What if your customers no longer see traditional credit as their first choice? For a growing number of people, especially the younger generation, that’s already a reality. They actively choose the simplicity and transparency of buy now, pay later options, justifying the buy now, pay later app development cost and thereby creating a clear opening for businesses to acquire new users and build deeper customer relationships.

The catch is that buy now, pay later (BNPL) is far more than a payment method. It’s a full-fledged financial product where success hinges on smart underwriting, robust compliance, and a flawless customer experience. Getting the technology right in BNPL app development is everything. Market research is essential in identifying these shifts in consumer preferences, analyzing competitors, and understanding market trends to inform BNPL app development strategies. It is equally important to validate and refine your initial app idea to ensure it meets real market needs and stands out among competitors.

This article breaks down how BNPL works and what it really takes to win with BNPL app development. We’ll look under the hood at the development process and the data science that power BNPL solutions, and lay out the two primary paths for implementation: building your own platform from scratch with buy now, pay later app development companies or integrating an existing solution.

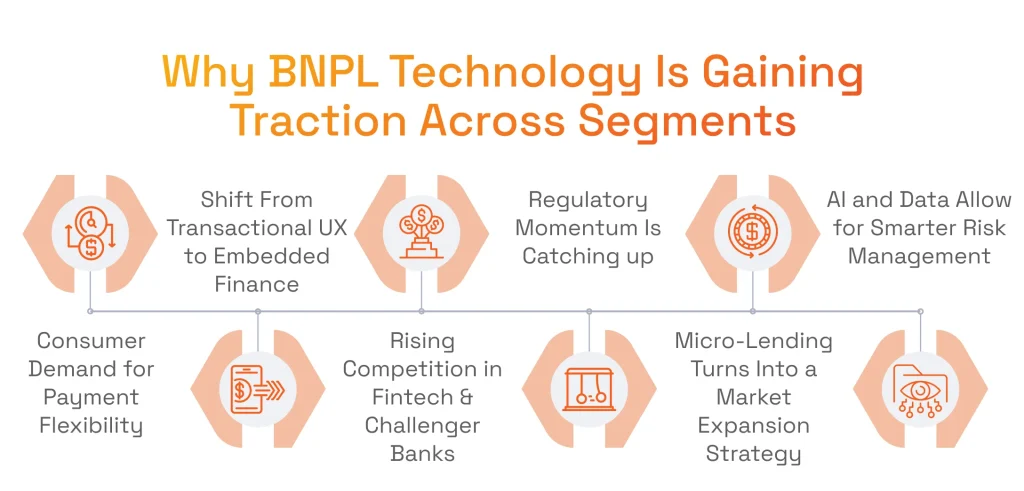

The Market Shift: Why BNPL Technology Is Gaining Traction Across Segments

That small Pay Later button at checkout is more than a feature. It represents a shift in how people borrow and buy, moving well beyond retail and creating a new strategic territory for buy now, pay later app development. Once a simple tool for selling more products online, buy now, pay later has become a sophisticated financial service model, and its momentum is accelerating for compelling reasons.

The BNPL market continues to grow as consumers look for alternatives to high-interest credit cards. Industry estimates project the market could reach around $9.2 trillion by 2032, reflecting a 29% compound annual growth rate from 2023 to 2032. This momentum explains why BNPL is now a strategic priority rather than an optional feature.

If anyone still wonders what BNPL stands for, first things first: it’s a clear business opportunity. There’s a growing appetite for straightforward and transparent financing. People, especially young people, are increasingly wary of revolving credit card debt. Instead, they prefer the clarity of fixed installment payments. Understanding different credit conditions, such as repayment terms, late fees, and eligibility criteria, is crucial for tailoring BNPL offerings to specific target audiences and improving competitiveness.

More than half of Americans currently use BNPL, and another 15% are expected to try it in 2025, according to the survey. For Gen Z, it’s often preferable to use credit cards for major purchases. The global market for BNPL services is valued at $343.5 billion in 2025 and is expected to jump by nearly 70% by 2030.

Of course, this rapid growth hasn’t gone unnoticed in the competitive market. As competition intensifies, with many BNPL providers entering the market, so does regulatory scrutiny. But this is good news, as quality assurance regulations in the US, UK, and EU are bringing structure and legitimacy to the market. Companies must comply with financial regulations and legal requirements such as KYC, AML, PCI DSS, and GDPR to ensure credibility, protect user data, and avoid costly adjustments. This creates a more stable and predictable environment for investment and buy now, pay later app development cost.

