Being one of the fastest-growing in the world, the Fintech market is projected to reach $492 billion by 2028, growing at a CAGR of 16.8%, according to Exploding Topics. These impressive estimates gave rise to several fintech development challenges, and the payment gateway development shares most of them. In this article, we will provide a detailed overview of how to create a payment gateway most efficiently, sharing some actionable insights from our tech experts.

The adoption rate of payment gateways dramatically increased during the COVID-19 pandemic, and as the world moved to other economic difficulties, payment gateways are becoming more popular than ever. According to Statista, the total transaction value of digital payments is expected to show an annual growth rate (CAGR 2023-2027) of 11.83% resulting in a projected total amount of US$14.78tn by 2027. So, in the next few years, you should capitalize on digital payments to get the most revenue for your organization, and we will help you do just that!

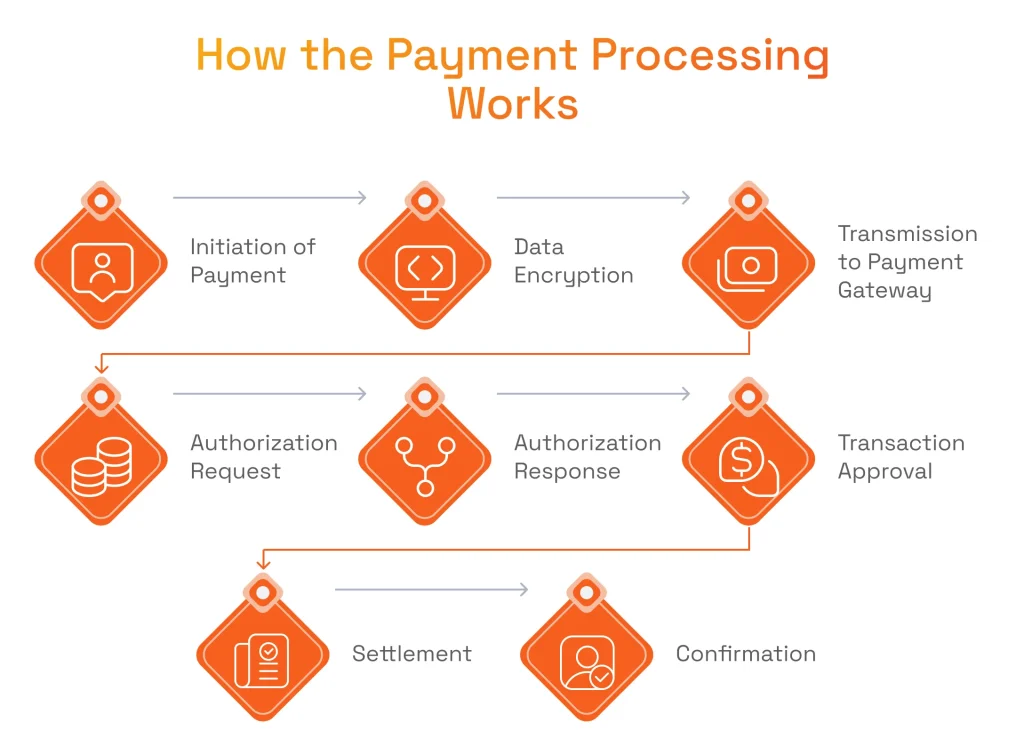

How the Payment Processing Works

Before discovering how to become a payment gateway, it is important to understand the fundamentals of payment processing. Payment processing is a series of steps involved in secure fund transfer from the customer’s bank account to the merchant’s account. This process involves multiple entities, such as payment gateways, acquiring banks, issuing banks, and payment processors, all working together to ensure smooth and secure transactions. Setting up a payment gateway is a critical step in this process because it acts as a bridge between the point-of-sale system or website and all financial institutions involved.

In our recent article, we have explained the essence of payment processing in more detail and prepared a guide on how to develop a payment processing app step-by-step!

Payment Gateway Workflow and Its Role in Payment Processing

In the payment processing ecosystem, the payment gateway is a critical component that:

- Encrypts payment data

- Connects merchants with payment processors, issuing banks, and acquiring banks

- Ensures the verification of transactions in real-time

- Transmits data accurately

- Offers seamless user experience

To provide you with a deeper perspective, let’s look closer at the role that payment gateway plays in payment processing, by overviewing what happens in this process.

- Initiation of Payment: the customer adds items to the cart and goes to the checkout or Point-of-Sale terminal.

