In our previous articles on SPD Technology’s blog, we already touched on the topic of implementing KYC standards in Finance. However, this process is widely used in various other industries where identity verification is important, such as Telecommunications, Online Services, Healthcare, and Professional Services. The KYC software market is growing exponentially, and, as reported by Grand View Research, is on the way to reach $15.81 billion in 2030, with a CAGR of 20.8% from 2022 to 2030.

According to Juniper Research, the number of digital identity verification checks worldwide will be higher than ever and will surpass $70 billion in 2024. This is a 16% growth on the previous year’s number of $61 billion. These numbers are much expected because digital fraud is evolving rapidly and presents a viable threat to organizations across the world. Account takeovers alone have increased by 155% globally in 2023 if Sumsub is to be believed.

With a deep understanding of the current situation and to help protect your business from digital fraud threats, we decided to offer you a detailed overview of the current top KYC solution vendors.

What to Consider When Choosing Between KYC Software Vendors?

While evaluating the options for KYC compliance software, there are a few key considerations that should be addressed. Let’s review each of them.

Compliance with Regulations

Ensure that the KYC software has robust features to perform Anti-Money Laundering (AML) checks and Customer Due Diligence (CDD) specific to your industry and region. This involves verifying customer identities, assessing the risk associated with their activities, and continuously monitoring transactions for suspicious behavior. The AML KYC software should also receive constant regulatory updates, as compliance requirements evolve.

Data Security and Privacy

Confirm that the KYC application employs industry-standard encryption protocols (e.g., SSL/TLS) to secure data during transmission and storage. Additionally, it is vital to verify compliance with data protection laws such as GDPR, HIPAA, or other relevant regulations based on your geographic location and industry.

Ease of Integration

Top KYC vendors provide robust Application Programming Interfaces (APIs) for seamless integration with client’s CRM, onboarding systems, and other required tools. Make sure that your vendor has one. It is also important to keep your business goals in mind, as the solution of your choice should be scalable to accommodate your organization’s growth and evolving integration needs.

User-Friendly Interface

Evaluate the user interface for simplicity and ease of use, as it should be intuitive and present a minimal learning curve for your team. Additionally, confirm that the interface is accessible across different devices, screen sizes, and browsers to accommodate various working preferences.

Automation

Look for KYC vendors that offer automation features in the following areas:

- Document verification of passports, driver’s licenses, and utility bills.

- Identity verification, including biometric checks and liveness detection.

- Risk assessments in real-time based on multiple factors.

Customization

Opt for KYC solutions that allow you to customize workflows, data fields, and risk-scoring parameters to align with your industry-specific requirements and cater the most to your unique business needs.

Audit Trail and Reporting

Ensure that the solution maintains detailed logs of all user activities, system changes, and customer interactions, as well as offers robust reporting tools that enable you to generate compliance reports, track key performance indicators, and facilitate audits effectively.

Cost

Make sure that you completely understand the pricing model, including any variable costs tied to the number of verifications or additional features. Assess the solution’s scalability concerning its cost to ensure it provides a positive return on investment as your business grows.

