Fraud in finance is getting smarter. Generative AI could push U.S. losses from roughly $12 billion in 2023 to $40 billion by 2027, fuelled by deep-fake IDs minted in seconds, “refund-as-a-service” charge-back bots, and loose micro-rings that flood platforms with lots of tiny transactions to avoid detection. Legacy, rules-based scoring tools that were built for a slower, simpler world can’t keep up with today’s fast, varied fraud. AI tools, however, can spot hidden links in under 50 milliseconds and boost detection rates by up to 300%. So, how does the use of AI in fraud detection reshape the financial industry? This article delves into precisely that.

AI in Fraud Detection: From Static Rules to Self-Learning Engines

Early fraud prevention systems were mostly rule-based: they applied a handful of fixed rules, such as single purchase limits, daily velocity caps, or simple point scores, for risky factors like large amounts or foreign locations. If any rule was triggered, the transaction was stopped or pushed to a human reviewer. However, once fraudsters started using AI, ensuring data security in fintech applications required AI-based approaches as well.

The first step forward was supervised machine learning (ML). Models trained on historical fraud could scan every card swipe in milliseconds. They ran hundreds of risk tests per transaction, which was far faster and more nuanced than manual rule-tuning. Plus, these models updated themselves as patterns drift, and fraud teams could replace weekly rule pushes with continuous learning.

Today’s best AI-powered fraud prevention systems are even more advanced as they add defenses equipped with deep learning, graph analytics, behavioral analytics, and generative AI. These systems don’t wait for developers to rewrite code to detect specific fraudulent activities. Instead, they retrain on fresh data streams, discover hidden links across accounts, and recalibrate thresholds on the fly. In effect, the fraud stack has evolved from a static checklist into a living system that learns faster than attackers can pivot.

Serhii Leleko

ML & AI Engineer at SPD Technology

“When criminals light the match with AI, financial institutions must answer in kind, fighting fire with fire, to detect, adapt, and shut attacks down before money leaves the system”.