- Data Encryption: the customer’s payment information is entered into the checkout form and encrypted by various methods like SSL (Secure Socket Layer).

- Transmission to Payment Gateway: the payment gateway receives the encrypted financial information and acts as a secure intermediary that facilitates communication between the merchant’s system and the financial institutions.

- Authorization Request: the payment gateway sends an authorization request to the issuing bank, which seeks approval for the transaction and verifies that the customer has sufficient funds or credit to complete the purchase.

- Authorization Response: the issuing bank sends an authorization response back to the payment gateway. The response includes information on whether the transaction is approved or rejected and additional information.

- Transaction Approval: after getting approval, the payment gateway allows the merchant to proceed with the order.

- Settlement: when the transaction is authorized, the merchant’s acquiring bank (the bank that maintains the merchant’s account) and the issuing bank work together to settle the funds. This settlement involves transferring funds from the customer’s account to the merchant’s account.

- Confirmation: the process ends with the gateway communicating the transaction status to the buyer and merchant.

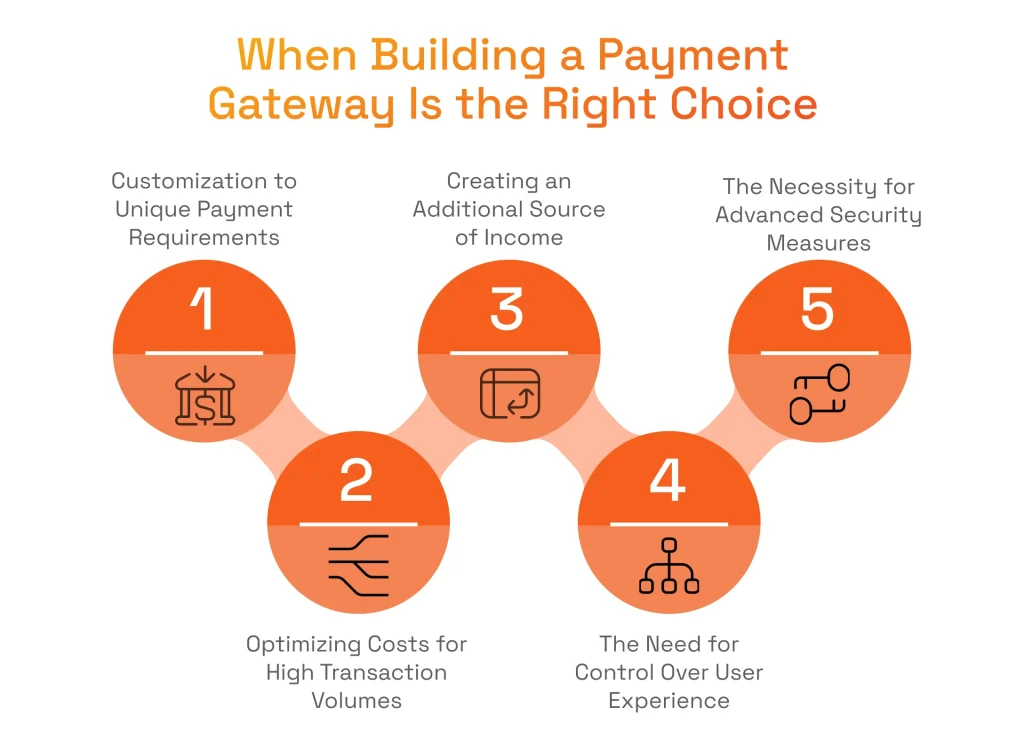

When Building a Payment Gateway Is the Right Choice for Your Business

Integrating an existing solution is hard enough, so why may your organization need to build one from the ground up? Below are some of the common situations when developing a custom payment gateway from scratch makes the most sense.

- Customization to Unique Payment Requirements: You need to cover specific business requirements like having specific types of transactions, currencies, and payment methods. There can be a situation where an off-the-shelf solution has several generic features and lacks business-critical functionality for your case, so there is a need to hire a dedicated development team for a tailored solution.

- The Need to Optimize Costs Because of the High Transaction Volumes: Existing solutions charge high registration and usage fees, that, with many transactions, may result in enormous expenses for the company.

- Additional Source of Income: Having a custom payment gateway, a company can become a payment gateway provider for other businesses, receiving an additional stream of revenue.