Best Vendors for AML KYC Bank Software to Choose From

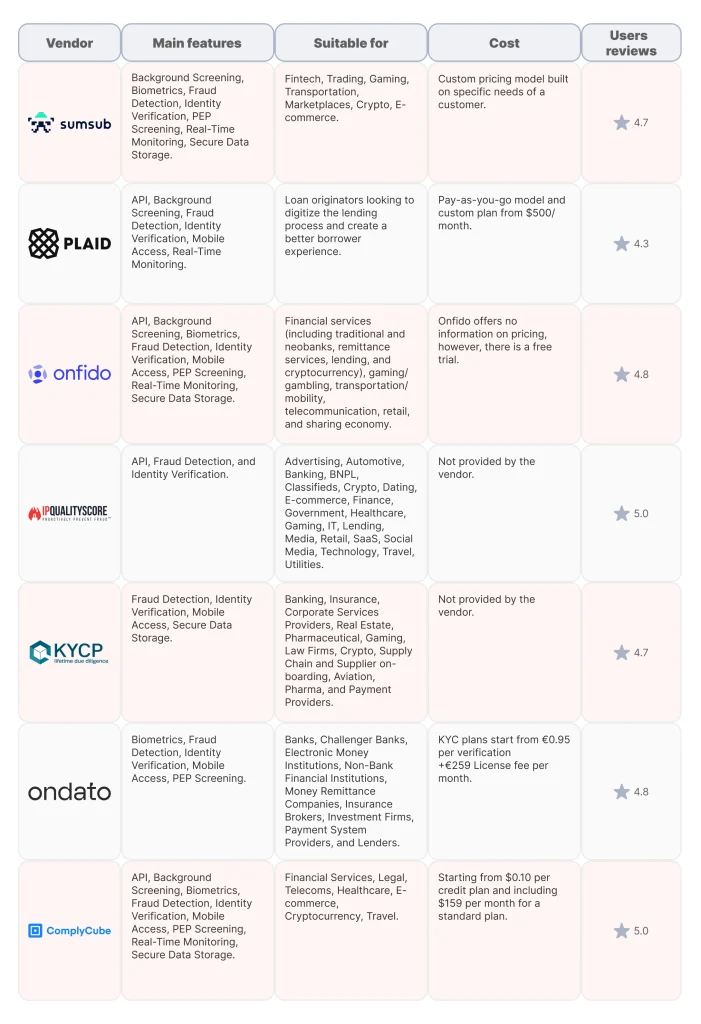

Sumsub

Sumsub verification platform is aimed at securing the whole user journey, allowing you to orchestrate the verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business. Sumsub has over 2,000 clients across the fintech, crypto, transportation, trading, and gaming industries including Mercuryo, Bybit, Huobi, Unlimint, Poppy, and TransferGo.

Main features:

- Background Screening

- Biometrics

- Fraud Detection

- Identity Verification

- PEP Screening

- Real-Time Monitoring

- Secure Data Storage

Pros:

- User-friendly product with great benefits and easy integration options.

- Low average response time with a high accuracy rate.

- Affordable pricing.

- Great support.

Cons:

- Limited levels of field customization.

- Insufficient explanation of various features causes misunderstanding.

- Limited functionality.

Plaid

Plaid technology platform that enables applications to connect with users’ bank accounts. Plaid focuses on lowering the barriers to entry into financial services by making it easier and safer to use financial data.

Main features:

- API

- Background Screening

- Fraud Detection

- Identity Verification

- Mobile Access

- Real-Time Monitoring

Pros:

- Powerful and dependable financial data connection capabilities.

- Robust integrations across many different payment/banking platforms.

- Modern APIs and good support.

Cons:

- Limited support of the financial institutions.

- Issues with timely customer support.

Entrust

Entrust provides an end-to-end AI-powered identity verification solution, enabling businesses to establish secure and seamless relationships with their customers. Its identity platform allows companies to onboard users at scale, effectively prevent fraud, and comply with KYC, AML, and other regulatory standards.

Main features:

- API

- Background Screening

- Biometrics

- Fraud Detection

- Identity Verification

- Mobile Access

- PEP Screening

- Real-Time Monitoring

- Secure Data Storage

Pros:

- Sandbox environment with good uptime.

- Great customer experience when switching from desktop/laptop device to mobile to capture identity documents with a camera, or take a selfie.

- Powerful identity verification features.

Cons:

- Load times can sometimes be a little long.

KYC Portal

KYC Portal is an award-winning fully dynamic, risk-driven Client Lifecycle Management platform. KYCP is fully focused on automating the back-office of KYC & due diligence processes, while also automating the calculation of risk, based on pre-defined dynamic parameters.

Main features:

- Fraud Detection

- Identity Verification

- Mobile Access

- Secure Data Storage

Pros:

- Good software with extensive options and frequent updates that make the life of the AML department easier.

- Inclusive onboarding.

- Straightforward integration.

Cons:

- No proper manual on how to use it.

- Takes a lot of work to configure the software to meet your specific needs.

Ondato

Being one of the biggest KYC AML software providers, Ondato is a digital compliance platform that helps businesses follow the latest KYC and AML rules. With multiple solutions for risk-free regulatory compliance, Ondato has your back on everything from identity verification and case management to due diligence and screening.

Main features:

- Biometrics

- Fraud Detection

- Identity Verification

- Mobile Access

- PEP Screening

Pros:

- Great customer support.

- Ease of use that includes an intuitive interface, automation capabilities, and customization options.

Cons:

- Limited integration options.

- High pricing for small businesses.

ComplyCube

ComplyCube is another prominent KYC company, offering an all-in-one platform for automating and simplifying Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Customer (KYC) compliance. It offers the most complete and flexible AML/KYC tools to help businesses verify genuine customers in seconds while deterring fraudsters.

Main features:

- API

- Background Screening

- Biometrics

- Fraud Detection

- Identity Verification

- Mobile Access

- PEP Screening

- Real-Time Monitoring

- Secure Data Storage

Pros:

- Easy to use.

- Providing a range of essential features, making an all-around AML compliance solution.

KYC Software Vendors Comparison Chart

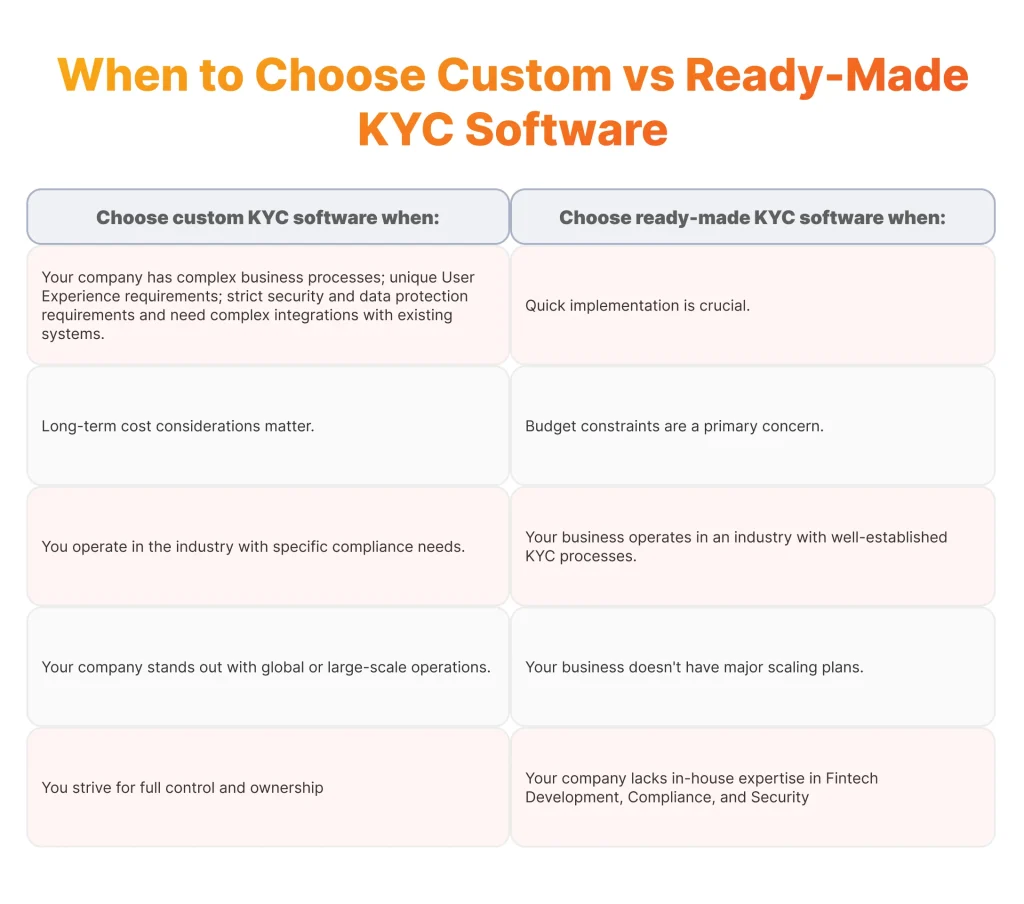

How to Choose KYC Software That Is Right For Your Business

Depending on the particular needs of your business, you may go with the AML KYC solution that is already on the market, and showing great results for its users worldwide. For some companies, this is also a way to avoid the most common fintech development challenges, so here is a brief description of scenarios, where the existing solution is the most fitting option.

When You Can Choose a Ready-Made Solution

- Budget constraints are a primary concern. Ready-made solutions typically have lower upfront costs compared to developing a custom solution. They usually follow a subscription or licensing model, allowing businesses to manage costs more predictably and calculate all pricing details upfront.

- Quick implementation is crucial. Another significant advantage of the best KYC software that is already on the market, is that it allows faster implementation, and, once again, is far more predictable in comparison to the custom software. In fact, off-the-shelf KYC software solutions are pre-built and ready to deploy, minimizing development time. This is particularly beneficial when time is a critical factor in meeting regulatory requirements or responding to market demands.

