66% of financial leaders agree that data is widely used in their organization and, therefore, financial firms become increasingly reliant on data analytics solutions to drive insights and establish well-informed decision making. Asset management companies are at the forefront of integrating data analytics into their processes as it allows them to optimize investment portfolios, manage risks, enhance client experiences, and improve many other processes.

As asset management data analytics capabilities are becoming the key to winning the competition, we explore the criteria that make competitive advantage possible.

The Critical Importance of Asset Management Analytics

Traditional asset management, which leans extensively on manual calculation, historical performance data, and qualitative research, can no longer thrive in today’s extremely volatile and complex investment market. Nowadays, the nature of asset management needs all-at-once efforts that cover dealing with multiple asset classes (equities, fixed income, derivatives, and alternative investments) and keeping your finger on the pulse of market trends (economic shifts, geopolitical events, and regulatory changes). The need for asset management analytics becomes pressing as numerous factors interact in unpredictable ways, creating a web of complexity that challenges even the most seasoned asset managers.

To deal with this complexity and derive insights from the seemingly unmanageable volumes of data, asset managers started integrating advanced analytics into daily financial operations. Data analytics in finance helps to deal with a deluge of information and keep track of dynamic data points, from market movements and corporate earnings reports to macroeconomic indicators and news sentiment. With data analytics, asset management reshapes the industry for the better with its numerous benefits.

Key Benefits of Data Analytics for Asset Management

Data analytics in asset management unlocks insights and streamline operations thanks to the ability to process vast amounts of data, identify patterns, and provide real-time, actionable intelligence. It enables the following advantages:

- More Effective Risk Management: By evaluating real-time data and forecasting market patterns, data analytics enables asset managers to detect risks and eliminate them before it is too late. This capability lowers potential losses and makes portfolios resistant to market volatility.

- Increased Operational Efficiency: By automating repetitive tasks and employing advanced analytics for portfolio rebalancing, reporting, and data integration, data analytics guarantees accurate results, lower operational costs, and focus on high-value activities.

- Better Customer Experience: By offering a deeper understanding of customer preferences and risk tolerances, data analytics allows creating customized portfolio strategies taking into account individual objectives of each investor.

- Compliance Transparency Enablement: By automating reporting, flagging potential issues, and ensuring that investment operations align with legal and regulatory standards, data analytics minimizes error, increases investment transparency, and, ultimately, ensures compliance with law.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“Modern data analytics surpasses traditional methods by providing real-time insights, predictive capabilities, and automation. It empowers asset managers to respond swiftly to market changes, personalize strategies, and ensure compliance, transforming how the industry operates.”

Types of Wealth Management Data

Investment managers deal with a variety of data types, each essential for understanding clients needs and preferences, crafting investment strategies, managing portfolios, and keeping all of that within compliance. Below are the types of wealth management data and their role in dealing with assets on different stages of the process.

- Client data includes demographic information, financial goals, risk tolerance, investment preferences, and transaction history. It is important for onboarding the client and defining its goals, developing a tailored portfolio with individual risk profiles and long-term objectives, and personalizing relationships between the client and their asset manager.

- Portfolio data encompasses holdings, asset allocations, performance metrics, and historical returns. This type is necessary for rebalancing and optimizing portfolios to increase returns and lower risks as well as for tracking performance of the portfolio over time to estimate the effectiveness of chosen investment strategies.

- Market and financial data consists of stock prices, interest rates, economic indicators, and corporate earnings reports. It allows making market analysis to predict trends and identify investment opportunities. Furthermore, it helps to make investment decisions, ensuring timely buying or selling of assets for capitalizing on their price movements.

- Regulatory and compliance data includes legal requirements, audit trails, and compliance reports. This type helps to comply with regulations, keeping all the investment activities within the law. It also serves wealth management analysis in creating accurate audit-ready compliance reports.

- Alternative data typically comprises social media sentiment, geospatial data, consumer behavior trends, and weather patterns. It serves for boosting the decision-making process, providing non-traditional insights to uncover unclear opportunities or risks.

