Regulatory pressure is increasing, and banks have strengthened monitoring programs and filed more suspicious activity reports than ever, reaching 2.6 million in the U.S. in 2024. Financial crime is also rising, with the UN estimating that 2–5% of global GDP is laundered every year. At the same time, customers want fast onboarding, but Forrester reports that friction causes 54% of online financial applicants to abandon the process before finishing.

These challenges put institutions under pressure from all sides, which is why many are rethinking KYC end-to-end. This article explains how AI for KYC can speed up the process and strengthen security through automated verification and risk-based decisioning.

Key Takeaways:

- AI scales KYC with faster verification, smarter risk decisions, and continuous monitoring.

- Traditional KYC is weighed down by manual tasks, siloed data, static rules, and false positives.

- Pressure to strengthen KYC is rising due to regulators, growing digital volumes, and financial fraud.

- Data quality decides outcomes thanks to governance, secure pipelines, and privacy.

- Custom KYC software beats off-the-shelf when regulations, workflows, and integrations demand a KYC setup aligned with your data and systems.

What Is KYC and Why It Matters More Than Ever

As regulatory demands rise, financial crime risks grow, digital channels scale, customer expectations increase, and KYC requirements change, companies need a better approach to Know Your Customer (KYC).

KYC is the process financial institutions use to verify customer identities, understand how they use services, and confirm the legitimacy of people and businesses behind each account. It helps institutions check documents and ownership, sort customers by risk level, and spot warning signs of money laundering, terrorism financing, and other unlawful activities. This is especially important for payment processing compliance, AML and sanctions compliance, lending and credit decisions, and onboarding controls, all of which rely on understanding customer risk.

KYC is essential for regulatory compliance, stronger fraud prevention, and greater client trust. When done right, it leads to consistent decisions, less risk from suspicious activity, easier onboarding, and more clients willing to be part of trustworthy businesses. If KYC fails, companies can face fines, more fraud, and data breaches. This proves why ensuring data security in fintech applications, including implementing KYC, is critical.

Oleksandr Boiko

Delivery Director at SPD Technology

“Without KYC procedures, regulators can fine financial institutions and may revoke their licenses to protect consumers, the financial system, and the economy from systemic risk.”

The Limits of Traditional KYC Processes

Traditional KYC was built for a slower financial world and is not well-adjusted to process much larger onboarding volumes, digital channels, and fraud tactics that have outgrown manual reviews and rigid rules.

How Traditional KYC Systems Work

In many organizations, KYC still depends on manual document collection and rule-based checks that look for set risk indicators. Customer data comes from separate internal systems and outside sources, then gets combined into a mostly static risk score that rarely changes. Since rules can’t always understand context or complex cases, many decisions and exceptions go to analysts. This means there is a heavy reliance on human review for onboarding, resolving alerts, and documenting results.

Core Challenges of Traditional KYC Processes

Old KYC methods slow down onboarding due to manual task completion and hurt the customer experience with repeated requests, delays, errors, and inconsistent decisions. Rule-based systems also create many false positives and distract compliance teams from real risks. Simultaneously, static rules cannot keep up with new fraud types, including fast-moving patterns surfaced, for example, in credit card fraud detection, such as card-not-present fraud and account takeover. As a result, teams spend more time on minor issues instead of identifying new financial crime patterns.

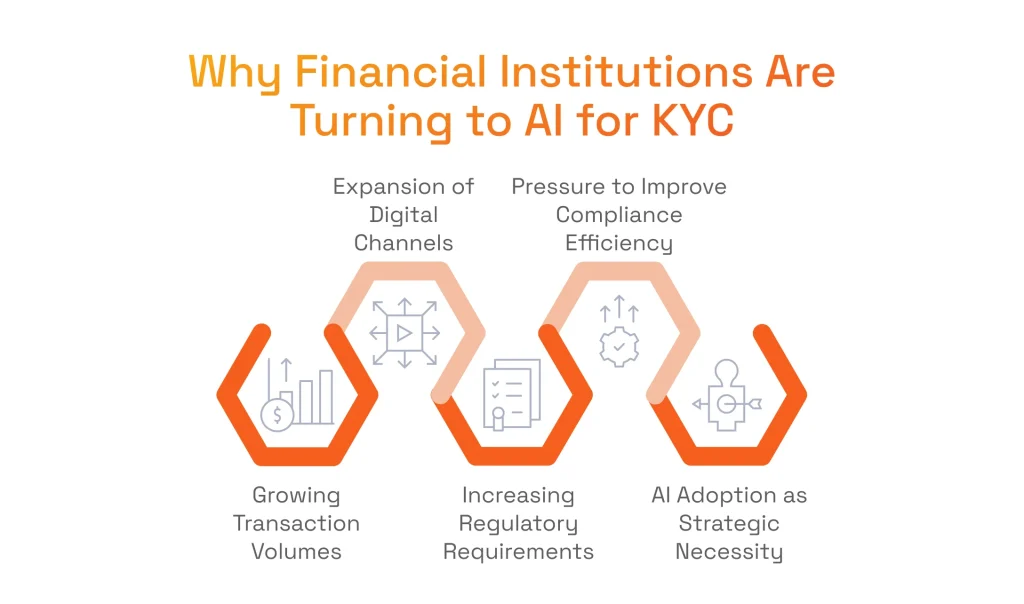

Why Financial Institutions Are Turning to AI for KYC

Traditional KYC processes slow the growth of financial entities and fintechs at the worst possible time, when they are trying to evolve without taking on more compliance risk, especially as fintech businesses in the era of commoditization compete on speed and customer experience. These methods make KYC teams face:

- Growing transaction volumes and digital channels: McKinsey notes the global payments industry handled 3.4 trillion transactions in various channels in 2023.

- Increasing regulatory requirements: Accenture reports more than 1,000 federal MRAs/MRIAs issued in 2024, alongside heavy remediation burdens.

- Pressure to improve compliance efficiency without slowing customer acquisition: A consumer survey found 68% of people abandoned a digital onboarding process for a banking product in 2022.

This is why the KYC software with AI capabilities has become a key tool for businesses. Gartner says finance AI adoption rose from 37% in 2023 to 58% in 2024, and stayed steady in 2025. The continuously rising demand for AI means that this technology helps organizations automate regular verifications, focus on the right cases, and support risk-based monitoring.

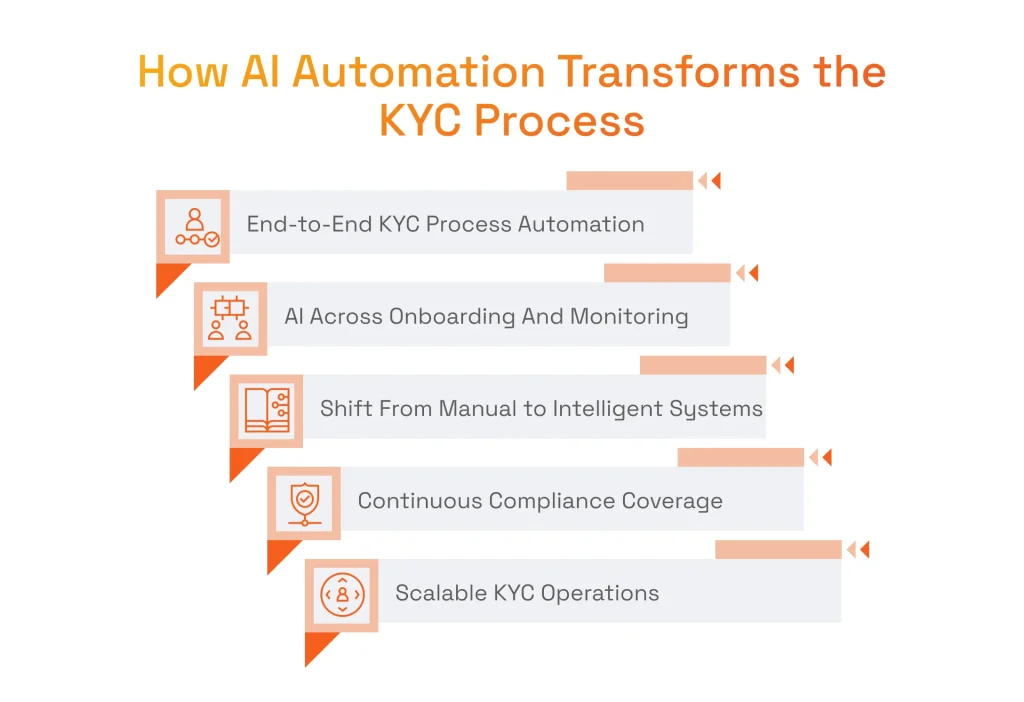

How AI Automation Transforms the KYC Process

Implementing KYC standards in banking, fintech platforms, payment processors, insurance providers, and more protects against money laundering and builds customer trust. That’s a given. Yet, AI automation takes KYC further.

Automated Identity Verification and Entity Verification

When companies decide to set up AI for KYC, they can automate customer verification by extracting and validating data from IDs, selfies, and supporting documents. Then, they can cross-check it against trusted internal or external data sources. For businesses, it can also verify entities and map beneficial ownership. This is done by linking corporate records and ownership signals. Computer vision, in its turn, helps detect tampering, forgery, and mismatches, while liveness and similarity checks reduce impersonation and synthetic identity fraud.

AI-Driven Risk Assessment and Fraud Detection

Instead of relying on static rules, machine learning models score risk using patterns in customer profiles, behavior, and historical outcomes. These models are beneficial for security measures, as they can surface non-obvious signals, such as unusual combinations of attributes or activity sequences, that often precede fraud or laundering. AI tools also support financial crime investigations. They focus on cases and group-related entities to highlight the most relevant evidence for analysts. Plus, they can learn from past false alarms and, this way, reduce false positives to improve detection quality.

Transaction Monitoring and Continuous Monitoring

Cutting-edge solutions with AI enable monitoring that adapts to how customers actually behave over time, across products and channels in the financial sector. It can analyze transactions in near real time to flag suspicious activity quickly and run post-transaction analysis to detect slower-moving patterns that rules miss. AI technologies also connect clues across accounts, devices, partners, and locations. This lets models spot unusual patterns and hidden connections that support financial crime compliance. KYC then moves from occasional checks to continuous monitoring, updating risk assessments as new information comes in.

Streamlining Customer Onboarding

AI models can automate manual processes, such as data capture, verification, and initial risk assessments. This way, low-risk customers move through identity verification more quickly, while only exceptions are routed for review. For many financial institutions, the use of AI technologies supports quicker, more consistent decisions by proposing outcomes with clear reasons and leaving final approval to humans when policy requires it.

Oleksandr Boiko

Delivery Director at SPD Technology

“Our clients note that leveraging AI and machine learning has given them control across their businesses. They get a stronger identity verification process, smarter monitoring, and fewer blind spots for financial crime. This happens without adding friction to onboarding.”

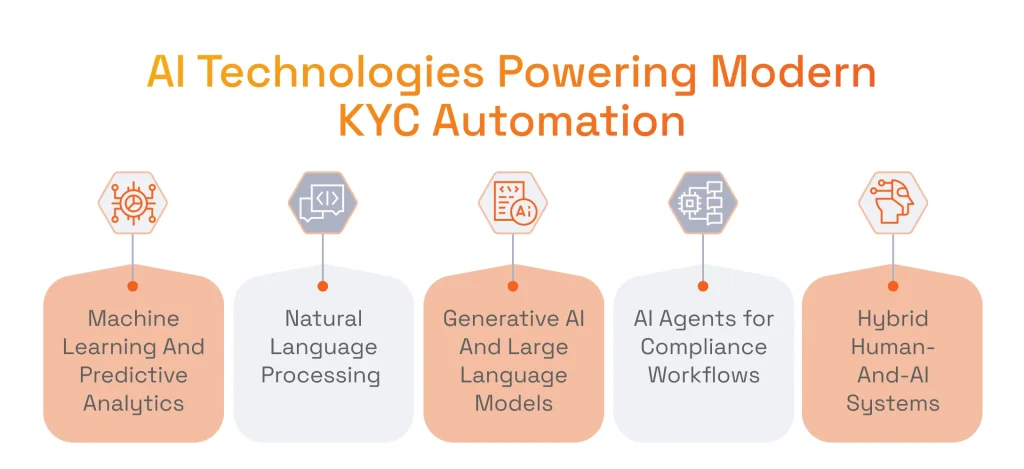

AI Technologies Powering Modern KYC Automation

AI tools used in modern fraud detection software development and KYC software creation streamline onboarding by coordinating multiple technologies, each optimized for different steps in the customer journey, and strengthen KYC compliance.

Machine Learning and Predictive Analytics

Financial teams that adopted innovative solutions powered by data analytics and machine learning, both supervised and unsupervised, were able to move beyond rigid rules in the KYC process. These tools improve risk assessment and enable anomaly identification throughout customer behavior and activity. Trained on historical outcomes and continuously refreshed, these tools can identify patterns linked to doubtful behavior earlier, reduce false positives, and support more consistent decisions across KYC workflows.

Natural Language Processing and Unstructured Data

Companies that want their compliance teams to analyze unstructured data, like IDs, corporate filings, contracts, and negative news, should use natural language processing (NLP) tools. NLP can extract important details, relationships, and warning signs from external sources and is especially helpful when key information is hidden in text rather than in structured databases.

Generative AI and Large Language Models in KYC

To speed up investigations, companies can use generative AI to summarize cases, draft narratives, and organize evidence for regulators. Large language models (LLMs) help analysts review complex alerts faster and cut down on manual work, but they need clear controls. These controls include using approved data, protecting sensitive information, and keeping audit trails. Thus, GenAI can be used responsibly in anti-money laundering and fraud detection programs.

AI Agents and Advanced AI Systems

Compliance departments turn to agentic AI when they need to orchestrate end-to-end workflows that unify data retrieval, scoring, alert triage, and documentation into a single assisted KYC process. For financial institutions, these systems can combine rules, predictive models, and LLM-based reasoning to automate routine activities. Yet, having AI agents does not mean departments do not need human reviewers. Quite the opposite, they are critical when decisions affect customer access, regulatory reporting, or potential money laundering risk.

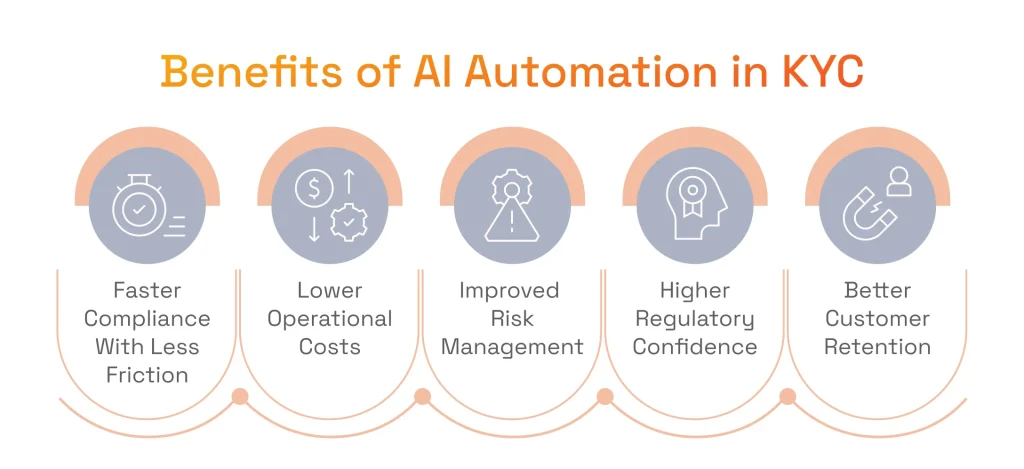

Benefits of AI Automation in KYC — Beyond Speed

AI automation makes the KYC process faster, error-free, and resilient. For example, in one of our projects, we built a merchant portal for Blackhawk Network’s (BHN), where onboarding verification was essential. We added OFAC screening and SSN/EIN checks to the registration process, automated approval logic, and synced verified data into Salesforce for better tracking. Below, we share the direct benefits of AI automation, illustrated by project results.

- Faster compliance with less friction: Companies can add checks directly into the user flow, automating data capture and only sending exceptions for review. In the BHN Merchant Portal, we built self-registration with OFAC and SSN/EIN checks into the onboarding process, removing manual steps.

- Lower operating costs without losing accuracy: Onboarding needs less manual efforts due to automated validation and consistent workflow rules. For BHN, we removed manual information collection, cutting onboarding time by seven times.

- Improved risk management and regulatory confidence: Companies can make verification workflows traceable and supporting data kept with each record. In BHN’s portal, authentication steps and approval logic were organized and synced into Salesforce, creating a clear audit trail and more consistent onboarding decisions.

- Reduced workload for compliance teams: Automating standard verification tasks and cutting down on unnecessary back-and-forth lowers the review burden and manual error. In the BHN project, moving onboarding verification to a self-service portal with automation removed much of the hands-on work.

- Improved customer onboarding and retention: Automation speeds up activation with clear steps and fewer delays. For BHN, the improved process helped bring in over 8,000 businesses in two years and supported growth in several programs.

- Better balance between automation and human review: AI automation is helpful for repeatable, policy-based decisions. It also makes sure that high-risk cases, exceptions, and unclear outcomes are sent to humans for review.

Data as the Foundation of AI-Powered KYC

AI only improves KYC when the underlying data is reliable. Models learn from what companies feed them, so poor-quality data with inconsistent labels, missing fields, and duplicate records can quickly spoil decisions and give little insight into why they decided that way. Strong data quality management is, therefore, a must for dependable KYC automation. This is especially true when verifying customer identities and screening higher-risk profiles such as politically exposed persons.

Effective AI-enhanced KYC depends on linking the right data points across systems. Financial institutions combine internal data (account history, device information, behavior, etc.) with external sources (sanctions lists, company registries, negative news, identity providers, etc.) to get a full view of each potential customer. When these inputs are standardized and well managed, they strengthen risk controls and improve fraud detection during onboarding and throughout the customer lifecycle.

Data security is just as important when using AI to automate KYC since the data involved is highly sensitive and confidential. For this reason, financial teams must implement access controls, encryption, retention policies, and auditable data pipelines. In this manner, they raise the chances of avoiding leaks and misuse. Because AI and machine learning models regularly require combining data from multiple systems and using it at a larger scale and frequency, weak governance can quickly affect onboarding and monitoring decisions. This puts financial institutions at risk of data leaks, regulatory penalties, and reputational harm.

Oleksandr Boiko

Delivery Director at SPD Technology

“Many clients ask for AI KYC automation expecting the model to take care of the main work, but data is no less important. No solid data engineering and governance — no meaningful automation.”

Key Risks and Considerations When Implementing AI in KYC

AI can modernize the entire KYC process, but only if it is used as thoroughly as any other high-stakes control. After all, financial services institutions value reliable decisions over just automation. So, these decisions must be auditable, explainable, and secure under regulatory scrutiny.

- Managing sensitive data with care: KYC automation gathers private customer data, so teams need strong access restrictions, encryption, retention policies, and monitoring across all connected data sources.

- Avoiding over-automation and blind trust in AI models: Models can be wrong because the data they’re fed isn’t always of perfect quality. This is why priority cases should undergo human review instead of relying only on automated approvals.

- Ethical aspects and transparency: Skewed training data or proxies can create space for bias that disadvantages some customer groups by mistake. To avoid this, companies must take care of clear governance to ensure fair treatment, consistent outcomes, and accountable decision logic.

- Ensuring explainability for regulators: An AI-based KYC system may affect approvals, risk levels, or monitoring decisions. So, financial institutions need transparent details and evidence trails to support regulatory compliance.

- Effortless integration with established systems: AI must blend into everyday work, such as case management, escalation processes, and reviewer tools. Otherwise, a poor fit means duplicate jobs, extra manual steps, and more slip-ups during new user setup.

In most cases, it is not always possible to take into account all the risks when implementing AI for KYC for the first time. However, ready-made software (even though off-the-shelf solutions may not always fit the specific business goals) offers a way to manage all these risks simultaneously.

Not sure how to choose the right KYC software?

See our list of the best KYC vendors and what they’re appreciated for.

When Custom KYC Software Matters More Than Off-the-Shelf Tools

Ready-made KYC tools can work for simple cases, but they often fall short when requirements differ by market, product, or customer type. Different regulations, risk levels, and business models require custom workflows, data sources, and evidence capture to meet KYC compliance and keep the onboarding process frictionless.

Conversely, when KYC software is developed to specifically fit the company’s processes, it lets teams tailor decision-making and automation to their operating model and set up, for example, specialized risk assessments, configurable review paths, or deeper integrations with internal systems. It also scales better over time because organizations can adapt controls, monitoring rules, and reporting as regulations and KYC practices evolve.

Building AI-Driven KYC Systems the Right Way

The development of AI-powered KYC tools begins by matching automation to core business goals and KYC compliance obligations. That means designing the system for auditability and transparency from day one. This includes feeding it high-quality data inputs and producing decisions that can be traced and explained. Equally important is human-in-the-loop decision-making for exceptions and high-risk cases.

For a successful AI setup for the KYC process, companies must recognize that this software should be a unified system with data flows, tailored processes, and seamless integration with existing systems. Only this perspective will allow businesses to cut busywork, elevate customer onboarding, and maintain oversight.

Why Experienced KYC Technology Partners Make the Difference

Companies that want to automate KYC often need to do it in a full-system approach. From the get-go, reliable results come down to smooth data handling, smart decision rules, and tracking proof from beginning to end. If companies skip solid upfront design, for example, automation will just amplify risks, pile on extra handiwork, and hurt KYC compliance rather than help it.

That’s why banks and financial firms gain a lot from teaming up with partners who have:

- AI/ML development expertise to create and test models, including safe use of generative AI, NLP, GenAI, and agentic AI, where they truly help;

- Data engineering experience to pull sources together, ensure top-notch data quality, and keep clear tracking from start to finish.

- Proven work in regulated fields to build strong controls, solid documentation, and review processes that hold up under inspection.

At SPD Technology, our team supports the development of custom KYC software for many financial companies. We design KYC systems with AI at its core, integrate automation into existing compliance workflows, and coordinate innovation with regulatory responsibility. In our project, we prioritize customer satisfaction and reduce exposure to data theft, regulatory fines, and remediation programs.

Looking for a team that can build custom KYC workflows and integrations?

Browse our list of the best fintech development companies.

Conclusion: AI Automation as the Future of KYC Compliance

The Know Your Customer (KYC) process, when combined with AI, addresses slow human verification, inconsistent risk decisions, and alert overload. While traditional systems commonly drain compliance teams, new AI-enhanced KYC systems using computer vision, NLP, GenAI, and other technologies drive faster identity verification, onboarding, transaction monitoring, and risk assessment with fewer errors. If you are looking for a solution like this for your business, we are happy to share our experience and expertise. Contact us, and our team will create a bespoke solution aligned with your goals.

FAQ

Can KYC Be Done by AI?

AI can perform many KYC tasks, like document checks, identity verification, screening, and risk scoring, but regulated programs still require human oversight, governance, and auditability for exceptions.

How to Use AI for KYC?

Use AI across the KYC lifecycle to:

- automate identity and document verification with computer vision;

- extract and validate customer data with NLP;

- run sanctions/PEP screening and adverse media monitoring;

- apply machine learning for risk scoring and anomaly detection;

- connect outputs to case management so exceptions go to human review.

What Is the KYC AI Model?

A KYC AI model is an ML system that estimates customer risk or flags anomalies.

Can KYC Be Automated?

Yes, much of KYC can be automated, but full automation is rare since high-risk cases and policy exceptions still need human review.