- Your business operates in an industry with well-established KYC processes. Industries like Finance and Banking often have common KYC requirements, and that’s why they may not need highly specialized workflows. Ready-made solutions designed for such industries may already incorporate best practices and compliance standards to deal with the most common compliance issues, reducing the need for extensive customization and creating any software from scratch.

- Your business doesn’t have major scaling plans. If you have a smaller business or a startup and don’t have plans for extensive growth for your organization and the need for intricate functionality, an off-the-shelf solution may cover your basic needs in an environment with limited financial resources.

- Your company lacks in-house expertise in Fintech Development, Compliance, and Security. A quest for developing custom KYC AML solutions requires deep domain knowledge in areas such as Fintech Development, Regulatory Compliance, and Cybersecurity. If you don’t have such expertise under your roof, it makes much more sense to rely on previously built software and focus your attention on the areas you have proficiency in.

However, KYC and identity verification vendors are not able to cater to all possible scenarios and situations, and that’s when custom software developers step in. Let’s review in the next section the cases when it makes sense to hire a dedicated development team and build a tailored KYC solution from scratch.

When It’s Better to Opt for Custom KYC Software

- Your company has complex business processes. Some businesses in certain industries have intricate and highly specialized KYC processes that cannot be fully covered by existing AML KYC vendors, making custom fintech software development essential for aligning the software precisely with the business’s specific processes. Specialized KYC processes may include enhanced Due Diligence (EDD), Biometric Verification, continuous Monitoring and automated KYC update, Customer Risk Profiling and Behavioral Analysis.

- You operate in the industry with specific compliance needs. Custom development allows for the incorporation of industry-specific compliance measures, ensuring accurate adherence to regulatory requirements that might not be adequately covered by existing solutions. Industry-specific compliance might include identifying and verifying the beneficial owners of entities involved in transactions and addressing the risk of money laundering through property transactions in the Real Estate industry, for example, or subscriber identity verification in the Telecommunications industry.

- Your business has unique User Experience requirements. If you have your vision for user experience in your organization, custom software development services enable the design of interfaces and workflows tailored to the specific brand identity and user preferences of the business, providing a unique and user-friendly experience to help the brand stand out among competitors.

- You have strict security and data protection requirements. Custom development allows the implementation of highly secure measures, encryption protocols, and advanced authentication mechanisms tailored to the specific security needs of the organization, for example, offering KYC solutions for banks and financial institutions. Ensuring data security in Fintech is always a priority for any organization, so an additional boost in this area is an undisputed advantage of the custom solutions.

- Your company stands out with global or large-scale operations. Custom software can be designed to handle scalability challenges from the very beginning, ensuring optimal performance under heavy loads, which may be critical for large businesses with extensive operations. Custom development also allows for the creation of a unified solution adaptable to various compliance standards, providing a consistent approach to KYC across different regions.

- You strive for full control and ownership. The custom development approach offers a level of ownership and flexibility that may not be achievable with off-the-shelf solutions, allowing businesses to have full control over the KYC system’s aspects, including data storage and updates.

- Long-term cost considerations matter. The initial overall price of the custom solution can be higher compared to the best AML KYC software available on the market, however, over a long period, constant growth, and evolving business needs, tailored software may end up being more cost-effective.

- You need complex integrations with existing systems. In case, your organization has a sophisticated IT infrastructure, third-party KYC software providers may struggle to cater to your needs with their solutions. A tailored solution, on the other hand, can be designed to fit precisely into the organization’s technology stack, ensuring smooth integration with existing systems and avoiding any compatibility issues.

Conclusion

Hopefully, this article presented a decent overview of KYC software companies, and now you are one step closer to figuring out whether an off-the-shelf application will work for you, or whether a tailored solution is required in your situation. We, at SPD Technology, are ready to handle KYC service-related requests, from consultation, to help with the integration of third-party software, as well as building your own from the ground up.

FAQ

Which are the best KYC software vendors?

There are plenty of companies that offer KYC as a service, however, the top market players you should consider include Sunsub, Plaid, Entrust, IPQS, KYC Portal, Ondato, and ComplyCube.

How to choose a KYC software vendor?

While choosing a vendor, focus on the following aspects. If you find that off-the-shelf software does not cover your specific requirements, consider dedicated software development team services from SPD Technology and create a custom solution.

- Compliance and Regulations

- User-Friendly Interface

- Integration Capabilities

- Automation and Efficiency

- Scalability

- Data Security

- Cost Structure

- Market Reputation and Proven Track Record.