The global cost of cybercrime is expected to reach USD 10.5 trillion in 2025 and USD 12.2 trillion by 2031, according to predictions by Cybercrime Magazine. In the financial sector, DeepStrike reports, the average breach costs USD 6.08 billion, second only to the healthcare industry. Today, strong financial mobile app security is a foundational element of every project, because in addition to devastating financial losses, potential data breaches damage customer loyalty and regulatory credibility beyond repair.

With billions of sensitive transactions moving across apps daily, there is no question why fintech app security matters, but rather how to ensure it is properly implemented. This article serves as a practical roadmap for building fintech applications with security woven into every layer, from authentication and APIs to compliance and fraud detection.

Drawing on SPD Technology’s proven expertise, we explore unique industry risks, best practices, and actionable strategies to help organizations launch and scale fintech solutions with resilience and confidence.

Unique Risks and Challenges in Fintech Data Security

Developing fintech app security solutions poses a set of specific challenges that your software development vendor should be aware of and have proven strategies to overcome them. Here, at SPD Technology, we understand those challenges deeply and would like to share how they should be addressed in real-world scenarios.

High-Value Target for Attackers

Fintech apps are considered a prime target for attackers that seek monetary gain because they are right at the center of financial transactions. A single breach can result in massive financial damages, regulatory fines, reputational collapse, and long-term or even complete loss of customer trust.

The approach to fraud protection should be layered, including using a combination of intrusion detection, anomaly-based monitoring, and real-time fraud analytics, ensuring threats are neutralized before they escalate. Companies should receive resilient environments so that their customers can be confident in the security of their apps.

Complex Regulatory Landscape

Fintech solutions must comply with frameworks like GDPR, PSD2, PCI DSS, SOC 2, and, in some cases, HIPAA, all while delivering seamless user experiences to stay competitive. Non-compliance, in turn, leads to severe fines, forced shutdowns, or restrictions on entering new markets.

Compliance-first design should be integrated into every layer, embedding auditability, consent management, and data minimization into system architecture. Platforms and apps must comply with all requirements, from PCI DSS compliance levels for merchants to GDPR, allowing companies to scale globally without facing legal bottlenecks.

Data Diversity

Fintech solutions should combine structured data from transactions with unstructured data that comes from documents, emails, and biometric inputs. Failing to complete this task will likely result in data leaks, integrity issues, and inaccurate reporting, undermining both security and decision-making.

To avoid this unfortunate scenario, we recommend building secure data lakes and warehouses with encryption at rest and in transit, coupled with role-based data segregation. This allows for creating secure data ecosystems that support analytics, AI, and compliance with minimal-to-no risk exposure.

Want to learn more about data security in fintech apps? Read our comprehensive guide on data warehouse vs data lake as we share our practical insights.

Integration with Third Parties

While integrating with KYC software vendors, payment processors, and open banking definitely expands fintech apps’ functionality, they add to the attack surface at the same time. Weak integrations invite man-in-the-middle attacks, data leaks, and fraud through compromised third parties.

To deal with this challenge, strict API governance should be enforced, along with mutual TLS authentication, and continuous monitoring across all integration touchpoints. Companies must maintain agility and partnerships while ensuring end-to-end fintech app security across the ecosystem.

Find out all the ins and outs of implementing KYC in banking, as we discuss how to do it safely and with maximum efficiency in our dedicated article.

Real-Time Performance vs. Encryption Overhead

Fintech providers are under constant pressure to balance lightning-fast transactions with adherence to encryption standards. Cutting corners on encryption is impossible, while poor optimization and latency can alienate users.

Hardware acceleration should be leveraged with hybrid encryption schemes, and performance tuning to minimize possible delays. Strong security and superior customer experience must be achieved, gaining a true competitive edge in the market.

Serhii Leleko

ML & AI Engineer at SPD Technology

“Partnering up with the right vendor can deliver fascinating results; however, one more risk remains — an insider threat. Privileged employees, contractors, or partners who already have access may bypass the most advanced financial mobile app security. That’s why a zero-trust mindset is mandatory in fintech, with behavioral analytics and strict monitoring on the inside.”

Best Practices for Ensuring Fintech Application Security

Security is the foundation of every fintech application, and its best practices must extend beyond surface-level protections to form a holistic defense strategy. While working on financial mobile application security, vendors must help their clients to protect sensitive data while maintaining the agility required in today’s competitive market. Below are some of the best practices to ensure the optimal approach to fintech apps’ data security.

