Main thoughts

- The use of Machine Learning and Data Analytics for Customer Segmentation unlocks new opportunities for Insurtech companies by allowing them to offer a more personalized experience to their customers.

- Data Security and Data Privacy remain a top challenge for any AI-related solution, including the ones in Insurtech.

- Predictive Analytics, Chatbots, Virtual Assistants, Recommendation Engines, and Dynamic Pricing are the most effective AI-driven solutions for up-selling in Insurtech.

- While there is a shortage of AI tech experts on the market, the industry will most likely move toward no-code/low-code solutions, opening new opportunities for non-tech experts.

Unlocking the Power of Artificial Intelligence for Up-Selling in Insurtech

Artificial Intelligence (AI) is already changing the ways businesses operate across numerous industries. According to Forbes, the AI market is expected to reach an astonishing $407 billion by 2027.

Insurance and Insurtech companies can truly benefit from the advancements of Artificial Intelligence, and one of the areas that can be improved the most is up-selling.

The concept of up-selling in the insurance industry has been there for years. It refers to the practice of offering additional or upgraded insurance products or coverage to customers beyond their initial or existing policies.

The following practices can be considered up-selling techniques:

- Enhanced coverage options, like, for example, in the case of a car insurance company, offering additional health insurance options.

Higher coverage limits as compared with the basic options. - Bundling multiple insurance packages from the same provider that results in cost savings for the customer. For example, bundling home and car insurance.

- Discounts for those customers, who upgrade their policies.

In this article, we will share our experience in insurance software development and insights on how exactly Artificial Intelligence can boost up-selling techniques for Insurtech companies and create significant advantages over the traditional approaches.

Don't have time to read?

Book a free meeting with our experts to discover how we can help you.

Book a MeetingUnderstanding the Role of Artificial Intelligence in Insurtech

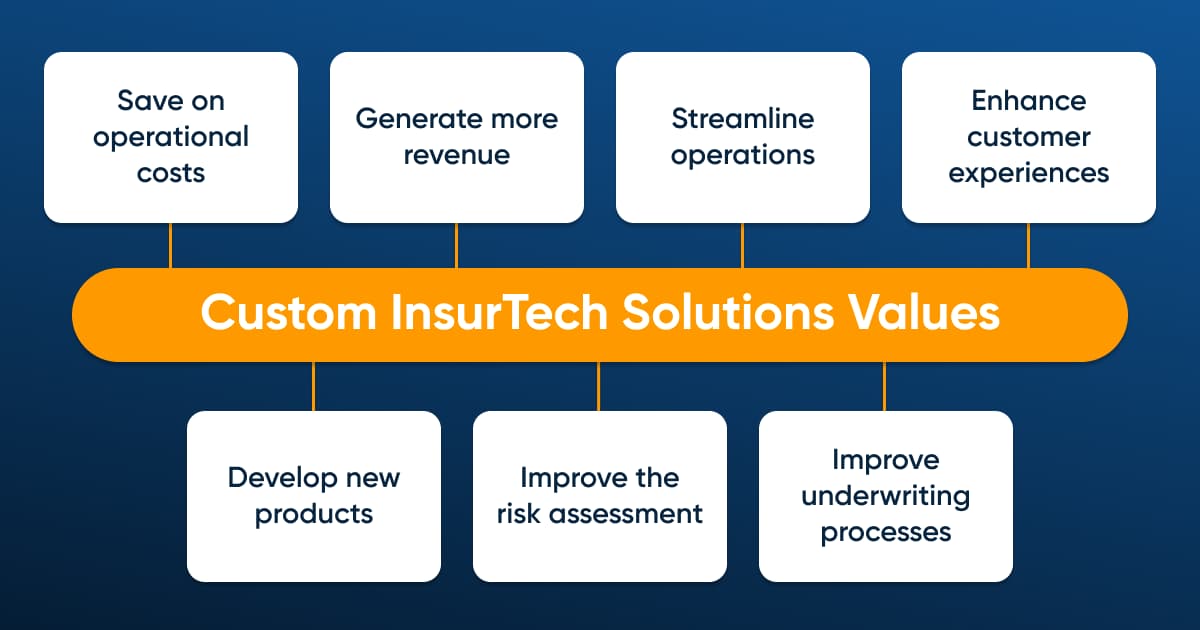

Let’s start with the definitions. The term Insurtech refers to integrating technological advancements into the Insurance industry. These advancements improve or completely transform the ways the insurance businesses operated previously. The key purpose of implementing Insurtech is to save on operational costs, generate more revenue, streamline operations, enhance existing customer experiences, develop entirely new insurance products, and improve the risk assessment and underwriting processes.

