While often viewed as an administrative task, managing workers’ compensation presents significant financial and operational risks. Manual processes and paper forms can lead to costly errors, especially as claim costs and multi-state regulations continue to grow.

Modern workers’ compensation software offers a different approach. It’s an integrated, AI-powered ecosystem that connects claims, compliance, healthcare, and analytics into one workflow. It helps move the process from a reactive cost center to a proactive, manageable asset that streamlines tasks and reduces administrative burdens.

Looking toward 2026, the focus is on data-driven decisions, predictive fraud prevention, and real-time visibility. This is what a modern digital claims management solution provides.

This article is a strategic guide on how to develop, implement, and integrate this software. We will cover the technology, the process, and the benefits.

Why Workers’ Compensation Software Matters in 2026

Let’s be blunt: managing workers’ compensation is getting more expensive, and the claims themselves are becoming more complex. As volume increases, so do the opportunities for cost leakage. Manual processes are simply overwhelmed, making it easy for both opportunistic and organized fraud to drain resources. This is why modern workers’ comp claims management software needs AI at its core. With fraud detection software development, you can instantly analyze thousands of data points to flag suspicious bills or impossible claim timelines, moving beyond simple processing to active fraud detection.

The financial exposure doesn’t stop with fraud. Regulators are introducing new, stringent rules, and the penalties for non-compliance are steep. A single mistake in a multi-state operation can be costly. Then there’s the people’s problem. A bad claims experience is one of the fastest ways to lose a good employee. If the process is slow, opaque, and frustrating, you’re creating a retention crisis. Good workers’ comp case management software automates compliance checks while providing the transparent self-service employees now expect.

Also, relying on historical reports to manage risk means you’re always one step behind. The entire goal has changed, and now, it’s about stopping them from ever happening. Modern platforms use predictive analytics to spot risk patterns in real-time, letting you fix a problem before it leads to an injury. Thus, you go from mitigating to preventing.

Want to learn more about how artificial intelligence is reshaping the entire insurtech industry? Read our article on the power of AI in insurance.

Understanding Modern Workers’ Comp Management Software

Workers’ comp software isn’t one single product. It is an ecosystem of specialized modules, and the right solution depends entirely on your role. An insurance carrier, for instance, requires a very different technology stack than a large self-insured employer or a third-party administrator (TPA), which is a key consideration in all insurance software development.

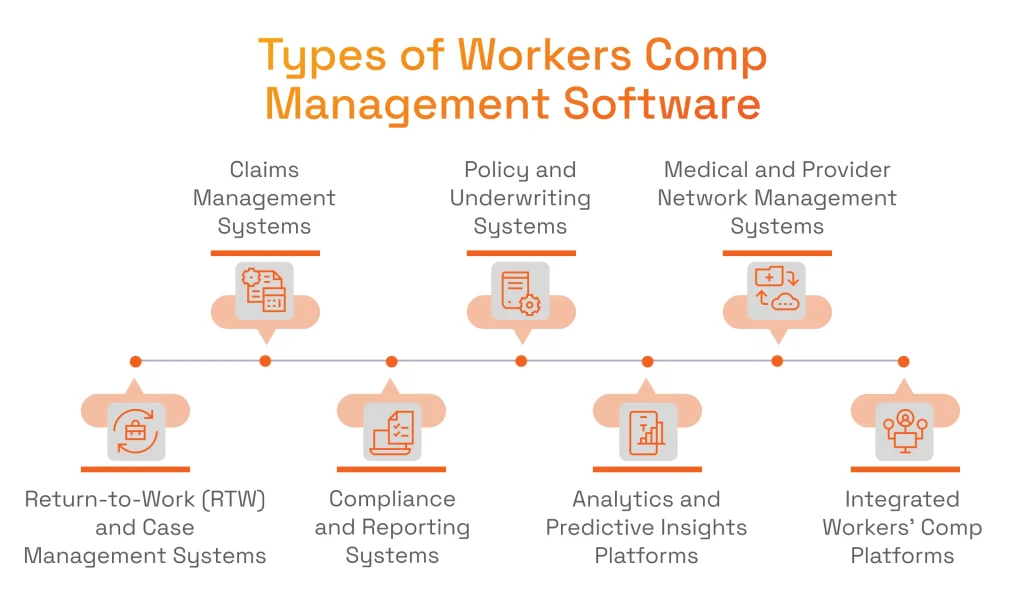

Types of Workers’ Compensation Management Software

Now, let’s discuss the seven main components that make up modern workers’ compensation software solutions. You can build them all into one system or use them as standalone tools that communicate with each other.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“From a delivery standpoint, the ‘ecosystem’ concept is key. Clients often have a strong legacy policy system but need a new analytics system. A modular API-first design lets us integrate new tools with old ones. It avoids the ‘rip and replace’ nightmare and delivers value much faster, which is what insurers demand.”

- Claims Management Systems

This is the operational heart of the system. A workers’ compensation claim management software platform automates the entire claims lifecycle, from the First Notice of Injury (FNOL) to final settlement. The claim management system becomes the central source of truth that tracks every document, communication, and action for adjusters and case managers.

The value comes from its core features. Rule-based claim routing improves efficiency by sending the right case to the right person. Integrated medical bill processing controls costs. Case tracking provides clear transparency for all parties. This is the foundation of effective workers’ comp claims automation software. - Policy and Underwriting Systems

This module is primarily for insurers. It manages policy creation, renewals, risk assessment, and premium calculations. This is the financial engine that prices risk for the carrier.

Its features are directly tied to profitability. Risk profiling and class code management ensure policies are priced accurately. Integration with payroll systems is a key function, allowing for real-time premium adjustments based on actual workforce data. - Medical and Provider Network Management Systems

Medical care is the single largest expense in this field. This software is built to coordinate treatment, manage provider networks, and control costs by ensuring care is necessary and appropriate.

Features like utilization review and pre-authorization act as critical checks against unneeded procedures. The system can also run analytics on provider performance, helping companies build a network that is both high-quality and cost-effective. - Return-to-Work and Case Management Systems

This module handles the human and logistical side of a claim. This is the workers’ comp case management software for proactively managing an injured employee’s rehabilitation and safe return to duty, which helps shorten claim duration.

Return-to-work (RTW) plan templates create consistency. Light-duty assignment management helps get people back to work safely and quickly. For the United States, embedded compliance alerts for OSHA (US Occupational Safety and Health Administration) or ADA (Americans with Disabilities Act) rules are a critical feature for protecting the employer from legal missteps. - Compliance and Reporting Systems

This is the essential risk management module. Its entire purpose is to ensure ironclad compliance with the complex, ever-changing web of state and federal regulations, from OSHA reporting to mandatory EDI (electronic data interchange) filings.

Automated EDI filing eliminates the manual errors that lead to fines. A built-in audit trail and record retention system provide instant defensibility in the event of a regulatory inquiry. This is the core of effective workers’ compensation compliance software. - Analytics and Predictive Insights Platforms

This module provides the analytical power for the workers’ compensation management software. It uses AI and predictive analytics to shift the organization from a reactive to a preventive posture.

Instead of just reporting on past claims, it uses AI for behavior analysis to find patterns. Predictive injury risk modeling can identify where an injury is likely to happen next. Fraud detection algorithms spot anomalies in billing or reporting that humans would miss. - Integrated Workers’ Comp Platforms

Such end-to-end solutions are the ideal state for large enterprises and insurers. An integrated workers’ compensation solutions platform combines most or all of the above modules into a unified workflow. This is true enterprise workers’ compensation software.

The main benefit is a centralized data hub that breaks down information silos. API-based integration with HR, payroll, and ERP systems creates a single source of truth. It often serves as a specialized custom insurance CRM development platform for managing all interactions.

Business Benefits of Workers’ Compensation Software

What do all these modules achieve for the business? Faster claim resolution and higher employee satisfaction. A straightforward and quick process in the employee claim management system reduces administrative overhead and directly improves talent retention. The operational drag of a slow claims system disappears.

The financial and risk benefits are just as clear. Intelligent automation slashes manual data entry and compliance costs. Better accuracy and AI-driven fraud prevention stop cost leakage, preventing fines and protecting margins.

Finally, there is the strategic benefit. Leaders get high-level visibility into claim progress and financial metrics. This provides the power to make informed decisions for risk management and financial forecasting, moving away from guesswork.

Want to see exactly how data is transforming risk management? Discover the strategic advantages in our article on data analytics in insurance.

Key Technologies Behind Modern Workers’ Compensation Software

Modern workers’ comp systems must first read and understand a flood of unstructured data. This includes scanned claim forms, doctors’ notes, and emails. Intelligent document processing (IDP) and OCR convert these images into text. Then, natural language processing (NLP) for business extracts meaning from text and converts it into structured, actionable data.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“This is the most critical step. From a delivery perspective, all downstream automation, such as fraud detection, bill processing, and analytics, breaks down if the data isn’t clean. You can’t automate chaos. Getting this ‘unstructured-to-structured’ conversion right is the foundation for the entire platform’s ROI.”

Once the data is clean and structured, the system can act. Intelligent automation and RPA (robotic process automation) handle low-level, repetitive tasks, such as validating fields, approving payments, and routing files. Machine learning does heavy analytical work. It identifies fraud patterns, predicts claim severity, and optimizes case management. This is the core of intelligent automation within a digital claims management solution.

This kind of intelligence can’t run on old architecture. A modern platform is built on a foundation of cloud architecture and microservices. Among the many cloud computing infrastructure benefits are scalability and 24/7 access. Microservices are just as important. This design means you can update the billing module without taking down the entire claims system. It’s the key to flexibility and continuous improvement.

None of this matters if it isn’t secure. The system must connect to the broader enterprise ecosystem. Secure integrations are critical for pulling data from HRIS (human resources information systems) or payroll tools and connecting with medical EHRs (electronic health records). This is all managed through a robust API strategy, built from the ground up to be HIPAA (Health Insurance Portability and Accountability Act) and SOC 2 (Systems and Organization Controls 2) compliant.

Developing Workers’ Compensation Software: Step-by-Step Process

Building workers’ comp management software is a high-stakes project. A successful, compliant platform demands a structured methodology. Our product development process is designed to manage this complexity, ensure alignment, and mitigate risk from the start.

Step 1: Define Business and Compliance Requirements

Everything starts with discovery. This isn’t just a features list. We define the business outcomes and key performance indicators (KPIs) first. Are we trying to reduce claim-to-closure time by 30%? Cut administrative costs by 50%? These goals dictate the entire project.

We map the needs of every stakeholder: claims, legal, HR, and finance. A critical part of this is a full audit of all compliance rules, including HIPAA, data privacy, and state-level regulations. This is where the advantages of strategic technology consulting become clear because a solid foundation prevents costly mistakes. Building on a faulty compliance foundation isn’t just risky; it’s a guarantee of costly mistakes.

Step 2: Design System Architecture and Data Infrastructure

Next, we design the architecture. This is the technical blueprint. It’s built to be scalable using a cloud-based, API-first approach, which ensures the platform can grow with the business and connect to future tools, not just current ones. Security is built into the blueprint, with an encrypted database at its core. We also plan all integrations with payroll, HR, and existing systems right from the start to avoid data silos.

Step 3: Build and Integrate Core Claims Management Modules

Now, we build. Using agile development, we first create the core workers’ compensation claims management system iteratively, delivering value quickly. It means the essential workflows are up and running: FNOL, case tracking, and validation, allowing a functional core product to get into the users’ hands for early feedback. We also integrate the workers’ compensation billing software component early to ensure all financial data is tracked accurately from day one, setting the stage for future custom AI solutions development.

Step 4: Apply Workflow Automation and AI

With the core stable, we add the “intelligence” layer. The goal here is to augment your skilled employees, not just replace tasks. This is where RPA (robotic process automation) is deployed for high-volume, repetitive tasks such as data entry or form validation. This frees up adjusters to handle complex cases. We also train and implement the machine learning models for fraud detection and claim severity prediction.

This step might also include using chatbots and virtual assistants in insurance to improve employee self-service and answer common questions.

Step 5: Test, Deploy, and Optimize

The final step is to test, deploy, and optimize. This involves rigorous, multi-level testing:

- Functional testing to ensure every workflow operates correctly.

- Security testing to find and fix vulnerabilities.

- Compliance testing to validate that all state and federal rules are being followed.

We use CI/CD pipelines for smooth, predictable deployments, resulting in less downtime. The project isn’t finished at launch. A modern platform evolves. We gather feedback and continuously optimize the system. This is especially true for the AI models, which learn from new data and become more accurate over time.

Choosing the right partner for a complex build is critical. Learn how to evaluate vendors in our guide into top product development companies.

Integrating Workers’ Compensation Software into Enterprise Ecosystems

Building a custom workers’ compensation software platform is only half the job. The other half is making it communicate with your existing technology. If the new platform isn’t fully integrated, it remains an isolated tool rather than a true enterprise solution. This isolation leads to data fragmentation and inefficient manual work.

The objective is to create a seamless, real-time data exchange between the new platform and the company’s core systems. When an employee’s file is updated in HR, the claims system should know. When a payment is approved in the claims system, the accounting software should see it instantly.

This process is about more than just convenience; it’s a security and compliance challenge. Connecting systems that handle sensitive employee health data and financial information requires a robust and secure-by-design approach.

A proper integration plan is broken down into critical parts. It starts with the core technical connections, moves to the vital security framework, and finishes with a plan for long-term performance and optimization.

Handling Integration Essentials

A new workers’ comp platform is only valuable if it’s connected to core business systems. It cannot be isolated. This includes HR platforms for employee data, payroll for premium calculations, and accounting for financial tracking.

A modern API-first approach is the only way to do this properly. It allows for real-time data exchange, not the old, slow nightly batch files. This is the importance of data integration in practice and the key to integrated workers’ compensation solutions.

Security and Compliance Integration

Just connecting is easy. Connecting safely is the real work. The method matters. We build security in from the start, applying end-to-end encryption and strict role-based access controls. Every API endpoint includes complete audit logging, which helps ensure that all data exchanges are 100% compliant with HIPAA, SOC 2, and GDPR (General Data Protection Regulation).

Post-Integration Optimization

We don’t “go-live” and walk away as the job continues. We monitor the performance of all integrations to ensure they are fast and reliable. After integration, we optimize API response times and provide ongoing support. The goal is to keep the entire ecosystem healthy and scalable long after the initial launch.

Common Challenges in Workers’ Compensation Claims Software Development (and How We Solve Them)

A custom workers’ compensation claims software project is complex, but the pitfalls are predictable. Here’s how our expert-driven approach mitigates the most common challenges.

Data Fragmentation

Problem

Information is stuck in silos. It’s trapped in legacy systems, endless spreadsheets, and different vendor portals. Adjusters waste time switching between applications to get a complete picture of a single claim.

Solution

We build a centralized data hub. A clear strategy connects and unifies all that scattered data. This provides every stakeholder — from adjusters to finance — a single source of truth.

Compliance Complexity

Problem

The rules constantly change. A reporting requirement in one state differs from that in its neighbor. Hard-coding this compliance logic is a common mistake that guarantees the software will be wrong in six months, exposing the business to fines.

Solution

We build a flexible, automated compliance module. It’s driven by an updatable rules engine that allows administrators to change the logic without new code. It also provides audit trails needed to prove adherence.

Security & Data Risks

Problem

A breach of employee or financial data is an existential failure. This software handles protected health information and sensitive financial details. The risk is enormous.

Solution

We treat security as foundational, not as a final step. Our DevSecOps framework, end-to-end encryption, and strict adherence to SOC 2/HIPAA protocols are all designed into the architecture from day one.

Low User Adoption

Problem

People won’t use a system they hate. If the new software requires more clicks or hides information, adjusters will find workarounds in their old spreadsheets. The system will be ignored.

Solution

Our design process is UX-driven. This means we involve the end-users from the start. The adjusters and case managers help us design a system that aligns with their actual workflow. We implement insurtech at scale to support your experts, not replace them.

Entrenched Manual Processes

Problem

Teams are used to their manual workflows. They often resist automation, either from habit or fear. They have a process that, while slow, is familiar.

Solution

The key is to automate the right things. We apply RPA and intelligent automation to repetitive and low-value tasks, such as data entry. This frees your skilled people to focus on high-value case management and negotiation, the work that requires human judgment.

Why Choose SPD Technology for Workers’ Compensation Billing Software Development

Building software for insurance is significantly different from other industries. We are a specialized engineering partner focused on high-compliance, data-intensive work in insurance software development. This is our dedicated field, and our insurtech development services are built on this specific expertise.

We back this up with a strong compliance foundation, including HIPAA, SOC 2, and ISO 27001 certifications. Our teams have deep experience in claims automation, optimizing workers’ compensation billing software, and applying AI/ML analytics to real-world insurance problems. We manage the entire process transparently.

A good example is our work for Pie Insurance. The company was dealing with fragmented billing and claims data, which created process bottlenecks and increased compliance risk.

We designed and built a cloud-native platform with automated billing workflows and a unified data structure. The outcome was a 40% improvement in claims processing speed. Just as important, the new system gave them a much stronger and more auditable compliance posture, with a 30% improvement in average checks.

Conclusion

The goal of modern workers’ compensation management software is to move beyond simple administration. It’s a strategic change. It transforms a reactive cost center into a data-driven, compliant asset. This is achieved through AI and automation.

Building such a platform requires a partner that understands both the technology and the regulations. SPD Technology has the specific insurtech expertise to engineer these secure and scalable systems.

Ready to update your workers’ compensation program? Partner with SPD Technology to build an intelligent, secure, and compliant platform that drives efficiency, reduces risk, and delivers a measurable return on investment.

FAQ

How much does workers’ comp claims management software typically cost?

The price isn’t fixed, as it depends on factors such as a custom build vs. a SaaS model, the number of users, the specific modules needed, and the number of systems it needs to integrate with. It’s best to frame this as a capital investment with returns measured in lower claim costs, reduced fraud, and avoided compliance penalties. We offer a detailed estimate after a discovery phase.

How long does it take to implement workers’ comp claims software?

For a custom-built platform, a realistic range is 6 to 12+ months. The main variables are data migration from old systems, the complexity of integrations with HR and payroll, and the need for rigorous multi-state compliance testing. We use an agile, phased approach to deliver a core MVP (minimum viable product) much faster, so you see value in months, not years.

How can small or medium-sized businesses benefit from workers’ comp software compared to large enterprises?

Large enterprises benefit from scale, but medium-sized businesses often see a more immediate and dramatic return. Many are moving away from manual spreadsheets, so the efficiency jump is huge. A single fraudulent claim or compliance fine can be a serious threat to a smaller business. This workers’ comp software for employers gives them the same enterprise-level tools for cost control, risk management, and compliance.