Implementing Multi-Layered Data Encryption

Financial data is a prime target for attackers, which is why encryption must occur both in transit and at rest. The best practices here include implementing multi-layered encryption strategies, leveraging advanced protocols, rotating keys, and hardware security modules to create overlapping safeguards that eliminate single points of failure.

Enforcing RBAC and Least Privilege Principles

Excessive access privileges are a common entry point for breaches. By applying role-based access control and the principle of least privilege, users and systems will only access the resources they need. This approach minimizes the attack surface and reduces insider risk.

Applying Secure API Design and Continuous Monitoring

APIs connect fintech apps to banks, payment providers, and partners, making them attractive targets as well. That’s why the connected APIs should be designed with strict authentication, throttling, and input validation, complemented by real-time monitoring to detect anomalies before they escalate into unfortunate incidents.

Embedding AI Fraud Detection for Financial Data Security

AI-driven models should be embedded into fintech platforms to detect unusual behavior patterns instantly, enabling proactive intervention without compromising user experience. Your ideal trusted vendor for this task should cover anything from AI in investment banking to ML-powered chatbots for customer support and beyond, including all major applications in fintech.

The best fintech development companies know how to build game-changing solutions for fraud detection and prevention. Discover the list of top market players in our featured article.

Adopting DevSecOps and Security Automation in CI/CD

Financial mobile application security is an undisputed starting point for each project in this domain. Through DevSecOps practices, vulnerability scanning, automated testing, and compliance checks must be integrated directly into CI/CD pipelines. This ensures every new release is secure by design and accelerates deployment without sacrificing trust.

Ensuring Cloud FinTech App Security with Zero-Trust Architectures

Most fintech platforms are now cloud-native, making zero-trust architecture essential. Secure systems must verify every request, whether internal or external, through identity, device, and context validation. This approach safeguards distributed systems while allowing scalability.

Building Auditability and Compliance Into the System Design

The Fintech industry is pushed by strict regulatory requirements, ensuring data protection for financial services. Modern systems should be designed with built-in auditability, logging, and compliance frameworks, making regulatory reporting seamless and reducing the risk of costly violations.

Serhii Leleko

ML & AI Engineer at SPD Technology

“With the growth of your fintech platform, make sure you maintain continuous security education and awareness for engineering teams. Even the most advanced fintech app security solutions, encryption, and monitoring can be undermined by human error. In our company, we make secure coding practices and ongoing training a core part of the delivery process.”

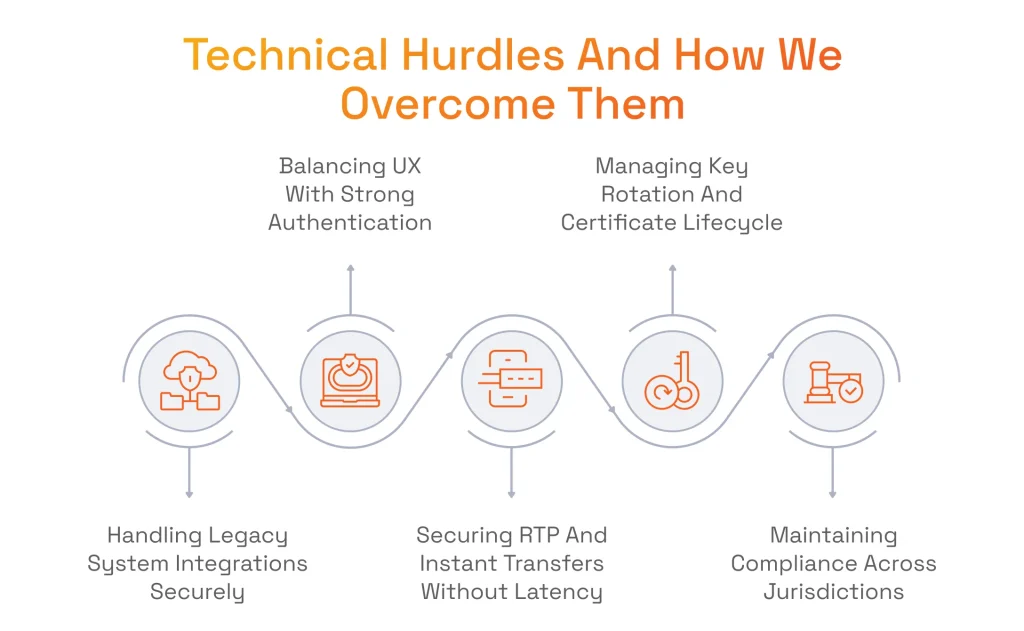

Technical Hurdles When Ensuring FinTech App Security and How We Overcome Them

Launching fintech app goes beyond just adhering to compliance; it is also about solving complex technical challenges without sacrificing performance, usability, or scalability. We have a deep appreciation of the fintech business domain and the necessary strategic foresight to tackle potential hurdles. Here are the most common of them.