- The Need for Control Over User Experience: With a custom payment gateway, a business can have full control over the payment interface, having an opportunity to tailor payment flows, checkout designs, and branding. This results in a cohesive and optimized user journey that improves customer satisfaction and loyalty.

- The Necessity for Advanced Security Measures: With a custom payment gateway, a company can benefit from AI-powered fraud detection, tokenization, and other advanced security measures that help comply with specific industry standards and ensure data protection.

Many companies may benefit from having a customized functionality, however, the most common examples include:

- Large Enterprises can handle massive transaction volumes without disruption.

- eCommerce Platforms and Marketplaces can benefit from integrating various payment methods and getting access to clients worldwide.

- Banking and Financial Institutions will improve the level of security that advanced fraud detection mechanisms provide.

- Nonprofit Organizations will be able to accept donations in various forms across the world, including recurring contributions or specific fundraising campaigns.

- Educational Platforms and Institutions can benefit from custom features like flexible fee structures and installment payment options.

- Organizations in the Travel and Hospitality Industries will gain access to such valuable features as dynamic pricing, and split payments for group bookings.

For all of those examples, along with the aforementioned case-specific benefits, having a custom payment gateway can become an additional source of revenue.

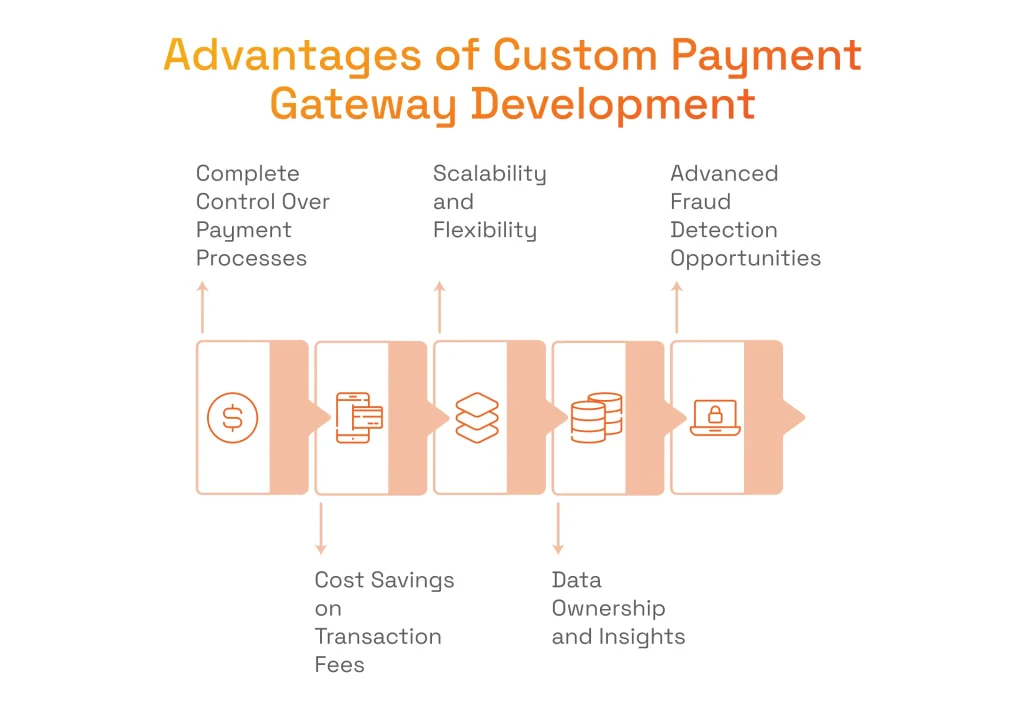

The Cutting-Edge Advantages of Payment Gateway Development

While developing your solution from scratch can have its difficulties, a custom payment gateway brings unique advantages that can transform your business.

Complete Control Over Payment Processes

You will be able to have control over the way your transactions are processed since your gateway is tailored to your specific needs and goals. It opens up possibilities for customized payment flows, preferred payment method integration, and implementation of features that enhance user experience and security.

Cost Savings on Transaction Fees

With a custom solution at your disposal, you can minimize or even, in some cases, eliminate entirely your dependency on third-party vendors and obtain lower transaction fees as a result. These savings can vary depending on the volume of your transactions, however, organizations of any size will benefit from reduced operational expenses.

Scalability and Flexibility

By design, a custom payment gateway will grow alongside your organization. The needs of your company will inevitably grow, as the volume of transactions increases, and the new groundbreaking technologies turn into industry standards at a rapid pace. With a tailored approach, you will obtain the necessary flexibility to serve the customers with advanced payment solutions.