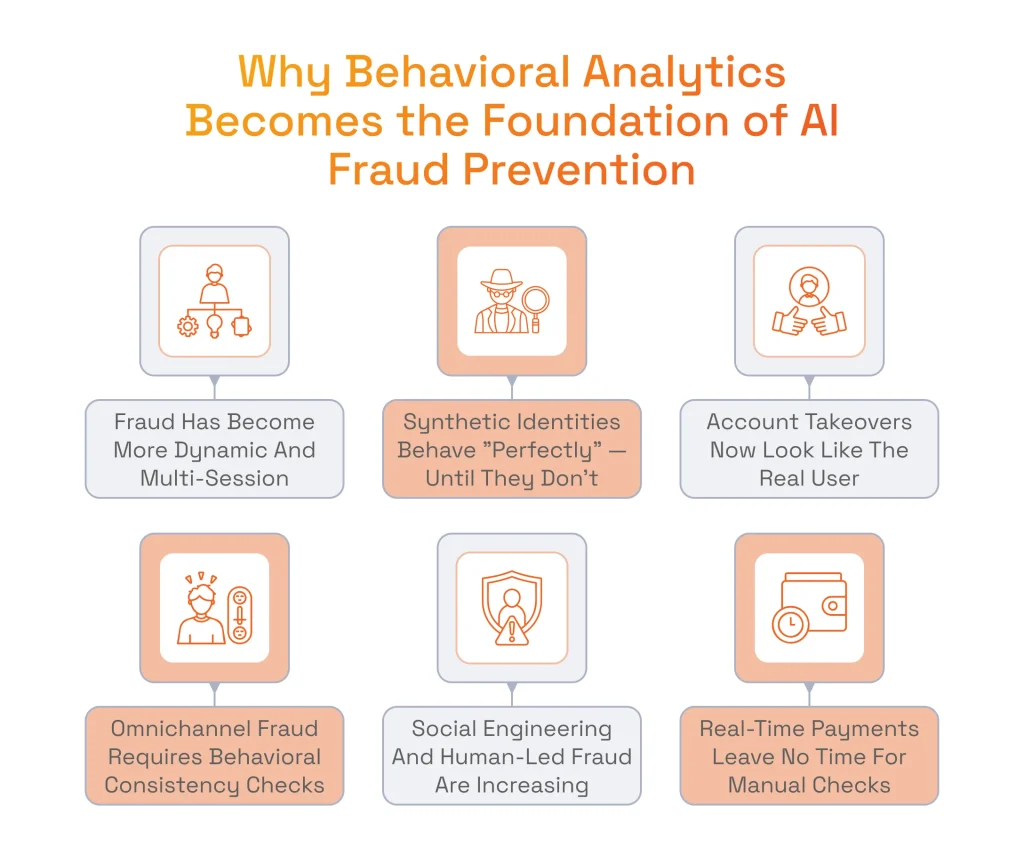

Why Behavioral Analytics Becomes the Foundation of AI-Powered Fraud Prevention

Behavioral analytics is one of the cornerstones of today’s AI-based fraud detection. It spots the slightest signs of potential fraud, such as keyboard cadence, mouse or swipe paths, field-editing rhythm, hesitation time, typical login hour, sequence of screens visited, etc. Then, these signs are fed to ML models, which create a baseline of each customer’s normal digital behavior and then flag any session that is different from that pattern. The need for behavioral analytics is driven by the factors we describe below.

Fraud Has Become More Dynamic and Multi-Session

Traditional fraud detection tuned for single events struggles in 2025 because attacks now unfold across dozens of small interactions spread over minutes, hours, or days. A fraudster might test a stolen card with a micro-purchase, add a new delivery address later, change account credentials from a different device, and execute the big cash out when risk systems have cooled down.

Static rules focus on one event at a time, so they miss slowly executed scams. However, behavioral analytics in AI-powered fraud detection tools stitches together every click and swipe across visits, which allows for revealing the whole plot and catching the fraud while it’s still in process.

Synthetic Identities Behave “Perfectly” — Until They Don’t

Synthetic identities hide behind valid data fragments, so their behavior looks legitimate at first glance. They put correct addresses, make reasonable purchase sizes, and use clean credit files. These fake identities make early life-cycle activity intentionally boring. However, once the credit limit grows large enough, the fraudster suddenly maxes all cards and vanishes.

Traditional rule systems either see nothing wrong or flag only at the final blow. In contrast, AI fraud detection systems with behavioral analytics record the subtle, statistical consistency expected from a real human: micro-pauses when typing familiar details, habitual login times, and typical navigation loops. When those micro-signals spread, the system spots the change and blocks transactions or accounts.

Account Takeovers Now Look Like the Real User

Fraudsters buy leaked passwords, copy device fingerprints and even route traffic through the victim’s city. To rule-based checks, fraudulent activity looks normal in such cases: same browser, same location, and same login ID. Yet, fraudsters act differently with all of that information: passwords are pasted instead of typing, browsers are flooded with pages the real owner never opens, locations are different from usual ones.

Fraud detection with machine learning and behavioral analytics tracks these tiny changes against the user’s personal baseline. The moment the activity feels “off,” it flags the session, and does it effectively, often before the thief can move any money.

Omnichannel Fraud Requires Behavioral Consistency Checks

Customers often switch between mobile apps, web browsers, and point-of-sale terminals, which creates a perfect window for fraudulent attack. Scammers choose the weakest channel and steal credentials, phish one-time passwords, empty phished one-time passwords, loyalty-point balance within a few minutes.

In such cases, traditional systems monitor each channel in isolation, so clues get lost when an attack occurs. Fraud detection using AI and behavioral analytics, on the contrary, spots cues from every touchpoint, forming a unified behavioral fingerprint independent of channel. When movement, timing, and gestures no longer align across devices, the system spots the cross-channel fraud and triggers an instant response action.

Deep-fake voices, scripted chatbots and spoofed phone numbers make it easy to fool customers into sending money to scammers. Because the victim passes every password check, normal rules see an approved user making a voluntary transfer. Nevertheless, the behavior or clicks changes: frantic mouse movements, longer pauses on warning screens, late-night logins, and text pasted from a fake “bank agent.”

