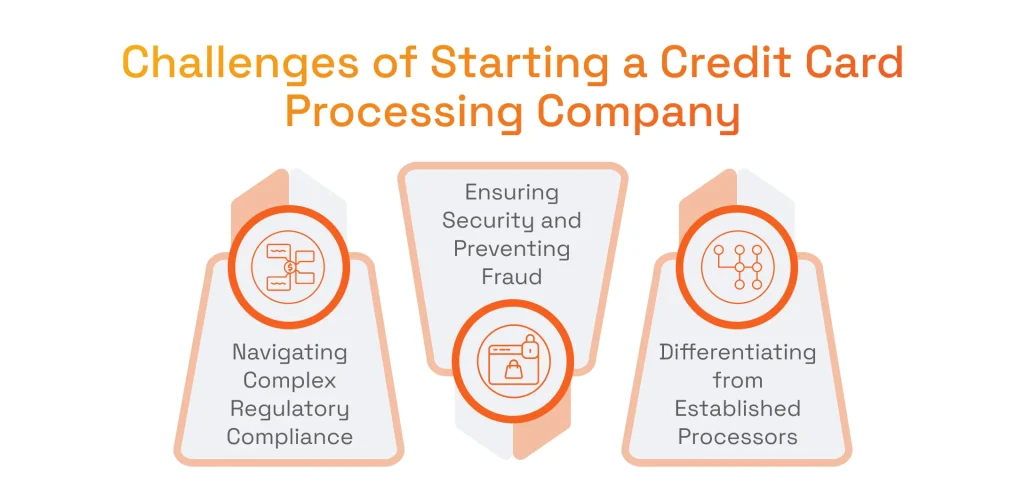

Common Challenges of Starting a Credit Card Processing Company

Along with finding out how to become a payment processor, you will have to learn how to deal with the most common fintech development challenges as well. In this section, we will discuss these roadblocks and highlight the ways to overcome them.

The payment processing industry is built on strict compliance requirements including PCI DSS, PSD2, AML, and KYC. Failing to meet compliance with industry standards will not only lead to penalties and reputational damage but can easily put your payment processing solution with a new payment gateway to a screeching halt.

Here, at SPD Technology, we hold security as our top priority, delivering secure, regulation-compliant financial projects. We implement advanced encryption protocols, AI-assisted identity verification, and secure data processing solutions while ensuring real-time transaction monitoring that complies with global standards such as PCI DSS and GDPR.

Ensuring Security and Preventing Fraud

The dangers of cyber threats can be overstated, as hackers implement new ways of completing fraudulent transactions as the technologies evolve. A company that wants to learn how to become a credit card processor, is also required to find out how to safeguard sensitive financial data while maintaining the fast and smooth performance of the system.

We, at SPD Technology, leverage our AI/ML development expertise to deliver powerful AI-driven fraud detection systems, as well as end-to-end encryption solutions to protect the financial transactions of our clients in real-time. Our experts offer multi-layered security solutions that include features like behavioral analytics, biometric authentication, and tokenization.

Differentiating from Established Processors

The ones who are finding out how to start a credit card processing company know that the market is dominated by well-established companies, making it very challenging for new companies to make their mark. To truly stand out from the competition, market players should present streamlined user experiences, clear pricing, and cutting-edge technologies.

While we don’t provide marketing consulting at the moment, our experts deliver scalable and highly efficient payment processing platforms. By providing access to the latest technologies, following latest security practices, and ensuring seamless third-party integrations, we help our clients to take their spot in the crowded market.

Why You Need a Reliable Tech Partner to Become a Credit Card Processor

Building a successful solution goes far beyond knowing the basics of how to start a credit card company and includes deep knowledge of technical nuance. You need to join forces with a trusted partner for a number of reasons.

First, a reliable tech partner can deliver extensive development, compliance approvals, and security mechanisms as fast as possible, streamlining the deployment thanks to pre-built frameworks, API integrations, and scalable infrastructure that accelerate deployment. Technical proficiency also helps to leverage advanced tools and technologies including AI, blockchain, and cloud-based payment architectures that will help to make your solution not only compliant but also future-proofed.

Like with other off-the-shelf solutions in any industry, existing platforms may lack customization and flexibility. A custom-built solution allows businesses to benefit from unique designs, personalized feature sets, tailored pricing models, and customer experiences. A proficient partner is able to develop a fully customizable infrastructure perfectly fitting your business model.