The core drivers behind this acceleration are clear:

- Rising competition in fintech & challenger banks

In the crowded digital banking space, offering BNPL is quickly becoming table stakes. As leading fintechs and challenger banks integrate these services, customer expectations have shifted. Users now see flexible payment options not as a perk but as a standard feature of any modern financial platform. The competitive landscape is a classic sign of the struggles facing fintech businesses in the era of commoditization.

For a fintech company, not offering buy now, pay later options means risking user churn. It has become a key tool for both acquiring new users looking for modern payment solutions and retaining existing ones. We will explore specific buy now, pay later examples later in this article.

- Regulatory momentum is catching up (in a good way)

The initial ‘Wild West’ era of BNPL is ending. Regulators in the US, UK, and Europe are establishing clear rules of the road, including requirements for more transparent terms and stronger affordability checks to protect consumers.

Regulatory clarity reduces ambiguity and builds consumer trust, making the buy now, pay later market a much more stable environment for strategic investment.

- Micro-lending turns into a market expansion strategy

A BNPL solution can often say ‘yes’ when traditional credit models would say ‘no’. By using alternative data for underwriting, these services can assess the risk of individuals with thin credit files. So, as we see, buy now, pay later technology is a powerful micro-lending engine that opens a path to serve underbanked populations and younger consumers. Here, off-card BNPL services can capture a whole new market segment.

- AI and data blend allows for smarter risk management

The magic behind instant approvals is a sophisticated blend of data and artificial intelligence. Modern BNPL platforms don’t just rely on a simple credit score. Their artificial intelligence (AI) models analyze hundreds of data points in real time: from a customer’s purchase history and repayment behavior to device information and other behavioral signals. This application is a perfect example of the broader impact of AI in fintech.

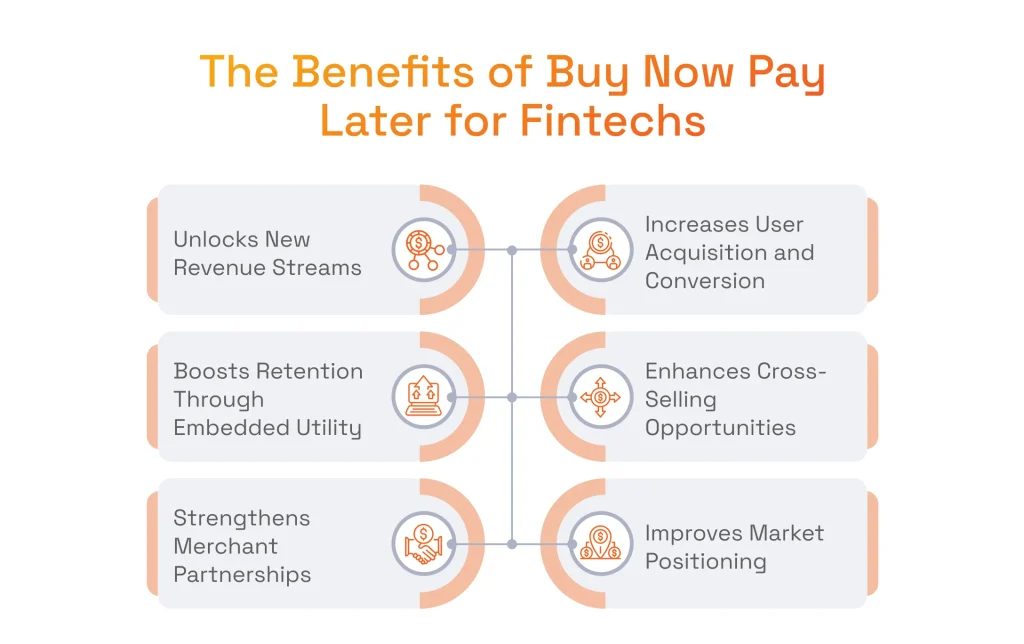

The Benefits of Buy Now, Pay Later Option for Fintechs

Integrating a buy now, pay later option is more than a defensive move to keep up with the market trends. It’s a strategic choice that delivers measurable advantages to your business and BNPL app development and impacts everything from top-line revenue to long-term customer loyalty.

Let’s talk about the benefits of BNPL services in greater detail.