Balancing UX With Strong Authentication

FinTech apps must enforce multifactor authentication, biometrics, or adaptive risk scoring, which can often create friction in the user experience. When the authentication flow is designed poorly, it can frustrate users, causing drop-offs, churn, and lost revenue opportunities.

Fully understanding this issue, we implement modern, adaptive authentication frameworks where extra steps are triggered only in high-risk cases, maintaining both security and smooth user journeys. Our clients benefit from higher customer retention and trust, as strong security feels seamless rather than obstructive.

Managing Key Rotation and Certificate Lifecycle at Scale

Distributed fintech ecosystems rely on numerous cryptographic keys and certificates that, if not rotated and maintained properly, pose critical vulnerabilities. Expired or compromised keys can lead to system outages, fraud, or catastrophic breaches.

To deal with this, we use automated lifecycle management with secure vault solutions and enforce cryptographic agility across environments. This ensures continuous protection with zero downtime, reducing both risk exposure and operational overhead.

Handling Legacy System Integrations Without Weakening Security

Many financial institutions still depend on legacy systems that lack built-in security mechanisms or rely on outdated ones. Integrating with such systems without additional safeguards can expose sensitive financial data and result in devastating compliance violations.

Having proven experience in modernizing outdated systems, we deploy API gateways, encryption layers, and granular access controls to wrap legacy systems in modern financial data security standards. This enables clients to modernize securely, unlocking innovation while avoiding costly redesign projects.

Securing RTP and Instant Transfers Without Latency Spikes

Real-time payments demand both zero-latency execution and robust fraud protection, two requirements that often conflict in money transfer app development. Weak safeguards increase fraud risk, while latency damages customer trust and competitive positioning.

With holistic experience in fraud detection, including credit card fraud detection with ML, we know how to design hybrid architectures with secure message validation, fraud detection pipelines, and optimized transaction monitoring. Our clients achieve fast, frictionless transfers with enterprise-grade fraud prevention, ensuring both trust and scalability.

Maintaining Compliance Across Multiple Jurisdictions

FinTech apps operate across diverse markets, each governed by strict and differing compliance requirements and fintech regulatory frameworks. Non-compliance, in turn, leads to fines, reputational damage, and restricted market access.

Knowing how to protect a fintech app, we embed compliance frameworks like PSD2, PCI DSS, and local regulations into the architecture from day one. This allows our clients to gain peace of mind with scalable systems that remain compliant globally while adapting to local rules.

Learn more about adhering to security standards in our featured article on the PCI DSS checklist for 2025, as we provide a detailed discussion on this topic, highlighting what really matters.

Why Building a Secure Fintech App Requires a Profound Approach

Given the numerous and complex aspects of secure fintech application development, ensuring financial data security strongly requires a profound approach. The wisest strategy in this case is to partner with a reliable development vendor, and below are the main reasons why.

Security Is Not a Single Layer

Financial applications handle some of the most sensitive assets, such as monetary transactions, identity data, and regulatory reporting. That means protection must extend to every layer simultaneously: infrastructure, APIs, user access, and data both at rest and in motion. A professional vendor is required in this case because only an experienced partner can design and implement consistent multi-layered defenses without leaving hidden vulnerabilities.

Compliance Is Non-Negotiable

Equally critical is compliance. Unlike general-purpose applications, fintech software must adhere to frameworks such as PCI DSS, PSD2, GDPR, SOC 2, and HIPAA, depending on the geography and domain. Falling short is not merely a legal or financial risk; it can end up in immediate operational shutdown. A vetted service partner is needed here for expertise in navigating diverse regulatory landscapes and ensuring that compliance is embedded into the system from day one.

Attack Surface Is Expanding

The attack surface in modern fintech continues to expand, with 18.4% of fintech companies experiencing publicly reported breaches. 28.2% of those had multiple incidents, according to the 2025 report by SecurityScorecard. Open banking APIs, digital wallets, and integrations with third-party services deliver tremendous value to customers, but they also multiply potential entry points for attackers. True professional vendors can anticipate evolving threats and architect secure integrations that strike a balance between innovation and resilience.

Real-Time Demands Raise the Stakes

Fintech applications must meet real-time user expectations. Instant transfers, biometric logins, and 24/7 availability leave no room for latency or downtime. Yet, heavy encryption and complex fraud detection mechanisms can slow performance if not engineered carefully. To deal with this, you need a partner who knows how to optimize systems where security and performance coexist without compromise.

Consider SPD Technology for Secure Fintech Applications Engineering

SPD Technology is well-known for its engineering reputation. We create fintech applications where resilience, compliance, and innovation go hand in hand. Here’s why industry leaders choose us as their development partner for the most complex fintech projects, including payment facilitators, end-to-end vulnerability management platforms and white-label eCommerce platforms from scratch.

Security by Design, Not as an Afterthought

We embed security into the architecture from day one, integrating end-to-end encryption, Role-Based Access Control (RBAC), and secure APIs into the application’s DNA. This proactive approach prevents vulnerabilities before they can be exploited, ensuring your fintech product remains protected and ready for future growth.

Proven Compliance Expertise

Regulations, including GDPR, PCI DSS, PSD2, SOC 2, and HIPAA are legal and reputational safeguards in fintech application security. All of our solutions meet and exceed these standards, enabling our clients to launch confidently in the most heavily regulated markets.

End-to-End Delivery With Zero Gaps

We are strong believers that fintech app security only starts with code, which is why we design cloud-native infrastructures, implement DevSecOps pipelines, and leverage our fraud detection software development skills to protect every component of fintech ecosystems. This holistic coverage prevents gaps where cybercriminals often strike, securing from evolving threats.

Experience With Data-Intensive, High-Load Platforms

Fintech projects are only as good as their ability to process sensitive financial data at scale. Our experience in projects like investment platform modernization and the fund distribution platform MVP proves we deliver systems that handle a high volume of secure transactions without bottlenecks. Clients rely on us to build architectures that combine speed, reliability, and airtight fintech data protection, even under peak load.

Mature Data Engineering + AI Expertise

Static rules are the thing of the past for the industry, as real-time fraud detection using machine learning is now a standard for market leaders. Our data engineering and AI/ML expertise enables advanced fraud detection, anomaly spotting, and behavioral analysis, helping clients stay one step ahead of threats. By pairing data pipelines with intelligent algorithms, we build fintech applications that not only comply today but also have the potential to evolve to meet the risks of tomorrow.

Track Record of Transformative Results

Our successes highlight the ability to turn complex fintech challenges into scalable, secure solutions. For one European investment client, we delivered a more secure architecture that achieved 10x faster reporting, directly improving both security and business agility. For another, we created a fund distribution platform powered by AI-driven smart search, safely connecting investors with opportunities while safeguarding sensitive data.

Flexible Engagement, Trusted Partnership

Fintech businesses in the era of commoditization struggle to stand out; however, we know how to find a specific approach to each unique case. Whether you need a security-first MVP to validate your product or reinforcement for an enterprise-scale platform, we adapt to your business model. Our flexible engagement approach ensures top security, regardless of budget or scope. More importantly, we see ourselves as long-term partners, not just vendors, helping you innovate confidently while maintaining fintech and payment processing compliance at every step.

Latest FinTech App Security Solutions: An Insight into Our Projects

Our fintech software development services allow global companies to gain and maintain leading market positions. Let’s examine how we do it in this brief digest of our most prominent case studies.

Streamlining an Investment Platform for a Western European Client

Business Challenge

The client is a Portuguese independent research firm providing unbiased and conflict-free research for institutional investors and money managers worldwide. Our team was hired to improve the existing legacy application that was outdated, harmed the brand image, and had poor performance.

SPD Technology’s Approach

We were chosen for the project thanks to 16+ years of large-scale system development, including work on PitchBook, a top private market data and financial research platform.

Our team modernized the existing application using the latest version of Angular, simplifying the UI/UX with responsive design, templates, and customizable components for a cleaner, more user-friendly experience. We re-architected the platform into a 12-factor, cloud-native application, enabling seamless scalability and deployment to Google Cloud Platform with CI/CD and zero-downtime releases.

For stronger data protection for fintech app, we migrated to Auth0, providing MFA, SSO, social logins, and role management. Performance was enhanced by optimizing SQL queries, caching, and resolving Hibernate inefficiencies. Additionally, we implemented asynchronous processing with Java CompletableFuture, significantly accelerating report generation and overall platform responsiveness.

Our Results

- Unprecedented Automation: Our improved version of the client’s investment platform allowed achieving 100% automation of core business processes with an astonishing 10x performance increase, compared to the legacy platform.

- Report Generation Time Boost: While maintaining all business operations of our client, we sped up report generation time from 1.5 to 30 minutes.

Ultimately, while redesigning an investment platform, we help our client to revamp a fintech application completely and save significant infrastructure costs by migrating to the cloud, while uncovering opportunities for entirely new modern functionality that was unavailable previously.

How We Developed an MVP for the Diligence Fund Distribution Platform

Business Challenge

The client is an American company with nearly twenty years of experience, launching an entirely new diligence fund distribution platform. Our expertise was required to develop an AI-powered platform that bridges asset managers and financial advisors, helping them with data-driven insights and highly efficient tools.

SPD Technology’s Approach

Developing an AI Smart Search has become a true highlight of this project. It allowed for matching community members, asset managers, wealth managers, and investors seeking business partners with aligned goals. Unlike general search based on basic filters like location, experience, and demographics, Smart Search leveraged AI and machine learning embeddings to capture semantic meaning from documents, images, and user bios. This enabled refined matches considering factors like ESG focus, asset class, AUM, vehicle preferences, and specialties, increasing cooperation success rates.

We started working on the ML module with PoC, evolving into a hybrid search reinforced by historical interaction data and a long-term data collection strategy. Following the PoC, the client approved building the Digital Information and Connection Hub, integrating Apify web crawling, news feeds, chat, HubSpot CRM, and analytics tools.

Our Results

- Key Product Functionality: Our AI-based matching process became a core product functionality for our client, attracting wealth and asset managers with an outstanding customer experience.

- Delivering Standout Features: We created a robust web crawling mechanism in 1 week, integrating it with Apify and resolving the challenge of noise data. We also developed a fully functional modern website and personalized recommendations.

Overall, as a result of developing an MVP for the diligence fund distribution platform, we delivered the first MVP, enabling our client to pitch to investors and raise funds for the subsequent iterations of the startup. The diverse functionality we developed serves as a strong foundation for competitive product and future market success.

Conclusion

In today’s world, fintech application security is fundamental, as it has become a standard for solutions with security woven into every layer. To deliver such sophisticated products, both technical expertise and a deep understanding of regulatory frameworks, as well as customer expectations, are required. That’s where the right development partner, who knows how to overcome fintech application development challenges, makes all the difference.

Here at SPD Technology, we have nearly two decades of hands-on fintech experience with a strong focus on compliance, scalability, and user experience. Our experts know how to turn a bright idea into a startup, and then into lasting market success. Whether you need to modernize legacy systems, launch a neobank, or implement next-gen fraud prevention, we will help you deliver secure and future-proofed solutions that will make a difference. Contact us to explore how our experts can accelerate your journey!

FAQ

How is AI used to detect fraud in fintech applications?

AI plays a central role in modern fintech data protection by enabling the analysis of large volumes of data in real time. Machine learning algorithms can identify unusual spending patterns, detect anomalies, and flag suspicious activity faster compared to traditional rule-based systems. As a practical example, AI helps to distinguish between normal customer behavior and potential fraud by evaluating hundreds of variables simultaneously, such as device fingerprinting, geolocation, transaction speed, and past activity. This proactive approach not only reduces false positives but also helps fintech solution providers stay ahead of increasingly sophisticated fraud techniques.

How do fintech apps comply with GDPR and PSD2 regulations?

GDPR (General Data Protection Regulation) and PSD2 (Payment Services Directive 2) are mandatory fintech regulations in Europe. Fintech providers are complying with them by implementing secure data encryption, privacy-first design, and robust access control mechanisms. This allows for protecting both customers and institutions, elevating data protection for fintech apps to a peak level.

How does multi-factor authentication (MFA) improve app security?

MFA is one of the top fintech app security best practices, as it strengthens security by requiring users to verify their identity through multiple authentication methods. By layering these security checks, MFA significantly reduces the risk of account takeover, phishing attacks, and credential theft. It has already become an industry security standard, proving its effectiveness in millions of cases.