- Operational data contains process workflows, transaction histories, and system logs. This kind of data contributes to easier operational bottlenecks or anomalies detection as well as streamlines reporting, trade execution, and client communication.

Advanced Technologies Transforming Wealth Management Analytics

Wealth management is a multifaceted process that requires consideration of the financial needs and goals of individual investors, families, and even businesses or institutions. Only advanced technologies can offer this level of customization and adaptability for leveraging analytics for wealth management.

AI/ML

According to Statista, 69% of financial services firms utilized AI for data analytics, making it the most common AI application in the industry in 2023. In asset management, data analytics powered by AI and ML is tuned for dealing with tons of diverse data to creatively approach investments and at the same time safeguard investors from any market adversities.

Having AI/ML development expertise implemented into wealth management analytics enables firms to automate data collection, enhance analytical precision, and reduce operational costs. For instance, our team developed an AI-powered web crawler for a leading U.S. asset management company, which automated the retrieval of financial data from numerous websites. This solution not only reduced manual data processing time from days to hours but also freed up the time of 20 employees.

And while you’re reading about how AI is transforming asset management, find out how AI is also impacting investment banking.

Big Data Asset Management

The business impact of Big Data is hard to leave unnoticed: in the financial sector, it contributes to nuanced understanding of financial markets and client behavior. Of course, it is possible thanks to analytics of both structured data (e.g., market trends, financial statements) and unstructured data (e.g., social media sentiment, news articles). By analyzing Big Data, asset management benefits from gaining insights into emerging trends, potential risks, and investment opportunities.

With Big Data analytics, asset management becomes more accurate, financial operations become more streamlined, and data collection goes through intelligent automation. For instance, we collaborated with MorningStar to overhaul and expand their data collection application. This initiative improved the retrieval and annotation of critical financial data, integrating it seamlessly into the firm’s financial applications. The newly enhanced system, incorporating around 150 business rules for data validation, streamlined operations and ensured higher data accuracy.

Cloud-Based Analytics

The cloud computing infrastructure benefits are evident when the necessity to cut the expenses of maintaining and modernizing conventional IT infrastructure arises. Because cloud platforms are so flexible, businesses may increase their analytics capabilities as needed to handle increasing data quantities or more complex analytics models without having to make large upfront investments.

Another project for MorningStar done by our team showed that cloud-based solutions can enhance performance and efficiency in asset management. We worked on transforming the client’s investment analytics application using a serverless cloud architecture. This transformation resulted in near-limitless scalability, increased processing speed, and reduced operational costs.

Natural Language Processing

The adoption of NLP in finance is accelerating, with the global NLP in finance market projected to grow from USD 5.43 billion in 2023 to USD 59.7 billion by 2033. When it comes to asset management in particular, NLP is valuable for making sense of unstructured data, such as news articles, financial reports, earnings calls, and social media posts. By performing these tasks, NLP gives asset managers the ability to understand market sentiment, predict the potential impact of global events, and uncover emerging trends that might influence investment strategies.

One of the possible uses of NLP is revealing public opinions on specific companies before adding their stock to investment portfolios. In such a way, asset managers can uncover either a positive sentiment, which suggests strong consumer trust or growth potential, or negative sentiment, which hints at controversies, declining performance, or reputational risks.

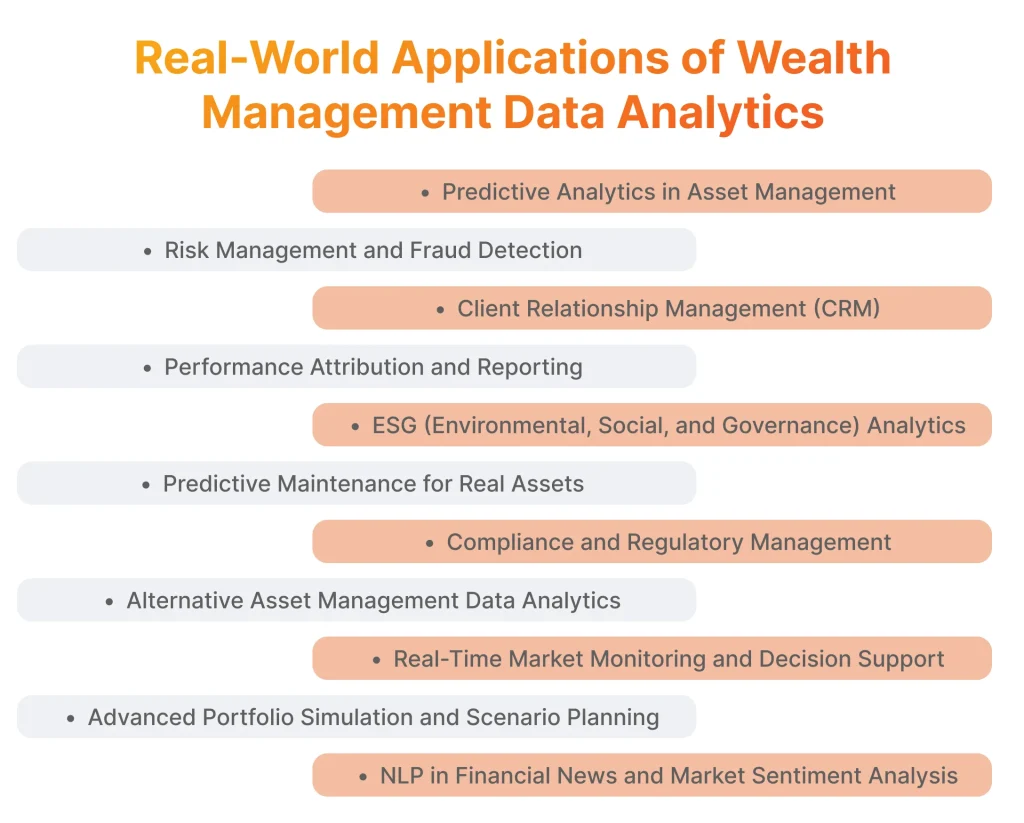

Real-World Applications of Wealth Management Data Analytics

With data analytics, asset management unlocks a whole spectrum of practical implementations, covering almost every aspect of managing wealth.

1. Predictive Analytics in Asset Management

Predictive analytics empowers asset managers in working with historical trends, real-time market data, and economic indicators to see how investment will perform in the future. Predictive analytics in asset management involves:

- Big data in investment forecasting that focuses on identifying emerging opportunities and mitigating potential risks to predict asset yields.

- AI for portfolio optimization that simulates scenarios to find the best asset allocation strategies. Furthermore, AI allows taking into account risk tolerance, market conditions, and financial goals to ensure portfolios are resilient.

2. Risk Management and Fraud Detection

Since asset management firms deal with massive amounts of private data on a daily basis, they often rely on data analytics and advanced technologies when it comes to fraud detection software development and risk management. They typically use:

- ML for risk prediction as advanced algorithms scan operational vulnerabilities to flag issues and help firms to take preventive measures. Moreover, ML algorithms enable stress testing to prepare companies to market adversities.

- NLP and Big Data for fraud detection as they help to find anomalies in data from emails, messages, and transactional records and uncover hidden threats.

3. Client Relationship Management (CRM)

Asset management companies deal with a huge number of clients, which have unique goals and risk tolerance. To make every connection with clients meaningful and effective, firms integrate CRMs with:

- AI/ML and Big Data for personalized wealth advisory that is based on a client’s unique goals, risk appetite, and preferences. In addition to the analysis of the data by these technologies, ML algorithms can continuously learn and adapt to new information and update recommendations and make sure investment advice is up to date.

- NLP for sentiment analysis as it allows to scan the tone and emotion in social media, market-related news to include financial trends in investment advice.

4. Performance Attribution and Reporting

When it comes to investment strategies refinement and transparency, wealth management companies perform performance attribution and reporting. In this manner they can analyze the specific factors driving portfolio returns and ensure accountability to clients. This usually involves:

- Big Data for performance metrics that involves analyzing market movements, asset selection, and allocation decisions to identify portfolios’ areas of strength and weakness.

- AI-powered reporting that allows companies to automate the generation of coherent reports with predictive analyses, benchmarking, and scenario simulations, to provide clients with actionable knowledge.

The demand for ethical investments grows as investors increasingly prioritize aligning their financial decisions with personal values and global sustainability goals. Wealth management companies thrive to satisfy this demand, and for that they use:

- AI for ESG scoring that analyzes data from corporate reports, news, and regulatory filings. Thus, AI generates accurate and up-to-date scores for companies.

- NLP for sustainability insights as this technology can extract actionable information from unstructured data to keep investment managers informed about environmental or social controversies affecting companies in their clients’ portfolios.

6. Predictive Maintenance for Real Assets

In order to optimize the value, performance, and lifespan of physical investments, asset management firms need to keep an eye on the condition of assets and be able to predict when maintenance is required. To ensure that, asset management firms utilize:

- Big Data and IoT integration that allows analyzing sensor data for anticipating maintenance needs, reducing downtime, and prolonging asset lifecycles.

- AI in real estate valuation to leverage demographic trends, market conditions, and property-specific data and provide accurate and dynamic property valuations.

7. Compliance and Regulatory Management

Finance is a highly regulated industry, requiring firms to adhere to strict compliance standards and ensure transparency in all operations. To ensure security in FinTech, comply with these regulations, and protect investors, asset managers use:

- AI for regulatory analytics helps streamline compliance processes by automating the identification of regulatory gaps and potential violations. Thanks to AI, data analytics tools can monitor changes in regulations and ensure that firms adapt to them.

- Cloud-based documentation to guarantee accountability for any changes and updates made to legal information, promoting transparency and, hence, complying with law.

8. Alternative Asset Management Data Analytics

In case an asset management firm needs to deal with non-traditional investment assets (private equity, hedge funds, real estate, commodities, infrastructure, venture capital, etc.), they stumble upon a lack of standard pricing mechanisms as well as unique, and, therefore, hard to follow market dynamics. To navigate these complexities, companies can utilize:

- Big Data for unconventional insights that is focused on the analysis of non-traditional datasets like social media trends, satellite imagery, or web traffic to get information about commodities, collectibles, or venture capital.

- ML for alternative data integration brings insights together by processing diverse datasets and uncovering correlations. This provides wealth managers with a broader perspective on market movements.

9. Real-Time Market Monitoring and Decision Support

As macroeconomic indicators change frequently and financial news appear every minute, asset and wealth managers need to be able to track them and adjust their clients’ portfolios accordingly. For that reason, they leverage:

- AI-driven market alerts to monitor global markets continuously and receive notifications about critical events to accommodate quick decision-making.

- Cloud-based collaboration tools to enhance decision support by allowing teams to access live market data and analytics in a centralized environment.

10. Advanced Portfolio Simulation and Scenario Planning

Just like said in the section above, the financial market experiences frequent fluctuations. This draws the need for constant portfolio optimizations, new risk mitigation strategies, and adjustment to ever-changing compliance requirements. To navigate the market’s unpredictable nature, asset managers can use:

- AI for scenario analysis to test how portfolios perform under various economic conditions, such as recessions or interest rate changes and optimize strategies to withstand uncertainties.

- Cloud computing to run complex simulations and analyses at scale. This ensures faster and more accurate planning to develop agile financial strategies in volatile markets.

11. NLP in Financial News and Market Sentiment Analysis

While traditional asset management required manual work for getting information from various sources of information, now insights can be extracted thanks to automated processes. In asset management, those processes are:

- Sentiment analysis for market prediction evaluates the tone and emotion of market discussions to let managers perceive important events and refine their investment approaches in accordance with them.

- NLP for real-time insights examines financial news, reports, and social media to identify events that may impact markets to help firms stay ahead of emerging trends and adjust strategies proactively.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“All the applications of data analytics benefit from its ability to provide actionable insights that drive decision-making. With data analytics, decisions are no longer reactive but strategic, enabling firms to enhance portfolio performance, improve client satisfaction, and maintain a competitive edge.”

Best Practices for Adopting Data Analytics in Asset Management

In order to uncover the full potential of data analytics for asset management and ensure accurate, data-driven decision-making, it is important to follow several best practices mentioned below.

- Focus on Data Governance and Quality: Adoption of a data governance framework established policies and procedures for data collection, validation, and storage that ensure data is accurate, complete, and trustworthy as well as protected with encryption, role-based access, and compliance with regulations.

- Adopt a Client-Centric Approach: Leveraging tools for better client understanding (predictive and Big Data analytics, NLP, chatbots) helps with proactive customer engagement as it offers more personalization.

- Ensure Real-Time Data Processing: Investing in scalable architectures and enabling IoT and edge computing as well as optimizing data pipelines and ensuring data synchronization allows asset management firms to process vast amounts of data, react to market fluctuations and adapt investment portfolios to client needs.

- Prioritize Risk Management: Integrating advanced models and AI/ML-driven simulations into everyday routine ensure firms can predict market adversities and mitigate risks through diversification.

- Emphasize Regulatory Compliance: Setting up automated compliance checks can help to continuously monitor updates to laws and regulations, ensuring that the firm’s policies and procedures stay aligned with current standards, while automated reporting will help to flag anomalies or rule breaches for immediate corrective actions.

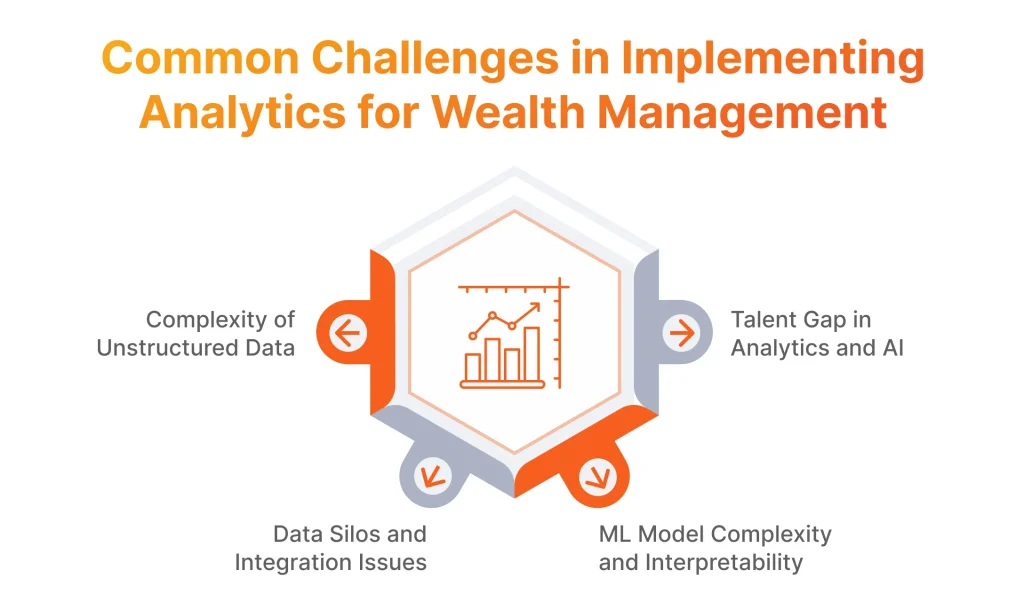

Common Challenges in Implementing Analytics for Wealth Management

Implementing wealth management data analytics rarely goes without challenges. Nevertheless, we deliver our data analytics services with deep understanding of these obstacles, ensuring tailored solutions that address each pain point effectively.

Complexity of Unstructured Data

Asset managers deal with unstructured data on a daily basis when trying to gain insights from client communications, market news, research reports, and social media sentiment. Since this type of data does not have a predefined format, it is much more difficult to organize, process, and analyze it. This leads to lowered accuracy of insights or lack of a holistic view of the market, its trends and opportunities.

To overcome this problem, our team usually leverages NLP and ML. While the former helps to derive practical insights from text (for example, client feedback or sentiment in social media), ML models identify patterns and correlations in them. To support this process, we also implement data normalization as it helps to transform all data into a consistent and structured format. In this manner, we ensure that firms gain access to accurate and readable data.

Discover more about the critical role of high-quality data and explore practical strategies for achieving it in our article on data quality management.

Data Silos and Integration Issues

Since many departments can be involved in dealing with data in asset management, it is often stored separately, which leads to data silos. Fragmented data sets are rarely integrated, hindering attainment of a complete view of client profiles, market trends, and operational performance. Another problem that often results in data silos is legacy systems, as they are typically outdated and lack the flexibility to communicate with modern data platforms and receive data from them.

We always stress the importance of data integration and, for this reason, implement modern data integration tools and set up scalable cloud-based platforms. This allows us to break down silos and create unified data pipelines. Additionally, our team ensures seamless data flow between systems with the help of APIs, ETL processes, and real-time synchronization.

ML Model Complexity and Interpretability

One of the FinTech applications development challenges is that ML models frequently operate as “black boxes,” which makes it challenging for wealth managers to understand how they arrive at certain decisions. In highly regulated sectors like wealth management, where transparency and compliance are essential, developing ML-driven functionalities presents a problem.

However, explainable AI (XAI) techniques come to help and allow us to overcome this issue. We integrate it into our machine learning workflows to provide clear data visualizations, breakdowns, and logical explanations for model outputs. In this way, investment managers can easily understand the reasoning behind predictions and decisions.

Talent Gap in Analytics and AI

With data analytics, investments have the chance to be more fruitful. At the same time, the rapid evolution of technology often outpaces the availability of skilled professionals who can effectively implement and manage these advanced systems. It can be difficult to find and keep employees with experience in data science, ML, and financial analytics, especially for businesses without well-established IT infrastructures.

To help financial companies to bridge this talent gap, we outsource AI and data specialists according to the chosen engagement model, implement the necessary solution and keep supporting it. In this way, we ensure that businesses can harness the full potential of analytics and AI without overburdening their internal teams and focus on their core competencies while leveraging advanced analytics to drive decision-making. It also ensures scalability and adaptability, enabling businesses to keep pace with technological advancements.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“When AI, ML, and Big Data emerged, you needed to embrace them really quickly to keep pace with their evolution. Fortunately, as these technologies are deeply intertwined with software development, our team began mastering them from the very onset so that we can rely on a strong foundation of seasoned experts to lead related projects.”

Why Implementing Wealth Management Analysis Requires a Profound Approach

The best fintech development companies are helping financial businesses in implementing data analytics for wealth management leveraging both technical expertise and understanding the specifics of this business. With this approach, it becomes possible to navigate the following industry nuances.

- Evolving Technological Landscape: Firms must integrate AI, ML, Big Data solutions into their daily operations to stay competitive. However, the intense pace of innovation makes it hard to combine cutting-edge analytics systems with existing legacy infrastructure and set up real-time processing or advanced portfolio simulation tools.

- The Need to Address Data Privacy and Security: Since businesses deal with sensitive data, they are frequent targets for cyberattacks and regulatory scrutiny. A specific expertise is required to navigate these nuances as implementing encryption, secure data access protocols, KYC standards, and threat detection systems as well as complying with GDPR and PCI DSS.

- Complexity of Client Portfolios and Market Volatility: The nature of wealth management entails dealing with diverse client portfolios that include a mix of traditional and alternative assets, each subject to unique risks and market dynamics. This created issues with merging data from multiple sources or complexities with creating accurate models to simulate market scenarios that are essential for effective work with financial portfolios.

- The Need to Build Long-Term Trust with Clients: Dealing with finances requires transparency and trust. However, the logic behind technology processes is complex to explain. This draws the need for XAI and ethical AI implementation that only experienced specialists can provide.

Reasons to Choose SPD Technology for Data-Driven Asset Management Enablement

Here, at SPD Technology, we combine our expertise and skills for you to get the advantages of strategic technology consulting and development as the project unfolds. Our focus is always on:

- Proven Expertise in Data Integration and Transformation: Our team specializes in integrating and transforming complex datasets from diverse sources, ensuring a unified and actionable view of asset portfolios. This allows us to break down data silos and provide insights tailored to distinct demands.

- Advanced AI, Big Data and Cloud Capabilities: We leverage cutting-edge AI algorithms, Big Data analytics, and scalable cloud solutions to deliver real-time insights and predictive analytics. These technologies empower you to make data-driven decisions with confidence, even in rapidly changing markets.

- Compliance and Data Security Expertise: With deep knowledge of financial regulations and data protection laws, we implement robust systems to ensure compliance and safeguard sensitive client information. Our secure analytics frameworks are designed to minimize risks while maintaining transparency.

- Proven Track Record with Large-Scale Financial Clients: SPD Technology has a history of delivering impactful analytics solutions for financial companies, helping them optimize portfolio performance and mitigate risks. Our success stories highlight our ability to handle complex challenges at scale.

SPD Technology’s Partnership with MorningStar: Globally-Leading Asset Management Company

One of our notable collaborations to set up data analytics was with MorningStar, a US-based asset management company.

Business Challenge

Morningstar sought to enhance its platform for asset management, and improvement of data analytics capabilities was one of the critical tasks to deliver. It was required to assist in streamlining operations, improving the platform’s performance, and introducing new business lines. The challenges included automating complex data collection processes, handling unstructured and noisy datasets, resolving poor software architecture, and migrating legacy systems to scalable cloud platforms. Additionally, the client required solutions resilient to high loads, supporting advanced analytics, and integrating seamlessly into their ecosystem.

SPD Technology’s Approach

We approached the challenges with a focus on leveraging cutting-edge data analytics and AI technologies for three applications within MorningStar ecosystem:

For the Web Crawler application, our team employed AI/ML models like Doc2Vec and Word2Vec to filter irrelevant data, prioritize information, and automate crawling across 500+ websites. This reduced manual processing and improved data relevancy scores.

For the Data Collection application, we redesigned its architecture to enhance data annotation and validation, reducing data losses by 90% and accelerating performance by 10x.

Lastly, the Kessler App was transformed into a cloud-based platform, leveraging AWS to achieve high-load capacity for 1 million daily users, integrating advanced investment analytics, and optimizing search functionalities.

Value Delivered

We successfully delivered three applications, and our data analytics and software engineering efforts allowed the client to get:

- Automated Data Collection Across 500+ Websites: We developed a custom web crawler app that allowed for a total automation of the core business lines.

- 10x Performance Optimization: We enabled core data analysis tasks to be performed by 2 employees instead of 20.

- 10x Data Storage Cost Reduction: Our experts migrated an investment analytics platform to the cloud, which offered great scalability.

- 10x Improvement of the Processing Power: Our team improved the Data Collection app’s performance and reliability, compared to MVP.

Conclusion

With advanced analytics, asset management introduces effective and fruitful investments so critical in today’s competitive financial environment. Data analytics in asset management also offers effective risk management, better operational efficiency, improved customer satisfaction, and compliance transparency and goes hand-in-hand with AI/ML, NLP, Big Data and cloud-based analytics.

Data analytics and data science use cases in asset management cover predictive analytics, risk management, client relationship management, performance attribution and reporting, ESG, predictive maintenance, compliance and security, alternative asset management, real-time market monitoring, advanced portfolio management, and NLP for news and market sentiment analysis. To implement data analytics for these use cases, it is important to follow best practices, which are data governance and quality, client-centric approach, real-time data processing, risk management, and regulatory compliance.

Still, the implementation of data analytics for managing assets is not always smooth. Unstructured data, data silos and issues with integrations, complexity of ML models and talent gap can hinder setting up data analytics wealth management. To overcome these challenges, upskilling your employees or hiring an experienced team can be beneficial.

SPD Technology performed dozens of projects with data analytics, including MorningStar, a global premier asset management firm and one of our long-lasting clients. Our company would be glad to help your business too – contact us and we will provide any advice for starting the implementation of data analytics for your asset management needs.

FAQ

What Is Asset Management Analytics?

Asset management analytics uses data analysis tools, AI, and machine learning to optimize investment strategies, manage risks, and improve decision-making by evaluating portfolio performance and market trends.

Which Type of Analytical Data Can Help You Make Investment Decisions?

Analytical data includes market trends, financial performance metrics, economic indicators, alternative datasets (e.g., social media sentiment), and risk assessments to inform portfolio allocation, asset selection, and strategy adjustments.