In the age of the unrelenting cyber fraud pandemic, payment gateways serve as safeguards that protect direct avenues into the well-being of financial institutions. Simultaneously, these safeguards become one of the main logical targets for malicious actors who use an ever growing range of means to exploit any possible vulnerabilities they have. Because of their instrumental role in securing financial flows, payment gateways need to be protected in a diverse range of ways every one of which must be taken into account and duly attended to to achieve a viable level of payment gateway security. More specifically, these techniques and approaches include Encryption (SSL/TLS), Tokenization (OAuth), Role-Based Access Control, and others.

In this article, we’ll find out in detail what protections your payment gateway needs, when in the solution delivery cycle they should be introduced, and how to implement them more optimally.

Approaching payment gateway security issues in any payment gateway development project should start with understanding payment processing compliance regulations.

Andrii Semitkin

Delivery Director at SPD Tech

“The existing payment processing compliance is not a mere regulatory formality, but a comprehensive security-related approach that helps ensure a high enough level of payment gateway security. It is also important to understand that the matters of payment gateway compliance and security are closely interconnected, and one cannot sufficiently ensure the required compliance without applying some of the security measures and techniques (like, for instance Data Encryption and Penetration testing)”

Because of this, it is necessary to first become familiar with the PCI DSS compliance and gain a sufficient understanding of what needs to be done for implementing KYC standards. What’s more, the issue of compliance remains relevant regardless of whether you choose to build a custom payment gateway or go for payment gateway integration. Correspondingly, the payment gateway security features that one should include and their related best practices fall roughly into two main groups, which we are going to discuss in the next sections.

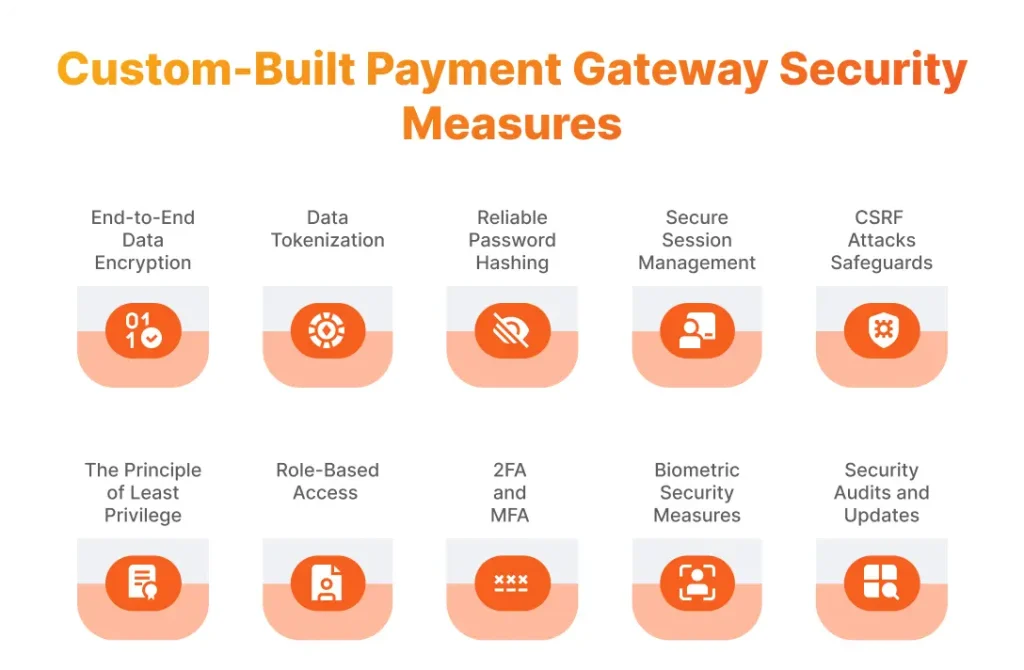

Achieving Payment Gateway Security During Custom Gateway Development Process

Let’s get started by discovering the security measures you have to keep an eye on when developing a payment gateway for your business from scratch.

Using End-to-End Data Encryption

Broadly used for data protection purposes otherwise, end-to-end Data Encryption plays a crucial role in securing transactional and cardholder data that a website collects at a checkout and transmits to a payment gateway for further processing. The data being collected and transmitted gets encrypted (or, in other words, converted into a coded message) by the website and then deciphered by the payment gateway.

One can say that employing strong protection algorithms dramatically reduces or, even, eliminates entirely the odds of data exposure or theft by malicious actors. However, to reach this effect, one should use a provenly robust encryption algorithm like, for example, AES 256 or Twofish. Notably, unlike the other major data protection approach called Data Tokenization we’ll dwell on next, Data Encryption is universal in terms of the kind of data it can be used to secure: this can be completely unstructured data for which Data Tokenization is not suitable. However, its considered to be a best practice to use Data Encryption in conjunction with Data Tokenization with a view to creating a more usable and optimal security combination.

Need more insights into ensuring fintech data security? Find them in our dedicated article!

Using Data Tokenization

Data Tokenization is a data protection technique that allows you to protect data by replacing sensitive data elements with non-sensitive substitutes, or tokens. Such a replacement makes it impossible to reverse the tokenized data to the original form, thus making it impossible for nefarious parties to intercept and use this information for illegal purposes. The tokens and original data points are linked with one another by means of a mapping system that has security safeguards of its own. Due to this, even having gained access to tokens, a malicious actor is unable to get hold of the sensitive information they are after.

As we’ve mentioned previously, Data Tokenization is usually used to protect structured data, like, for example, Social Security numbers or card numbers. In this sense, it is not as flexible as Data Encryption. Nevertheless, it does have another upside – with Data Tokenization, the sensitive data being tokenized never leaves the website the payment originates from, making this security approach superior to any encryption algorithm no matter how robust.

Implementing Reliable Password Hashing and Secure Password Storage

Software development is the stage during which you must necessarily address one more payment gateway security issue – reliably secure user passwords.

To achieve this, it is necessary to employ different password hashing algorithms. You should pick a hashing algorithm with proper salting, i.e. the function that adds random data and thus protects the solution against attacks that use precomputed tables. The best choice here would probably be Argon2, while two more viable options would be bcrypt (password-hashing function)and scrypt (password-based key derivation function).

Volodymyr Soska

Senior Software Engineer at SDP Tech

“At the same time, there are also hashing algorithms that are patently unsuitable for password hashing, including that in payment gateways. In particular, they include MD5 and SHA-256 that are way too fast as compared with the other algorithms, especially bycrypt. This allows an attacker to use a much larger number of password combinations and impairs these algorithms’ protective ability.”

While working with credentials, you should avoid hardcoding any sensitive information within the code. Also, one should make it into a policy to store only salted and hashed passwords.

Employing Secure Session Management Techniques

Secure Session Management is another aspect of ensuring robust payment gateway security.

First off, it is important to implement secure attributes to prevent the cookies sent by the application server from being sent in plain text and reviewed by parties that are not authorized to see them. A cookie that contains a secure attribute is sent with an encrypted request using the https:// protocol.

It is also necessary to implement proper timeout values to automatically log users out after a period of inactivity. This minimizes the risk of unauthorized access to an active session and reduces exposure to potential threats.

Implementing Safeguards Against Cross-Site Forgery Attacks

Cross-site forgery attacks pose a serious threat as they cause a user with authorized access to perform a hacker-induced action, for example, an action that is required to change user access rights, submit a transaction, or delete some data. To launch a successful forgery attack, a hacker needs a cookie-driven user session and knowledge of the parameters of the requests that they want executed.

For preventing a cross-site forgery attack, one should implement CSRF tokens – randomly generated unique session values the application sends to the client-side and gets back from there inside the request.

However, there are several requirements that need to be met here in order for the procedure to be secure. For instance, one should:

- Validate and use CSRF tokens in both POST and GET requests.

- List all tokens in the system and validate them against this list too.

- Link both the current user session and the cookie that is used for tracking this session.

- Set the application to perform the validation procedure at all times, and not only in those cases, when the session token is present.

Along with CSRF tokens, one can also use the Same-Site Cookie Prevention that restricts the origin a cookie and related requests can be sent from, as well as Custom Request Headers.

Implementing the Principle of Least Privilege and Role-Based Access (RBA)

The user clearance for any user actions in your payment gateway application must be based on the principle of Least Privilege, whereby all users must be able to access only those parts of the functionality and digital assets that they vitally need in accordance with their role in the system and the related needs, duties, and responsibilities. Proceeding from this principle, one must implement Role-Based Access to all the different functions across the application.

Correspondingly, it makes all the sense to spend time on outlining the needs and rights of the different roles in the application’s user hierarchy and reflect this information in the functional specification for the payment gateway security architecture.

Feel like getting lost in Software Requirements Specification? Discover how to write a SRS document step-by-step!

Implementing Two-Factor and Multifactor Authentication

No matter how complicated, conventional passwords have several drawbacks that make using them as the primary means of securing access to an application a hazard.

For example, they can get stolen. Or they can be hacked if they are not strong enough, and most users tend to limit themselves to meeting the minimum acceptable password requirements while composing their passwords. Because of this, there is a need to use some other security factor in conjunction with a conventional password to reliably user secure access to a payment gateway.

Two-Factor Authentication (2FA) has now become the norm and most often includes a SMS, a security token, or a phone call to the user’s mobile device as the second security factor. Of these three options, the SMS option is the least reliable one as an SMS represents plain unencrypted text hackers can sometimes intercept.

To make the protection even stronger, you can Increase the number of security factors. For example, you can do this by adding a USB token that contains an electronic signature, digital certificate, or biometric data. Unfortunately, this Multi-Factor (MFA) security combination would not be something most users would be comfortable with from the point of view of user friendliness.

A great way to create a very strong and user-friendly 2FA or MFA combination would be to add some reliable biometric Identity Verification method.

Using Biometrics-Based User Access

In fact, one can use Biometrics both as one of the factors in 2FA security combination and even as the only means of securing user access to a payment gateway. Some of the Biometric Identity Verification methods are considered to be reliable enough for the latter to be an option (although we’d still recommend using them in a 2FA combination). These methods are based on human biometrics that are impossible to fake and include:

- Fingerprint Scanning

- Vein Recognition

- Iris Recognition

- Voice Recognition.

Of these techniques, Iris Recognition and Voice Recognition are the most widely used and practicable ones as, unfortunately, techniques like Fingerprint Scanning or Vein Recognition require some specific types of devices. For Iris Recognition, you need a special IR camera or a mobile device with an iris scanner. Iris and Voice Recognition are considered to boast a 90-99% accuracy of the recognition result.

Performing Updates and Security Audits

Lastly, it is essential to not only know the specifics of fintech software development and use this knowledge, but also make sure your system’s security does not degrade over time and stays up to date. You must keep tabs on all the latest software patches and apply them to all the corresponding software components, including libraries and dependencies, in a timely manner. Additionally, to identify and eliminate various vulnerabilities, one must conduct regular security audits and make regular code reviews.

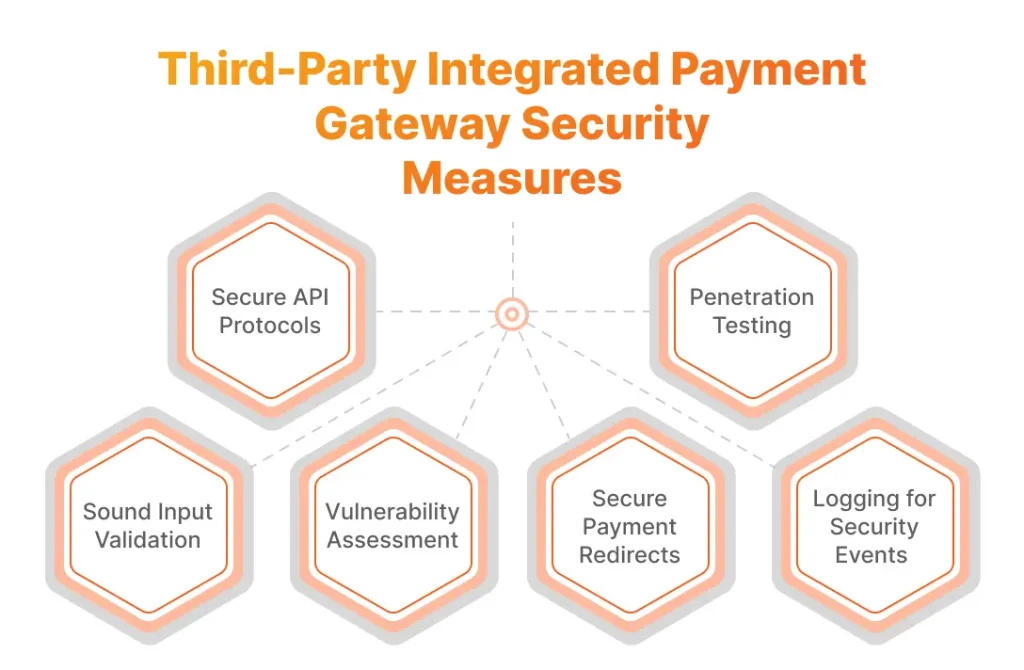

Implementing Payment Gateway Security During Payment Gateway Integration

In one of our recent articles, we explained how to integrate a payment gateway into your app. Now, let’s find out what payment gateway security measures you have to pay attention to when integrating a third party gateway solution into your payment processing system.

Using Secure API Protocols

During payment gateway integration, you need to reliably secure the APIs used to provide the interactions between your payment application and the payment gateway. For this purpose, one can use the https protocol that encrypts the data being transmitted and performs the related authentication. Also, in conjunction with the https, one should use TLS/SSL to add an additional layer of encryption to all your traffic.

Implementing Sound Input Validation

As a process, input validation allows you to counter injection attacks, like SQL injections and Cross-Site Scripting (XSS). For example, in the case of SQL attacks, hackers can use user-supplied data to insert malicious code into database queries. To preempt such attempts, one can use such input validation approaches, as:

- White lists – creating a list of characters and strings that are allowed to be used.

- Server side validation – using server-side validation in conjunction with client-side validation for the server to detect any malicious code that has bypassed the client side.

- Parameterized queries and prepared statements – using these types of queries and statements allows one to separate the user-supplied data from the SQL queries and thus prevent any malicious code from being injected into the SQL queries.

Similarly, for averting Cross-Site Scripting attacks, you can use both Input Validation with the help of regular expressions and other techniques, as well as a technique called Output Encoding. In the latter case, your system will encode all the user-provided inputs so that they are not interpreted as JavaScript or HTML code. It should also be mentioned that reliable protection against SQL injections and Cross-Site Scripting (XSS) can also be provided by Wall Application Firewalls (WAFs).

Conduct Regular Security Audits, Vulnerability Assessments, And Penetration Testing

To keep your system efficient at all times and rule out security breaches, you must conduct payment gateway security testing, security audits and vulnerability assessments on a regular basis. One should also pay most close attention to Penetration Testing that is, incidentally, mandated by PCI DSS: according to the PCI DSS regulation, this kind of testing is to be conducted at least once in 12 months.

Make sure your company is compliant with the latest regulations by using our PCI DSS compliance checklist!

Penetration testing essentially represents a security assessment that aims to detect any security vulnerabilities in the company’s infrastructure and applications by testing them from both inside and outside their network environment.

Using Secure Redirects in the Payment Process

Open URL redirection is a security hazard that occurs in those cases when one can specify the redirected URL from outside the application. Malicious actors most frequently use Open redirects to plant malware or launch a phishing attack, but sometimes they can also use it for Cross-Site Scripting.

To reduce the attack surface, you can:

- Impose a white list of the allowed redirects.

- Implement only the redirection requested by the application and exclude as much as possible any user input-related redirection.

- If user input is still required, limit the user inputs to http and https URLs only.

It should be mentioned that there are various tools, like, for example, automated security scanners, that allow you to find open redirect vulnerabilities in an application.

Implementing Logging For Security Events

Your payment gateway security requirements should include implementing a capability that logs any events related to enforcing your security policy and ensuring robust payment gateway security. In addition, this functionality must also enable your staff in charge to easily review the created logs for any unusual activities. In this sense, it may be very useful or, even, necessary to implement corresponding alerts and reminders.

Conclusion

A good understanding of the payment gateway security features and techniques and strict compliance with the payment gateway security standards are central to preventing online payment fraud associated with payment gateways. The multi-faceted and complex character of these processes and the relatively high complexity of payment software development as such make it quite hard for both client businesses and less experienced software providers to cope with the related challenges.

We, at SPD Tech, would be glad to help and share our practical experience, gained during our collaboration with industry-recognized payment processing and eCommerce companies. Our experts would be keen to answer your questions on payment gateway security and other technical issues your business may face.

FAQ

What is a secure payment gateway?

A secure payment gateway is one that has the full range of protections against the various existing kinds of fraud, supports secure storage of credentials and secure handling of cardholder and transactional data, and provides secure interactions with payment systems.

How to secure a payment gateway?

One should first ensure that the payment gateway is fully compliant with the relevant regulations and then implement all the main payment security features and techniques both during the payment gateway development and payment gateway integration phases.

How do I know that my payment gateway is secure?

To make sure your payment gateway is secure, you should conduct security audits, vulnerability assessments, and Penetration testing.