Launching a new product takes months, not weeks. Customer expectations for modern insurance services are almost impossible to meet. IT maintenance costs continue to climb.

These are all symptoms of one root problem: rigid, outdated legacy systems. For decades, these platforms were the stable core of the insurance sector, but they have become a barrier to growth. They are difficult to update, can’t connect to new data sources, and prevent meaningful automation, which is the key driver in insurtech.

Many carriers now choose to create insurance software that is tailored to their specific operational needs. Custom insurance software solutions improve operational efficiency by automating core insurance workflows such as underwriting, claim management, and policy administration.

Custom insurance software development is a strategic approach that focuses on building smart and scalable platforms. These advanced, innovative, and customer-centric solutions deliver custom solutions powered by AI, predictive analytics, and cloud infrastructure.

In this article, we’ll outline the technologies, processes, and solutions that define custom software development for insurance, and how companies must stay ahead by adopting advanced technologies and leveraging resources to meet evolving market demands.

How Modern Software Development Transforms the Insurance Business

Insurance software development is, at its heart, building the core engine of an insurance carrier. It’s the collection of systems that power end-to-end insurance management and manage customer relationships, often using AI for customer behavior analysis. For a long time, this meant running the business on static, siloed platforms that were stable but incredibly difficult to change. This describes most of the legacy software used in insurance companies today. Many insurers operate on monolithic systems built before modern APIs or cloud standards, which can lead to integration difficulties.

The old model is no longer competitive. When building insurance software, integrating new features into an existing solution is crucial, rather than just digitizing forms, to keep up with current market trends.

The new standard is an AI-driven ecosystem that integrates data from telematics, IoT devices, and customer interactions. By 2026, AI and real-time data are increasingly integrated into core insurance software workflows, transforming underwriting, claims management, and customer engagement. This shows how artificial intelligence and the Internet of Things enable innovative solutions in insurance. However, integrating new tools with legacy systems can create data silos, slow performance, and raise compatibility issues.

The transition redefines modern insurance management and how insurers serve customers. They are driven by clear business goals:

- Operational efficiency through widespread automation.

- Enhanced accuracy in risk assessment and pricing.

- Personalized customer experiences that build loyalty.

- End-to-end compliance and data transparency.

These goals are the foundation for modern insurance software applications. Insurance companies must assess and track various risks, including market, credit, operational, and reputational risks.

Insurance companies face challenges in managing vast amounts of data and processing claims swiftly and accurately, making it essential to leverage the right resources for development, ongoing support, and risk management. Custom insurance software can enhance customer engagement through a self-service customer portal that guides customers through the insurance process. Custom insurance software development can also enhance communication and interaction among all stakeholders, including insurers, healthcare providers, and patients.

Key features of insurance software include comprehensive policy management, efficient claims processing, CRM (customer relationship management), underwriting, insurance billing, and strong analytics & reporting.

Custom Insurance Software Development Tech Stack

A modern insurtech platform is not a single product but an ecosystem of custom software solutions working together to turn data into decisions. A well-organized group of microservices within the platform enhances security, scalability, and flexibility in custom software development.

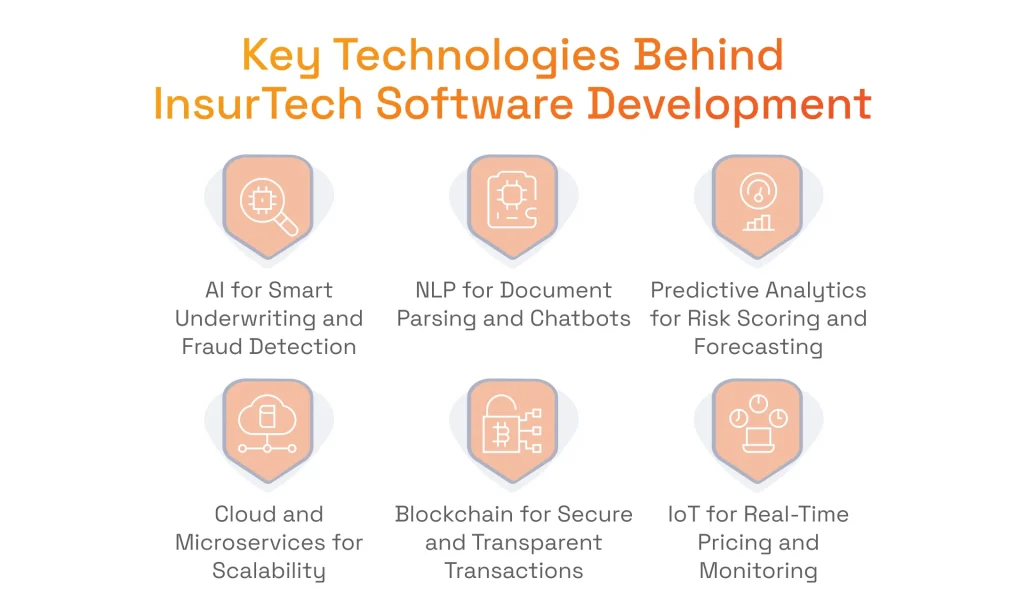

The intelligent layer is driven by artificial intelligence and machine learning (AI/ML). It automates complex tasks, such as underwriting risk assessment, and uses machine learning to detect fraudulent claims that a human adjuster might miss. Understanding the business impact of Big Data and AI is the first step to scaling. A modern custom insurance software solution is built on this intelligent layer. Insurance companies are increasingly adopting technologies such as AI, robotic process automation (RPA), and IoT to enhance customer service and streamline insurance operations.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“Clients often want to start with AI, but we advise them to start with their data infrastructure. Deciding how to choose the right technology stack for insurance software often starts with the data strategy, not the application layer.”

Moving to the cloud helps insurers decommission expensive and inflexible on-premises data centers, just one of the many cloud computing infrastructure benefits. The fuel for this engine comes from predictive analytics and Big Data. These tools analyze vast volumes of customer data to create highly accurate risk scores, forecast potential losses, and identify customers at risk of churn using behavioral customer data, which is the core function of modern insurtech software development.

Other technologies provide specialized, high-value functions. Blockchain is increasingly used to create transparent, smart contracts that can automate claims processing and premium payments when predefined conditions are met. IoT and telematics provide a new stream of real-time behavioral data that allows insurers to offer proactive risk prevention and create new usage-based policies.

One of the most important components of custom insurance software development is the insurance app that enables user-friendly payments and claims processing. The software must be able to interact securely with multiple payment gateways and service providers via API integrations to ensure efficient payment processing through integrated payment software.

Custom insurance software can enhance data security by implementing robust encryption and user authentication to protect sensitive data. Implementing a zero-trust architecture (ZTA) is vital for security in modern insurance software development.

Key Types of Insurance Product Development Software

Building a next-generation custom insurance software platform requires solutions that address specific high-impact business problems. The right insurance software development technology depends on the specific business problem you want to solve with custom solutions. We find that the greatest value comes from developing these five custom software solutions, each designed to optimize a critical part of the insurance product development value chain.

These components are not built in isolation. They are designed as parts of a modular ecosystem. Data from a claim, for example, feeds the risk analytics platform. An insight from the analytics platform, perhaps from demand forecasting with machine learning, might then be used to update the underwriting automation rules. Custom insurance software solutions can also provide a comprehensive toolkit for insurance risk model design and management, automating actuarial calculations and insurance pricing.

#1. Claim Management and Fraud Detection

Claim management is the most automated process in insurance software. The claims process is the moment of truth for every policyholder. This software is built to optimize the entire journey, starting with OCR (optical character recognition) that instantly captures data from insurance documents like a first notice of loss. By automating claims processing with AI and machine learning, insurers are eliminating manual intervention, thereby improving speed, reducing costs, and increasing accuracy.

AI-driven rules engines, a core component of fraud detection software development, verify claim details against the insurance policy, check for predictive fraud indicators, and, in many cases, approve payouts instantly. AI-powered fraud detection reduces processing costs, reduces fraud-related losses, and builds customer loyalty through transparent and fast resolution.

AI can also analyze damage assessments through computer vision, offering instant evaluations. Robotic process automation (RPA) automates repetitive tasks in insurance, allowing employees to focus on more strategic activities. RPA reduces the time and effort required to process claims and improves accuracy. These automation efforts improve customer satisfaction by reducing claim settlement times and lowering costs. This part of software development for the insurance business often provides the highest ROI, especially for commercial insurance software applications.

#2. Policy and Underwriting Automation

The goal of this insurance product development software is to accelerate underwriting and policy management, making them faster, more innovative, and more consistent. It streamlines the entire workflow: from initial quote to final policy issuance. By applying automated risk scoring, real-time pricing models, and robotic process automation for back-office tasks, it eliminates guesswork and manual data entry. This allows underwriters to focus on complex and high-value cases while automation accelerates policy issuance, and it gives customers a much smoother application experience.

#3. Risk Analytics and Performance Monitoring

Executives need a clear, accurate, and up-to-the-minute view of enterprise-wide risk. Performance monitoring tools, backed by professional data analytics services, deliver this. They feature data visualization dashboards that track key metrics like loss ratios, claim frequencies, and new policy acquisition costs. More advanced platforms include predictive models that allow leaders to simulate different market scenarios and see their potential impact. Thus, data analytics informs your strategic decisions.

Want to see how modern data practices are changing strategic risk management? Read our article on data analytics in insurance.

#4. Broker and Agent Enablement Solutions

Your intermediary channels, including insurance agents and brokers, need tools that help, not slow them down. Enablement solutions improve productivity by centralizing account management for agents and brokers. These are often mobile-first dashboards that give agents everything they need in one place: the ability to generate quotes, access client policy information, get digital signatures, and manage renewals through centralized policy management. Providing a modern and easy-to-use toolset directly improves customer satisfaction.

A core part of enabling agents is giving them a central tool to manage relationships. Learn more about custom insurance CRM development.

#5. Compliance and Audit Management Systems

Managing regulatory compliance significantly increases costs and complexity in custom insurance software development, especially when operating across multiple states or countries. Regulatory requirements vary by country and insurance product type, especially in health insurance, which complicates compliance during development. Compliance and audit management systems are specifically designed to automate governance and simplify audits. They create a complete, unchangeable audit trail for every insurance policy change, rate adjustment, and claim payment.

Custom Software Development for Insurance: Step-by-Step Process

A successful insurance software development project moves methodically from a business concept to a fully operational, secure, and intelligent platform. This is one of the advantages of strategic technology consulting; we follow a straightforward multi-stage process to ensure nothing is left to chance and that the final product delivers on its core objectives. This is our proven approach to insurance software system development.

Step 1: Define Business Goals and Users

The first step in software development for insurance is a discovery phase to define success. We work with your stakeholders to identify the specific insurance vertical (P&C, health, etc.) and the primary problem we are solving. We clarify the exact metrics for success: whether it’s cutting operational costs, improving customer retention, or reducing claims resolution time. This clarity is vital for building insurtech at scale. As an experienced custom insurance software development company, we also define the key user roles to guide the entire design and development process: agents, underwriters, policyholders, and adjusters.

Step 2: Plan the Architecture and Data Foundation

Once we know what we’re building, we map out how. The standard for any new insurance platform is a flexible, API-driven, microservices-based architecture. This design allows for true scalability and easier upgrades. We then plan the data infrastructure to power real-time analytics, typically a centralized data warehouse or lake.

The entire blueprint is built on a secure cloud foundation that meets HIPAA, SOC 2, or GDPR requirements. It includes a clear plan for interoperability with your existing systems, such as customer relationship management and enterprise resource planning systems. This planning highlights the importance of data integration.

Step 3: Integrate AI and Predictive Analytics

This is where the platform’s intelligence comes to life. We integrate machine learning models to automate critical functions, such as underwriting risk evaluation and fraud potential scoring. We apply natural language processing (NLP) for business to streamline document management or to set up chatbots for instant customer service. AI-powered chatbots improve customer service by providing instant responses to customer queries and assisting users throughout the claims process.At this step, we also enable predictive models for customer lifetime value and churn prevention, turning your data into a strategic tool. Artificial intelligence helps insurance employees manage large data sets more effectively and improve decision-making across underwriting, claims, and risk management.

Learn more about the existing opportunities and upcoming trends for this technology in our article on AI in insurance.

Step 4: Embed Data Security and Compliance

Security and compliance are integrated from the first line of code, not bolted on at the end. This DevSecOps approach is essential in the insurance industry. Handling customer data means full compliance with regulations, including end-to-end encryption, and tokenization for all sensitive information. We implement strict data retention policies based on your regulatory needs and built-in compliance modules for ISO, NAIC, and GDPR. Automated audit trails and anomaly and fraud detection are used to ensure full accountability and system integrity.

Step 5: Develop, Test, and Deploy

We use an Agile development methodology, which means we build in iterative sprints. Agile methods provide flexibility in custom insurance software development by enabling iterative delivery, rapid feedback, and continuous adaptation to changing requirements. Quality is enforced through a heavy emphasis on automated testing (unit, regression, and load) to catch bugs before they reach production. Our CI/CD pipelines automate deployment and version control, allowing us to release updates faster and more reliably.

Step 6: Optimize and Retrain After Launch

A modern software system is a living asset. After launch, we monitor the key business metrics and system performance (like uptime and NPS). We establish a feedback loop for continuous UX improvements. Critically, AI models can “drift” and become less accurate. We implement a strategy to retrain your models with new data to ensure they remain precise and fair. This final step is a permanent part of the custom insurance software development lifecycle.

Common Challenges in Insurance Software Development That Increase Operational Costs

In our experience, every major insurance software project runs into a similar set of hurdles.

Our value isn’t just in our technical skill, but in our playbook for solving these known blockers from day one.

Dmytro Tymofiiev

Delivery Manager at SPD Technology

“Everyone wants to build a new AI platform, but they forget the 30-year-old mainframe in the basement that still processes 90% of their claims. You can’t ignore the legacy system. The key isn’t a ‘big bang’ replacement; it’s a modular approach with APIs. We build bridges, not just new islands.”

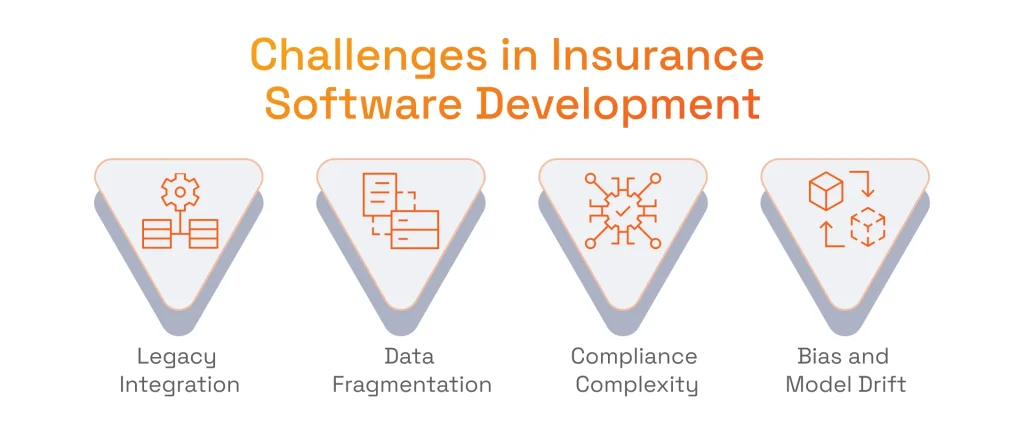

The most common challenge is legacy system integration. A “big bang” replacement is simply too risky for most carriers. We opt for a modular modernization, using API middleware to build a secure bridge between your new cloud applications and your existing core. This is one of the most common challenges we are asked to solve as a custom insurance software development company.

This immediately helps solve the next problem: data fragmentation. With data scattered across different silos, we design and build governed pipelines to pull it into a centralized data lake. This creates a single reliable source for all data analytics. Of course, that centralized data must be managed. The complexity of compliance across multiple jurisdictions (like GDPR or NAIC) can be daunting. The insurance software we build can provide real-time monitoring of compliance with internal policies and regulatory requirements.

This same discipline applies to the AI models. An algorithm can develop bias or “drift” over time, leading to decreased accuracy. We control this through explainable AI (XAI) and by implementing a clear retraining schedule to ensure models remain precise and fair.

Why Choose SPD Technology as Your Insurance Software Development Company?

Choosing a software development partner is the most critical decision in a modernization project. You need software developers who speak the language of insurance, not just code. This includes understanding specialized applications, like using chatbots and virtual assistants in insurance, and the core systems they connect to.

An insurance software provider needs to understand the high-compliance and high-stakes nature of insurance. SPD Technology is a technical engineering company offering insurtech development services with deep domain experience across the FinTech, HealthTech, and insurtech sectors.

Cross-industry knowledge enables our software developers to deliver custom solutions aligned with real insurance needs. We understand your business logic and regulatory pressures, and know how to build secure, auditable systems from the ground up. We believe in end-to-end ownership, delivering custom solutions from the first architectural drawing to long-term post-deployment optimization.

We specialize in software development that combines advanced analytics with custom AI solutions development that create a competitive edge, with proven experience in predictive modeling, risk analytics, and NLP automation. By leveraging cutting-edge technologies and digital transformation, we enhance overall service quality, customer experience, and operational efficiency.

Our Experience in Real-World Case Studies of Software Development for Insurance

When Pie Insurance needed to modernize its billing and data operations to keep pace with its success, the company turned to SPD Technology. We delivered a comprehensive re-architecture of their company’s warehouse and billing infrastructure.

Revamping Billing and Data Management Infrastructure

This project focused on rebuilding Pie Insurance’s core data and billing infrastructure. The client’s existing systems couldn’t keep up with their success. We were brought in to engineer a new data management solution that could scale.

- Business challenge: Pie Insurance was scaling faster than its systems could handle. Their billing and data platforms were creating operational friction and couldn’t provide clean data for reporting.

- Our Solution: Our team was brought in to re-architect their data management solution. We designed and built a highly scalable data warehouse and refactored their entire billing system to improve efficiency.

- Our Results: By streamlining payment workflows, we saved the customer success team 40% in operational time and drove a 3x increase in automated clearing house users, resolving policy termination issues. The improved UX and new options also led to a 30% increase in average checks.

Learn more about the case and how our experienced team handled it.

Creating an API Service and BI Visualization for Embedded Insurance

This project involved building a two-part solution for a client in the embedded insurance domain. The client needed a high-performance, scalable API to deliver data to partners, and a powerful internal Business Intelligence (BI) solution to track their own performance. We were tasked with designing and building both systems concurrently.

- Business Challenge: An embedded insurance provider needed a more robust and scalable way to deliver data to its partners. They also required an internal BI solution to track business performance.

- Our Solution: We developed a high-availability API service to act as the central hub for all partner data integrations. At the same time, we built a full-featured BI solution with custom dashboards to visualize key metrics.

- Our Results: The new API service provided a fast, reliable, and secure data flow, improving partner satisfaction. The BI dashboards provided their leadership and operational teams with clear and actionable insights to make smarter business decisions.

Ready to Build Your Custom Insurance Solution?

The future of insurance is predictive, not reactive, with customer satisfaction driven by intelligent automation. Intelligent insights, smart automation, and a personalized approach to customer service power the developments in insurance software. In this new environment, success requires a careful balance of three elements: clean data, scalable technology, and a deep understanding of compliance.

This is what SPD Technology builds: scalable custom solutions for insurance companies. The advanced software ecosystems we create deliver custom solutions that allow each custom insurance solution to manage risk more effectively and better serve customers. Our software developers and data scientists help you build a future-ready insurance platform. Contact our team, your trusted custom insurance software development company, to start building your solution.

FAQ

How do you start developing custom insurance software from scratch?

We begin with a discovery phase. Our team works with your stakeholders to define the business problem, map user roles (agents, underwriters, etc.), and identify key metrics. We then design the system architecture and technology stack before starting development.

What are the differences between cloud-based, on-premises, and hybrid insurance software deployment options?

On-premises is hosted on your servers, giving you complete control but requiring high capital and maintenance costs. Cloud-based (SaaS) is hosted by a vendor, offering scalability and lower upfront costs. A hybrid approach mixes both, often keeping sensitive data on-prem while using the cloud for flexible applications.

What are the typical ongoing maintenance and upgrade costs for insurance software after initial launch?

Ongoing costs typically range from 15 to 25% of the initial development cost annually. This covers secure cloud hosting, essential security patches, regulatory updates, new feature development, and the continuous monitoring and retraining of any AI models.