According to GlobeNewswire, the global Insurtech market has grown from $10.44 billion in 2022 to $13.49 billion in 2023 at a compound annual growth rate (CAGR) of 29.3%. It is projected to grow to $39.44 billion in 2027 at a CAGR of 30.7%.

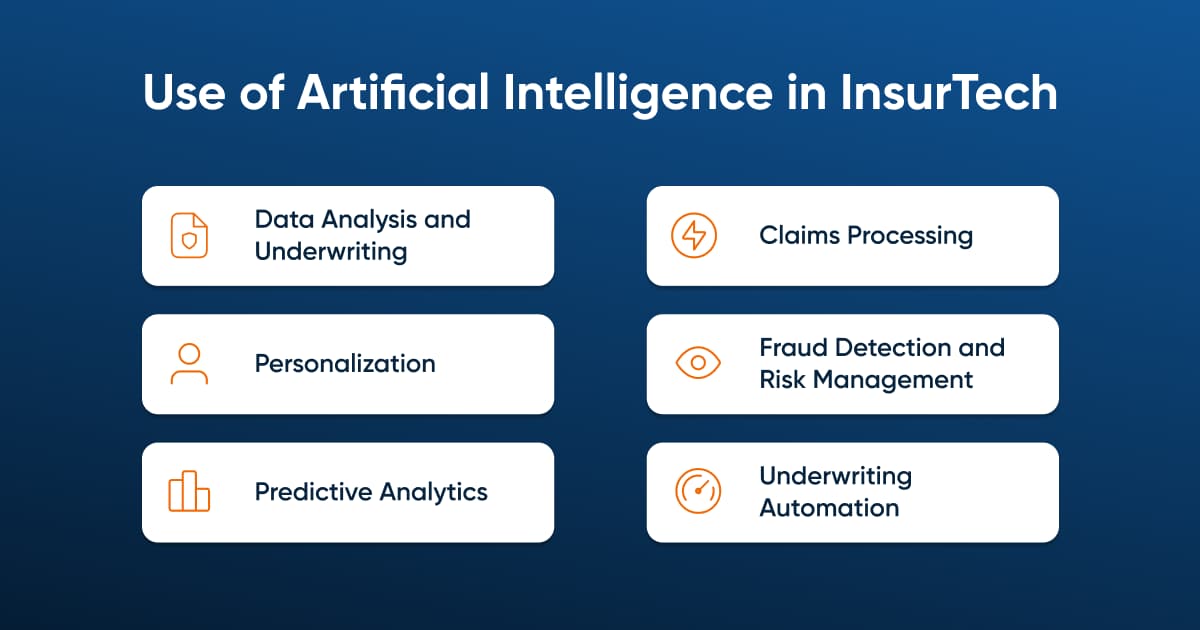

Artificial Intelligence (the field of computer science and technology that focuses on creating intelligent machines, capable of performing tasks that typically require human intelligence) plays a significant role in the Insurtech revolution. It is reshaping or impacting several major aspects of insurance operations and customer experience, including Data Analysis and Underwriting, Claims Processing, Personalization, Fraud Detection and Risk Management, Predictive Analytics, and Underwriting Automation.

Some of those areas have to do with the up-selling process one way or another, and we will discuss them more closely in the next section.

Leveraging Artificial Intelligence for Up-Selling in Insurtech

Enhancing Customer Segmentation and Personalization

Utilizing AI for advanced customer segmentation involves leveraging Machine Learning and Data Analytics techniques to automatically identify and categorize customers into distinct groups based on their needs, behaviors, and characteristics. This process allows companies to improve their up-selling marketing strategies and involves the following steps:

- Collecting relevant data from multiple sources, including information on customer profiles, history of transactions, claims data, and customer interactions.

- Preprocessing collected data by handling any missing data, removing outliers, and standardizing variables, as well as incorporating additional datasets.

- Selecting features by identifying those variables that are most likely to contribute to the customer segmentation process.

- Deciding on the most appropriate Machine Learning algorithms.

- Training the model on the prepared dataset.

- Applying the trained model to segment the customer base into meaningful clusters.

- Validating the effectiveness of the segmentation process against the predefined metrics and existing business goals.

- Analyzing each customer segment to get valuable insights and identify the common characteristics and patterns.

- Personalizing marketing messages, product recommendations, pricing strategies, and customer experiences based on the results of the customer segmentation.

- Continuously updating and refining the customer segmentation models as new data becomes available and the business goals evolve.

Implementing personalization strategies with AI is much more effective as compared to implementing them manually, and proper customer segmentation leads to effective automation and customization that creates a tailored customer experience.

