As digital transactions, customer interactions, and market dynamics generate massive amounts of data daily, financial businesses try to leverage that data and create actionable insights for better decisions. Business intelligence (BI) plays a central role here since it enables companies to systematically collect, integrate, analyze, and present this vast and diverse data in meaningful ways. This is why the global BI market was valued at $ 31.34 billion in 2024 and is projected to reach $ 63.17 billion by 2034.

Financial business intelligence (FBI) offers enhanced decision-making through real-time data analytics, improved forecasting with predictive analytics, strategic planning thanks to scenario modeling, and more. This article delves into its role, potential, complexities and proven ways to effectively implement financial BI for your organization.

The Growing Role of Business Intelligence in Financial Industry

73% of CFOs are using tools equipped with the latest technology to drive operations across the company. In finance, business intelligence is one of the advanced tools that powers decisions at every step of the process, from planning and budgeting to risk management. Yet, the most common and widely used components of BI are reporting and visualization.

Since the business impact of Big Data is evident in every operation in the financial industry, BI enables unlocking the full potential of that data via reports and dashboards. Reporting capabilities allow for the creation and distribution of standardized or customized reports. Meanwhile, data visualization techniques (graphs, charts, and heat maps) provide an interactive way to explore data. Consequently, operation teams receive the possibility of spotting trends or anomalies and interpret them to reveal the root causes of performance fluctuations, highlight potential cost-saving opportunities, and guide resource allocation. What’s more, BI introduces automation, which eliminates time-consuming manual input and reduces errors, thereby allowing professionals to focus on creative and high-value tasks.

What’s more, BI’s impact goes beyond operations and supports strategic endeavors. Finance BI empowers CFOs to shape long-term organizational direction. BI tools help CFOs utilize sophisticated analytics and predictive modeling to simulate such financial scenarios as shifts in market conditions or changes to operational costs, to make decisions that align with the company’s strategic goals. These insights support more precise forecasting and provide finance leaders with the possibilities to fine-tune budgets, optimize investments, and mitigate risks before they impact the company.

Advantages of Finance Business Intelligence

The financial organizations become more data-driven and create more value thanks to the beneficial impact of BI capabilities, such as:

- Enhanced Visibility: FBI eliminates data silos and creates a single source of truth to ensure that CFOs, finance managers, and other stakeholders can access consistent, up-to-date information once they need it. This makes it easier to identify trends, spot potential issues early, and align financial strategies across the organization.

- Proactive Decision-Making: Real-time dashboards in FBI enable finance teams to respond quickly to changing market conditions or internal performance shifts. Instead of waiting on batch reports or manual updates, employees who make decisions receive automatic alerts and live KPIs to be able to act on insights as soon as they arise.

- Scenario Planning: BI finance tools provide “what-if” modeling capabilities to allow finance leaders to simulate potential outcomes of different potential strategies. In this manner, financial leaders can have scenarios of the impact of changes in pricing, market demand, or operational costs.

- Investor and Stakeholder Confidence: FBI systems provide the ability to present data-driven reports by drawing on real-time data and advanced analytics. This helps deliver precise, transparent information about financial health for external parties.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“Today, it is impossible to imagine a financial company without BI tools integrated into their everyday processes. As regulations change, the market fluctuates, and customers perform endless transactions, only BI can help unify this endless flood of information and make effective use of it.”

