AI and investing have already become a transformational tandem, a fundamental industrial shift that disrupts the ways organizations conducted their operations before. Gitnux reports that 82% of investment firms use Artificial Intelligence for portfolio management, while 78% leverage it for risk assessment. So, i you operate an investment firm and don’t use the latest technological advancements or even ignore them altogether, you risk being at a major disadvantage compared to the competitors and suffer from poor investment strategies.

We, at SPD Technology, fully understand the importance of AI-powered investment analysis, so in this article we will discuss how companies improve their investment strategies with the help of cutting-edge AI/ML solutions.

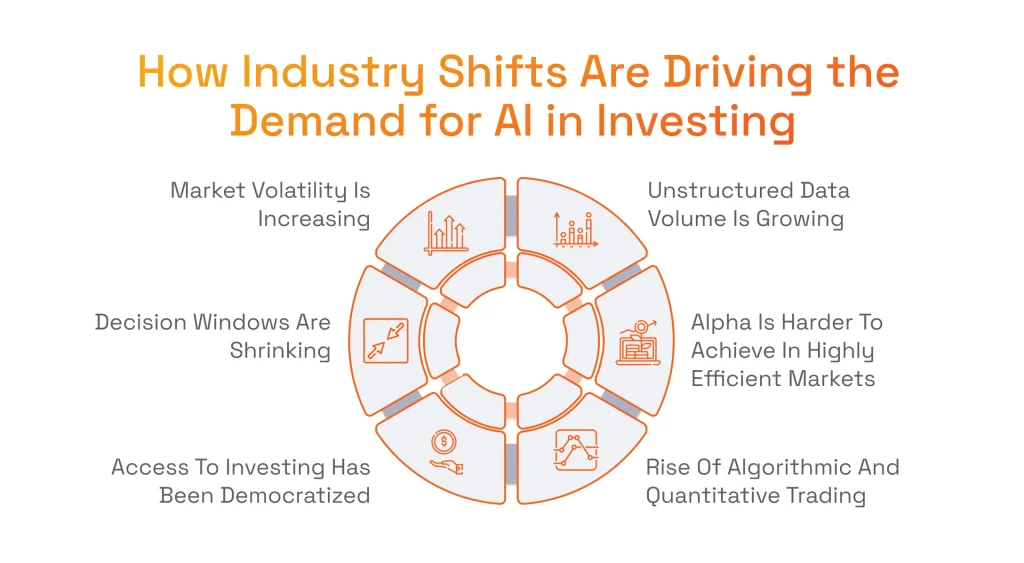

How Industry Shifts Are Driving the Demand for AI in Investing

The investment industry is undergoing massive changes, driven by shifts in economics, technology, and the behavior of market players. These changes are reshaping the nature of investment decisions and boosting the demand for intelligent automation enablement, particularly with the help of AI-based technologies. Below are the most critical factors that shape the necessity to leverage AI for the investment industry:

- Market Volatility Is Increasing: Traditional approaches struggle to respond in real-time to macroeconomic fluctuations and geopolitical instability, while Artificial Intelligence in investing not only is able to process vast data streams but also adjust strategies timely.

- Decision Windows Are Shrinking: Market shifts may happen in seconds, as the time lag between data acquisition and action can negatively impact profits. The speed of analysis and automation that AI for investing solutions offer, helps to minimize latency and deliver highly responsive investment strategies.

- Access to Investing Has Been Democratized: Thanks to the improvements in data analytics in finance, there are plenty of low-cost brokerage services and fintech platforms that allow new players to enter the market. Your competitors are probably already using some kind of investment AI to get smarter and faster insights, since off-the-shelf solutions are common and effective.

- Alternative and Unstructured Data Volume Is Growing: According to Sphere, unstructured data is expanding with a compounded annual growth rate of 61%, as it includes anything from social media sentiment to satellite imagery. Compared to human experts, AI for investments has unprecedented capabilities in extracting value from unconventional data sources and capitalizing on emerging opportunities.