Predictive Analytics for Identifying Up-Selling Opportunities

The power of AI-based predictive analytics in Insurtech is quite impressive. The key areas where predictive analytics can be effective are risk assessment, fraud detection and prevention, underwriting, personalized pricing, claims management, and portfolio optimization.

As to applying AI-based predictive analytics for up-selling, you should start with the customer segmentation process we’ve described above. With enough information (historical data, policy details, customer behavior, and purchase history), one can use AI for calculating the odds of a customer accepting an upsell offer.

Chatbots and Virtual Assistants for Upselling

Virtual assistants and chatbots are already transforming customer engagement in the Insurance industry, and the global insurance chatbot market was valued at $467.4 million in 2022. It is projected to reach $4.5 billion by 2032, according to Allied Market Research.

Just like with any other industry, chatbots in Insurtech take over the basic communication functions. You don’t need a human employee anymore to answer questions, address concerns, and provide detailed information about the available upsell options. The virtual assistant is able to explain to the customer the additional coverage options and possible cost savings. While talking to the customer, a chatbot can take into consideration their preferences and the history of their previous interactions with this customer.

You can set up a virtual assistant to proactively offer customers up-selling opportunities at the right time, thus increasing the odds of conversion.

Recommendation Engines and Cross-Selling Opportunities

Recommendation engines are a major game changer for Insurtech. They utilize the power of AI to suggest insurance products or services to customers. The most common types of recommendation engines include those based on:

- Collaborative filtering – AI analyzes past customer interactions, such as policy purchases and claim history, and identifies patterns and similarities between the different customers. In this scenario, the recommendation engine offers similar insurance options to customers with similar actions.

- Content-based filtering – AI analyzes the features, attributes, and content associated with each product that the customer has used and offers them similar products.

- Hybrid recommendation engines are a mix of the former two types.

One can also add the elements of reinforcement learning, which means that Machine Learning algorithms will continuously adapt and improve their recommendations based on customer feedback and behavior.

Recommendation engines offer great opportunities for cross-selling, as AI can be set to offer the most suitable policy upgrades, add-ons, or bundling options.

Dynamic Pricing and Personalized Offers

Some of the common AI-driven dynamic pricing models used in Insurtech for up-selling include:

- Customer risk-based pricing that is based on claims history, driving behavior, or health indicators and allows one to understand the risk levels for each customer. The model adjusts prices, offering higher prices for high-risk customers.

- Usage-based pricing that is based on data from IoT devices, telematics, or other sensors that is collected in real time. For example, more careful drivers can be offered lower prices.

- Dynamic market pricing is based on the current market conditions and competitors’ pricing.

AI algorithms create the opportunity to craft personalized offers with the help of some other common models:

- The personalized bundle pricing model allows combining multiple coverage options to create personalized insurance bundles at a competitive bundled price.

- Loyalty-based pricing takes into account customer loyalty and the customer’s history with the company to come up with personalized discounts.

Overcoming Challenges and Ensuring Success

Data Privacy and Security Considerations

Data privacy concerns in AI-driven Insurtech, are practically the same as in any other industry that leverages Artificial Intelligence. First and foremost, it is data collection and consent, because Insurtech companies must ensure that they collect information in compliance with the applicable data protection laws and regulations.

Data security is just as important, so companies must take all possible precautions to prevent data breaches and cyberattacks. Other important concerns are data usage limitation, retention, and deletion, as well as third-party data sharing.