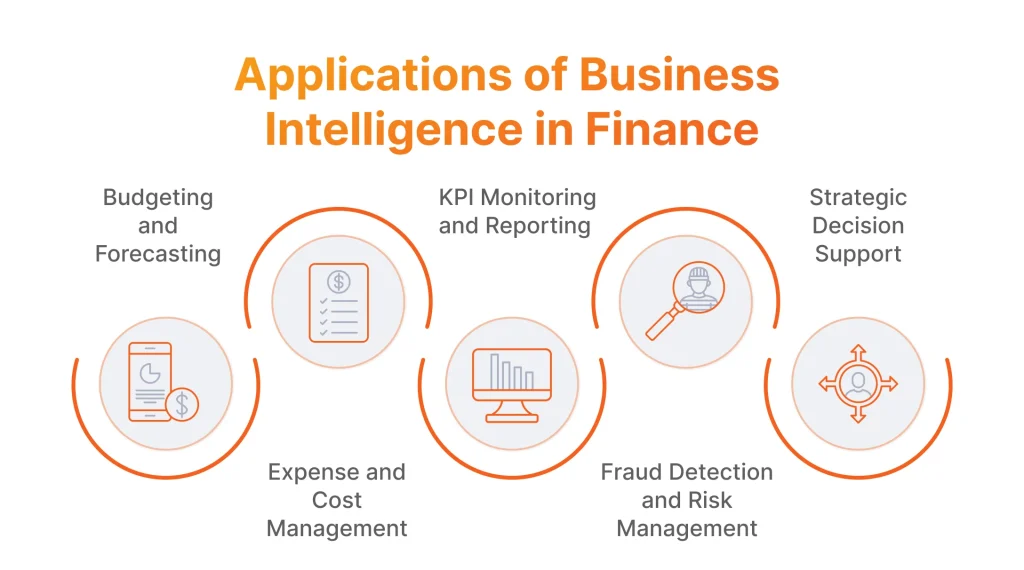

Applications of Business Intelligence in Financial Services

In financial services, business intelligence covers a range of critical activities thanks to its abilities to process vast amounts of data, identify trends, and deliver actionable insights in real-time. Below are some of the key areas where BI plays a pivotal role.

Budgeting and Forecasting

BI introduces advanced analytics features, including predictive modeling and scenario analysis to refine financial estimates. This allows finance professionals to see past expenses, revenues, cash flows, and profit margins as well as changes in consumer behavior, technological advancements, regulatory shifts, and live updates on cash balances, transaction volumes, account receivables and payables.

By doing so, they get a holistic perspective of financial information to come up with prognosis on the future budgets without the need for manually juggling multiple spreadsheets and disparate data sources. Additionally, this data can be visualized, making it much easier for stakeholders to interpret complex forecasting models.

Expense and Cost Management

To scrutinize countless transactions for understanding where and how financial resources are being used, BI tools enable intelligent automation that covers the aggregation of expense data across several sources. This makes it possible for finance managers to utilize interactive dashboards to analyze spending trends, pinpoint cost drivers, and identify inefficiencies almost in real time. In such a way, they achieve visibility of spendings and can get control over expenses to make sure that the organization maintains optimal profit margins.

KPI Monitoring and Reporting

Business intelligence is usually backed up by advanced analytics, and data analytics in finance allows assessing financial health by tracking KPIs (revenue growth, profit margins, liquidity ratios, etc.) and consolidating this data into concise reports or even dashboards. This leads to a centralized view that provides stakeholders with an accurate big picture of organizational performance. This reporting can be further set up to be done automatically for timely insights and quick addressing of performance issues, gaps, or inconsistencies. Thus, financial organizations ensure continuous improvement and a data-driven approach to company’s growth.

Fraud Detection and Risk Management

To prevent fraud and manage risks, it is essential to analyze massive volumes of transactional data, preferably in real time. With business intelligence, finance organizations apply BI tools for credit card fraud detection, identity theft prevention, money laundering control, and more. It can be done since BI-driven tools are powered by advanced analytics and ML to recognize specific patterns (unusual transaction frequency, sudden changes in account behavior, user anomalies, etc.) and act to mitigate them. What’s more, BI-driven scenario analysis allows risk management teams to try out several scenarios for stress factors and understand how to approach the most vulnerable aspects of their systems.

Strategic Decision Support

BI tools help to make the most out of market trends, competitive positioning, and internal operational efficiencies. The primary benefit here comes from the fusion of advanced analytics and scenario simulation. The first gives executives the power to evaluate potential acquisitions, new product lines, or geographic expansions, collect key indicators (market share, customer segments, profitability metrics, etc.), and map strategic initiatives based on them. The second allows testing the potential performance of these initiatives under various conditions to enable executives to anticipate possible outcomes.

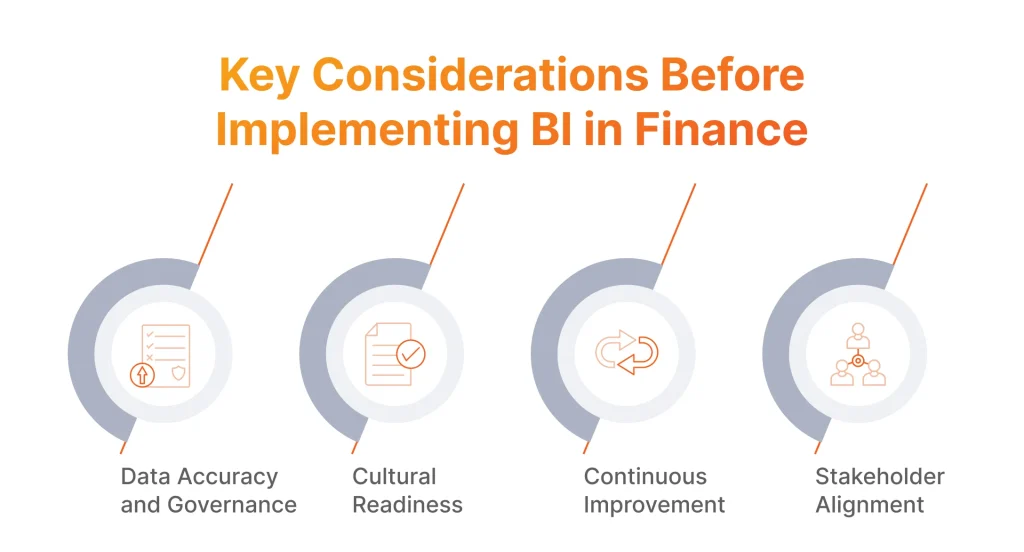

Key Considerations Before Implementing Business Intelligence for Financial Services

While many financial organizations are willing to enable business intelligence in their operations, only a few can actually do it: those who invested efforts into reshaping their companies’ culture and processes. To become one of the companies with BI-enabled functions, you need to address the following factors.

- Data Accuracy and Governance: Without clean data, even the most advanced BI tools will deliver unreliable insights and even lead to losses. In fact, Gartner estimates that poor data quality leads to an average loss of $12.9 million annually. To avoid these risks, organizations should establish clear data governance policies that define data ownership, standardize data formats, and set protocols for data validation. These policies often include regular audits, automated cleansing routines, and clearly documented procedures for handling exceptions or discrepancies.

- Cultural Readiness: Implementing BI does not only require tech expertise. It also involves shifting how teams operate. A data-driven culture encourages all employees to use data as the foundation for making decisions. Such a cultural change demands continuous education, clear communication of benefits, and visible support from leadership.

- Continuous Improvement: Financial BI should be viewed as an evolving, iterative process rather than a one-time project. Initial deployments may scare the employees as they reveal user adoption challenges, data quality issues, or feature gaps in BI platforms. Instead of quitting data initiatives, organizations should embrace them as learning opportunities and collect feedback to further refine processes.

- Stakeholder Alignment: Securing buy-in from key stakeholders, including C-level executives, finance managers, IT teams, and end-users, lays the groundwork for seamless BI adoption. Early involvement of leadership is particularly critical: when executives prioritize BI initiatives, it sets an example that data-driven decision-making is now a business core principle. Hence, they can help unlock budget resources, facilitate cross-departmental collaboration, and remove organizational barriers that might hinder BI adoption.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“Adopting BI is a multifaceted process. It requires thorough planning and coordination for integrating BI tools with data infrastructure, aligning with strategic goals, training employees, fostering a data-driven culture, and ensuring IT-business collaboration.”

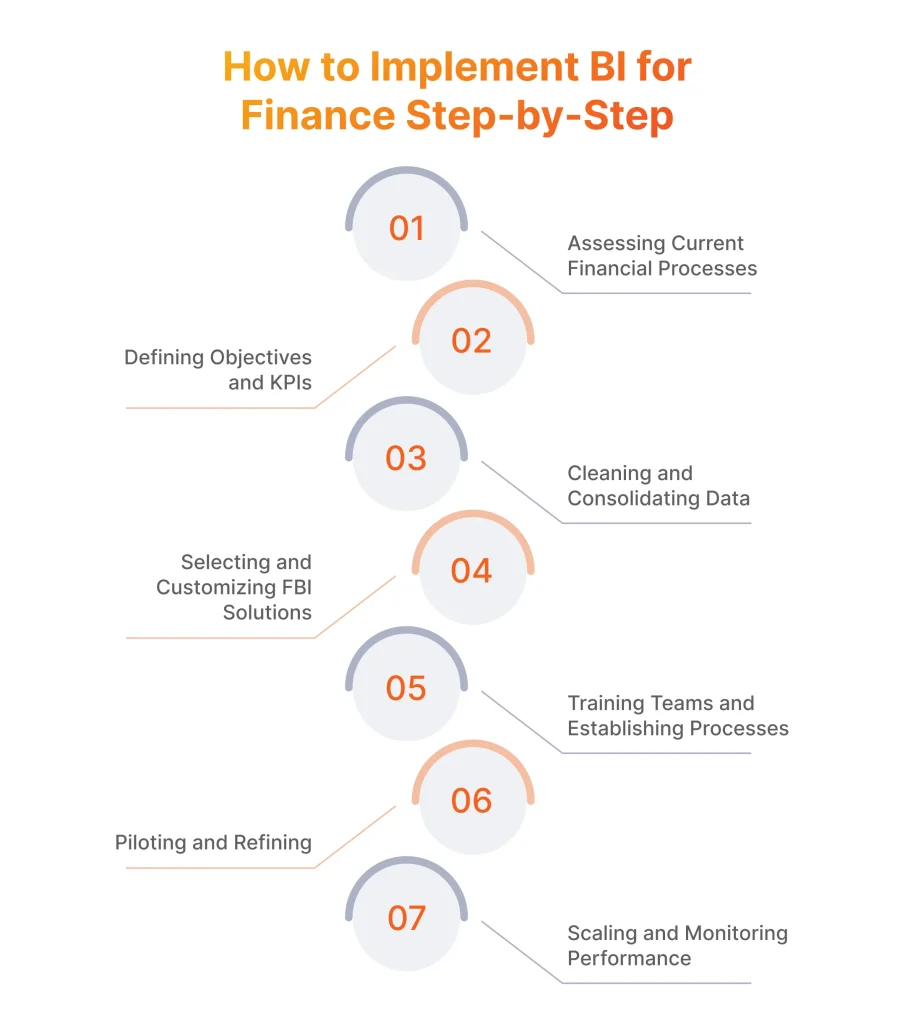

BI for Finance: Step-by-Step Instruction to Strategic Implementation

We always suggest our clients to perform the integration of business intelligence in finance operations with a phased approach. By making one step at a time, the company can achieve a more mindful and productive BI implementation that ultimately yields substantial results in the company’s operation optimization.

Step 1: Assessing Current Financial Processes

We always recommend starting BI implementation with the evaluation of existing financial processes and workflows. In this fashion, the business gets the chance to map out how information currently moves through the organization, pinpoint gaps in data accessibility, and highlight areas of unnecessary complexity. At the same time, the company can identify pain points, such as data silos, manual reporting tasks, or redundant activities to be ready to address them in the next stages. By the end of this step, the company will see exactly where BI can bring the greatest value and how it should be integrated into the day-to-day operations.

Step 2: Defining Objectives and KPIs

Before putting any BI technology into practice, it’s vital to clarify what the organization hopes to achieve with it. For that, the business needs to set specific objectives, such as reducing reporting time, improving accuracy in forecasting, or enhancing risk management. With these goals in mind, they can establish clear KPIs like the speed of financial close, forecast variance, or fraud detection rates. Thus, organizations can maintain focus on delivering tangible business outcomes rather than utilizing BI tools for technology’s sake alone.

Step 3: Cleaning and Consolidating Data

We always state that high-quality, well-governed data rules an effective BI implementation. This is why we usually advise companies to cleanse, standardize, and combine data from multiple sources before actually integrating BI tools. All data from spreadsheets, legacy systems, or disparate databases must be free from duplicate entries, consistent in data fields, and uniform in coding structures.

Step 4: Selecting and Customizing FBI Solutions

With clear objectives and reliable data in place, companies can move forward and evaluate different BI platforms that are suitable for the financial sector and their goals in particular. This entails comparing features like data visualization, predictive analytics, and integrated reporting capabilities. However, not all the off-the-shelf solutions can accommodate the unique processes or regulatory requirements that a company may face. In that case, additional customization can make sure the tool can cover the necessary requirements for scalability, usability, or functionality.

Step 5: Training Teams and Establishing Processes

Even the most advanced business intelligence for financial services can only deliver value when users understand how to use them effectively. This is why we stress the importance of training on the new platforms and associated processes to our clients. During training sessions, like workshops or regular meetings, the company’s employees can understand how automated reporting, real-time dashboards, or predictive modeling work. At the same time, during such sessions, it is important to establish clear workflows for data entry, validation, and analysis in order to make sure data is always ready for BI processes from now on.

Step 6: Piloting and Refining

Before a full-scale rollout, organizations benefit from a pilot project or proof of concept with a limited scope. For example, we usually suggest running a BI tool solely for a specific financial process. In such a way, the organization can identify any technical bottlenecks, user adoption hurdles, or data integrity issues, collect feedback and address bugs and implement functionality improvements.

Step 7: Scaling and Monitoring Performance

Once the pilot has proven successful, finance organizations can scale the BI solution to additional departments, regions, or use cases. At this stage, continuous monitoring of performance and reviews against defined KPIs is crucial for demonstrating value to stakeholders. This ongoing evaluation ensures that the BI solution remains aligned with the organization’s overall strategies and objectives.

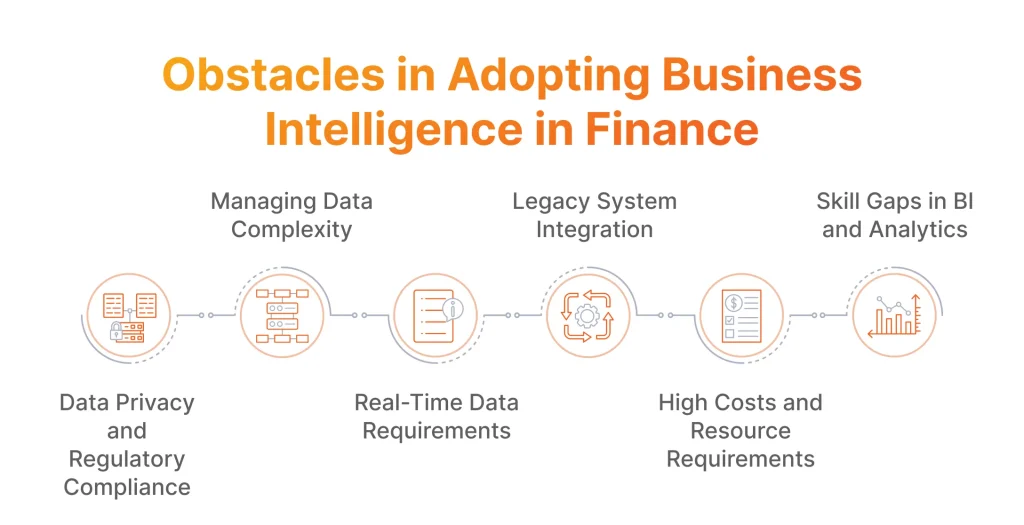

Obstacles in Adopting Business Intelligence in Finance

While there are some significant FinTech app development challenges, overcoming them is not an easy yet totally doable task. When it comes to additional integration of business intelligence, financial services application development gains another layer of complexity. However, we overcame these challenges not even once. Below we share how.

Data Privacy and Regulatory Compliance

Ensuring data security in FinTech apps is of paramount importance, since they store highly sensitive information. This data can be a subject to identity theft, unauthorized access, and various cyberattacks that compromise both user trust and the integrity of the financial services companies. At the same time, financial organizations need to deal with regulations like GDPR, PCI DSS, and various banking mandates. We always help our clients to comply with regulatory standards in order to prevent them from being subjected to significant fines.

To navigate these challenges, we:

- Develop clear data governance frameworks that outline data ownership, access controls, and usage policies.

- Implement KYC standards to verify customer identities, ensure regulatory compliance, and prevent fraudulent activities.

- Use BI tools with built-in compliance features, automated reporting, and real-time alerts to quickly identify potential breaches.

- Incorporate encryption, tokenization, and de-identification techniques to minimize exposure of personally identifiable information.

Managing Data Complexity

As mentioned above, financial companies accumulate vast amounts of data from transactions, customer records, market feeds, and other sources. This variety of data formats and volume can complicate data integration, cleansing, and analysis. Consequently, this can result in inefficient implementation of business intelligence in financial services that generate inconsistent or even unreliable insights.

To address this obstacle, our team:

- Standardize data formats and naming conventions to reduce confusion and inconsistency.

- Employ ETL processes or data virtualization solutions to manage and unify data from disparate sources.

Real-Time Data Requirements

Our clients working in the financial sector always state the importance of timely decisions and ask us to eliminate any delays in data availability or analysis when we collaborate with them on BI tools development or integration. This is important as it allows companies to seize more opportunities and decrease risks. Ensuring real-time or near-real-time data feeds demands advanced infrastructure and optimized processes, which can be challenging to implement.

To manage this complexity, we:

- Invest in real-time processing engines to capture and process data continuously.

- Use in-memory databases and distributed computing to handle large volumes of live data quickly.

- Implement real-time dashboards and alerts to quickly identify bottlenecks or delays in data pipelines.

Legacy System Integration

Many financial institutions rely on older core banking systems, mainframes, and proprietary solutions that do not natively integrate with modern BI platforms and can not exchange data with them seamlessly. However, the importance of data integration and system interoperability is obvious here as it supports analytics and ensures timely insights by providing a unified view of all financial data.

To make legacy system works seamlessly with BI tools, we:

- Use APIs and middleware connectors to bridge legacy and modern systems without extensive rewrites.

- Perform migration with prioritizing high-impact modules to spread out costs and reduce risks associated with large-scale overhauls.

- Employ a virtualization layer to allow BI tools to access data from legacy systems in near-real-time without fully restructuring them.

High Costs and Resource Requirements

Deploying BI tools, hiring skilled professionals, and maintaining advanced analytics platforms often requires substantial expenses. From our experience, this is especially painful for smaller or mid-tier financial institutions that may struggle to justify these costs, especially without instant ROI.

We usually solve this problem with the following tactics:

- Leverage the benefits of cloud computing to minimize upfront hardware and infrastructure investments.

- Focus initial BI efforts on the most value-adding or cost-saving areas to demonstrate quick wins.

- Combine open-source analytics solutions with commercial platforms to reduce licensing fees.

- Opt for solutions that can scale up or down based on usage, preventing overinvestment in underutilized resources.

Skill Gaps in BI and Analytics

The companies that hired us for implementing BI often required a blend of technical and analytical skills. This is because their in-house team usually are well-versed in the domain-specific tasks but lack expertise in areas such as data science, AI/ML development, or advanced data analytics. Without our help, they may experience slow adoption.

To help these companies get quicker results with BI, we:

- Provide ongoing training and workshops to upskill existing staff in BI tools, data analytics, and visualization best practices.

- Collaborate with technology vendors to fill immediate skill gaps and accelerate knowledge transfer.

- Recruit data scientists, BI analysts, or data engineers who can drive BI financial analytics initiatives and mentor internal teams.

Why Businesses Should Rely on Experts for Successful Finance BI Implementation

Implementing business intelligence for finance requires deep technical expertise since many technologies that drive BI, like AI/ML, data science, and advanced analytics, are highly intricate and required to be learnt from ground up. In-house teams often lack such skills, but the best FinTech development companies usually can offer that and solve many technical challenges connected to the financial sector.

These development companies can also support the project of their clients with:

- Regulatory Compliance Expertise: Experts possess deep knowledge of evolving financial regulations and standards (GDPR, PCI DSS, etc.) to ensure that BI solutions align with compliance requirements and protect businesses from costly legal risks.

- Customized Solutions for Industry Needs: Professionals tailor BI platforms to specific financial sector challenges and workflows, delivering insights that address unique industry pain points.

- Accurate and Scalable Data Management: Specialists design robust data architectures that handle increasing data volumes seamlessly, making sure data is accurate and reliable as businesses expand.

- Cost and Resource Efficiency: Skilled BI partners streamline implementations and optimize resource utilization, reducing operational costs and accelerating ROI.

- Future-Proofing Technology Investments: Experts continually update BI solutions in line with emerging technologies and trends, which ensures that businesses remain competitive and resilient over time.

Consider SPD Technology as Your Partner in BI Finance Transformation

SPD Technology has over 18 years of experience in delivering financial applications and dozens of happy clients, including PitchBook, Mogami, and Poynt. Our clients have chosen us for:

- Experience Across Financial Niches: SPD Technology has experience working across multiple financial domains, including banking, insurance, and asset management, which makes us versatile partners for financial BI projects.

- Expertise in Advanced Technologies: With our deep expertise in AI/ML development and advanced data analytics, we ensure that your BI solution is future-proof and capable of generating real-time, data-driven insights.

- Customization for Financial Use Cases: Our experts specialize in building customized BI solutions for covering such functions as risk modeling, fraud detection, portfolio analysis, and customer segmentation.

- Commitment to Long-Term Partnerships: With some of our clients, we have formed long-term relationships that have lasted for decades, and we are ready to provide similar support and apply our technical expertise to your company as well.

Business Intelligence Financial Services SPD Technology’s Success Story

We have collaborated with Mogami, a financial services company, for over 10 years. Together, we have created a personal finance management application, powered with analytics and data visualization, that steadily attracts new users.

Business Challenge

Our client needed to develop a personal finance management application to accommodate a big number of users with streamlining their financial lives. The app needed to be integrated with banking accounts to collect financial data (expenses, income, etc.), analyze that information and offer users insights on how to improve spending habits.

SPD Technology’s Approach

We opted for React Native development to create one app that can work on both, Android and iOS platforms. This allowed us to cover a larger audience. However, the app was built on an architecture-rigid foundation that in conjunction with banking integrations slowed down performance and prevented us from adding any new features and scaling the software. However, we migrated the app to the cloud and managed to pinpoint areas with poor performance and created custom solutions to resolve those.

One of the major parts of the project was enabling real-time tracking of expenses and insights into spending patterns. We developed an intuitive interface that supports personalized budget planning, making it easy to set goals and monitor progress. Beyond day-to-day expense tracking, Mogami provides users with actionable recommendations to optimize their finances, improve savings, and foster healthier spending habits.

Value Delivered

We successfully delivered a financial planning application for the Mogami team. The collaboration with them was so fruitful and productive that we continued working with them, enhancing their applications and providing ongoing support. The app continues to receive new active users and is a solid player on the market.

Conclusion

Business intelligence is a vital tool for financial services companies: it brings data visibility, improves scenario planning, and elevates decision making. BI can be used across multiple use cases, including budgeting and forecasting, expense and cost management, KPI monitoring, fraud detection, and strategic planning.

In order to implement BI in finance, organizations must complete several steps. From initial set up assessment and defining objectives to cleaning data, selecting tools, and piloting the first BI project, finance companies need to ensure data accuracy, cultural readiness, and stakeholder alignment to make BI functions effective.

However, there are several challenges that may hinder BI implementation. Those are data privacy and compliance, legacy systems, high costs, and internal team skills gaps. To solve them, companies can partner with a technology vendor who has the expertise in both emerging technologies that drive BI and the financial industry. We know for sure that such collaborations can be fruitful as we ourselves delivered dozens of similar projects, including one for Mogami. If you need support in BI implementation, we can help you too. Just contact us, and our team can figure out how to enhance your operations with effective reporting and visualization.

FAQ

What Does Financial Intelligence Do?

Financial intelligence analyzes financial data to provide insights, support strategic decision-making, optimize budgeting, manage risks, detect fraud, and enhance overall financial performance, enabling businesses to achieve their goals effectively.

Why is Financial Intelligence Important in Business?

Business intelligence in the financial industry is crucial for informed decision-making, improving profitability, ensuring regulatory compliance, managing risks, optimizing resources, and gaining a competitive advantage, which drives sustainable business growth.