- Unlocks new revenue streams

A BNPL business model opens new revenue channels, primarily through per-transaction merchant fees and overall cost structure. Depending on regulations, customer interest in longer-term plans can also generate revenue. This diversifies the income of your buy now, pay later business and offsets the BNPL app development cost. This fee is typically collected automatically through an integrated payment processing gateway at the point of sale.

- Increases user acquisition and conversion

Sticker shock is one of the biggest reasons for cart abandonment. BNPL removes that barrier by breaking down a large total into small, manageable payments. BNPL services can reduce cart abandonment rates by offering instant financing options at checkout, which encourages consumers to complete their purchases. Additionally, offering BNPL options can increase the average order value by 70%, as customers are more likely to spend more when they can pay in installments, helping you recoup the BNPL app development cost. Businesses on Stripe have seen up to a 14% increase in revenue on sessions where buy now, pay later was an option. This is especially true for high-ticket BNPL purchases, such as electronics or furniture. This converts more existing users and attracts new customers seeking this payment flexibility.

- Boosts retention through embedded utility

BNPL is naturally sticky. When a customer makes their first purchase, they enter your ecosystem. The repayment schedule, including upcoming payments, strengthens user engagement over weeks or months, supported by push notifications and alerts that remind users about installments and account activity, building customer loyalty. The quality of that digital engagement inside a buy now, pay later app, which often spans weeks or months, frequently hinges on the mobile app development services behind the platform.

Beyond repayment mechanics, BNPL software increasingly includes loyalty programs and rewards. Discounts, cashback, or exclusive offers encourage repeat purchases and strengthen long-term customer relationships, turning financing into a recurring engagement channel rather than a one-time transaction.

Unlike a one-off transaction, BNPL provides a utility customers rely on, making them more likely to return for repeat purchases. Loyalty programs and rewards within BNPL apps can further drive business growth by increasing customer retention and engagement, ultimately contributing to the business’s overall expansion. These programs often include discounts and special offers, which incentivize repeat purchases and increase customer engagement.

- Enhances cross-selling opportunities

A customer who trusts you with credit is a warm lead for other financial products. The customer data from your buy now, pay later technology is valuable. Once they are actively using your payment solution, introducing other investment tools is a natural next step, especially when customer support is reinforced through chatbot integrations that provide instant assistance at scale.

- Strengthens merchant partnerships

If you offer a white-label BNPL solution, you stop being just another vendor and become a growth partner. You’re providing merchants with a tool that offsets merchant fees and directly increases their conversion rates and average order values, making your service indispensable. You can provide data-backed intelligence on customer behavior and solidify a mutually beneficial relationship.

- Improves market positioning

Offering a data-driven BNPL app development service sends a clear signal: you understand the needs of today’s consumers. It’s especially effective for attracting a younger, tech-savvy demographic that actively seeks out brands that align with their financial habits and preferences. Ensuring seamless transactions through robust integrations is vital for a smooth user experience and operational efficiency in buy now, pay later app development.

Turning fintech product ideas into reality hinges on choosing the right partner. Wondering who leads the market?

Read our article on the best fintech development companies.