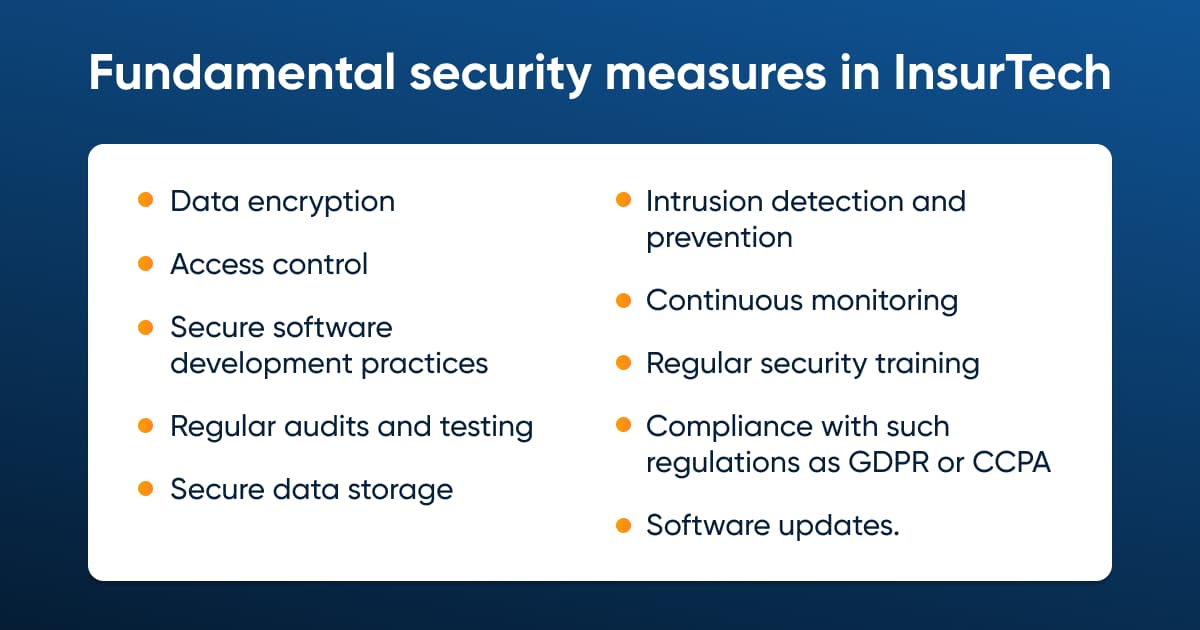

Implementation of the following security measures is fundamental for any Insurtech software development company:

- Data encryption

- Access control

- Secure software development practices

- Regular audits and testing

- Secure data storage

- Intrusion detection and prevention

- Continuous monitoring

- Regular security training

- Compliance with such regulations as GDPR or CCPA

- Software updates.

Ethical Use of AI in Insurtech

Companies must ensure transparency and explainability of the data for customers. Every user must understand how their data is used and processed by AI algorithms.

Insurtech companies must consider the use of anonymization and pseudonymization to protect customer identities while leveraging customer data for AI models’ training.

To ensure the fairness and transparency in AI applications, customers must have complete control over their personal data, with an option to opt out of the processing activities for some specific data.

Integration and Implementation Challenges

There are plenty of challenges that are blocking AI-driven Insurtech from reaching its full potential. Data quality is one of the most important ones, as high-quality data is essential for accurate predictions, calculations, and decisions. Insurance data can be complex, unstructured, and located across various entirely different systems, so ensuring quality data can become a major challenge for an insurance company.

Speaking of systems, many insurance companies are still running on legacy IT systems that are incompatible with the cutting-edge AI technologies. Integrating modern solutions can be a significant challenge and a costly endeavor.

For smaller companies, implementing, managing, and scaling AI solutions still can be expensive, and don’t provide the expected competitive advantage on the market.

Finally, there is a lack of skilled talent in the market, as there is still a limited number of proficient data scientists, machine learning engineers, and domain experts.

However, all those challenges can be successfully dealt with, if you have an experienced company by your side. We, at SPD Technology, offer custom AI solutions development services, and have experience in helping businesses of any size and across multiple business verticals. So, we are ready to discuss your particular business scenario and help you with the implementation of AI solutions.

Future Trends and Opportunities in AI-Powered Up-Selling

According to a recent study by Accenture, insurance companies that offer more personalized services can boost customer engagement by 89%. So, we should expect the continued rise of AI-powered personalization solutions not only for up-selling, but for the Insurtech industry across the board. In the coming years, we should expect further improvements in Predictive Analytics, Natural Language Processing (NLP) in chatbots and virtual assistants, Voice Recognition, and Image and Video Analysis.

Regarding the lack of skilled AI talent on the market, the situation may change in the future. Low-code/no-code trends in software development will most likely include AI, thus allowing organizations to customize systems in accordance with their needs by using drag-and-drop methods and pre-built templates. So, for Insurtech companies, this will mean faster integration into the existing ecosystems and even better business opportunities.

It is also important to mention the rise of Generative Pre-trained Transformer 3 (GPT-3) with its bot version ChatGPT and the image generation tool DALL-E. Both tools can be used for marketing activities in Insurtech.

Conclusion

Despite the reasonable concerns and current challenges, leveraging AI for up-selling in Insurtech is a great idea, especially, if you are looking to unlock new opportunities for growth.

Implementations like customer segmentation and AI-powered data analytics can be performed without disrupting your core operations and adding value to the existing processes. While some other possible implementations like recommendation engines and chatbots may require more effort, the possible improvements are worth it.

The most important thing to understand while working with AI is data quality. You need to make sure that you have accurate, quality data in the amount that will allow AI to make calculations correctly.

If you have any questions about building your AI-powered solution, please feel free to contact our team at any time!

Ready to speed up your Software Development?

Explore the solutions we offer to see how we can assist you!

Schedule a Call