Finally, a proven vendor knows how to set up a payment gateway and handle any other tech-related aspect, letting you focus on the business side of the project. You will be able to fully concentrate on growth strategies and merchant acquisitions.

SPD Technology as Your Custom Payment Solutions Development Partner

We, at SPD Technology, can be a perfect partner for you, as we have 19+ years of hands-on fintech software development experience. Our experts know how to overcome development challenges and deliver end-to-end payment solutions according to the highest industry standards.

While complying with PCI DSS, PSD2, AML, and KYC in our solutions, we also integrate automated compliance monitoring, reporting, data encryption, and fraud detection mechanisms. Speaking of fraud detection, we leverage our custom AI solutions development expertise to build modern fraud detection systems with features like real-time anomaly detection and biometric authentication.

In all of our projects we ensure seamless API connectivity, secure data exchange, and compatibility with major banking institutions. We deliver flexible and future-proofed payment ecosystems with a variety of integrations from ACH networks to digital wallets.

We support all of our solutions as long as needed, providing 24/7 technical support and ensuring that any issues with the performance will be addressed immediately, preventing any financial losses related to downtime.

Starting Credit Card Processing Company: Poynt Success Story

Proving that we know how to start a payment processing company and build its critical functionality, let’s look closer at the scope of work that we delivered for one of our prime clients.

Developing Custom Payment Processing Services for Poynt Open-Commerce Platform

Business Challenge

Our client is Poynt, a leading veteran B2B company that operates on the verge of eCommerce and Fintech industries. Poynt provides an eCommerce website platform, payment gateway, point of sales, domain registration, and web hosting solutions. The challenge was to enable an existing payment processing service to operate via PayFac Model, implement the UI part of the payment gateway, and develop several other important features.

SPD Technology’s Approach

For this project, we provided a dedicated team of 10 experts that started with revamping the settlement service for PayFac transactions. This included redesigning the architecture, as well as optimization of transaction processing and settlement.

After that, we moved to make changes to the plans and subscriptions system enabling usage-based, and tiered billing models. We developed a react-based UI component from scratch that allowed merchants to collect payment details within their checkout pages easily.

Our experts completely redesigned the payment processor integration module for enhanced compatibility and functionality. To maintain system reliability, we built an automated regression testing framework to streamline feature testing.

Finally, we established bidirectional data synchronization, ensuring real-time updates across multiple internal systems. These enhancements significantly improved the platform’s scalability, flexibility, and performance.

Value Delivered

- The New Business Model for the Client: our involvement helped the client become a payment facilitator, and enabled merchants to benefit from an improved unified platform.

- Improved Customer Experience: along with a second main processor that serves as a PayFac for merchants, we also introduced several major features and design improvements that elevated customer experience.

Ultimately, developing custom payment processing services for Poynt open-commerce platform became a big success that led to a major acquisition of our client, as we remained key service providers for the new owners.

In Conclusion

IIn answering the question of how to start a payment processing company, we’ve touched upon several important components of success. Undoubtedly, a great deal will also depend on the technical excellence your payment processing software development vendor can provide.

In this sense, it is essential for a payment processing startup to combine the knowledge of the business aspects with a fair understanding of the technicalities involved in order to make your interactions with your software development vendor more productive, and, eventually, achieve a better quality of the resulting product. As a provider of bespoke fintech software development services, we have experience with helping a high-scale payment-processing startup take off, and would, certainly, be delighted to answer any of your related questions – just write to us.

FAQ

What is a payment processor vs payment gateway?

In a nutshell, payment gateways collect credit card and transactional information, while payment processors handle the rest of the payment transaction through interactions with the card-holder’s bank and the merchant’s acquiring bank.

How to become a payment processor?

To understand how to start your own credit card processing company, you need to choose a target market, research into the business needs of the various merchants in this market, develop a custom payment-processing solution or pick a white-label payment-processing platform, find partner banks, and take care of the payment infrastructure-related matters.

How difficult is it to build a payment processor?

Just like with any other software application, it depends on the features of the solution, and, incidentally, on the payment methods, currencies, and other parameters that you want to include. The guidance of a well-seasoned custom software development company can make the task a great deal easier: they can help include only the features you need and embed the ability to scale the application whenever that needs to be done.

How much does it cost to start a payment processing company?

Again, everything depends on the scale and functionality of the payment processing solution you want to build. In relation to a MVP, the figure can approximately range from $250K to $500K. For a more accurate cost estimate, get in touch with our experts.