Data Ownership and Insights

Since you will be running a payment gateway, your experts will have complete control over transaction data and be able to extract valuable insights from it. In particular, analyzing this data will help to understand the customers better, optimize operations, and make smart, data-based, strategic decisions.

Advanced Fraud Detection Opportunities

Industry-leading vendors know how to integrate cutting-edge fraud detection mechanisms into your custom solution. These mechanisms leverage AI-driven models and custom rules, that are able to proactively identify and mitigate fraudulent activities, far better compared to off-the-shelf solutions that are not tailored to your unique business scenario.

How to Create Payment Gateways: Core Elements Breakdown

Creating a payment gateway entirely from scratch is a complex task that requires careful planning and exceptional proficiency in the implementation. In this section, we will discuss this process step-by-step to help you understand the scope of work and the nuance of each one.

Planning and Choosing the Right Technology

So, your business needs something other than top off-the-shelf payment gateway solutions like Stripe, Square, PayPal, or Authorize.Net, and you decided on building a custom payment gateway. This is a fascinating journey that includes creating your payment gateway infrastructure, integrating necessary payment processors, developing custom functionality (saving credit or debit card information, for example, or billing and subscription features), creating a CRM system, implementing essential security features, and obtaining required certifications.

As for choosing the right technology, there is no short and sweet answer to the question of the perfect tech stack for your upcoming project. It will be a good idea to start from a high-level perspective based on your specific business needs, determine what modules you may need, and then dive deeper into the details.

Front-End Components

When you wonder how to set up an online payment gateway for a website, one of the important things to think about is how the payment process will look for the users.. There are several UX elements, that are must-haves in this case:

User authentication

Implementation of the secure authentication mechanism for users and admins, with possible integration with single sign-on (SSO) solutions.

Payment form

Designing a user-friendly payment form where users enter their payment information, such as credit card details, billing address, and any additional required information.

Responsive design

Adhering to the concept of responsive design, meaning that the payment gateway’s front-end components are designed to work across various devices and screen sizes.

As for the technology stack, it is possible to develop the aforementioned, as well as the front-end side of CMS with commonly used technologies like HTML/CSS/JavaScript and frameworks and libraries including React, Angular, Vue.js, jQuery, and Bootstrap.

Back-End Components

Server

On the enterprise level, we will be working with large amounts of transactions, so self-hosted servers will not withstand the high load and become more and more expensive with the expanding number of operations. The obvious solution is leveraging сloud сomputing. If you want to focus on how to make a payment gateway from scratch and improve its business logic instead of being stuck in server management, cloud server is the best option for your infrastructure.

If Statista is to be believed, Amazon Web Services leads the market of Cloud Infrastructure Service providers with 32%, staying ahead of Microsoft Azure with 22% and Google Cloud with 11% respectively.

Dmytro Nesterenko

Software Development Engineer, SPD Technology

“Cloud infrastructure offerings from all three market leaders Amazon, Microsoft, and Google are equally suitable for payment gateway development, they only differ in pricing and slightly differ in available features. We work with Amazon AWS as the most developed and powerful Cloud provider in the world, however, Microsoft and Google offer enough tools and capacities for a payment gateway software development company to build a solution. The only thing for sure is that Cloud infrastructure is a must-have, and hosting your own servers will limit the growth of your organization.”

So, if AWS becomes your Infrastructure-as-a-Service of choice, you will already have predetermined infrastructure tools integrated into this solution that your developers can work with. This means that your back-end tech stack will be defined by the available technologies of your Cloud Infrastructure provider.

Database

As a part of a Cloud provider, your developers will receive several infrastructure solutions to choose from. In the context of payment-related solutions, the best choices will be scalable and regularly updated databases, able to withstand high loads and the ones that can provide high levels of server and data security.

Volodymyr Soska

Software Development Engineer, SPD Technology

“Data handling for payment gateways has a specific set of rules and regulations, for the developers to adhere to. There is a certain way to receive sensitive financial data, store it, and share it with the participants in the payment gateway workflow. So, the requirements for the manipulation of the financial data play a key role in choosing the right database for the project.”

Other components

Depending on the case, we can use other components from the Cloud provider. For example, a message broker (Amazon SQS or Kafka), achieves the necessary functionality by implementing the existing solutions.