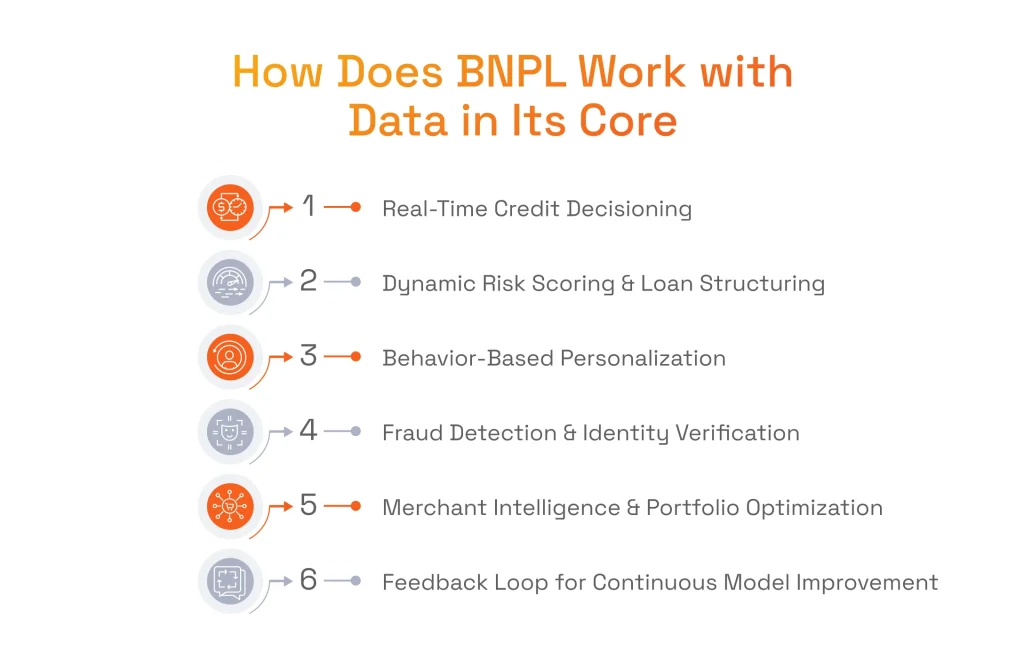

How Does BNPL Work with Data in Its Core

From the outside, buy now, pay later looks like a simple button on a checkout page, but that simplicity is deceptive. Behind the scenes, BNPL app development supports a high-speed, data-intensive lending product that works because it acts on massive volumes of information in milliseconds.

Here’s a look under the hood at how data powers every critical function of a successful BNPL platform.

Real-Time Credit Decisioning

While traditional lending takes days, BNPL payments take seconds. This speed is possible because automated engines instantly analyze data points far beyond a credit report, including purchase behavior, cart value, device ID, location, and transaction history.

Powerful AI models then calculate a user’s likelihood of repayment on the spot, opening up credit access for people who might be invisible to slower systems.

Dynamic Risk Scoring & Loan Structuring

No two customers or transactions are the same. A smart BNPL system knows this and uses custom scoring algorithms to structure loans dynamically instead of offering a flat credit limit.

Based on its real-time analysis, the platform instantly decides the appropriate loan limit, the number of installments, and whether to offer an interest-free period. A new customer buying a small-ticket item might get different terms than a long-time user with a perfect repayment history who is making a larger purchase.

Serhii Leleko

ML & AI Engineer at SPD Technology

“The core engineering challenge in BNPL is building a system that can trust a new user instantly. You can’t do that with a traditional credit score alone. You need a data model that understands context, weighing a user’s behavior against the product, merchant, and other real-time signals to make smart decisions on the spot.”

Behavior-Based Personalization

The data’s job isn’t done after the initial approval in most BNPL programs. Past transactions, shopping habits, repayment history, and even how a user interacts with your buy now, pay later app all feed into a continuous personalization loop. Insights help the platform make smarter decisions over time. Personalization can identify which users are good candidates for higher credit limits, who need a gentle payment reminder, and which accounts might require tighter restrictions to prevent defaults.

Fraud Detection & Identity Verification

The speed and accessibility of BNPL also make it a target for fraud. AI models act as a security team, trained to spot anomalies by integrating identity data like KYC inputs with behavioral indicators, such as typing speed or session time. It allows the system to flag deviations instantly, stopping fraudulent transactions and protecting your business. The methods used are often more advanced than traditional credit card fraud detection because they must happen in real time.

Merchant Intelligence & Portfolio Optimization

The speed and accessibility of BNPL also make it a target for fraud. AI models act as a security team, designed to protect customer data by spotting anomalies, while advanced security features such as biometric access and encryption safeguard user accounts and sensitive information. Data encryption is essential for protecting sensitive information in BNPL solutions. Robust data encryption helps prevent cyber attacks and ensures compliance with cybersecurity standards.

AI solutions integrate identity data, such as KYC inputs, with behavioral indicators, such as typing speed or session time. It allows the system to flag deviations instantly, stopping fraudulent transactions and protecting your business.

Feedback Loop for Continuous Model Improvement

Advanced BNPL solutions should get smarter with every transaction. Each data point is fed back into the system, be it a successful purchase, a declined payment, an early installment, or a late fee. The constant feedback loop continuously refines the credit scoring and fraud detection models. The result is a system that self-optimizes over time and improves approval rates for good customers while steadily reducing default rates and losses.

In short, data is the foundation of modern BNPL services. Without real-time analytics, automation, and adaptive learning models, the entire system becomes unsustainable at scale.