- Alpha Is Harder to Achieve in Highly Efficient Markets: Information today moves almost instantly, instantly affecting asset prices and neglecting companies’ traditional advantages. Where conventional methods fail, AI in investment uncovers subtle inefficiencies and unobvious patterns, helping companies gain leading positions.

- Rise of Algorithmic and Quantitative Trading:The Business Research Company believes that by the end of 2025, the global algorithmic trading market will reach USD 22.03 billion. Quantitative trading also has much potential, so investment decisions will become more machine-driven than ever, requiring AI-driven solutions from leading organizations.

Serhii Leleko

ML & AI Engineer at SPD Technology

“It is also important to note that overall operational complexity is increasing. Processes like compliance, reporting, and risk management have become more data-intensive than ever. So, when you implement any AI solution in your organization, looking at it solely as an investment tool will be a mistake. If you implement AI, consider covering other critical areas to reduce costs and streamline operations.”

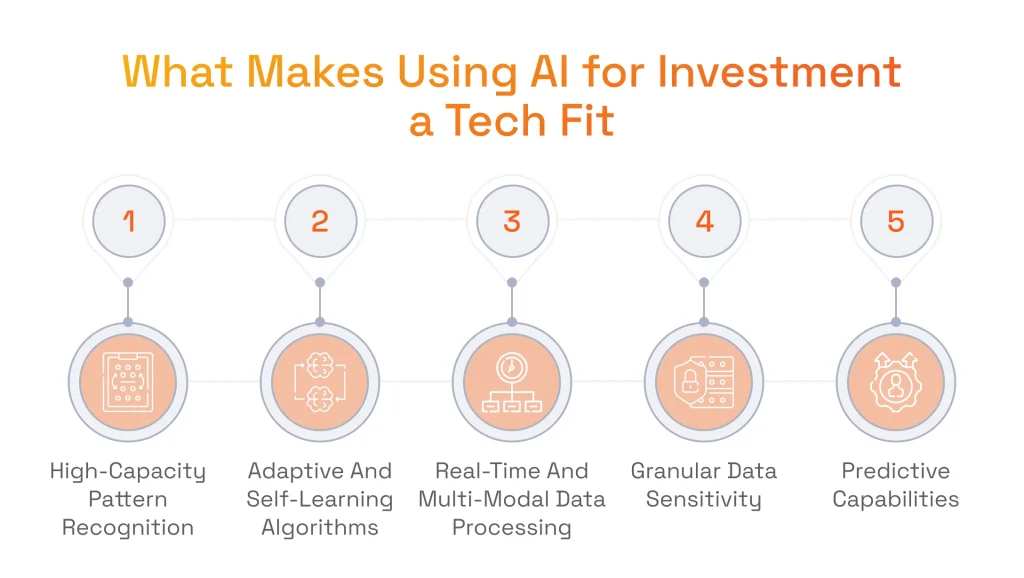

What Makes Using AI for Investment a Technological Fit

Leveraging AI development services is more than just a trend for leading investment companies. It is a perfect technological match for modern investment needs, including portfolio management, risk analysis, and decision-making. AI for investing is more than capable of handling this market’s data-heavy and highly complex nature, and here is why.

High-Capacity Pattern Recognition

This is one of AI’s most valuable assets in this industry. Investment markets are influenced by a complex combination of signals, from economic indicators and price movements to sentiment and behavioral trends. With AI, it is possible to identify correlations and patterns across enormous datasets, imperceptible to human analysts or traditional models. This ability allows for the early detection of both anomalies and trading opportunities.

Adaptive and Self-Learning Algorithms

Due to the self-learning algorithms and its adaptive nature, AI works perfectly in dynamic environments. Opposite to traditional rule-based systems, machine learning models are capable of adjusting to new data, shifting investor behavior and evolving market conditions. So, whether it is regulatory shifts or response to volatility spikes, AI for investment management delivers tangible results.

Real-Time and Multi-Modal Data Processing

Enabling real-time data processing is definitely one of the most complex Fintech applications development challenges, and at the same time, financial signals come from diverse and high-speed sources. AI-driven systems are capable of working with structured financial data, while at the same time ingesting alternative data sources like social media feeds and processing them simultaneously to provide a holistic overview.