Back-End Sub-Systems to Develop

In practice, a company that knows how to implement payment gateways works with many microservices and subcomponents, placed on different servers and having different databases. Each microservice may have the same, similar, or entirely different tech stack. Depending on the size of the project, the number of microservices may vary from 5 to 100+, and some of them are common for projects in other industries like logging, error handling, and auditing modules. Let’s focus on the vital back-end sub-systems in our case:

Transaction processing

This is the heart of a custom payment gateway solution, and it involves integrating external payment processing services. According to business demands and geography, there is a demand to integrate multiple established payment processors.

The implementation of each processor into your solution involves the following steps:

- Register for an account with the chosen payment processor and obtain the necessary API credentials (API keys, merchant IDs, and other authentication details).

- Code an integration layer within your custom payment gateway, to handle various payment-related operations (payment requests, authorization responses, transactions, and settlements). Java programming language is the technology of choice for this task, here in SPD Technology, and for this industry, since it has cross-platform functionality, a high-security level, and many available libraries. Programming on Java also allows reusing developed components on Android-based Point-of-Sale terminals. What’s more, you are welcome to leverage our Java development services and our top-skilled programmers would be glad to unlock the full potential of this technology for your project!

- Before deploying the integrated solution in a production environment, each integration should be tested and meet the certification standards of a respective payment processor.

Volodymyr Soska

Software Development Engineer at SPD Technology

“Certification is the most time-consuming part of the third-party payment processor integration. While the actual technical integration may be completed within a month, getting the right to use it may take a couple of months, depending on the provider and its regulations.”

Risk Management and Fraud Detection

There are different layers to this. It all starts with Know Your Customer and Know Your Business processes for each transaction. To evaluate businesses and customers, it makes sense to use both internally developed tools and integrate third-party solutions like Google reCAPTCHA for customer evaluation.

The vendor usually develops a Fraud Detection module with a certain business logic. As for Fraud Detection tools, they are complex technological solutions leveraging cutting-edge Artificial Intelligence and Machine Learning technologies. While the payment gateway software development vendors can offer custom Fraud Detection functionality, it is more common and cost-effective to use third-party integrations for this purpose like Cybersource from Visa, for example.

Reporting

A well-built reporting module is crucial for payment gateway administrators, merchants, and stakeholders to gain insights into the performance and health of the payment system. The specific features and functionalities, as well as tech stacks, may vary based on the requirements of the payment gateway and the needs of its users.

Pricing

There are two entirely different types of pricing we should deal with:

- On the level of transactions and fees of payment processors.

- On the business level for the users of your payment gateway.

Each one requires a separate module to cover its functionality. Additionally, in some cases, a separate module with a logic for tax calculation may also be required.

Security Features

This is a complex topic, as on different levels, security requires different implementations. It is safe to say that the vendor is mostly responsible for the correct reception and encryption of data, while other aspects are usually covered by the Cloud provider and third-party integrations. Here is a quick overview of the most common techniques:

2-factor authentication

In a custom payment gateway, 2FA can be implemented to add an extra layer of security during login, administrative access, or access to any sensitive operation. 2FA adds a layer of authentication to protect access to the payment gateway’s administrative interfaces.

Tokenization

This technique involves substituting sensitive data such as credit card numbers with a unique identifier or token. Instead of storing actual credit card numbers, tokens are stored and processed, reducing the risk associated with handling sensitive information.

Encryption (SSL, TLS)

SSL and its successor, TLS, are cryptographic protocols that encrypt data during transmission, ensuring that sensitive information exchanged between the user and the payment gateway remains secure.

Read our expert article to get a deeper insight into ensuring payment gateway security!

Quality Assurance and Testing

A major scope of work is related to making sure that the system will work properly with timely resolution of any occurring issues.

In the context of custom payment gateways:

- Unit Testing is similar to any other software development project.

- Integration Testing requires much more effort since we have plenty of different complex integrations to work with and test cases to cover.

As our fintech software developers shared from their experience, sandbox accounts for integrated payment processors are not always stable, resulting in failing integrated testing on the side of software developers. The development company should work in cohesion with a third-party vendor’s support service to work this out.

