In an era when nearly every aspect of our lives is digitalized, online money transfer stands out as no exception. Cashless payments have seamlessly integrated into our daily routines, saving time and sparing us the bureaucracy of traditional banking. It’s no surprise that online payment transfer app development has become one of the worth-considering business ideas.

According to Precedence Research, the global digital remittance market was valued at USD 19.1 billion in 2022 and is projected to reach approximately USD 77.60 billion by 2032. As the market continues to expand, the sooner you establish your presence, the quicker you can grow your customer base and drive substantial revenues.

This guide on how to develop a money transfer app is set to help businesses achieve this online presence in the financial sector faster and more efficiently.

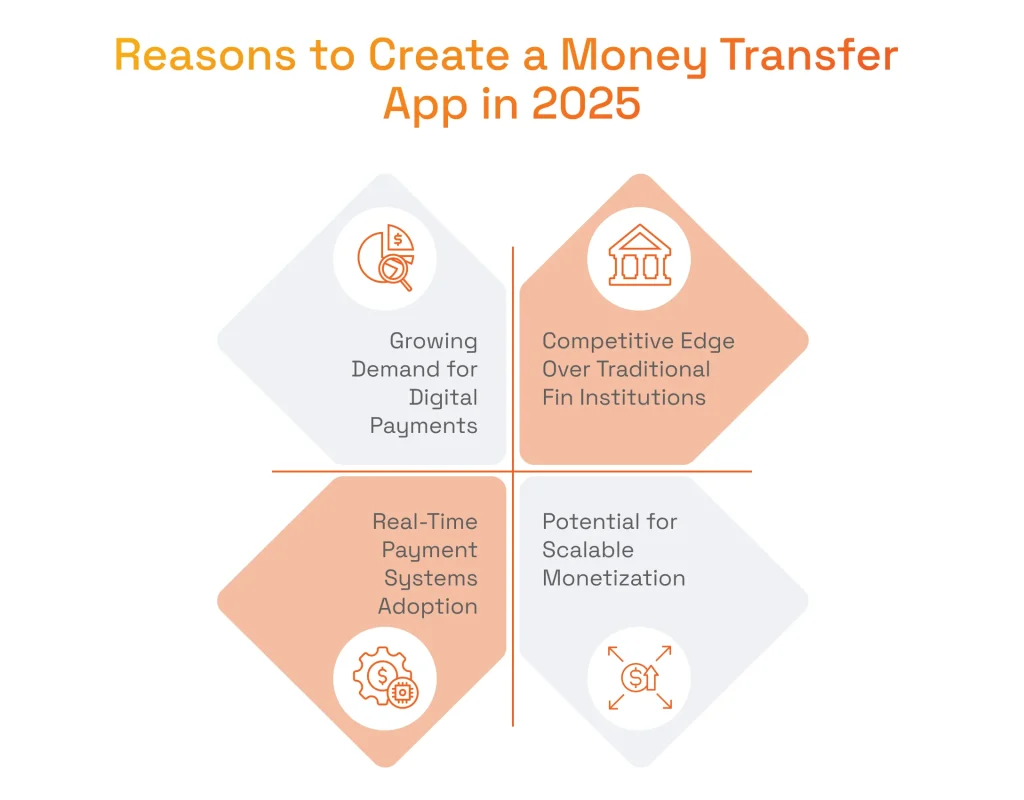

What Makes Money Transfer App Development a Relevant Business Idea

In the highly competitive financial sector, users demand instant, secure transactions. But that’s just one reason to invest in the development of money transfer applications. For businesses exploring how to stand out in a commoditized financial market, offering a well-designed money transfer solution can unlock growth, differentiation, and long-term relevance. Below, we explore the key factors that make this a compelling business opportunity.

Growing Demand for Digital Payments

In 2023, 9 out of 10 of consumers reported using some form of digital payment during the year, according to McKinsey’s 2023 Digital Payments Consumer Survey. Such an increasing reliance on the money transfer software can be explained by the widespread use of smartphones and trust in the online shopping practices. Businesses, in turn, can address this surge in consumer interest and accommodate their needs with the right user-centric features, robust security measures, intuitive designs, and AI solutions for fraud detection. Thus, they can create new revenue opportunities and serve the needs of online consumers.

Competitive Edge Over Traditional Financial Institutions

Many financial systems were developed a long time ago, and they are now deeply integrated into the financial institutions’ processes. Upgrading those systems requires significant financial investment and advanced skills, which can be a barrier, especially for large, established institutions with extensive legacy systems. Yet, today’s end users as well as financial companies need a tech-driven software that is easy-to-use, has impeccable performance and speed, and can be personalized. This sets the path for technology startups to accommodate those needs and offer streamlined user experiences, dynamic pricing models, and instant settlement options to align better with consumer expectations.

Potential for Scalable Monetization

Digital payment apps can have an array of monetization options due to a versatile nature of financial transactions. Businesses can employ transfer fees, subscription plans, currency exchange margins, or even a freemium model. This not only creates multiple revenue streams but also allows diversifying income. What’s more, businesses that own money transfer apps can partner with online merchants or eCommerce platforms to integrate their payment capabilities into websites with a steady user base and, thus, create referral or commission-based revenue channels.

Real-Time Payment Systems Adoption

Nowadays consumers and businesses expect their funds to be sent and received immediately. If businesses can build money transfer apps that integrate directly with these real-time networks, they can ensure swift, transparent transactions. This creates a significant advantage to users who do not like to wait for a purchase to be completed in more than several seconds. Plus, real-time transfers enable numerous downstream benefits. Financial tools that previously depended on batch processing can now operate without disruptions, helping consumers with up-to-the-minute balances, faster reconciliation, and more precise budgeting.

