In one of our recent articles, we discussed how to build a payment gateway, including detailed descriptions of each key component and its role, as well as offered solutions to the most common fintech development challenges, based on our experience.

This time, let’s take a closer look at the actual development process with stages, time estimates, and expenses you might have when developing a payment gateway from the ground up. The process involves addressing technical requirements, implementing robust security measures, ensuring compliance with industry standards, and considering security costs, compliance costs, and the need to meet regulatory standards as key financial factors, along with building a scalable infrastructure. We will also discuss the cost of a payment gateway, which depends on factors such as required features, security standards, scalability needs, geographic region, and developer rates.

Without further ado, let’s get started.

Types of Payment Solutions

A payment solution is an essential system that empowers businesses to accept payments from customers through a variety of channels, including online, in-person, and mobile platforms. In today’s digital economy, understanding the different types of payment solutions is crucial for any business looking to streamline its payment process and enhance customer experience.

The three primary components of a modern payment solution are payment gateways, payment processors, and merchant accounts:

- A payment gateway acts as the digital bridge between a customer and a business, securely transmitting payment details during transactions. It ensures that sensitive payment data is encrypted and safely passed from the customer to the acquiring bank.

- A payment processor is responsible for the actual processing of transactions, moving funds between the customer’s bank and the merchant’s account. The payment processor works behind the scenes to authorize transactions, manage settlements, and handle any disputes that may arise.

- A merchant account is a specialized bank account that allows businesses to accept digital payments from customers, whether those payments are made via credit card, debit card, or other payment methods. The merchant account holds the funds from processed transactions before they are transferred to the business’s main bank account.

By integrating these components, businesses can offer a seamless payment experience, accept payments through multiple payment methods, and ensure secure, efficient online transactions. Choosing the right payment solution is a foundational step in building a robust payment infrastructure for your business.

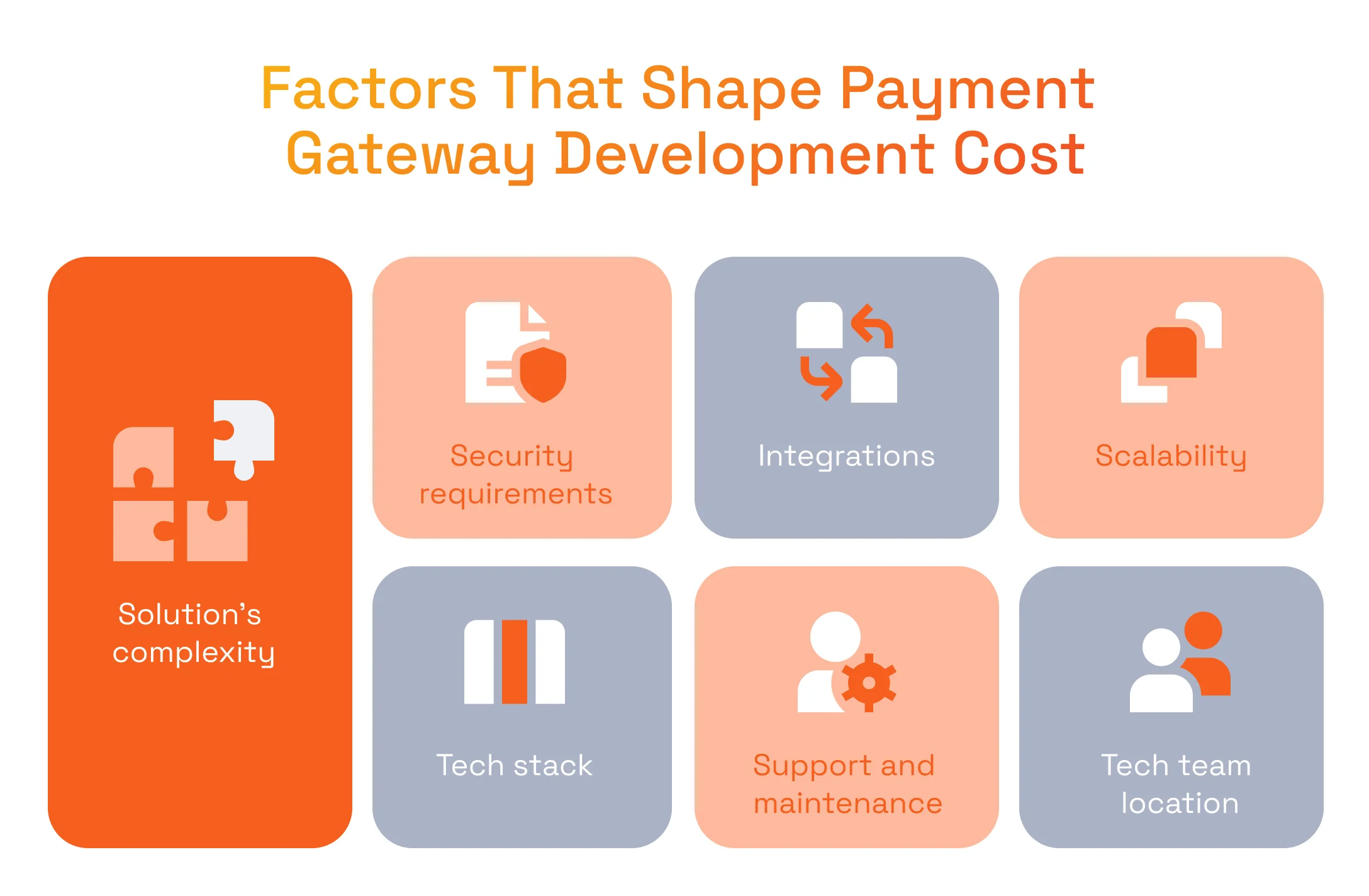

What Factors Affect Payment Gateway Development Cost?

Solution’s Complexity

The number of features and their complexity may dramatically change your cost to build a payment gateway. The basic features you will require for the payment gateway project are as follows. A basic payment gateway is a simple, entry-level solution suitable for small businesses or startups, supporting essential features like card payments, straightforward checkout, and standard security.

The implementation of tailored functionality is one of the top reasons to go with custom software development in the first place, so, chances are, your business may need some of the unique functionality. The less common features, that require increased expenses, include:

- Multiple Currencies Wallet

- Smart Contracts Integration

- Subscription Management

- Dynamic Payment Routing

- Voice-Activated Online Payments

- Tokenization for Non-Card Data

- Offline Payment Support.

Advanced features such as multi-currency support, AI-driven fraud detection, and recurring billing can significantly increase both the initial development cost and the future maintenance cost of a payment gateway. The complexity of features like recurring billing and fraud prevention not only raises development costs but also impacts ongoing maintenance cost, as these features require regular updates, security audits, and compliance checks to remain effective and secure.

Security Requirements

Meeting mandatory security requirements, such as PCI DSS compliance, or implementing industry-standard data encryption protocols like Secure Sockets Layer/Transport Layer Security (SSL/TLS), is already time- and effort-consuming enough. Security costs and compliance costs are major components of the overall budget, as adhering to regulatory standards requires ongoing investment.

Security requirements, such as PCI DSS compliance, significantly impact payment gateway development costs, with security and compliance measures often accounting for 15-20% of the total budget.

Additionally, there can be not only global but also regional security standards to comply with that will influence expenses.

Ongoing compliance costs include monthly regulatory filings, legal fees, and mandatory security audits, which can average $4,000 per month.

Volodymyr Soska

Senior Software Engineer at SPD Technology

“The system architecture of a payment gateway should prioritize end-to-end encryption, tokenization, and adherence to industry standards such as PCI DSS. By implementing these security measures, developers fortify the software against potential vulnerabilities and protect the integrity of online transactions. One of the best practices for this case is to integrate a multi-layered security framework that combines encryption, authentication, and continuous monitoring.”

However, adding some advanced security measures, critical to a certain case or industry, may result in a significant budget bump in your final payment gateway development cost.

While building a cutting-edge solution, far superior to the out-of-the-box offerings, you may require the next functionality:

- Biometric Authentication: adding fingerprint or facial recognition functionality.

- Machine Learning Fraud Detection: leveraging artificial intelligence and machine learning for analyzing transaction patterns and identifying potential fraudulent activities automatically.

- Geolocation and IP Filtering: restrict access to the payment gateway based on predefined location criteria.

- End-to-end Encryption: extending encryption measures to ensure end-to-end encryption, protecting sensitive financial information at every stage of the transaction process.

Integrations

There are two types of integrations to consider: the integration of your gateway with other platforms and the integration of payment processors into your gateway. Let’s take a closer look.

Integration with Platforms

The types and number of platforms you need to integrate with may change the costs dramatically, as integrating with an e-commerce platform or a mobile app requires a scope of work that is entirely different compared to integration with actual physical Point-of-Sale systems in stores.

Take a look at payment gateway integration step-by-step instruction!

Integration with Payment Processors

The core functionality of the payment gateway includes integration with external payment processors. Depending on the business demands, and the location of operations, the number of those processors may vary. Every integration requires coding and a set of actions to obtain the certification from a payment processing vendor. So, the more payment processors are required, the higher the overall cost of payment gateway development will be. A higher number of integrations with financial institutions and payment services not only increases initial setup fees but also leads to higher ongoing maintenance costs and ongoing monthly fees.

It is important to add that integration of payment processors is a normal practice after the gateway is launched and business demands change, so it makes sense to consider integrating only the most vital payment processors in the first iteration of the solution to cut costs.

User Interface and User Experience (UI/UX)

Depending on your design needs, the expenses for the Front-end part of the solution may also change quite significantly. The bare minimum is having designs for user authentication and payment form modules, however, with more modules, a higher design complexity, and the expertise level of your developers and designers, the final cost will increase.

Scalability

The potential need to scale your solution is an important thing to consider as well. Once launched, it is expected that your payment gateway will perform with 0.1% to no downtime, so any technical issues while scaling the solution may harm business and result in massive financial losses. If you expect your solution to handle increased loads of traffic in the future, you should plan it from the start to have the capabilities to grow seamlessly.

Support and Maintenance

Ongoing support of an own payment gateway sometimes requires a dedicated team that will address any issues as they arise. Not only, it is vital to update security measures and maintain functionality, but also to keep a finger on the pulse of any changes in the integrated third-party payment processors and make sure they all work correctly. Ongoing maintenance and support are essential to ensure the payment gateway remains secure and compliant with evolving standards.

For big, enterprise-level projects having a DevOps team for maintenance and security patches is essential.

Customization Requirements

In case you have unique business processes, not designed for payment gateway integration at all, this can be another factor that adds to the final cost. Additional effort will be required to prepare your organization for such integration, but if you hire a dedicated development team from a company with years of experience in payment gateway integration, your software development vendor may help you prepare your organization cost-effectively.

Development Team Location

The location of your tech team is another crucial factor in any software development project. When making a final choice, you are likely to face a common dilemma of a more expensive and sometimes more accountable in-house team versus the less expensive, but remote outsourcing team. This choice alone may result in a drastic price tag difference.

Keep in mind that the COVID-19 pandemic changed the approach to labor, and in the IT industry in particular. According to Forbes, the computer and IT sector was the top industry for remote work in 2023, so this trend is here to stay and there’s a big chance that your local developers will prefer to work remotely anyway. Keep in mind the growing shortage of global tech talent, and you might as well go with outsourcing.

The global outsourcing market is as big as ever and is expected to reach $525 billion by 2030, according to Grand View Research. In terms of hiring dedicated software developers, the USA remains the most expensive place to do it, with hourly rates for a senior developer $75-$125. At the same time, you can hire an expert with the same level of expertise in Eastern Europe, for at least twice as low. Latin America and Asia are viable options to consider as well.

Technology Stack

It will be a wise choice to consider the most popular programming languages and frameworks if they are suitable for the task of lowering costs in this category. When choosing a technology stack, it is crucial to ensure the development team has the necessary technical expertise in backend engineering, security protocols, and compliance with financial regulations, as these specialized skills are essential for building a secure and reliable payment gateway.

For example, based on our experience, we consider Java to be the best choice for the development of the back-end part of a custom payment gateway. Being utilized by 30.55% of developers in 2023, according to Statista, it is safe to say that by choosing Java, you will have higher chances to hire qualified developers. In addition, there is an enormous amount of libraries available, as well as a large online community for this particular programming language.

Payment Gateway Software Development Cost Breakdown

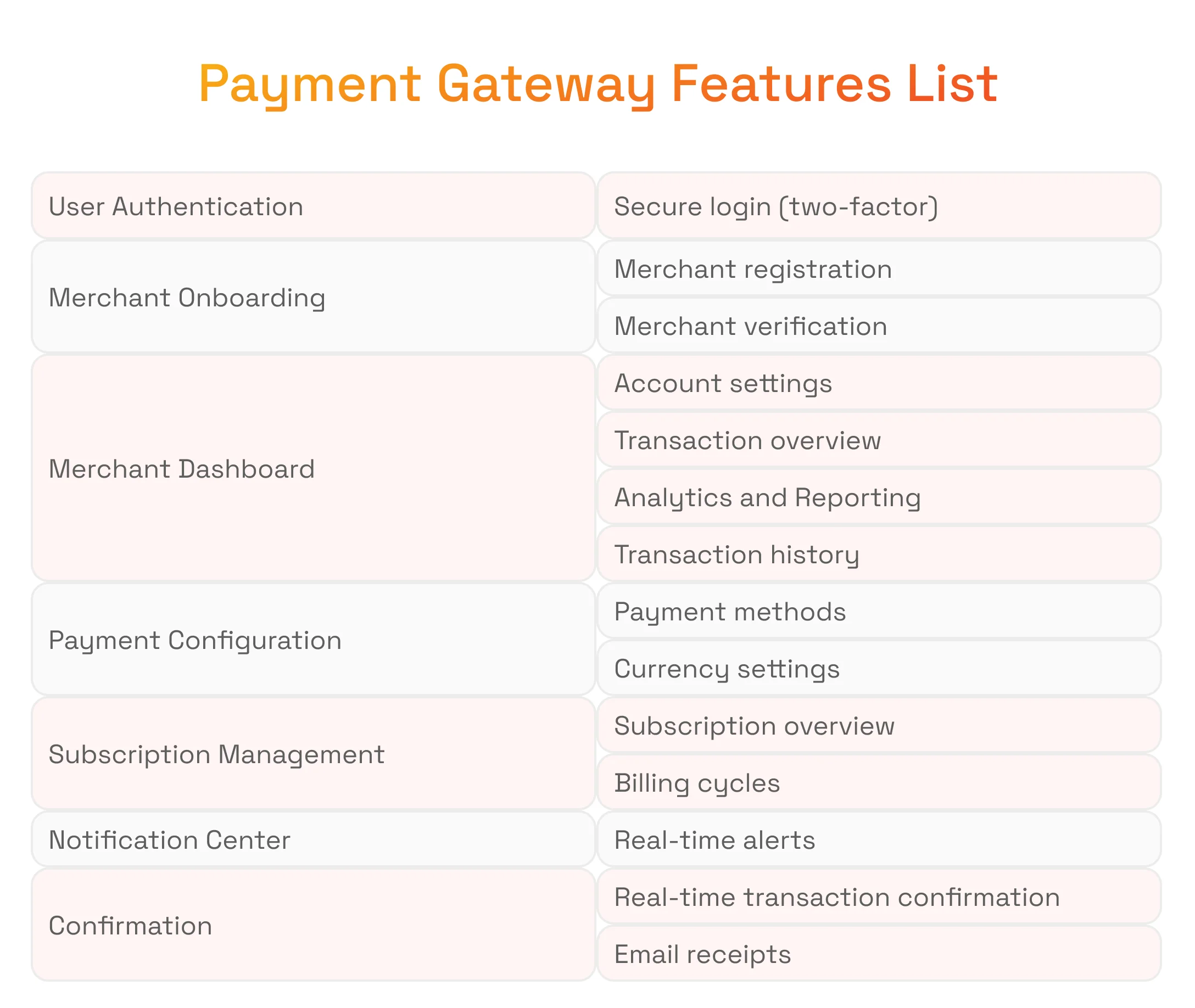

While it is impossible to specify a cost to develop a payment gateway that will suit every business scenario, we definitely can offer a feature breakdown and approximate prices for each part of the solution. When considering the total cost, keep in mind that payment gateways charge ongoing transaction fees for each payment processed, which can significantly impact your expenses over time.

Ongoing costs, such as infrastructure, security, API maintenance, and customer support, should also be factored into the total cost of ownership, as these expenses persist throughout the system’s lifecycle. Additionally, instead of building a custom solution, you may opt for a third-party payment gateway—an off-the-shelf option with quick setup and standardized features, ideal for businesses seeking faster integration and reduced compliance burdens.

Below, we will discuss each stage of the entire process, providing you with a description of the necessary functionalities.

Want to get a clear vision of payment gateway development process at first? Feel free to read our step-by-step guide into building a secured and compliant payment gateway!

Stage 1 – Infrastructure Set Up

Developing a custom payment gateway starts with a reliable, scalable, and secure infrastructure. Infrastructure costs are a significant part of the budget, as they include ongoing expenses for hosting, security, maintenance, and scaling to ensure reliable and compliant operations. The microservice architecture approach is popular for such payment systems, allowing for modular development, scalability, flexibility, technology diversity, and easier maintenance.

Implementation of the microservice architecture entails dividing the payment gateway into smaller, independent microservices that handle specific functions (e.g., separate modules for authentication, processing, and reporting). Each microservice should have a well-defined API to communicate with other services.

Microservices infrastructure set-up takes 4 weeks approximately and involves:

- Organizing repositories based on microservices.

- Creating service templates for each microservice that include authentication mechanisms and logging

- Using services like Amazon EC2 for hosting microservices, Amazon RDS for databases, Amazon S3 for file storage, and Amazon VPC for network isolation.

- Using Apache Kafka or Amazon Simple Queue Service (SQS) for building a reliable and scalable messaging system.

- Implementing Continuous Integration and Continuous Delivery (CI/CD) pipelines to automate the testing, building, and deployment of the microservices.

Initial setup costs for secure, high-availability environments require significant upfront and monthly capital, with ongoing hosting costing up to $50,000 monthly for high-volume transactions.

As a part of our recent project from the FSA/HSA digital payments business niche, we had to set up and oversee the infrastructure on Amazon Web Services (AWS) for various applications and teams, configure networks, and set up databases, ensuring scalability and security.

Stage 2 – Business Service Development

This includes the management of business accounts, Merchant IDs (MIDs), and merchant settings. Additionally, implementing a simple Know Your Business (KYB) logic at this stage is essential for ensuring the security, compliance, and smooth operation of the payment gateway. Business service development usually takes up to 4 weeks.

Stage 3 – Payment Service Development

The initial step in developing a payment gateway is establishing business relationships with a payment processor or acquiring bank. The customer initiates a payment by selecting a product or service, proceeding to checkout, and entering payment details.

This involves creating a set of services and APIs that handle the authentication, payment processing, and management of payment statuses. Backend development is the most resource-intensive and complex phase, critical for transaction processing, security, scalability, and integration. For an MVP (Minimum Viable Product), you can start with stubs or mock implementations to simulate the behavior of the actual services.

The key steps here include:

- Implementing secure two factor authentication mechanisms, using industry standards OAuth 2.0 or JWT (JSON Web Tokens).

- Developing APIs for payment requests, processing, responses, refunds, and chargebacks.

- Creating major operations with stubs, including payment initialization, payment processing, and retrieving payment status.

- Introducing payment status management.

- Providing idempotency/concurrency support.

The payment service must process payments securely and efficiently, verifying customer information, communicating with banks, and ensuring the secure completion of payment transactions. The card network plays a crucial role in confirming transaction approval by communicating between the payment processor and the issuing bank, and also facilitates settlement after an approved transaction. The issuing bank is responsible for verifying the customer’s funds, assessing the transaction’s validity, and responding with approval or decline to ensure secure payments.

By focusing on these components, it is possible to build a functional MVP for your custom payment gateway in 4 weeks. As your system evolves, you can replace stubs with actual implementations and integrate with external payment processors to provide end-to-end functionality. This functionality allows merchants to customize the types of payments they accept and manage the currencies in which international transactions are processed.

Payment methods may include such important functionalities as:

- Payment method selection

- Customization of accepted cards

- Digital wallet integration

- Bank transfer and ACH configuration

- Cryptocurrency integration

- Subscription and recurring payments configuration.

Supporting multiple payment options, such as cards, bank transfers, e-wallets, and cryptocurrencies, is essential for comprehensive transaction processing and directly impacts development cost and system functionality.

Depending on the particular case, the required payment methods may vary, but it’s safe to say that your custom payment gateway needs to support at least credit and debit cards, digital wallets, and bank transfers. As for currency settings, it will be a good idea to add a supported currencies module, multi-currency support and processing, and dynamic currency conversion.

Stage 4 – Payment Page and Widget Design

Designing a Payment Page and Widget for a custom payment gateway involves creating user interfaces and components that facilitate the payment process. It could be done in 6–8 weeks, depending on the number of features.

Key considerations and features for this stage include:

- Payment form that merchants can embed into the e-commerce process.

- Client- and server-side validation.

- Payment confirmation redirection and 3-D Secure support.

- User-friendly error messages and real-time notifications.

- Responsive design with small screen support and mobile-friendly components.

- Customizable “Pay” button.

- Designing an iframe that merchants can easily embed into their website using a simple HTML snippet.

Stage 5 – Support Team Admin Portal Development

Developing a Support Team Admin Portal involves creating a secure and efficient system in the form of a web app, using authentication with Keykloak, business management features, and simple KYB UI. It could be done in 6 weeks.

Verification functionalities for the Support Team Admin Portal may vary depending on the particular case, however, the most common elements include:

- Business and document verification.

- Background checks.

- Risk assessment.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance.

- Implementation of the underwriting process.

Stage 6 – Basic Merchant Portal Development

Registration part may include the following modules:

- Online registration portal.

- Functionality to collect basic merchant information (business details, contact information, legal information, etc.).

- Document submission.

- Business profile creation.

- User account setup.

The merchant dashboard plays a crucial role in providing merchants with the tools and information they need to manage their accounts effectively. The merchant’s account is essential for settlement and funds transfer, as it receives funds from customers via the acquiring bank, ensuring secure and compliant transaction processes.

Here’s a quick overview of key features that can be included:

- Account settings with profile management, security settings, notification preferences, and payment preferences.

- Transaction overview with real-time transaction monitoring, transaction status indicators, and transaction details.

- Analytics and reporting including performance analysis, sales reports, chargeback reports, and customizable reports.

- Transaction history with search filters and options, downloadable statements, refund management, and reconciliation tools.

There are a few other features that also can be implemented in a merchant dashboard. For example, for more advanced users, API access and integration options to allow seamless integration with other business tools, accounting software, or third-party applications may be extremely useful.

Overall developing a Basic Merchant Portal involves creating a user-friendly web application that allows merchants to manage their profiles, access payment reports, and configure settings. It can be developed in 8 weeks.

However, more complex solutions require more time and effort to be created. For example, as a part of our collaboration with a globally represented financial transaction processing company, we had to create an Merchant Portal for businesses onboarding, implement OFAC (Office of Foreign Assets Control), and EIN/SSN (Employer Identification Number / Social Security Number checks, integrate the platform with a payment solution and develop the subscription management page.

Stage 7 – Commission and Billing Integrations

Implementing Commission and Billing Integrations involves creating a system that calculates transaction fees, generates invoices for merchants, integrates with billing services for automatic billing, and provides reporting features on both the Admin and Merchant portals. An MVP version of this could be done in 8 weeks, while end-to-end product is estimated at 10 weeks. Features we should mention include subscription management and a notification center.

- Subscription management. Subscription management is a crucial aspect of a custom payment gateway, especially for businesses that offer products or services on a recurring billing basis. Subscription overview provides merchants with a centralized dashboard that gives them an overview of all active subscriptions, including key metrics such as the number of subscribers, revenue generated, and churn rate. The billing cycles module allows merchants to control the recurring intervals at which a customer is billed for a subscription or usage-based service.

- Notification center. The notification center serves as a centralized hub for all communication related to payment transactions, account activities, and important updates. An important element of this feature is real-time alerts for transaction-related activities, such as successful payments, pending transactions, and any issues encountered during processing.

Stage 8 – Testing

Complete E2E testing & debugging for the MVP release can take around 8 weeks, integration testing lasts 4 weeks, and load testing may require 2 more weeks. Because of dealing with lots of personal and financial data and the highest concerns of ensuring data security in fintech, there is no option of cutting costs on testing at all. The business reputation of your company is at stake here, so the goal is to hire qualified QA experts for the most optimal salary.

Stage 9 – Obtaining Certifications

Obtaining certifications for the MVP of a payment gateway is an important step to ensure that your system meets industry standards, security requirements, and compliance and financial regulations. The specific certifications you’ll need may vary based on your geographic location, the target market, and the nature of your payment services.

Stage 10 – Deployment and Launch

Ensure that all planned features and functionalities have been developed and tested thoroughly, and conduct a final security review to identify and address any potential vulnerabilities to finally launch the product.

After the successful launch, regularly iterate on the system based on user feedback and evolving industry standards to maintain a competitive and secure offering.

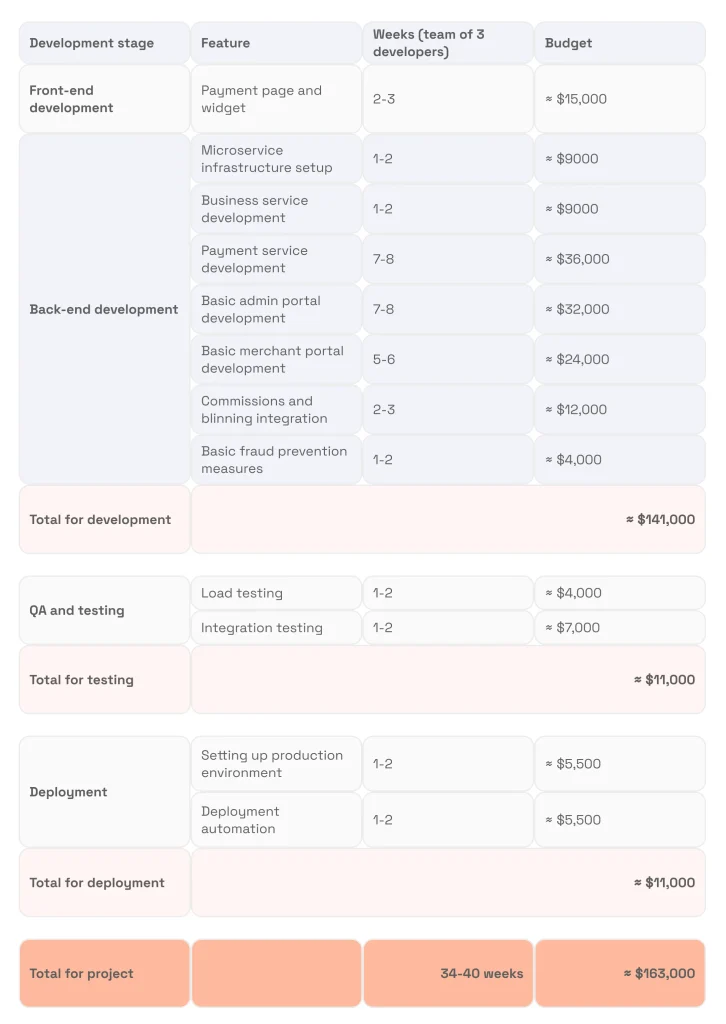

How Much Does It Cost to Build a Payment Gateway

Now, let’s specify the actual costs, supposing that we have a team consisting of 2-3 fintech development specialists. Suppose you have to create a payment gateway MVP with a hosted payment form, for a single country, currency and language, for basic eCommerce usage and with no custom or advanced features. In this case, the approximate time and cost to develop a payment gateway will be as follows. Building a custom payment gateway involves a higher upfront investment, but for high-volume or scalable platforms, this can be more cost-effective over time due to greater control, security, and scalability.

*Information provided in this article can not be used as a public offer of services.

So, how much does it cost to build a payment gateway? According to our basic and rough estimate that doesn’t take project-specific requirements into account, creating a Minimum Viable Product for a payment gateway will cost $163,000 on average, plus you have to keep additional expenses in mind. For example, there are also payment gateway certification costs that are highly individualized and depend on the geographies you want to serve with your payment gateway solution.

Summing up, in 2026, you can expect between $160,000 and $250,000 for a Minimum Viable Product (MVP) of a custom payment gateway, with slight variations depending on functionality.

How Long Does It Take to Build a Payment Gateway

Building a payment gateway is a complex process that can roughly be divided into ten stages. Creating a Minimum Viable Product (MVP) for a payment gateway typically takes around 8-10 months. During this period, developers focus on delivering a simplified version with core functionalities, which provides a foundational framework for further refinement. As the development progresses, additional features and integrations can be added to enhance the gateway’s capabilities.

The time frame for building a complete and fully integrated payment gateway will vary based on the complexity of desired features, regulatory compliance, and the specific needs of the business. However, starting with an MVP allows for a quicker market entry, enabling businesses to gather feedback, make improvements, and iterate on their payment gateway solution.

Conclusion

While the effort and cost to build may seem substantial, a custom payment gateway should be seen as a strategic investment in creating a competitive advantage, meeting industry standards, and providing a secure and efficient platform for financial transactions. By carefully planning, leveraging modern technologies, and prioritizing user experience and security, your business can build a solution that meets current standards and maximizes the benefits for your organization.

Based on our expertise in Fintech, we suggest you start with a consultation from an experienced tech provider. We, at SPD Technology, will be happy to be your vendor of choice and offer the most effective solution!

FAQ

How much does it cost to build a payment gateway?

You need to be ready to invest at least $163,000 for an MVP with a core functionality. For a more accurate estimate based on your project requirements, get in touch with our experts.

How can you estimate the cost to build a payment gateway?

It all starts with determining what features you need to implement, in order to achieve your business goals. After that, you choose the tech stack and the development team for the job and will end up with approximate estimations. We, at SPD Tech, would be glad to help you with this task.

What factors impact payment gateway development costs?

The key factors include the number of features and their complexity, the number of integrations, the development team location and size, and the timeframes.