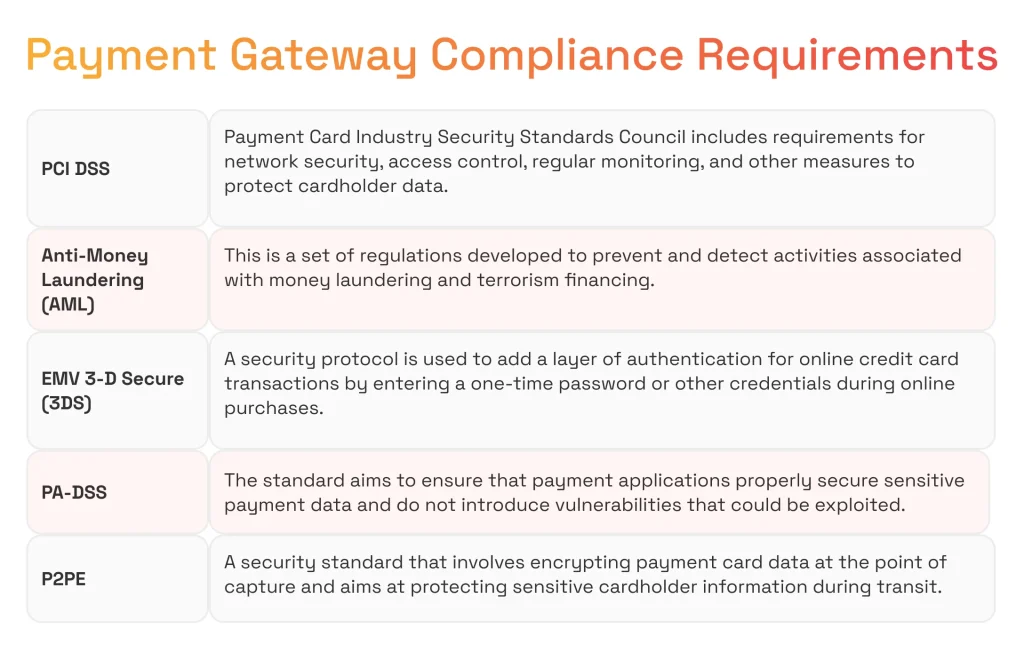

Ensuring Compliance

While discussing how to create a payment gateway, it is impossible to ignore the most important cybersecurity standards and regulations.

PCI DSS

A set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. Developed by the Payment Card Industry Security Standards Council (PCI SSC), PCI DSS compliance requirements cover network security, access control, regular monitoring, and other measures to protect cardholder data.

Make sure your business is PCI-compliant following our PCI DSS compliance checklist for 2024!

Anti-Money Laundering (AML)

This is a set of regulations, policies, and procedures implemented by financial institutions and other entities to prevent and detect activities associated with money laundering and terrorism financing. AML regulations are designed to ensure that businesses have robust processes in place to identify and report suspicious transactions.

EMV 3-D Secure (3DS)

A security protocol is used to add a layer of authentication for online credit card transactions. It is an extension of the EMV (Europay, MasterCard, Visa) standard used for chip card transactions. 3DS prompts users to enter a one-time password or other authentication credentials during online purchases.

PA-DSS

A set of security requirements established by the Payment Card Industry Security Standards Council (PCI SSC) for software vendors that develop payment applications. The standard aims to ensure that payment applications properly secure sensitive payment data and do not introduce vulnerabilities that could be exploited.

P2PE

A security standard that involves encrypting payment card data at the point of capture (e.g., at a Point-of-Sale terminal) and maintaining that encryption until the data reaches the secure environment of the payment processor. This helps protect sensitive cardholder information from being intercepted and compromised during transit.

Deployment, Support, and Maintenance

The deployment process is similar to any other software development project. However, with a custom payment gateway, a big project, there can be a need to support many servers, so having a dedicated DevOps team for maintenance and supporting security patches is a must-have.

Payment Gateway Development Challenges

Custom development of payment gateways introduces a unique set of challenges that require diverse expertise in software development, security, and financial transactions to overcome. In this section, we will share our solutions to common obstacles in this process.

Timely Maintenance of Many Integrations with Payment Processors

As the business grows and expands its functionality to new countries, more integrations with payment processors are required. The more payment processors are being added to the gateway, the harder it gets to maintain their functioning.

We deal with this challenge by keeping every payment processor integration up-to-date, because any third-party vendor can make changes anytime, causing disruptions in the existing integrations. Dealing with this often does not involve actual coding, but rather communication with a support team of a particular payment processor vendor and resolving issues together. Having dozens of payment processors integrated may turn this into a serious problem that requires much attention.