High-Value Opportunities of Creating an Own Money Transfer Platform

While many industries often reach a plateau in growth due to market saturation, limited innovation, or increased competition, the financial sector is universally essential, which eliminates multiple scaling restrictions. Moreover, today digital banking and blockchain challenge the existing financial firms to ensure better experiences for their customers. For better or for worse, not all firms can accommodate this growing customer demand. This is one of the reasons that allows new businesses and startups to engage in money transfer app development.

Capturing a Growing Market

As smartphone adoption increases and consumers shift toward online and mobile financial services instead of traditional ones, the potential user base continues to become wider. Consequently, businesses that want to launch a mobile money transfer app have a valuable chance to attract customers early and solidify their position on the market before the market becomes oversaturated with competitors.

To maximize this opportunity, it is beneficial to offer instant transfers, competitive exchange rates, or enhanced security measures. This allows businesses that only emerge as the financial market players to carve out a loyal user segment.

Potential for High Profit Margins

Payment transfer apps can ensure several substantial revenue streams. Those can be transaction fees, foreign exchange margins, subscription services for premium features, and partnerships with banks and financial institutions. Such a business model not only brings more money to the business but also mitigates risks associated with reliance on revenues from a single product or service.

Another good news when you decide to build a payment app is that they do not require huge operating costs once the underlying technology and compliance measures are in place. This is because scalable architectures, API integrations, and automated risk management systems reduce the need for large staffing operations.

Opportunity for Global Reach

A business that has a digital nature can break free from geographical limitations. This is how a money transfer business usually has the potential to expand beyond local markets. By integrating multiple currencies, partnering with international banking networks, and incorporating local compliance standards, an online payment app can win new customers abroad.

With this global reach, the two opportunities discussed above also become more relevant: such an app opens doors to untapped customer segments and diverse revenue streams.

Accessing Customer Data and Insights

Having control over the complete money transfer system grants insights into how users interact with the app, their transaction habits, and the latest market changes. The business can use this information to enhance products, customize marketing approaches, and elevate the overall user experience. Sure thing, such use of data has to be done by strictly following privacy and security standards.

To make the most out of customer data, data analytics is the most suitable tool to leverage. It helps to uncover hidden patterns, trends, and opportunities as well as not obvious risks in vast amounts of transactional and behavioral data. Alongside AI/ML development, data analytics can help businesses identify user preferences, anticipate future needs, and personalize services.

Andrii Semitkin

Delivery Director at SPD Technology

“Building a money transfer app addresses a market scarcity for secure, convenient, and efficient financial solutions. By seizing this untapped domain, startups can position their ventures at the forefront of a rapidly growing sector.”

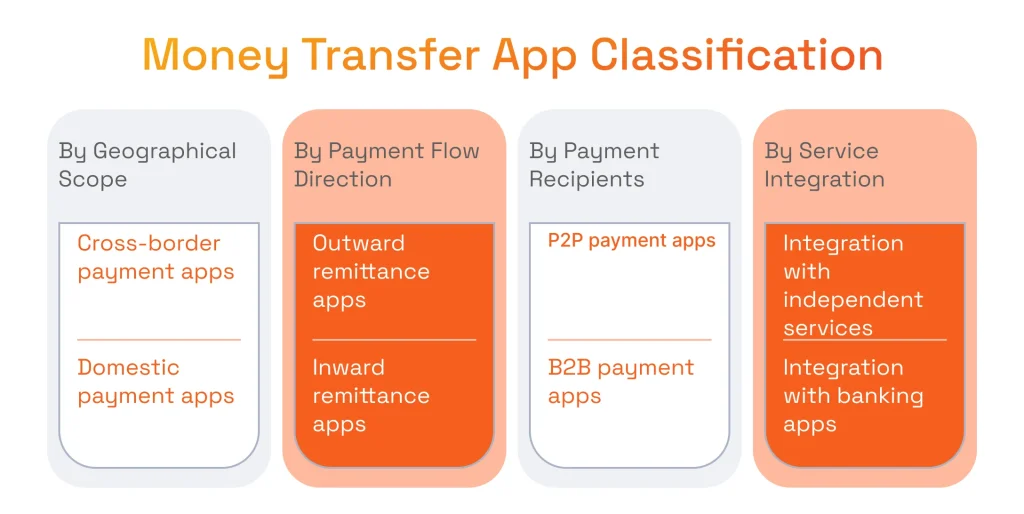

How Money Transfer App Works by Its Types

Before diving into the actual payment software development, selecting the right type of the financial software upfront is crucial to lay the groundwork for how a money transfer app works and how it will serve its target audience.

For instance, while aiming to develop a peer-to-peer (P2P) money transfer app, it is necessary to consider core features like easy user authentication, two-factor authentication, secure transaction processing, multiple transfer methods, and instant transfers, including support for international money transfers if required. On the other hand, creating a business-to-business (B2B) payment platform within the broader financial technology ecosystem may require invoicing capabilities, multiple payment methods support, integration with accounting software, and tools to help businesses generate revenue more efficiently.

Essentially, compiling a complete list of core features based on the preferred app type before starting to build a money transfer app can save a lot of inefficiencies, delays, and overhead costs later in the process. It also prevents the final product from lacking essential functionality, failing to meet user expectations, or missing a user-friendly interface that ensures smooth adoption.

Essentially, compiling a complete list of features based on the preferred app type before starting to build a money transfer app can save a lot of inefficiencies, delays, and overhead cost further in the process. It also prevents a final product from lacking essential features or failing to meet user expectations.

By Geographical Scope

#1 Cross-Border Payment Apps

As the name suggests, this type of app facilitates cross-region or international transfers. To make transactions faster, more convenient, and cost-effective for users, cross-border payment apps must have features of:

- Multi-currency support;

- Currency conversion;

- Secure cross-border transactions;

- Real-time exchange rate information;

- Transfer tracking;

- Integration with international banking networks or payment gateways.

#2 Domestic Payment Apps

If the app needs to operate only within a single country or geographic region, business should go for domestic money transfer app development.

Domestic transfer apps typically rely on features such as:

- Paying bills;

- Transferring funds between accounts;

- Making purchases from local merchants;

- Bill splitting;

- Integration with local banking systems.

By Payment Flow Direction

#1 Outward Remittance Apps

If the business aims to help users facilitate fund transfers from one country to another, it may opt for an outward remittance app designed for sending money across borders. The main purposes for transactions are supporting family members, paying for international services, or investing in overseas opportunities.

Outward remittance apps typically offer the following features:

- Transaction processing;

- Multiple currency support;

- Competitive exchange rates;

- Real-time tracking of transactions.

#2 Inward Remittance Apps

The focus of inward money transfer apps is on enabling users to receive funds from overseas into their local bank accounts. These apps cater to recipients who expect to receive money from family members, friends, employers, or clients located abroad.

When wondering how to develop a money transfer app for inward transactions, the business needs to consider the following functions:

- Instant notifications of incoming transfers;

- Transparent exchange rates;

- Options for receiving funds in local currency;

- Managing received funds.

By Payment Recipients

#1 P2P Payment Apps

P2P payments, where individuals can transfer money directly to one another, continue to be one of the significant FinTech trends in 2025. Apps that offer such payments prioritize accessibility and speed for users looking to exchange money with friends and family. P2P money transfer apps allow sending and receiving money quickly and conveniently without the need for traditional banking.

To create a P2P money transfer app, the following features are must-haves to include:

- Easy account setup;

- Secure transaction processing;

- Instant transfer capabilities;

- Integration with contact lists;

- Splitting bills;

- Requesting payments.

#2 B2B Payment Apps

In contrast to P2P, B2B money transfer apps focus on facilitating financial transactions between businesses. They offer an easier way to pay suppliers, vendors, or contractors, as well as receive payments from clients.

B2B payment apps typically offer features such as:

- Invoicing;

- Account management;

- Integration with accounting software;

- Support for multiple payment methods;

- Expense tracking;

- Reporting.

By Service Integration

#1 Integration with Independent Services

Independent services, such as PayPal, Venmo, or Stripe, allow users to benefit from payment services across multiple websites, apps, and devices. These financial platforms often provide additional features like:

- Buyer and seller protection;

- Currency conversion;

- Access to funds via linked bank accounts or credit cards.

#2 Integration with Online Banking Apps

Banking apps are typically part of a larger banking ecosystem than independent services. They include:

- Account management tools;

- Budgeting tools;

- Loan applications;

- Customer support.

Such desktop or mobile transfer apps are also tightly integrated with online banking services and users’ bank accounts, providing fast access to funds and banking transaction history, and often prioritize security and regulatory compliance to protect users’ financial information.

Want to unlock seamless transactions? Learn how to develop a payment processing app and streamline online payments effortlessly in our guide!

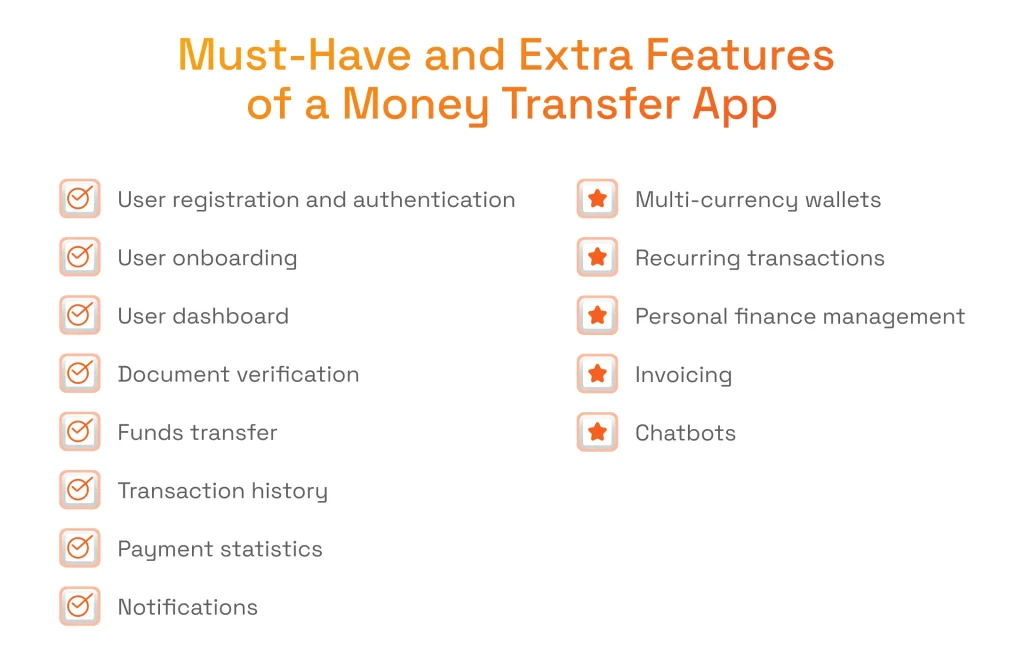

Must-Have and Add-on Features of Money Transfer Applications

To create a money transfer app, businesses always consider a number of essential features, regardless of the focus of the future software. These features keep the app functioning, user-friendly, and secure, no matter its goal.

The features described below are identified in the Statista report as the most important ones, as they contribute to the app’s usability and convenience for users.

- User Registration and Authentication: Secure process for users to create accounts and verify their identities.

- User Onboarding: Guided steps to help new users set up their accounts and understand app functionality.

- User Dashboard: Centralized interface displaying account details, transaction history, and settings.

- Document Verification: Confirmation process for user identity and supporting documents.

- Funds Transfer: Ability for users to send and receive funds securely within the app.

- Transaction History: Record of past transactions, including details such as date, amount, and recipient.

- Payment Statistics: Insights into users’ payment activities, including spending patterns and trends.

- Notifications: Real-time alerts about account activity, transactions, and important updates.

Further, in case businesses seek to build a money transfer app that can offer more convenience for customers and enhance competitiveness, the following advanced features may offer them just that.

- Multi-Currency Wallets: Support of international transactions and currency conversion.

- Recurring Transactions: Automated, recurring payments for regular expenses such as subscriptions or bills.

- Invoicing: Generation of invoices directly from the app, streamlining billing processes.

- Chatbots: Assistance with inquiries to facilitate transactions and resolve disputes.

- Personal Finance Management Features: Functions designed to track expenses, set budgets, and analyze spending patterns, like the ones we have created for Mogami.

The Best Practices to Create a Money Transfer App UI/UX Design

Money transfer app development involves navigating complex user workflows and effectively displaying detailed financial information. As a result, prioritizing the user experience becomes one of the key application development challenges in the FinTech industry. The following list of tips for an intuitive interface must facilitate the creation of the app’s UI/UX design.

Tip #1: Onboarding must be intuitive and seamless. To ensure that, it is best to choose a minimalistic style and design the registration process in steps to guarantee users have a smooth interaction with the app from the very beginning.

Tip #2: The main screen must prioritize the dashboard. In this manner, it becomes possible to serve customers vital information such as account balances, recent transactions, and important actions.

Tip #3: Main financial data must be shown in charts and graphs. This helps present income and expense statistics, payment limitations, currency exchange rates, and other information in a visually appealing and digestible format.

Tip #4: Visual confirmation and progress indicators should bring clarity. Intuitively visualized information about interaction with the app makes the payment process transparent and provides users with a sense of confidence with each click.

Tip #5: Padlocks and secure icons should highlight security. Adding them to the app’s interface shows users their private data, transactions, and accounts are protected.

Tip #6: Neumorphism, minimalist design, and subtle gradients add a touch of modernity. Such stylistic choice creates a visually pleasing and contemporary interface that engages users.

Andrii Semitkin

Delivery Director at SPD Technology

“Design must prioritize simplicity and trust. An intuitive interface with minimal steps to complete a transfer, and clearly display security cues (like encryption icons or 2FA options) reassures users their funds are safe.”

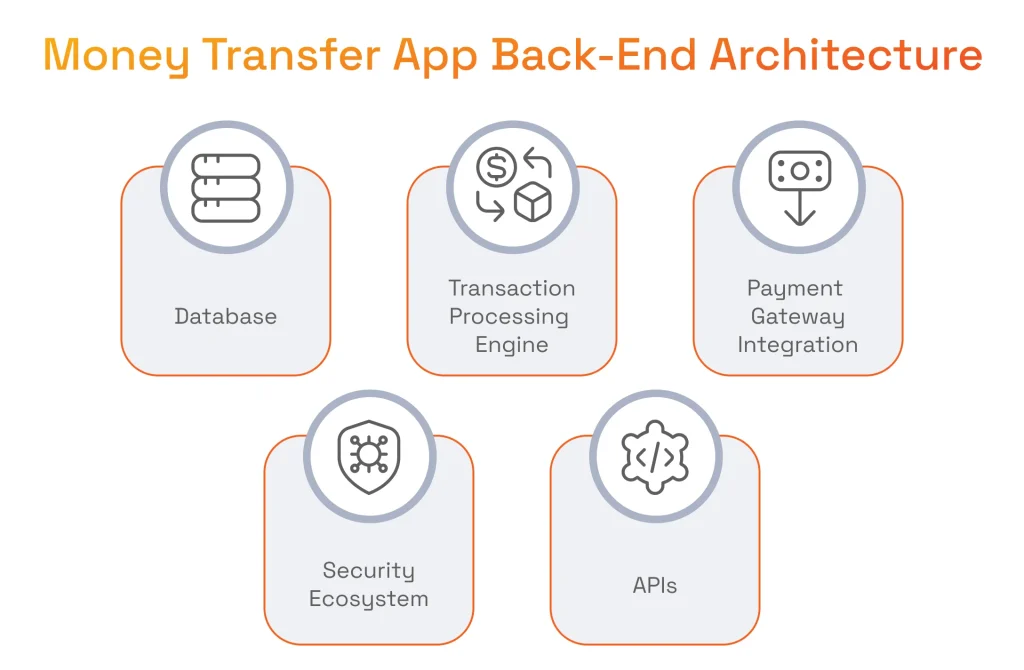

Back-end Specifics of Online Payment Transfer App Development

The back-end development in the FinTech software development services lays the foundation of the software with databases, security, server-side logic, and APIs. Below are the essential aspects that needed to be addressed to create money transfer apps.

Database

The database functions as the essential backbone for storing all information. All the data about user profiles, transaction records, account balances, and other crucial information necessary for the application’s functionality is kept there. It must be architected to efficiently manage high volumes of transactions while maintaining data integrity, consistency, and security.

The following considerations are important while working on the app’s database:

- Relational database systems like PostgreSQL or MySQL can be beneficial for a payment app development due to their robust transactional support and ACID compliance.

- Designing a schema optimized for transactional data storage with the help of Entity-Relationship Diagrams and tools such as DBDesigner or MySQL Workbench helps handle a high volume of transactions reliably and quickly.

- Utilizing indexing using B-tree or hash indexes in PostgreSQL or MySQL helps enhance query performance (especially for frequently accessed data fields) and leverage features like partial indexes or expression indexes for further optimization.

- Implementing database-level encryption with Transparent Data Encryption or third-party encryption tools such as Vault by HashiCorp helps protect sensitive information such as user credentials and transaction details.

Transaction Processing Engine

Another component that manages the entire transaction lifecycle is the transaction processing engine (TPE). It validates transactions, seeks authorization, and securely executes them while adhering to regulatory standards. The TPE logs transaction details for auditing and ensures scalability and performance under high volumes. It also ensures the accuracy and consistency of data, as well as manages the flow of funds between accounts.

Here are the considerations for working on the TPE:

- Developing a high-performance transaction processing engine with multithreading and possibly asynchronous processing assists in handling concurrent transactions.

- Utilizing distributed locking mechanisms like Apache ZooKeeper or optimistic concurrency control techniques such as Multi-Version Concurrency Control in databases like PostgreSQL allows preventing data inconsistencies and ensuring transactional integrity.

- Implementing connection pooling libraries such as HikariCP or Tomcat JDBC Connection Pool aids in managing database connections.

- Designing algorithms with message queue systems such as Apache Kafka or RabbitMQ helps with transaction routing and reconciliation.

Payment Gateway Integration

When creating the plan for how to make a money transfer application, establishing seamless communication between the app and external payment networks or banking systems is a key consideration. In some cases, creating a payment gateway can be the optimal solution because it gives businesses full control over transaction flows, security protocols, and integration logic.

However, if building a gateway from scratch is not an option, payment integration services can cover business needs. With it, the back-end system will handle communication with the payment gateway APIs and manage transaction authorization, processing, and settlement, while ensuring compliance with industry regulations.

The following considerations help navigate the payment gateway integration process:

- The integration of payment gateways leveraging RESTful APIs and SDKs provided by payment service providers must adhere to industry standards like PCI DSS and security protocols such as TLS encryption.

- The implementation of secure tokenization mechanisms with JSON Web Tokens or encryption libraries such as OpenSSL helps replace sensitive payment information with unique tokens.

- Handling various payment methods including credit cards, bank transfers, and digital wallets can be done utilizing technologies like Stripe Elements or PayPal Checkout SDK.

- The development of robust error management and retry mechanisms with circuit breakers or exponential backoff algorithms ensures handling transient failures.

Need a deep understanding of how to integrate a payment gateway into your app?

Check our detailed guide and learn a step-by-step process!

Security Ecosystem

The financial industry is vulnerable to cyberattacks, identity thefts, or security breaches. This is why ensuring data security in FinTech must be prioritized to protect sensitive user data, prevent fraudulent activities, and guarantee compliance with regulations such as GDPR and PCI DSS. Establishing a reliable security ecosystem involves integrating encryption, secure authentication mechanisms, fraud detection systems, and regulatory compliance measures into your app to safeguard against cyber threats and maintain data privacy.

The following considerations can enhance security initiatives during the app development:

- A multi-layered security architecture with firewalls, Web Application Firewalls, and encryption can secure networks, accesses, and the app overall.

- Establishing HTTPS protocol with TLS encryption contributes to secure communication between clients and servers.

- The implementation of OAuth 2.0 or JWT-based authentication and authorization mechanisms allows controlling access to APIs and sensitive resources.

APIs

To facilitate interaction between components of the payment transfer app and external services or platforms, the back-end development also needs to include APIs (Application Programming Interfaces). These APIs enable seamless data exchange, streamline development processes, and grant smooth communication of your app with third-party services like banking systems or payment networks.

The following considerations help with API integrations:

- It is beneficial to design RESTful APIs using Node.js with Express.js or Spring Boot, following the principles of resource-oriented architecture and adhering to REST constraints such as statelessness and uniform interface.

- It is recommended to utilize technologies like URL versioning or custom headers for API versioning to maintain backward compatibility and enable graceful evolution of API endpoints over time.

- It is crucial to implement rate limiting and throttling mechanisms using Redis or Nginx, or built-in features of API management platforms like Kong or Apigee, to prevent API abuse and ensure fair usage of resources.

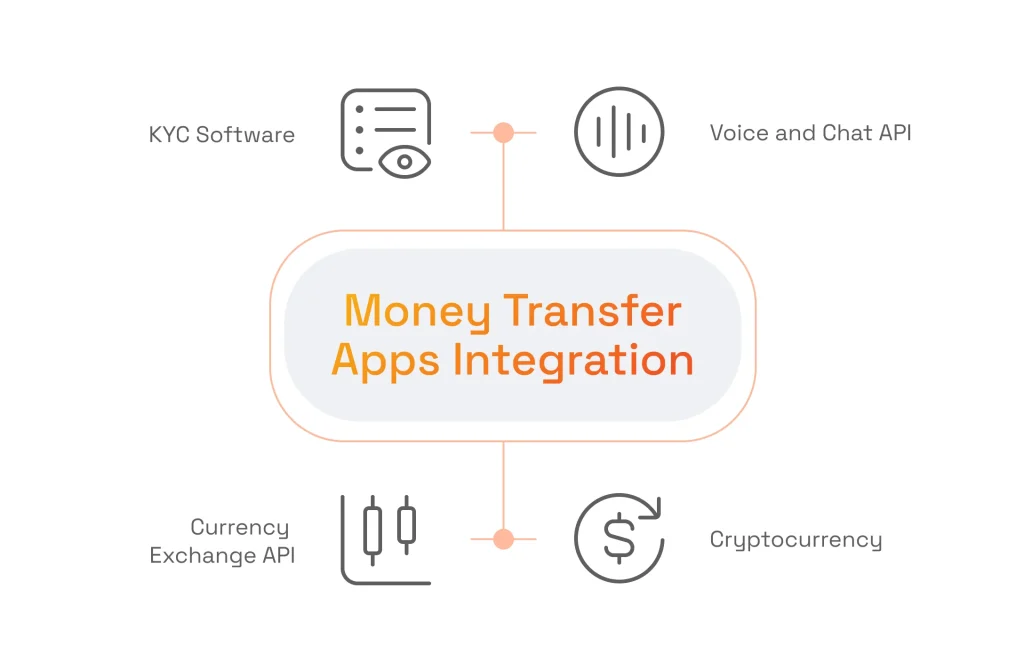

Must-Have API Integrations to Build Money Transfer App

Money transfer service providers often seek ways to enhance it. This is where third-party integrations can further boost the functionality of the software.

KYC Software Integration

KYC (Know Your Customer) software is a cornerstone of security for apps focusing on finances. It safeguards against fraudulent activities, verifies customer identity, and helps prevent money laundering. KYC software vendors like Onfido, Plaid, or Comply Cube are developed following EU/FATF guidelines and provide a comprehensive overview of customers’ information.

KYC in financial services is the standard procedure. The basic aspects of any KYC software are:

- Compliance: With a KYC software in place means adhering to regulations and security standards of many financial institutions that require the verification of IDs, prevention of fraud, and terrorist financing.

- Security: With KYC software, the app won’t be vulnerable to unauthorized transactions.

- Credibility: Having a KYC software shows customers that the business is committed to ensuring their security and privacy.

- Enhanced User Experience: Thanks to KYC software integration, users can enjoy a seamless onboarding, automated identity verification, and reduced friction.

Voice and Chat API Integration

Not only does voice and chat functionality help resolve clients’ queries in a blink of an eye, but it also offers accessibility and fosters the impression that money transferring app providers are always willing to help their clients. Tools like Twilio or Sendbird offer AI-powered chatbots, voice calls, and video calls, proving the financial service provider is always within reach for its customers.

The main benefits of voice and chat integrations for payment transfer apps are:

- Enhanced Customer Support: With voice and chat integrations, payment apps can have more convenient and accessible customer support features (instant availability, 24/7 operations, processing several queries simultaneously).

- Accessibility: Voice interfaces make the app more accessible to users with visual impairments thanks to the ability to navigate, execute transactions, and receive real-time feedback through auditory cues.

- Improved Engagement: Chat integrations can handle a wide range of queries, from simple FAQs to complex transaction issues, providing assistance to a broader audience.

- Personalization: Voice and chat technologies can analyze user data, including transaction history and interaction patterns, to customize interactions.

Cryptocurrency Integration

Cryptocurrencies continue to maintain their popularity. According to the McKinsey report, 43 percent of past and present cryptocurrency owners are motivated by its investment potential. Thus, providing opportunities to crypto owners can serve as a competitive advantage for your financial business, namely:

- Greater Customer Reach: Users who prefer to pay or receive payment with cryptocurrencies will more likely to use a money transfer app that supports digital money.

- Lower Transaction Costs: While traditional methods can involve multiple intermediaries, each adding their own fees, blockchain-based transactions typically settle without the need for intermediaries.

- Enhanced Security and Transparency: Blockchain transactions are recorded on a blockchain, reducing the risk of fraud and unauthorized alterations.

Currency Exchange API Integration

With API integration for currency exchange, businesses make it easy for users to send and receive funds in the currency they prefer. For apps that handle payments across countries, these APIs are must-haves. They help convert money into the currency used in the country it’s being sent to.

The benefits of enhancing the app with currency exchange APIs are:

- Real-Time Exchange Rates: Having currency exchange APIs integrated into the app, users have the ability to check the latest exchange rates in real time.

- Automated Currency Conversion: This feature enables users to effortlessly transfer funds in various currencies automatically, without calculating rates or fee manually.

- Cost Efficiency and Competitive Pricing: Utilizing the API enables the app to secure enhanced rates and decrease transaction expenses.

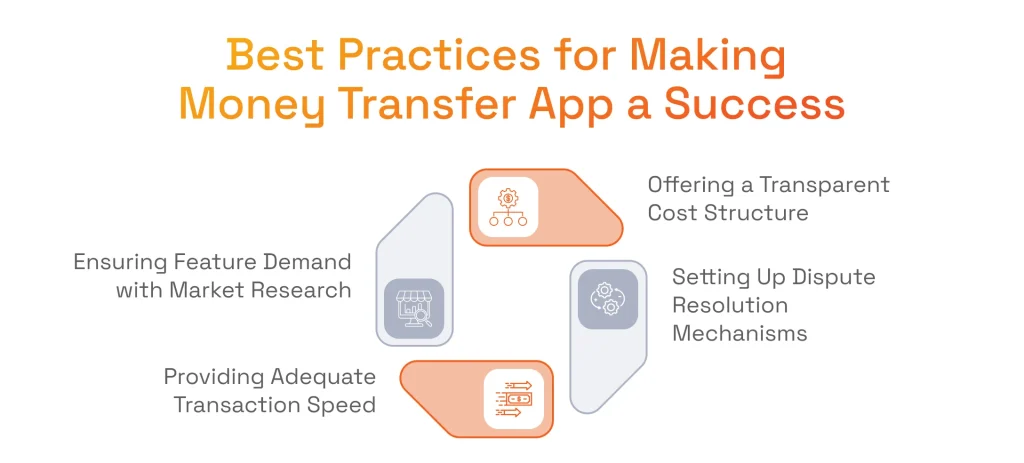

How to Make Money Transfer App a Success: Key Considerations

No matter if you are planning to develop a P2P money transfer app, a B2B app, a cross-border app, or any other type, there are always considerations to pay attention to before you start online payment app development.

Ensuring Feature Demand with Market Research

The FinTech sector is highly competitive. To become a solid player in this crowded marketplace, it is crucial to analyze current trends, user behaviors, and competitor offerings. This allows businesses to identify which features are most in demand to understand how to make a money transfer app that addresses the needs of a modern user.

While doing a feature demand research, both quantitative data, such as transaction volumes and popular payment methods, and qualitative insights through surveys, focus groups, and user interviews need to be taken into account. Understanding the pain points and desires of potential users allows businesses to prioritize features that will add the most value.

Offering a Transparent and Competitive Cost Structure

Nothing hurts a business more than giving customers confusing and unfair prices. To build trust and retain users of the app, it is crucial to ensure that pricing is both transparent and competitive. Transparency means openly disclosing all transaction-related fees, providing users with information on transfer charges, exchange rates, and any additional costs. Companies can enhance this aspect by offering detailed breakdowns and comparing their fees with those of traditional banks or competitors.

Establishing a competitive pricing model can further help ensure impeccable transparency. This can be done by taking advantage of economies of scale, negotiating better rates with financial partners, and employing efficient technologies to reduce operational expenses.

Providing Adequate Transaction Speed

Transaction speed is a critical factor that significantly impacts user satisfaction and the overall success of a money transfer application. Users expect their transactions to be processed instantly or within a very short timeframe. Delays in transfers can lead to frustration, loss of trust, and ultimately, a decline in user retention.

To meet these expectations, it is essential to optimize the app’s infrastructure to handle high volumes of transactions efficiently. This involves using robust backend systems, leveraging real-time payment processing technologies, and ensuring seamless integration with financial networks and banks.

Setting Up Customer Support and Dispute Resolution Mechanisms

Quick responses from your customer support team can significantly boost user satisfaction. To make those possible, the app must offer multiple channels of support, such as live chat, email, and phone support, to cater to different user preferences. Here businesses can go even further and engage in AI solutions development to provide their customers with AI-powered chatbots that can handle common inquiries. For example, we delivered such a chatbot for HaulHub. It is enhanced with the RAG approach for fluency in generated responses and offers support with natural dialogue.

Similarly, reliable dispute resolution fosters trust in the app. To establish them, it is important to develop clear policies and procedures, implement user-friendly reporting channels, and establish a dedicated dispute resolution team. In this manner, businesses can handle user issues, minimize dissatisfaction, and build a strong foundation of trust and reliability.

Possible Obstacles to Create Money Transfer App and How We Solve Them

It’s impossible to plan how to build a successful money transfer app without paying attention to challenges that may arise in the process. Fortunately, we can say from our experience that any complexities are possible to overcome. In this section, we share the most common obstacles we encountered during project development and how we overcame them.

Regulations differ from one country to another, and navigating the regulatory landscape governing online payments can be challenging. However, it’s crucial not to neglect this aspect to avoid hefty fines, reputational damage, and even the revocation of operating licenses. By diligently complying with regulations, such as PCI DSS, KYC, PSD2, SOC2, and AML, businesses can steer clear of legal complications and ensure the app’s legitimacy.

To make sure that all the compliance requirements are fulfilled, we:

- Conduct thorough legal research or hire specialized consultants to understand relevant regulations (e.g., AML, KYC).

- Implement robust customer onboarding processes that include identity verification and transaction monitoring.

- Maintain detailed transaction records and audit trails for regulatory review.

- Suggest our clients to establish partnerships with reputable banking institutions and opt for tailored payment gateways services to leverage existing compliance frameworks.

How Do I Comply with AML and KYC Regulations in Fintech Apps?

To comply with AML and KYC regulations, money transfer applications must be developed with consideration for legal, technical, and operational measures. This includes verifying user identities with official documents and biometrics, screening customers against global watchlists, and monitoring transactions in real time for suspicious behavior.

Fintech platforms must also maintain secure, long-term records and obtain proper licensing from regional authorities like FinCEN, FCA, or BaFin. Beyond the technical setup, assigning a compliance officer, training internal teams, and enforcing clear reporting procedures are essential to staying ahead of regulatory demands. With the right approach to developing a money transfer application, fintech companies can protect users, prevent fraud, and build trust in their platforms.

Discover the latest payment processing compliance requirements in our dedicated article!

Ensuring Data Security and Fraud Prevention

Apps that transfer money instantly store critical details such as bank account numbers, credit card information, personal identification data, and transaction histories. Any of this data can be a target for financial gain or identity theft. This is why they are vulnerable to phishing scams, malware infections, and data breaches, each capable of compromising the security of user information.

To launch a secure money transfer app on the market, it is essential to:

- Employ end-to-end encryption and secure protocols (e.g., HTTPS, TLS) to protect data in transit.

- Use advanced authentication methods (e.g., 2FA, biometric scans) to verify user identities.

- Implement real-time fraud detection systems powered by ML to spot and flag suspicious activity.

- Conduct regular security audits and penetration tests to identify and address vulnerabilities.

Handling Operational Challenges in Real-Time Transactions

Another complexities during online payment transfer app development are connected to user demand for instantaneous fund transfers. It creates operational challenges related to system load, concurrency, and transaction accuracy. Any latency or downtime can erode user confidence and lead to lost transactions.

To ensure balancing speed, accuracy, and reliability of the app, we:

- Design a scalable backend architecture with load balancing and redundancy to handle high transaction volumes.

- Employ database optimization techniques, such as sharding or partitioning, to manage concurrency effectively.

- Integrate real-time payment rails for immediate settlements.

- Implement monitoring systems with real-time alerts for unusual transaction spikes or system failures.

- Use queuing mechanisms to manage transaction bursts and ensure each payment is accurately processed.

Ensuring Ongoing Infrastructure Maintenance

As user bases grow and market demands change, the underlying infrastructure of a money transfer app must evolve to maintain speed, security, and reliability. To ensure financial transactions at scale, providers should not neglect regular maintenance. It helps prevent performance bottlenecks and security vulnerabilities, which will lead to the loss of users.

To make sure the app continues running smoothly, we:

- Schedule regular maintenance windows and software updates to keep systems secure and up to date.

- Implement a DevOps culture with CI/CD pipelines for smoother deployments.

- Monitor system performance metrics and scale resources proactively.

- Maintain clear documentation of configurations, deployments, and version histories to facilitate troubleshooting.

Why Developing a Money Transfer App Requires Expert Tech Expertise

Having support from an experienced partner can bring more expertise and clarity on how to create a money transfer app. By collaborating with a technology vendor, you can get:

- The Opportunity to Integrate Advanced Features: Professionals know how to enhance a custom money transfer application with AI/ML expertise to ensure advanced fraud detection capabilities and personalized user experiences.

- Maintaining High Availability and Uptime: A tech vendor can ensure that the app remains available and operational 24/7 thanks to building resilient and scalable infrastructure.

- Adapting to Evolving Market Trends: Experts are always improving their tech knowledge and enriching their tech stack, learning new technologies, and discovering emerging market trends to create the app up to the latest innovations.

- Customizable Features Tailored to Business Needs: Technical experts can develop flexible architectures that allow for easy customization and scalability, meeting specific operational and technical requirements and without sacrificing app performance.

- Unlocking Data Analytics and Reporting Capabilities: Specialists can implement data warehousing and analytics capabilities that enable the app to process large volumes of transactional data to unlock valuable insights for decision-making and strategic planning.

- Ensuring Data Security and Compliance: Experienced app developers can implement advanced security protocols, such as encryption and multi factor authentication, while ensuring the app meets general data protection regulations and financial legal requirements.

Partner with SPD Technology for Money Transfer App Development

With over 20 years of experience and deep understanding of the financial services industry, we deliver top-notch solutions that stand out on the market, convert customers, and bring revenues. Our team can guide you through every step of how to build money transfer app, ensuring a smooth and successful development process thanks to:

- Proven Experience in Fintech Solutions: We have successfully developed and deployed a variety of financial applications tailored to meet unique challenges and financial regulations.

- Seamless Payment Gateway Integration: Our team specializes in integrating multiple payment gateways, including PayPal, Stripe, Braintree, WorldPay, and Payoneer, ensuring smooth and secure transactions.

- Advanced Security & Compliance Frameworks: We prioritize critical app security aspects, including end-to-end data encryption, secure user account management, strong authentication mechanisms, compliance with anti-money laundering regulations, and AI-powered fraud detection systems that proactively monitor suspicious activity.

- Expertise in Emerging Technologies: Staying ahead of the curve, we leverage the latest emerging technologies such as AI/ML and data analytics to enhance the functionality and security of your money transfer app.

- Cost-Effective and Time-Efficient Development: Our streamlined development processes and agile methodologies ensure that your money transfer app is built efficiently without compromising on quality.

- Trusted by Industry Leaders: We are proud to be trusted by global fintech leaders such as BHN, Poynt, and Mogami, who rely on our expertise to power their financial solutions.

How to Make a Money Transfer App: SPD Technology’s Success Story

At SPD Technology, we build long-term relationships with our clients. For example, we partnered with Mogami to develop their financial application.

Business Challenge

Mogami aimed to continuously evolve its personal finance application to stay ahead of market trends and user demands. Over the span of a decade, they needed to gradually improve scaling to accommodate a growing user base, integrate new features without disrupting existing services, and improve processing speed to offer better user experience.

SPD Technology’s Approach

We adopted an agile development process, focusing on iterative enhancements and close collaboration with Mogami’s in-house team to deliver a PWA solution. This app enables financial management, personalized expense plans, monitoring expense patterns, and allows users to link their profiles to banking accounts for monitoring expenses. During the project course, we also improved performance and speed and integrated the MX solution.

Value Delivered

We developed a robust iOS and Android-friendly financial application for Mogami. Now, the application is thriving thanks to:

- MX Solution Integration: We enabled its adoption by banking institutions, strategically positioning our client to effectively market the solution within the financial services sector.

- Growing User Base: Because of its feature-rich, cross-platform, and performance optimized nature, the app has attracted a steadily increasing number of users.

Conclusion

Developing a custom money transfer app presents challenges such as managing complex user journeys, handling vast financial data, implementing intricate backend business logic, and ensuring a seamless user experience. Nevertheless, we believe that our comprehensive guide has shed the light on how to create a money transfer app, providing a thorough understanding of the necessary steps.

To recap, it is essential to determine the app’s operational scope, transaction facilitation, and integration preferences. Once these factors are clarified, outline the app’s features and proceed with front-end and back-end development, alongside necessary integrations. Additionally, paying attention to features in demand, transparent pricing, adequate transaction speed, dispute resolution mechanism, and support will provide even a greater competitive advantage to a money transfer app. Sometimes some challenges may arise during the development of a payment transfer app. Those can be regulatory compliance, data security issues as well as real-time transaction and infrastructure complexities. The development team can easily resolve these issues when partnering with a trusted tech vendor. At SPD Technology, we also help clients to develop top-notch Fintech solutions.

So if you need a hand in your money transfer app project, do not hesitate to get in touch with us for payment software development!

FAQ

How Long Does It Take to Develop a Money Transfer App?

Developing a money transfer app typically takes 4 to 9 months, depending on complexity, features, compliance needs, and team size. Additional time may be required for testing, licensing, and integration with payment providers.

Is It Legal to Launch A Money Transfer App in the US or Europe?

Yes, it’s legal, but you must comply with strict regulations. In the US, this includes obtaining state money transmitter licenses and FinCEN registration. In Europe, PSD2 compliance and registration with a financial authority are required.

What Are the Most Common Mistakes When Building a Money Transfer App?

Common mistakes include neglecting regulatory compliance, underestimating fraud risks, poor user experience design, and weak security in a mobile app handling financial transactions. Many startups also fail to conduct proper market research, define clear key features, or prepare a detailed project plan before development begins.

Another frequent issue is underestimating development cost, especially when scaling from a basic money transfer app to a more advanced solution with enhanced security, compliance, and integrations. Teams often overlook the importance of collecting early user feedback, which can result in misaligned functionality and costly redesigns later.

Many startups also fail to plan for scalability or choose unreliable third-party payment integrations, which can limit long-term growth and stability.