In our track record, there are many fintech solutions. For one of our clients, we built a reliable and scalable custom SMB funding platform. Our software solution became their growth engine, helping the company provide $350 million in financing to thousands of businesses.

Buy Now, Pay Later Examples

The biggest names in BNPL and app development companies didn’t get there by following a single definition. Each of them represents a distinct strategic bet on BNPL app development and how to win the competitive BNPL market. Looking at how they operate reveals the different ways BNPL services can be built to create value.

Klarna

Klarna is a leading buy now, pay later provider globally that originates in Sweden. The company went public in September 2025 and currently holds the largest market share in the BNPL space. Klarna operates as a licensed bank and offers a variety of financing options, including “Pay in 4” installments, “Pay in 30 days,” and longer-term financing. By integrating Klarna, merchants can offer flexible payment solutions to their customers, significantly improving the checkout experience.

Klarna’s comprehensive platform has cemented its position as one of the most recognized and widely used e-payment systems for e-commerce worldwide. This approach gives customers maximum choice and financial flexibility at checkout, while merchants benefit from Klarna managing credit risk and payment processing.

Apple Pay Later

Apple’s strategy in BNPL app development is all about ecosystem control. By funding Apple Pay Later from its own balance sheet, it maintains complete ownership of the user experience. The service is deeply integrated within Apple’s app development platform, including Apple Wallet, the Apple Card, and Apple Savings. The integration delivers an intuitive user interface that enables BNPL within users’ existing digital wallets.

Sezzle

Sezzle is another notable BNPL provider. Its “Sezzle Up” program allows users to build credit and was the first North American BNPL platform to report to major credit bureaus. Sezzle’s revenue more than doubled year-over-year in Q4 2024, with continued growth projected.

Affirm

Affirm is a leader in BNPL app development, a pure-play technology and data science company that offers a clear answer to the question of how BNPL works with sophisticated tech. Its core strength lies in its proprietary AI-powered underwriting models that assess risk in real-time using alternative data, not just traditional credit scores. This allows Affirm to confidently handle larger-ticket items and offer customized loan terms, often with simple interest, and flexible payment plans.

Affirm’s success is built on its advanced use of data to manage risk. Want to learn more about using intelligent fraud management?

Discover the details in our article on AI in fraud.

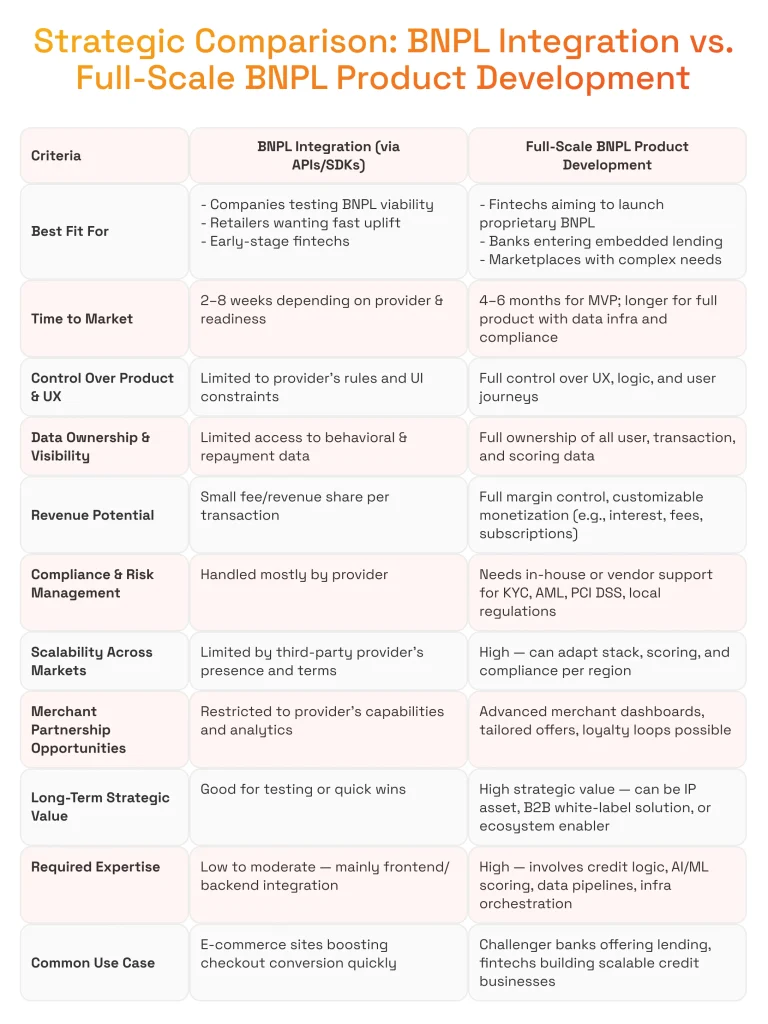

Two BNPL Technology Implementation Paths: Build or Integrate

Once you’ve decided to offer BNPL, the next critical decision is how to implement it. You need to choose the right platform and features, considering whether to develop a buy now, pay later app natively for iOS or Android, or to take a cross-platform approach to reach a broader audience more efficiently.

The choice between integrating a third-party service and building your own platform depends entirely on your strategic goals, resources, and long-term vision. Each path comes with its own set of fintech application development challenges overseen by a dedicated project manager, who ensures proper project planning and milestone-based delivery.

Here is a direct comparison of the two strategies.

Option 1: Building a Buy Now, Pay Later Product from Scratch

This is the path for companies investing in buy now, pay later app development that want to own their financial product, top to bottom. It’s the right choice for fintech app development companies building, for example, a proprietary lending service, marketplaces that need to control the full user journey, or banks aiming to offer white-label BNPL for business customers.

BNPL app development involves significant technical work, with full-cycle development from scratch typically taking 4 to 9 months:

- Developing the backend credit decisioning logic, a loan management system, and repayment workflows.

- Integrating KYC, fraud detection software, payment systems, and payment gateway APIs.

- Setting up the data infrastructure for credit scoring, risk analytics, and regulatory reporting.

- Creating the front-end components for checkout, user registration, profile management, visually appealing dashboards, and notifications.

Although higher development costs can range from $30,000 to $250,000 or more, depending on scope, the advantage is complete control over the user experience, data, app development cost, and the product roadmap. Complexity, delivery timelines, and integrated features are the main cost drivers here. Core factors include feature depth, delivery timelines, and the level of personalization required for risk models, dashboards, and merchant tools. Choosing the right platform early on is critical to keeping the overall project budget under control.

The investment needed for BNPL app development also depends on the team’s structure. Working with a full-service development company often costs more upfront than hiring freelancers, but it typically reduces long-term risks tied to security, compliance, and scalability. The geographic location of the development partner can further influence pricing, timelines, and communication efficiency.

You can innovate freely, creating proprietary scoring models. This platform becomes a core business asset that can be scaled or resold as a B2B service.

Serhii Leleko

ML & AI Engineer at SPD Technology

“Integrating a third-party solution means renting a BNPL service provider’s risk model; it’s fast, but your innovation is tied to their roadmap. Building your own platform means creating a data asset. Every customer interaction enriches your models over time, allowing for hyper-personalization and risk management that no off-the-shelf solution can match.”

Option 2: Integrating a Third-Party BNPL Service

This approach is about speed and efficiency. It’s a smart move for fintech apps or neobanks wanting to add BNPL as a feature without a massive upfront investment or for retailers looking to quickly increase conversion rates. It’s also a great way to test market demand and minimize development costs by outsourcing development.

Integration is a much lighter technical lift compared to building a BNPL solution from scratch:

- Connecting to a third-party BNPL service provider’s API, payment gateways, or embedding their SDK.

- Applying light branding and UX customizations to match your user interface.

- Syncing essential data like customer records and repayment statuses.

- Configuring transaction rules in the provider’s merchant admin dashboard.

You get to market fast with a lower initial app development cost. The BNPL service provider handles the heavy lifting of credit scoring, fraud management, secure payment processing, and most payment processing compliance regulations. It’s an effective way to offer a valuable feature to your customers without diverting your engineering team from its core mission.

Despite varying levels of technical complexity in buy now, pay later app development and the upfront costs, both paths require a BNPL app development company to ensure the solution is secure, scalable, and properly integrated with your existing systems.

Consider SPD Technology as Your BNPL App Development Company

Whether you choose buy now, pay later app development from scratch or integrate a third-party solution, success with BNPL solutions depends on a technology partner experienced in buy now, pay later software development, user experience, data science, and regulatory compliance. SPD Technology supports both tracks: from full-scale BNPL product engineering to smooth third-party integration and data pipeline development.

We bring a specific set of skills to the table that are critical for BNPL software development.

- Proven fintech product engineering track record: For years, our teams have delivered secure, scalable, and reliable fintech platforms. We understand the critical importance of ensuring data security in fintech applications from day one.

- Expertise in BNPL-enabling technologies: We work with the technologies that power modern BNPL software. Our expertise covers AI/ML, big data analytics, cloud-native architecture, and secure API development for BNPL services.

- AI/ML-driven decisioning systems: We have direct experience building the intelligent core of a BNPL solution. Our data science teams can develop custom AI/ML models for real-time risk scoring, fraud detection, and credit decisioning, making your platform truly competitive.

- Smooth integration capabilities: If integrating is the right path for you, we make sure the app development process is done right. We handle API connections, data synchronization, and UI embedding to ensure secure payment integrations seamlessly integrate with your existing ecosystem.

- Built-in regulatory readiness: We don’t treat compliance as an afterthought. Our BNPL development process includes building for regulatory requirements, such as KYC standards in banking, AML, and data privacy, from day one, helping you navigate legal rules and evolving market trends in the BNPL space.

Business-centric delivery: Our focus is on delivering measurable outcomes and optimizing business operations, not just code. We deliver high-quality BNPL app solutions that meet client expectations and regulatory standards. It doesn’t matter whether you want to increase conversion, enter new markets, or create new revenue streams, we work with you to understand your goals and ensure the technology we build directly supports them.Whether you choose to build a proprietary system or integrate a third-party solution, success depends on a technology partner who gets the nuances of user experience, data science, and regulatory compliance. SPD Technology supports both tracks: from full-scale BNPL product engineering to smooth third-party integration and data pipeline development.

We bring a specific set of skills to the table that are critical for modern fintech products.

- Proven fintech product engineering track record

For years, our teams have delivered secure, scalable, and reliable fintech platforms. We understand the critical importance of ensuring data security in fintech applications from day one. - Expertise in BNPL-enabling technologies

We work with the technologies that power modern buy now, pay later services. Our expertise covers AI/ML, big data analytics, cloud-native architecture, and secure API development for a solid technical foundation. - AI/ML-driven decisioning systems

We have direct experience building the intelligent core of a BNPL solution. Our data science teams can develop custom AI/ML models for real-time risk scoring, fraud detection, and credit decisioning, making your platform truly competitive. - Smooth integration capabilities

If integrating is the right path for you, we make sure it’s done right. We handle API connections, data synchronization, and UI embedding to ensure the third-party service works perfectly within your existing ecosystem. - Built-in regulatory readiness

We don’t treat compliance as an afterthought. Our development process includes building for regulatory requirements like the standards for KYC in banking, AML, and data privacy from day one to help you navigate the evolving legal rules in the BNPL space. - Business-centric delivery

Our focus is on delivering business results, not just code. It doesn’t matter whether you want to increase conversion, enter new markets, or create new revenue streams, we work with you to understand your goals and ensure the technology we build directly supports them.

Beyond the Plan: Your Next Step

The demand for BNPL is undeniable. It’s a clear path for fintech solutions to win new customers, increase conversion, and build deeper relationships that enhance customer engagement. But as we’ve seen, success with BNPL comes from mastering the technology that powers it.

We’re talking about real-time decisioning, AI-driven risk models, and secure data pipelines. Whether you choose to build your buy now, pay later app from the ground up or collaborate with a third-party BNPL service provider, the technical execution and quality assurance must be flawless, including thorough testing for security, performance, and regulatory compliance.

Ready to turn this market shift into a true competitive advantage? Our teams specialize in developing BNPL solutions that work at scale. Contact us to discuss your software development project.

FAQs

How is BNPL different from traditional financing or layaway?

BNPL gives you the item immediately, unlike layaway. Compared to credit cards, it offers fixed, interest-free installments, making it a simpler and more transparent financing option without revolving debt.

Which BNPL services are the most popular in the US and Europe?

In the US, services like Affirm, Afterpay, and Klarna are very popular. In Europe, Klarna is a dominant force alongside other regional players. Apple Pay Later is also gaining significant traction in markets where it’s available.

Is buy now, pay later safe to use?

Yes, reputable buy now, pay later (BNPL) technology providers use strong encryption and fraud detection to protect your data. Safety also depends on responsible use. Since it’s a loan, ensure you can afford the repayments to avoid late fees and protect your credit.