Maintaining High Reliability

The maintenance team is responsible for ensuring 99.9% availability of the service, and quickly resolving any issues that might occur and negatively affect the performance. Any performance issues will harm the core business functionality, and the whole point of having a custom solution will be lost.

To overcome this challenge, we create a detailed roadmap with basic instructions on what to check if any anomaly happens in the system. We fully realize that it is super important for maintenance experts to know what to do and how to react in case any problem occurs because minutes of technical-related downtime can cost our clients millions of dollars.

Developing a Real-Time Fraud Detection System

This is a significant challenge because to build an advanced system that functions in real-time, a fraud detection software development company should master the latest machine learning algorithms, use robust data pipelines, and constantly update to stay ahead of evolving threats. Furthermore, retaining low latency is critical, because even the slightest delay can disrupt the transaction flow.

We, at SPD Technology, truly embrace our knowledge of AI/ML development and offer our clients highly accurate, modern fraud detection systems. We integrate features including behavior analytics, anomaly detection, and dynamic risk scoring that allow our solutions to detect fraud in real time without any significant downtime.

Learn more about fraud detection using machine learning models in our featured article, which highlights the most interesting use cases.

Significant Upfront Investment

Like with any other custom project, there are big initial financial costs involved. The lion’s share of them goes to fund infrastructure setup, get a compliance certification, and develop advanced software features. This challenge is especially critical for startups and mid-sized businesses since these costs can be a major blocker for achieving maximal ROI.

We know how to optimize resources due to our extensive experience with payment gateway development, and having proven tools, frameworks, and technologies that already got significant results. Speaking of them, in the next section we offer you to look closely at our approach to payment gateway development in terms of costs and resources.

Tools and Resources to Build a Payment Gateway of High Quality

Let’s move on to the brief overview of what you need to develop a solution of exceptional quality and performance.

Team Structure to Create Payment Gateway

For developing a payment gateway from the ground up, you need a multidisciplinary team with expertise in fintech, software development, security, and compliance. While depending on the size of the project and the complexity of integration the number of experts can grow exponentially, we are strong believers that for a basic functioning MVP, 2-3 fintech development specialists would be just enough, and you can scale the team later if needed.

Time to Develop a Custom Payment Gateway

The payment gateway development timeline is a crucial aspect that businesses need to factor into their strategic planning. On average, it takes approximately 8 months to construct a Minimum Viable Product (MVP) for a single currency, self-hosted payment gateway for basic eCommerce usage. This duration of custom payment gateway development encompasses building such modules as designing a payment page, business and payment services development, basic admin and merchant portals development, plus billing and fraud detection services integrations.

The time to develop more advanced functionality is further heightened when considering the need for customization. For example, adding more currencies, integrating with new payment methods and payment processing systems will extend the time frame to build your own payment gateway. While the 8-months time frame for a custom payment gateway MVP development serves as a baseline, you still should approach this venture with a strategic mindset, understanding that customization, integration with reliable payment service providers and adaptability are key to meeting the evolving needs of the digital payment ecosystem.

Payment Gateway Development Cost

Building a payment gateway MVP with a hosted payment form for basic eCommerce use, targeting a single country, currency, and language, costs approximately $160,000–$250,000 in 2025. This estimate excludes project-specific requirements and additional expenses, such as certification costs, which vary by geography.

If you are interested in a more detailed cost breakdown, we invite you to read our featured article on this topic.

Discover a brick-by-brick estimate of the cost of payment gateway in our dedicated guide!

Why Partnering with a Tech Vendor to Create a Payment Gateway Makes Sense

There are several reasons to partner with tech experts for this goal. The first reason is faster time to market, as experienced vendors know how to leverage development frameworks, modern tools, and technologies to speed up the development process. While the custom payment gateway development process is resource-intensive and time-consuming, a pro vendor can speed up it while retaining quality to help you get a competitive advantage in a rapidly changing market.

Indeed, custom payment gateway development requires massive investments in technology, experts, as well as further support. Top tech vendors know how to efficiently optimize those costs and lower the upfront investments, by offering flexible pricing models and practical financial advice at every stage.

Also, any payment gateway project requires narrow expertise with industry-specific, cross-industrial knowledge of finance, security, and software development. Experienced vendors have those experts, as well as connections and capabilities to assemble a required development team when necessary.

With custom payment gateways, reliability is paramount, because any significant downtime may lead to massive financial losses and damaged reputation. Proficient tech vendors always prioritize stable performance and uptime, securing the 24/7 operation of your payment gateway.