Granular Data Sensitivity

AI financial analysis makes it possible to detect subtle signals in extremely noisy environments. When done right, AI can perform at levels far beyond traditional tools, whether it is tracking micro-movements in high-frequency trading or pinpointing sector-specific sentiment shifts.

Predictive Capabilities

While we already talked about how can AI help with investing for processing real-time data, the technology is used with historical data as well. In this use case, AI models are able to forecast asset performance, estimate risk exposure, and even simulate the potential impact of macroeconomic scenarios. This allows investors to leverage proactive instrument strategies, in the addition to reactive ones.

Serhii Leleko

ML & AI Engineer at SPD Technology

“The scalability of AI is one thing that can not be overlooked, as it brings significant business value for companies. Based on our experience, once we train ML models, our solutions can be deployed across multiple strategies, markets, and risk profiles simultaneously, saving costs for our clients. This is nearly impossible with traditional manual or rules-based systems.”

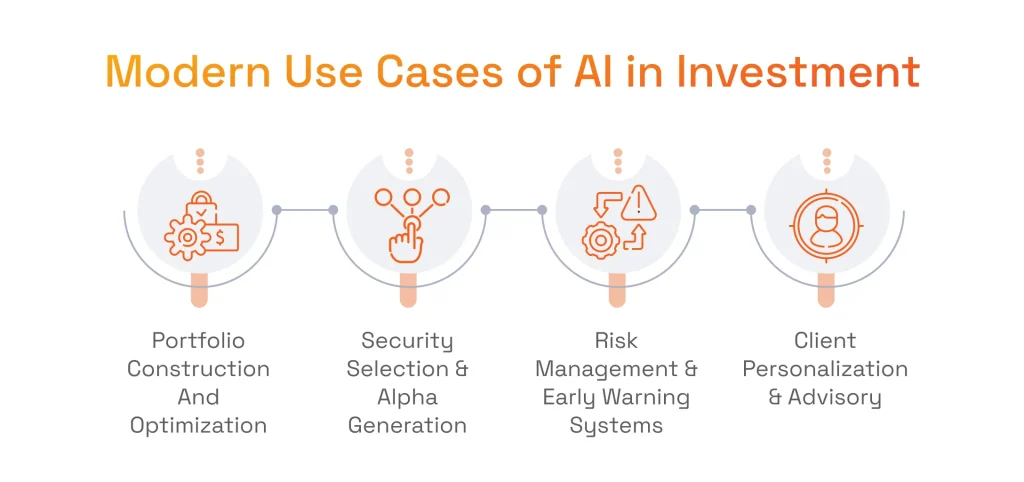

AI Investing in Action: Where It’s Reshaping Investment Decisions

When companies leverage all the advantages of strategic technology consulting by partnering up with professional software development vendors, the sheer power of AI and investing becomes apparent. Here are some interesting examples of implementing AI/ML for investment projects.

AI in Investment for Portfolio Construction & Optimization

AI-based solutions are a great choice for numerous scenarios of optimizing portfolios and balancing risk and return. For instance, BlackRock’s Aladdin platform employs AI to analyze vast datasets, aiding in constructing optimal portfolios and managing risk effectively. In another example, Microsoft’s application of machine learning to its investment portfolio led to a 10% improvement in returns and a 5% reduction in risk.

Security Selection & Alpha Generation

With the help of Natural Language Processing (NLP) technology, it is possible for AI systems to analyze earnings calls, news articles, and regulatory filings, uncovering underpriced assets. Qraft Technologies, a prominent company from South Korea, utilizes AI in its ETFs to adjust holdings based on market sentiment and projections, demonstrating AI’s role in active security selection. Additionally, AI-powered ETFs like EquBot’s AIEQ leverage IBM Watson to analyze financial news and social media, selecting a diversified portfolio of U.S. equities.

Our company also has some interesting use cases in this category. We are providing fintech development services for our client, global investment data analysis platform. During more than a decade of collaboration, we delivered several business critical solutions, including the pioneering, at the time, AI/ML trend detection system that processes 60,000 news topics and 50,000 articles a day.

Risk Management & Early Warning Systems

AI is a great tool for ensuring data security in fintech applications and the investment area in particular. With the help of AI, it is possible to enhance risk management by detecting anomalies and predicting potential market stress. Mastercard is a prime example of this, as its AI-powered fraud detection systems analyze up to 160 billion transactions annually to identify potentially fraudulent activities in real time.

AI in Investing for Client Personalization & Advisory

Lastly, AI also shines in personalized investment advice by analyzing individual behaviors and goals. Betterment is a prominent robo-advisor that employs AI technology to manage clients’ portfolios, offering customized investment advice and constructing diversified portfolios based on individual goals and risk preferences. One of TIFIN’s AI-driven platforms, such as Magnifi, provides personalized investment solutions, enhancing client interactions and improving efficiency, democratizing intelligence to enable better investor outcomes.

Want to learn more practical implementations of AI in investment banking?

Read our featured article for more information on the game-changing use cases!

Will AI in Investment Replace Human Advisors – Future Outlook

As Artificial Intelligence investment continues to reach new heights, surpassing what was possible, this question becomes even more relevant: will AI eventually replace portfolio managers and financial advisors altogether?

This is a reasonable concern, since AI can handle enormous volumes of financial data in seconds, uncover hidden patterns, and execute trades faster than any human could. PwC forecasts that AI could contribute up to $15.7 trillion to the global economy by 2030, with financial services among the top industries set to benefit. In many companies, AI is pivotal in asset management data analytics, portfolio construction, compliance, and client onboarding.

While undeniable benefits like unprecedented automation capabilities and data processing exist, some essential human elements, like nuanced emotional intelligence and precise ethical judgment, are still impossible to replicate. AI can detect a market anomaly, but it cannot counsel a nervous retiree during a downturn or intuit the nuanced goals behind a client’s investment decision, failing to build client trust.

The truth is that humans must work with machines to maximize possible benefits. Now, leading teams combine human creativity and intuition with the performance and scale of AI. The advancements in generative AI development can be considered a very important factor in this collaboration, since with the help of Large Language Models (LLMs), areas like drafting investor communications, summarizing earnings calls, preparing investment memos, and even simulating client interactions can be improved dramatically.

Winning companies have undergone a vital mindset shift, changing the question from “Will AI replace us?” to “How can we use it to make better decisions and deliver more value?”.Are you considering leveraging AI as a strategic partner for decisions and not a substitute for employees? In the next section, we will discuss the first steps of how to use AI for investing.

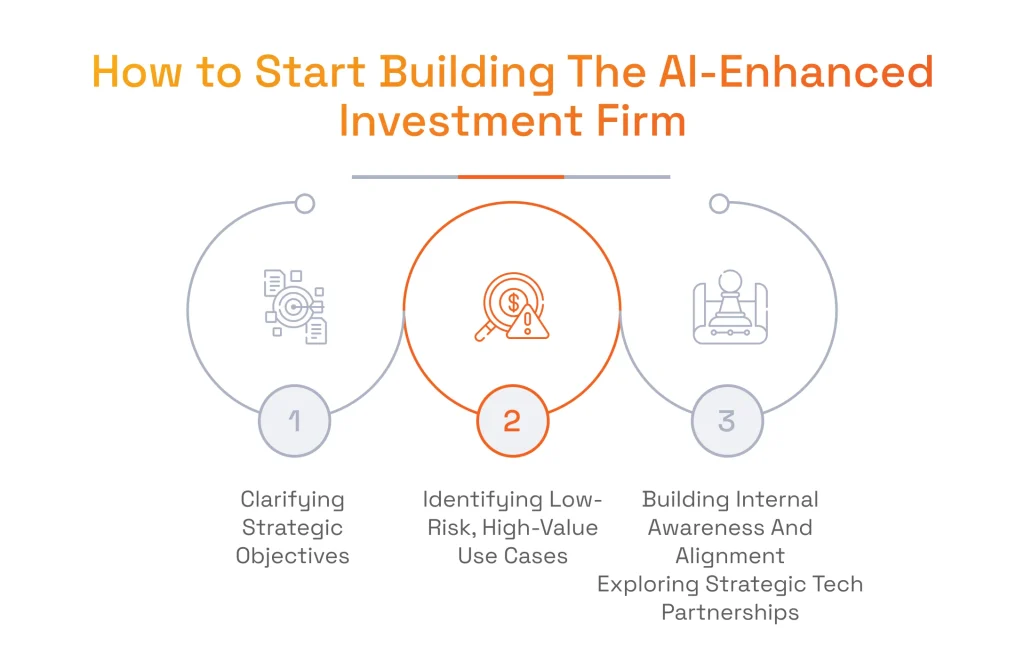

Building the AI-Enhanced Investment Firm: Where to Start

Simply put, a project combining Artificial Intelligence and investing should start with a thought-out strategy. Based on our experience implementing AI/ML projects across entirely different business verticals, organizations should consider the following first steps as the starting point.

Clarifying Strategic Objectives

Be specific with the goals of why you invest in AI, since the technology should be a means to an end, not the end itself. Are you aiming to enhance alpha generation, improve operational efficiency, deepen client personalization, or strengthen risk management? Understanding your organization’s unique goals will help you prioritize AI initiatives that align with your business strategy.

Identifying Low-Risk, High-Value Use Cases

It makes sense to determine and focus on low-risk, high-value use cases in which quick wins are possible. Many companies start with narrowly defined pilots, such as using NLP to summarize regulatory filings, deploying machine learning models for client segmentation, or automating repetitive compliance tasks. With practical targeted applications, getting ROI and building confidence among stakeholders becomes possible.

Building Internal Awareness and Alignment

Building internal awareness and alignment among your employees also has enormous value. Professionals who invest with AI should be aware of the technology’s capabilities and how it will impact their regular workflows. Transparency, cross-functional collaboration, and ongoing training sessions are mandatory for increasing adoption and building trust across the organization.

Exploring Strategic Tech Partnerships

Unfortunately, only a few organizations have the in-house resources to develop scalable AI solutions from scratch, adhering to strict regulatory, ethical, and data governance requirements. So, exploring the option of joining forces with an experienced technology vendor can accelerate progress and ensure the success of the AI initiative. The right development partner brings the technical expertise and domain knowledge, while aligning cutting-edge solutions with your company’s specific business goals.

Additionally, after initial evaluation, a tech vendor can propose other possible implementations of AI, for example, delivering not only an automated investment solution but also one that helps with implementing KYC standards in financial services.

To help you select a trusted technology provider, we created a list of the best fintech development companies with the necessary expertise to thrive with AI innovation!

Conclusion

It is safe to say that AI in investing is at a promising trajectory, covering a variety of use cases from robo-advisors for wealth management to high-frequency trading. While the AI investing technology is still not ready to outperform human traders completely, AI excels in automating decision-making, improving risk management and operating with vast amounts of complex data, uncovering the business impact of Big Data.

We are ready to help you with custom AI solutions, as our company has almost two decades in the fintech industry, creating groundbreaking projects for global leaders. At SPD Technology, we can help your organization stay on the cutting edge of innovation and outperform the competition.

FAQ

What are robo-advisors and how do they use AI?

Robo-advisors are modern software solutions that help with financial planning and investment management with minimal human involvement. The most common users of these are retail investors who are looking for innovative investment strategies at a minimal price. Leading companies like Betterment and Wealthfront use AI-driven robo-advisors in several major ways, including:

- Portfolio optimization

- Investment portfolio personalization

- Tax-loss harvesting

- Market monitoring

- Chatbots and virtual advisors

Can AI outperform human investors?

AI for investments can sometimes take over the work of human experts, but not in all possible scenarios. While AI is completely free from emotional bias, can easily process large volumes of data and can detect unobvious patterns, there are still some limitations. The most notable include the fact that successful investment strategies should consider human psychology as well, and also that many AI solutions lack transparency required for efficient management. Currently, the best strategy is to pair AI with human employees.

How do hedge funds use AI?

Hedge funds are one of the most common examples of using AI for investing. The list of specific use cases includes:

- Algorithmic trading

- Sentiment analysis

- Predictive modeling

- Risk management