Banking fraud prevention systems with behavioral analytics senses these signals by comparing them with the customer’s past, more balanced, behavior. Thus, it spots the difference and freezes the payment, asks extra questions, or alerts a financial institution employee who can intervene and see if the translation or any other activity is fraudulent.

Real-Time Payments Leave No Time for Manual Checks

Instant payment services, such as RTP, Faster Payments, and Pix, settle money in seconds. There is no pending state where analysts can double check a questionable transfer. If a bank waits even two minutes, the funds are long gone.

Only an automated payment fraud prevention system that scores behavior in real time can be helpful in this case. As a result, fraud detection software development is increasingly focused on building real-time systems that can handle high-speed transactions without compromising security. The behavioral analytics that lie in this system’s core analyze hundreds of the slightest fraud signs and instantly produce a risk score. Legitimate payments are approved, and suspicious ones stop before they empty the account.

Willing to dive deeper into how AI and ML prevent fraud?

Read our featured article on credit card fraud detection using machine learning!

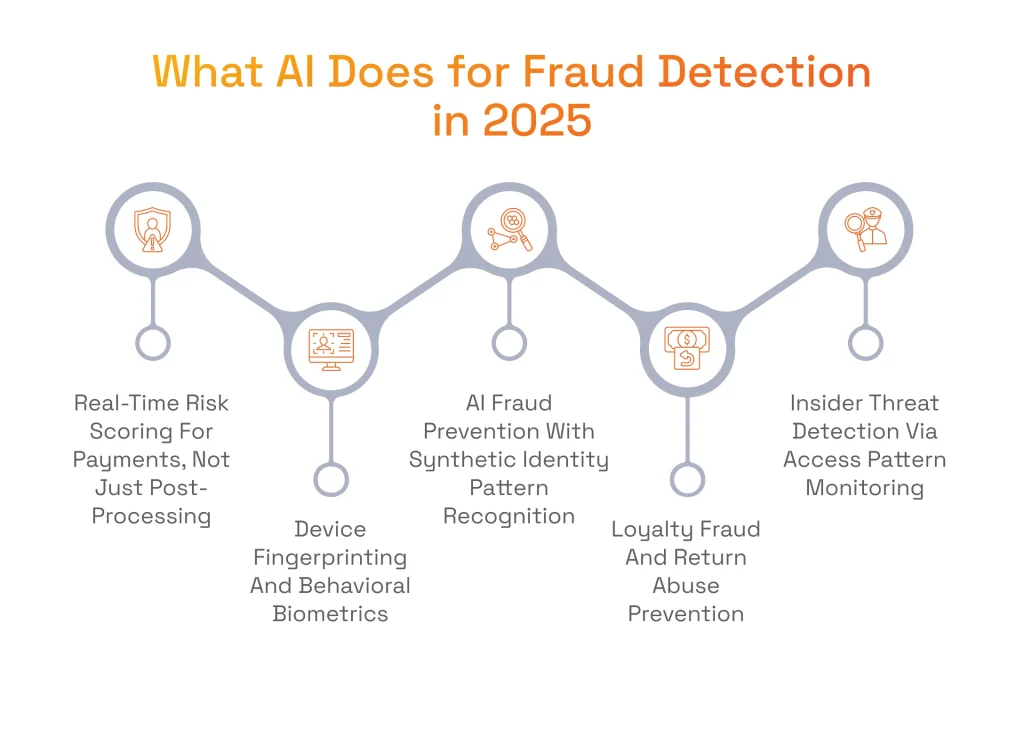

Beyond the Basics: What AI Does for Fraud Detection in 2025

AI and fraud detection are meant to work in tandem in 2025 due to the increasing complexity of financial threats. Enhancing fraud prevention systems with advanced AI/ML capabilities provides a number of enhancements listed below.

Real-Time Risk Scoring for Payments, Not Just Post-Processing

Today, emerging threats can be identified within 30–50 ms thanks to streaming AI pipelines in the mechanism of payment gateway fraud detection. These systems, which underwent merchant and transaction risk management features development, keep key signals like card history, device fingerprints, behavioral biometrics, and network graph links continuously refreshed in memory. As each transaction moves through the system, the pipeline instantly enriches it with these pre-cached features, runs a lightweight AI model at the gateway or POS, and returns a real-time risk score.

Device Fingerprinting and Behavioral Biometrics

Static device IDs are no longer enough. Luckily, AI in fraud detection systems combines simple fingerprints with sensor data such as phone tilt, battery patterns, typing speed, and operating-system signals. The model learns each customer’s usual digital journey and notices tiny changes, for example, pasting where the person normally types or swiping at a different angle. After every safe session the baseline is updated, so genuine users pass smoothly while impostors are stopped without extra passwords or CAPTCHAs.

AI Fraud Prevention with Synthetic Identity Pattern Recognition

With AI, fraud detection systems have the potential to spot synthetic identities even though those typically look flawless until cash out. These systems use graph neural networks that study millions of credit-line histories, address links, and bureau records to spot weak warning signs weeks before the fraudster strikes. Extra clues, such as shared devices, and sudden social media activity, help find fake identities even when little credit data exists, which significantly enhances credit card fraud detection.

Loyalty Fraud and Return Abuse Prevention

Modern AI fraud detection software has a reinforcement learning model that reviews buying rhythm, product mix, package-scan images, and courier GPS data to flag suspect returns in real time and prevent point farming and fake returns. Once the system detects signs that are out of the ordinary, it then recommends the lightest action that still protects margin, such as issuing store credit instead of cash. In loyalty programs, tokenised point wallets and live anomaly checks stop large point transfers if the instant scripted patterns diverge from normal returns.

Insider Threat Detection via Access Pattern Monitoring

AI-powered fraud detection has an analytical mechanism that allows spotting fraud that comes from the employees. This mechanism highlights the importance of data analytics in finance as it tracks every privileged click, query, and API call, comparing them with peer behavior and personal history. Unusual data exports in the night, sudden USB writes, or repeated lookups of sensitive tables trigger an automatic privilege downgrade and a discreet alert to security staff. By reading intent signals the system moves beyond simple logs to deliver context-aware protection against insider misuse.

Only established tech vendors can expertly navigate data analytics, AI/ML, and behavioral biometrics for fraud detection.

Find the best professionals in the field in our article on the best Fintech development companies.

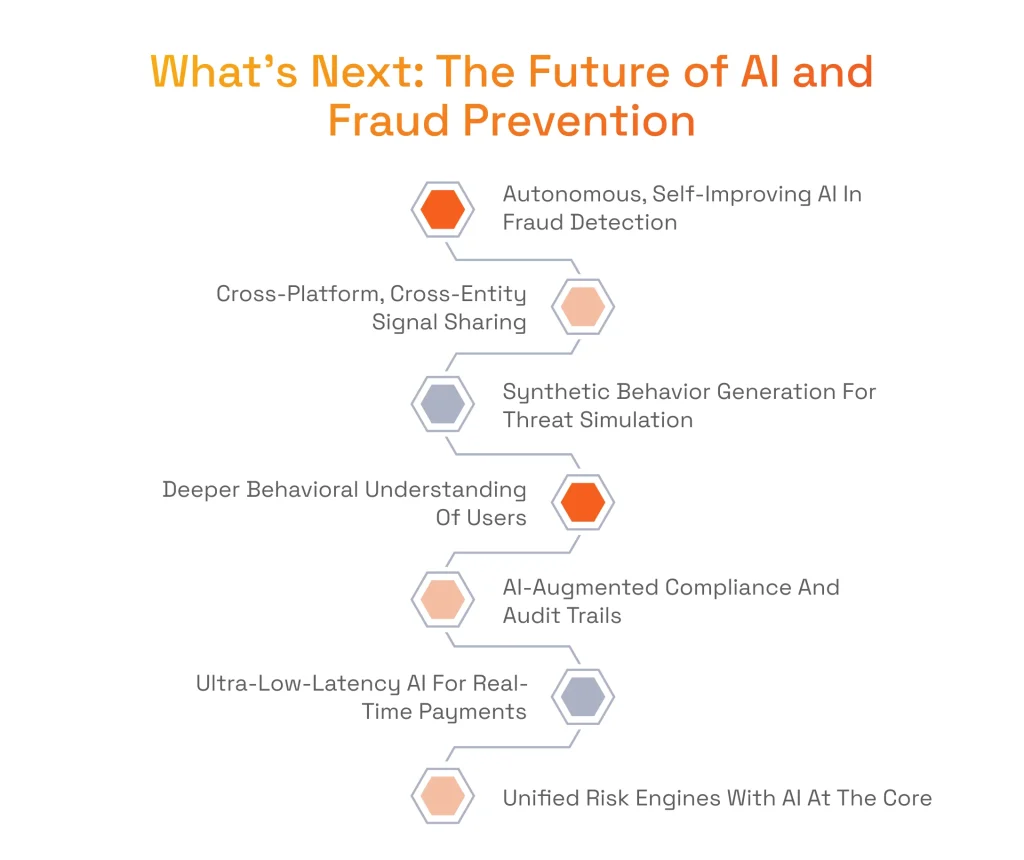

What’s Next: The Future of AI and Fraud Prevention

With AI, fraud detection can do even more than solving Fintech app development challenges of today. It can be more forward-thinking and become proactive or even autonomous in detecting threads. Below are the enhancements that we can expect in the near future.

Autonomous, Self-Improving AI in Fraud Detection

The next wave of AI fraud prevention engines will retrain themselves continuously, drawing from live feature stores and streaming labels to keep models constantly fresh. They are going to include:

- Continuous self-retraining from live feature stores and streaming labels keeps models always current.

- Meta learning that fine tunes hyper-parameters on the fly.

- Reinforcement learning that tests “policy nudges” safely in a sandbox.

- Guardrails set by risk teams (e.g., false-positive limits, CX impact).

- Counter measures instant deployment with tighter velocity caps, dynamic CVV tests, micro-authorisation limits.

Cross-Platform, Cross-Entity Signal Sharing

When each bank or merchant stores fraud data in its own silo, criminals can move between institutions undetected. For this reason, fraud detection with AI needs a shared model that can be used by several businesses to ensure a holistic financial threat prevention. Such systems with shared model will have the following capabilities:

- Federated learning that lets banks, PSPs, and merchants train shared models on encrypted updates, not raw data.

- Cross-entity pattern detection, including a single device opening accounts at multiple lenders.

- Data-clean rooms and confidential computing enclaves that share anonymised signals while allowing for seamless implementation of KYC standards, as well as GDPR and CCPA guidelines.

Synthetic Behavior Generation for Threat Simulation

The next frontier in proactive fraud defence is AI that doesn’t just respond to attacks, it creates them. Leveraging generative AI for fraud detection will help simulate fraud scenarios by mimicking human and bot behavior at scale. These synthetic simulations will pressure-test systems, helping security teams discover vulnerabilities before criminals do. AI fraud detection solutions with simulation will involve:

- Generative models trained on real fraud patterns to simulate emerging tactics.

- Synthetic user sessions that stress-test authentication systems, rate limits, and behavioral biometrics.

- Closed-loop simulations that continuously expose model weaknesses.

- Faster testing of new defences against complex multi-step fraud (e.g., social engineering + account takeover).

Deeper Behavioral Understanding of Users

AI for fraud prevention is evolving from simply flagging anomalies to understanding why users behave the way they do. With richer behavioral and contextual data, future systems will distinguish legitimate uncertainty from malicious intent and unlock more precise fraud prevention. This evolution will include:

- Multimodal AI that fuses typing speed, scrolling patterns, device tilt, and even facial cues.

- Real-time analysis of emotional state indicators, such as hesitation or rushed input.

- Personalised behavior baselines trained on long-term activity.

- Adaptive scoring that reflects context (e.g., urgency vs. coercion).

- Reduced false positives by better recognising legitimate behavior variations.

AI-Augmented Compliance and Audit Trails

With fraud payment processing compliance rules becoming more complex and global regulations tightening, requiring AI to show reasoning behind its actions. This is why AI-based compliance tools are expected to automatically generate audit logs, flag policy violations, and produce regulator-ready reports in real time. Using AI to detect fraud in accordance with compliance regulation will include:

- Explainable AI that shows why a transaction was flagged, declined, or escalated.

- Natural language reporting to generate compliant documentation for frameworks like PSD3, DORA, and the EU AI Act.

- Continuous monitoring of model fairness, accuracy, and bias.

- Real-time alerting on threshold breaches (e.g., false-positive rates, discriminatory impact).

Ultra-Low-Latency AI for Real-Time Payments

As instant payment rails like FedNow and SEPA Instant scale globally, fraud engines must match speed with precision to be able to prevent fraudulent transactions. Using AI for fraud detection will power decisions in under 50 ms, an engineering and intelligence challenge that demands new architectures with:

- Real-time model inference at the payment gateway or device level.

- Persistent in-memory feature stores for instant access to behavioral and transaction history.

- Distilled models running on GPUs or FPGAs for sub-second decisions.

- Adaptive batching and caching to reduce latency without affecting accuracy.

- Fraud scoring built into the authorisation path to meet hard settlement deadlines.

Unified Risk Engines with AI at the Core

Siloed fraud, AML, and credit risk systems create duplication, delays, and blind spots. The banking and financial services industry will use fraud prevention platforms with unified AI models that process all risk types from a single stream of events. This will help to deliver faster and more consistent decision-making. Such unified risk engines will offer:

- One orchestration layer to manage fraud, AML, sanctions, and credit scoring in parallel.

- Sub-models for specific risks that feed into a combined decision policy.

- Shared feature stores and graph networks to reduce data duplication.

- Global customer profiles updated in real time across all risk areas.

Such a combination of next-level AI and fraud prevention systems is inevitable if companies are thriving to accommodate their clients with top-tier security. At the same time, it poses a challenge for many companies as they need to adapt, acquire new expertise, and invest in advanced technologies to keep pace with technological breakthroughs. As one of the solutions, they can leverage the advantages of strategic technology consulting or even hire a dedicated development team. With such expert help, they can blend their Fintech expertise with AI-focused solutions delivery.

Conclusion

The role of AI in fraud detection is increasingly significant nowadays, as fraudsters also use AI and ML to target financial institutions with more sophisticated threats. These threats become dynamic, use synthetic identities, take over accounts, target omnichannel, and use social engineering. AI is often coupled with behavioral analytics, data analytics, and other technologies to fight fraud effectively. Thus, it becomes possible to enable real-time risk scoring, behavioral biometrics, synthetic identity pattern recognition, return abuse prevention, and access pattern monitoring.

In the future, using AI in fraud detection will help financial institutions fight attacks with autonomous self-improvement, cross-entity signal sharing, deeper behavioral understanding of users, AI-augmented compliance, and low-latency AI. If you want to start innovating your fraud detection systems to outrun competitors, you can ask us for expert help. With two decades of experience, Fintech expertise, and AI skills, we can deliver a tailored fraud detection solution that protects your business.

FAQ

Can AI Detect Emerging or Unknown Fraud Techniques?

Modern AI employs anomaly detection, graph analytics, and self-learning feedback loops to surface patterns unseen in training data, flagging emerging fraud tactics before static rules or human reviewers notice them.

How Quickly Can AI Systems Respond to Fraudulent Activity?

Leading payment risk AI scores each transaction within 50 ms, updating models in minutes from streaming feedback. That speed lets issuers or merchants block, step-up, or price transactions before authorisation completes.

Is AI-Based Fraud Detection Compliant with Regulations?

Yes, if architected properly. Explainable AI documents decisions, federated learning shields personal data, and continuous monitoring enforces PSD2, GDPR, DORA, plus EU AI Act limits on bias, fairness, and transparency.