Last but not least, a tech vendor will help you make sense of the regulations and standards of the payment industry, and deliver solutions that will comply with PCI DSS, GDPR, as well as other regional requirements.

Consider SPD Technology for Payment Gateway Software Development

We stand out as a trusted payment gateway development partner due to our 19+ years of proven experience in the fintech industry, delivering groundbreaking solutions by leveraging our deep expertise in AI/ML, data analytics, payment solutions, and document management.

During our two decades of driving innovation for global clients, we collaborated closely with top payment infrastructure providers, integrating countless platforms and payment methods, and expanding service accessibility for the customers of our clients.

We always keep the highest level of attention to security by getting the most out of sophisticated AI-driven fraud detection and risk management techniques to safeguard our payment gateways and their integrations, continuously analyzing potential threats in real time.

In most of our projects, we develop customized solutions tailored to specific use cases. So, whether you operate in banking, eCommerce, fintech, subscription, or any other industry, we will find an optimal approach to achieve your goals.

Our company is proud to have long-term relationships with many of our clients, as we continue to support and evolve our projects for 5+ years on average and more with timely maintenance and updates, as business and technological demands grow. Let’s take a look at one of our most prominent use cases, where our fintech proficiency truly shined.

How to Set Up a Payment Gateway – Nimble Commerce Success Story

Business Challenge

Our client is an eCommerce startup from Silicon Valley that helps merchants and brands to create and manage their own pre-paid offer and gift card programs, as well as resell through a network of retailer and publisher-branded sites. The challenge for us was to replace the previously hired vendor and build a high-scale and extremely feature-rich B2C and B2B solution completely from the ground up.

SPD Technology Approach

While the project started with only 2 developers, we eventually dedicated to this project several dedicated teams totaling 30 experts. Since our functionality was the core of the product, we collaborated closely with the client’s leadership and product teams during the design and development phases. Part of our teams relocated on-site to ensure seamless support and provide help during the critical phases of development.

We also worked with NimbleCommerce’s B2B customers to help in negotiations and technical onboarding. Our teams kept up with the solution’s rapid growth and expansion across diverse geographies, as we successfully integrated 27 different payment systems by leveraging specialized workflow. SPD Technology not only launched the product on time and without any technical blockers but also incorporated powerful AI/ML features into the solution, exceeding the expectations of the client.

Value Delivered

- Bringing Business Vision to Life: we successfully helped our client turn an idea into a profitable, game-changing business venture during 6 years of fruitful collaboration.

- Obtaining Millions of B2C Customers and Thousands of B2B Clients: our cutting-edge product became a massive market success and established the new industry benchmark for white-label features and reaching users across the globe.

Overall, this is a great example of how to set up a payment gateway, as we helped the product grow and succeed, meeting all the challenges that we had along the way. During its peak in 2016, NimbleCommerce was acquired by BlackHawk Network Inc. (BHN), and we continued to improve the product under new ownership.

Conclusion

Hopefully, this article sheds some light on how to build a payment gateway system covering your unique business needs, improving your functionality, and saving you money as a result. It is important to note that depending on the type of your business, whether it’s a payment gateway for in-store or online business, the required components will differ, as well as the optimal tech stack for the project. So, it makes sense to consult an experienced payment gateway development company in this niche, before making any significant decisions.

FAQ

How to build a payment gateway from scratch?

It will be a good idea to hire an experienced payment software development vendor with a proven track record of similar projects or, at least get a consultation, to plan your next steps in this endeavor.

How to build a payment gateway like Stripe?

To create payment gateways, you should go through the following steps:

- Business analysis

- Building a payment gateway infrastructure

- Integrating payment processors

- Developing custom functionality

- Building a CRM system

- Implementing security features

- Obtaining certifications

How much does it cost to build a payment gateway?

It is impossible to give specific estimates, as the final payment gateway development cost is influenced by a variety of factors including scope, features, amount of customizations, and integrations. You are always welcome to get in touch with us for a more accurate estimate!

How to set up a payment gateway on my website?

- For a proper payment gateway setup, you should follow the instructions of your gateway provider. Typically, it includes:

- Creating an account in the system

- Getting API credentials

- Integrating the gateway

- Implementing the required security measures

- Testing

- Launching

- Maintaining.

- For a proper payment gateway setup, you should follow the instructions of your gateway provider. Typically, it includes: